Kansas Property Tax Calculator

Kansas Property Tax Calculator - ($60,000 x.115 = $6,900) $60,000 (actual market value) x.115 (state residential assessment fee) = $6,900 (assessment value) Chapter 79, article 51 motor vehicles; Our sedgwick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states. The tax calculator should only be used to estimate an individual’s tax liability. Web the table below shows median annual tax payments, median home value and effective property tax rates for every county in kansas.

Press show values to see the values in the table below. Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full registration year. Chapter 79, article 51 motor vehicles; Title and tag fee is $10.50. Web estimate my sedgwick county property tax. Our douglas county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states. Web our kansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states.

5 things you need to know about property taxes in Kansas Kansas

Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and local taxes. $60,000 statewide residential assessment rate: Web the kansas department of revenue offers this “tax calculator” as a public service to provide payers of kansas income tax with information to estimate their overall annual kansas income tax liability. The.

Hecht Group How To Pay Your Kansas Property Taxes Online

Press show values to see the values in the table below. Our douglas county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states. Calculate how much you'll.

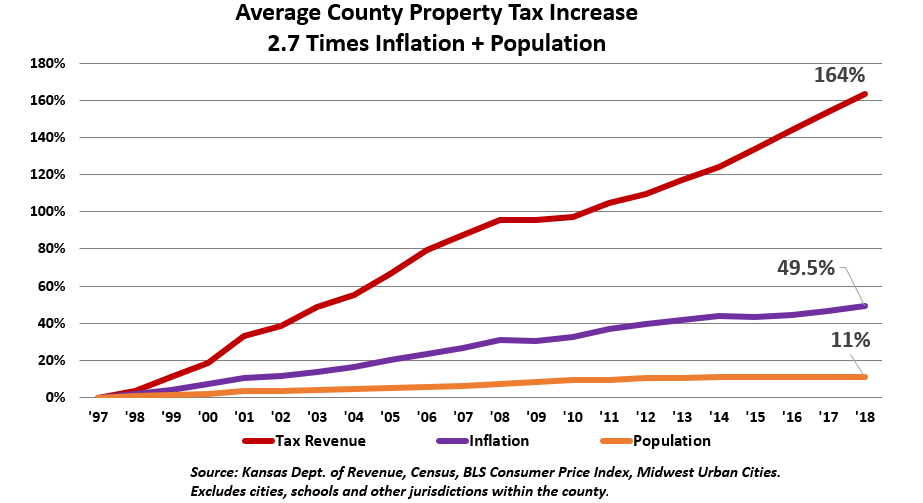

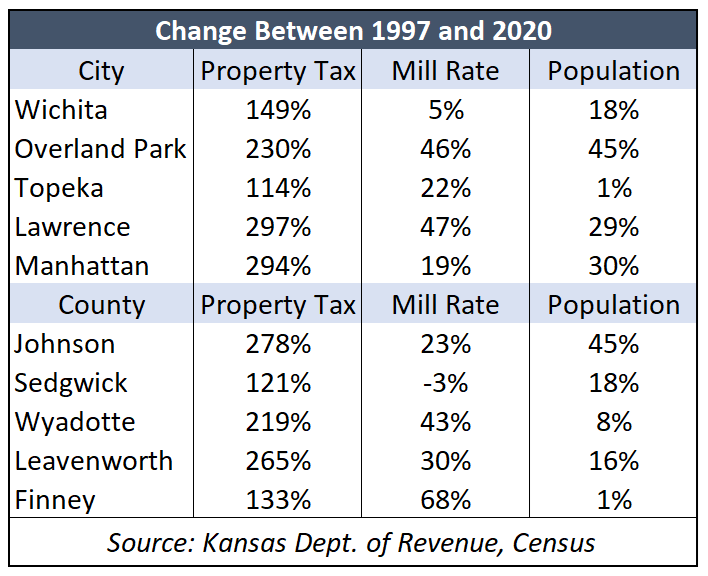

Local Government Pushes Property Tax to Record Levels Kansas Policy

Counties may tax such property at a rate of up to 0.75 percent, and cities or townships may impose an intangible property tax of up to 2.25 percent. Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full.

