Kentucky Property Tax Calculator

Kentucky Property Tax Calculator - For comparison, the median home value in. Assessment value $ homestead tax exemption. Web motor vehicle taxes in kentucky. (ap) — kentucky lawmakers have advanced a proposed constitutional amendment meant to protect older homeowners from having to pay higher property. On july 1, the real property tax rate.

Motor vehicle property tax motor vehicle property tax is. These taxes are levied on your wages, not your taxable income. For comparison, the median home value in hardin. Web our oldham county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the. If you are receiving the homestead exemption your assessment will be reduced by $46,350. Web calculate as much you'll pay into quality taxes go your home, given your location and assessed home value. Web counties and cities charge a percentage, ranging from 0.00075% to 2.50%.

PRORFETY Kentucky Property Tax Form 62a500

Property taxes in kentucky are relatively low. Do you pay ad valorem (tangible personal property) tax on inventory? Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Web choose a reliable kentucky property tax calculator, such as the one provided by the.

How to Estimate Commercial Real Estate Property Taxes FNRP

Web calculate as much you'll pay into quality taxes go your home, given your location and assessed home value. A constitutional amendment that would prevent property tax increases for kentucky homeowners who are 65 years old and older could be on the november. Web the amount you pay in property taxes each year depends on.

How Are Kentucky Property Taxes Calculated PRORFETY

Property taxes in kentucky are relatively low. For comparison, the median home value in hardin. Compare your rate to the kentucky and u.s. Web the amount you pay in property taxes each year depends on two things: Web the kentucky senate is seeking voter backing to provide some tax relief for homeowners 65 and older..

How Are Kentucky Property Taxes Calculated PRORFETY

If so, you may be able to receive a credit against your income taxes for. Web jefferson county, kentucky property tax calculator; Anoka county, minnesota property tax calculator; (1) the assessed value of your property and (2) the tax rates that are levied at both the state and local. Web kentucky has a flat income.

Property Tax Calculator

Enter the property details, including. (1) the assessed value of your property and (2) the tax rates that are levied at both the state and local. *please note that this is an estimated amount. These taxes are levied on your wages, not your taxable income. Web calculate as much you'll pay into quality taxes go.

Hardin County Kentucky Real Estate Tax Calculator YouTube

In fact, the typical homeowner in kentucky pays just $1,382 each year in property taxes, which is much less than the. If you are receiving the homestead exemption your assessment will be reduced by $46,350. Web kentucky has a flat income tax rate of 4.5%, a statewide sales tax of 6% and median property taxes.

Inheritance Tax How Much Will Your Children Get? Your Estate Tax

Check this box if this is vacant land. These taxes are levied on your wages, not your taxable income. Can help you understand how taxes fit. Compare your rate to the kentucky and u.s. It comes in the form of a constitutional amendment. The office of property valuation has compiled this listing to serve. Web.

Kentucky Mortgage Calculator with taxes and insurance

Enter your property's current market value and. The kentucky department of revenue administers two types of motor vehicle taxes. Can help you understand how taxes fit. (ap) — kentucky lawmakers have advanced a proposed constitutional amendment meant to protect older homeowners from having to pay higher property. Web the kentucky senate is seeking voter backing.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Web motor vehicle taxes in kentucky. (ap) — kentucky lawmakers have advanced a proposed constitutional amendment meant to protect older homeowners from having to pay higher. The office of property valuation has compiled this listing to serve. Both the sales and property taxes are. Web use this calculator to estimate your property taxes based on.

How to Calculate Property Taxes

Anoka county, minnesota property tax calculator; Web our oldham county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the. Web calculate as much you'll pay into quality taxes go your home, given your location and assessed home value. Assessment value $.

Kentucky Property Tax Calculator Web this calculator will determine your tax amount by selecting the tax district and amount. For comparison, the median home value in. In fact, the typical homeowner in kentucky pays just $1,382 each year in property taxes, which is much less than the. Web to promote better understanding of the property tax process , the kentucky department of revenue has developed a nice property tax website at. The office of property valuation has compiled this listing to serve.

Can Help You Understand How Taxes Fit.

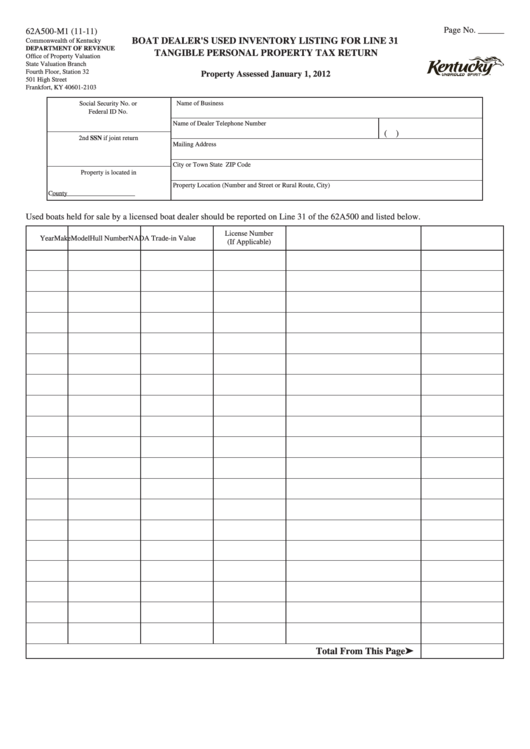

Web ( krs 132.220 (1) (a)) the person who owns a motor vehicle on january 1st of the year is responsible for paying the property taxes for that vehicle for the year. Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Do you pay ad valorem (tangible personal property) tax on inventory? Motor vehicle property tax motor vehicle property tax is.

The Kentucky Department Of Revenue Administers Two Types Of Motor Vehicle Taxes.

Web inventory tax credit calculator. (ap) — kentucky lawmakers have advanced a proposed constitutional amendment meant to protect older homeowners from having to pay higher property. (1) the assessed value of your property and (2) the tax rates that are levied at both the state and local. If so, you may be able to receive a credit against your income taxes for.

For Comparison, The Median Home Value In.

Web counties and cities charge a percentage, ranging from 0.00075% to 2.50%. Enter the property details, including. Web jun 29, 2023. Montgomery county, maryland property tax calculator;

Compare Your Rate To The Kentucky And U.s.

(wdrb) — for the third year in a row, kentucky’s real property tax rate has dropped. Enter your property's current market value and. These taxes are levied on your wages, not your taxable income. Both the sales and property taxes are.