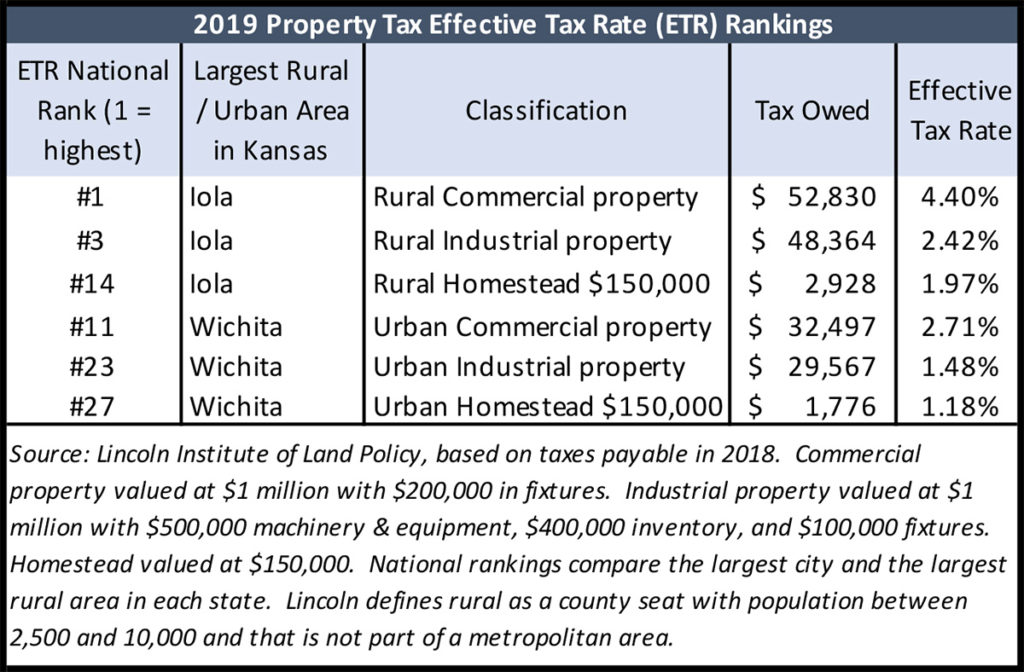

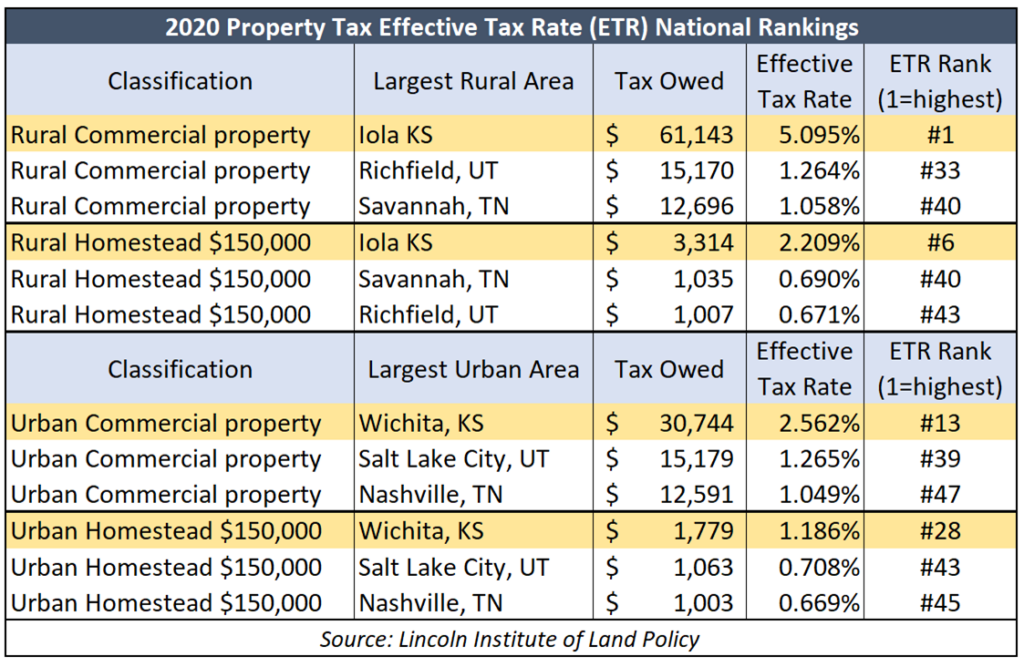

Kansas has some of the nation’s highest property tax rates Kansas

Web rv trailer registration schedule and service fee chart. Web while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property tax estimator tool to calculate your approximate yearly property tax based on median property tax rates.

Property Tax Calculator

This will start with a recording. Our sedgwick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states. Web kansas property tax. Chapter 79, article 51 motor.

Kansas has some of the nation’s highest property tax rates Kansas

Chapter 79, article 51 motor vehicles; First letter of last name: The state’s average effective property tax rate (annual taxes as a percentage of home value) is 1.33%. Homeowners with a total household income of $35,700 or less may be eligible for the homestead refund. Web estimate my douglas county property tax. $60,000 statewide residential.

Property Tax

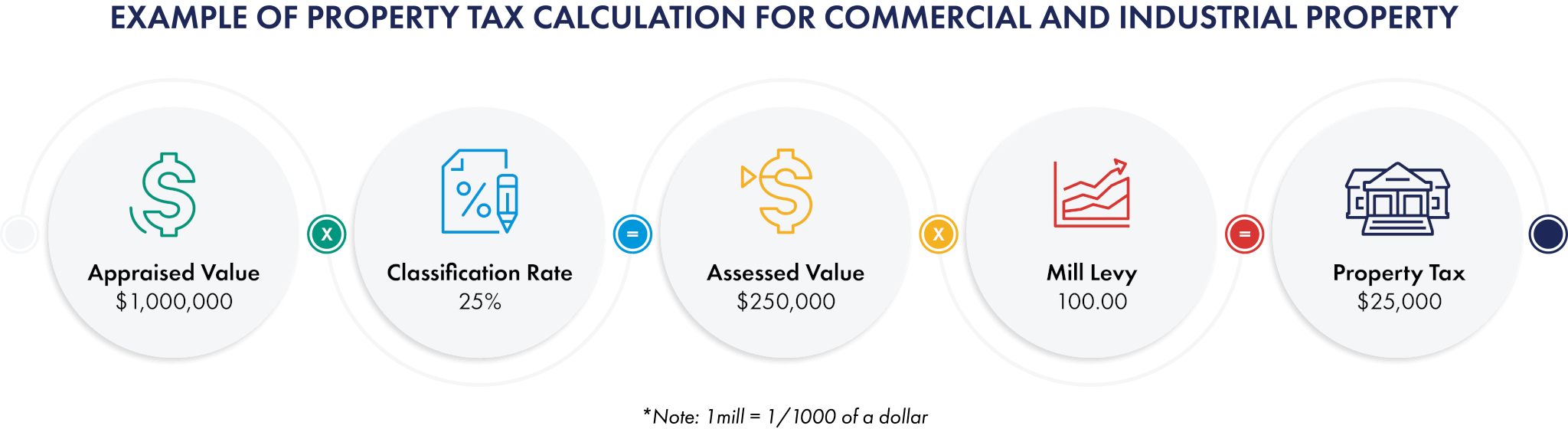

The core responsibilities are tax calculation, billing and distribution. 11.5% the assessed value of your home would be $6,900. Show values clear values city of manhattan tax liability riley county tax liability Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Counties may tax such property.

5 things you need to know about property taxes in Kansas Kansas

Homeowners with a total household income of $35,700 or less may be eligible for the homestead refund. How much does it cost to register a vehicle? Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Our douglas county property tax calculator can estimate your property taxes.

Tax Calculator Chanute, KS Official Website

Enter your details to estimate your salary after tax. Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full registration year. Web the table below shows median annual tax payments, median home value and effective property tax rates.

Kansas Tax Calculator 2023 2024

Web finance manhattan taxes residential property tax calculator residential property tax calculator show the breakdown of property taxes enter market/appraised value of your residential property: Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full registration year. Homeowners.

Kansas Property Tax Calculator Web our kansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full registration year. Chapter 79, article 51 motor vehicles; Maintaining guidelines for the valuation and taxation of personal property;

Web Smartasset's Kansas Paycheck Calculator Shows Your Hourly And Salary Income After Federal, State And Local Taxes.

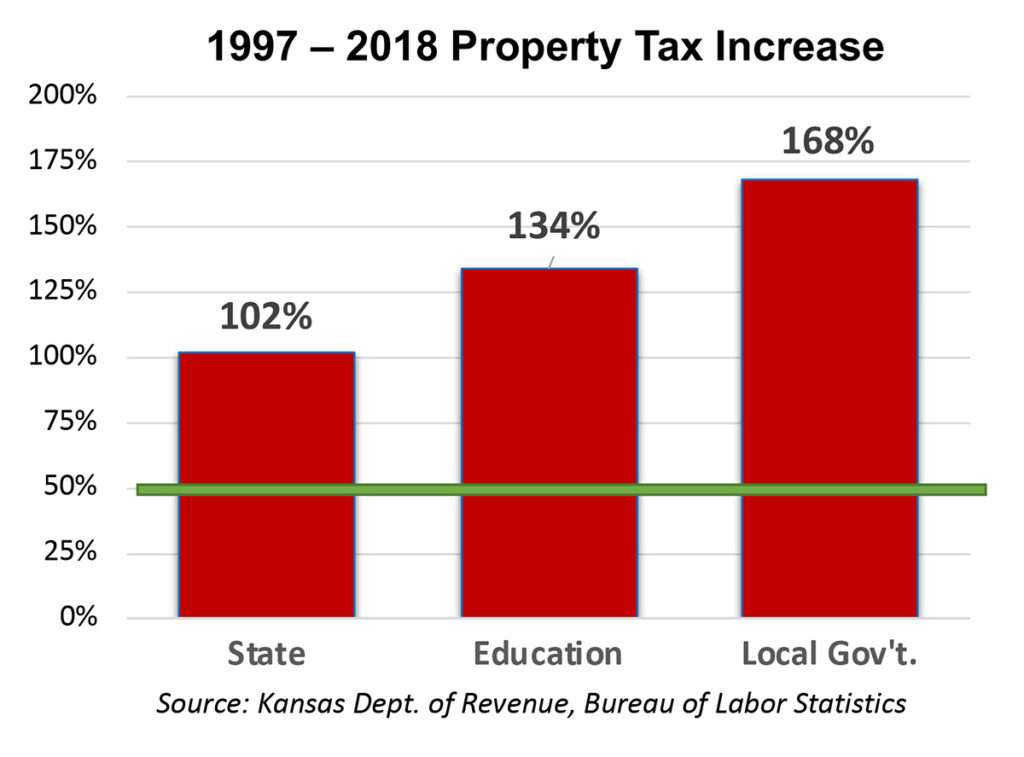

The state’s average effective property tax rate (annual taxes as a percentage of home value) is 1.33%. Web while the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free kansas property tax estimator tool to calculate your approximate yearly property tax based on median property tax rates across kansas. Web use the kansas department of revenue vehicle property tax calculator to estimate vehicle property tax by make/model/year, vin or rv weight/year, for a partial or full registration year. Web our kansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states.

The Kansas Property Tax Payment Application Allows Taxpayers The Opportunity To Make Property Tax.

Web as an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). $60,000 statewide residential assessment rate: Title and tag fee is $10.50. Show values clear values city of manhattan tax liability riley county tax liability

($60,000 X.115 = $6,900) $60,000 (Actual Market Value) X.115 (State Residential Assessment Fee) = $6,900 (Assessment Value)

Web estimate my douglas county property tax. Compare your rate to the kansas and u.s. Web kansas credential fee chart; The core responsibilities are tax calculation, billing and distribution.

Calculate How Much You'll Pay In Property Taxes On Your Home, Given Your Location And Assessed Home Value.

11.5% the assessed value of your home would be $6,900. How much does it cost to register a vehicle? Homeowners with a total household income of $35,700 or less may be eligible for the homestead refund. Our sedgwick county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kansas and across the entire united states.