La Property Tax Calculator

La Property Tax Calculator - 2nd installment due april 10th. Web estimate your los angeles property taxes with our free los angeles property tax calculator. Census bureau) number of cities that have local income taxes: Web supplemental secured property tax bill an additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of. Web the standard deduction in california is $5,202 for single filers and $10,404 for joint filers.

Web supplemental secured property tax bill an additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of. Propertyrecord.com has been visited by 100k+ users in the past month Taxpayers in california may also be eligible for a number of tax credits, for. Most annual property taxes include a computation based on a percentage of the. Web general info supplemental tax estimator this tool is designed to help you estimate property taxes after purchasing your home. That, in turn, reduces the home’s annual tax bill. Census bureau) number of cities that have local income taxes:

Estimate your 2023 property tax today Department of Revenue Hand in

Web louisiana income tax rate: Tax bills are mailed in oct. Web use this louisiana property tax calculator to estimate your annual property tax payment. 2nd installment due april 10th. For comparison, the median home value in los. Input details like purchase price to calculate your estimated property tax bill. Web find out how much.

These States Have the Highest Property Tax Rates TheStreet

After a property transfers, state law (proposition 13,. Tax bills are mailed in oct. Propertyrecord.com has been visited by 100k+ users in the past month Los angeles county collects, on average, 0.59% of. Customize using your filing status, deductions, exemptions and more. 1st installment due nov 1. Web estimate your los angeles property taxes with.

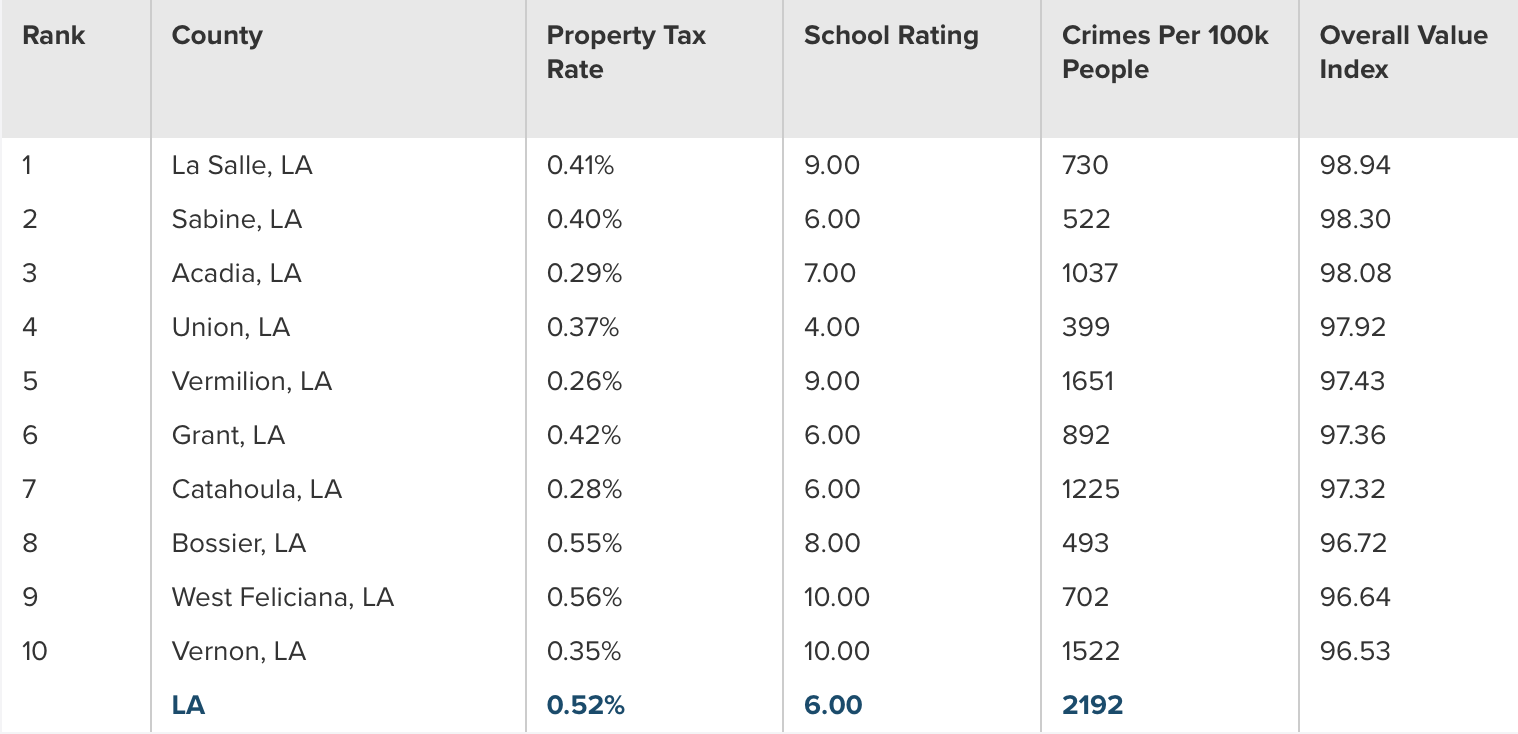

Acadia Parish Ranks Third in Louisiana where Homeowners Get Most Value

That, in turn, reduces the home’s annual tax bill. Web the supplemental tax estimator provides an estimate of the amount of supplemental taxes you can expect to pay if you have recently purchased a property. Web use this louisiana property tax calculator to estimate your annual property tax payment. Los angeles county collects, on average,.

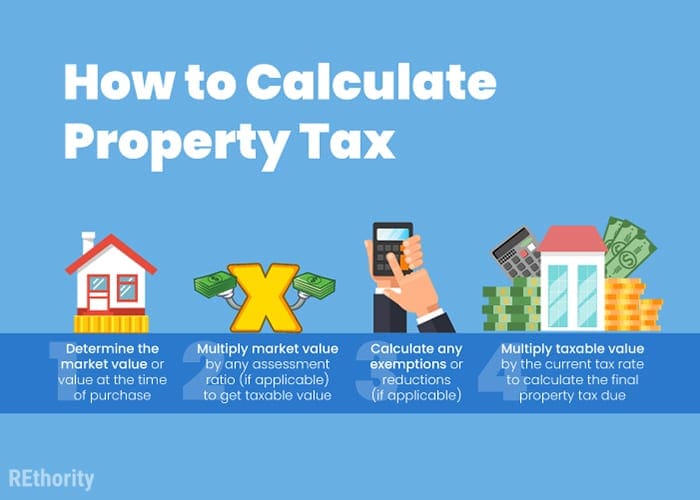

How to Calculate Property Taxes

Propertyrecord.com has been visited by 100k+ users in the past month Web la property tax rate is approx 1.25% paid in two installments each year. Web estimate your los angeles property taxes with our free los angeles property tax calculator. Web estimate my louisiana property tax. For comparison, the median home value in los. To.

Property Tax Calculator and Complete Guide

Input details like purchase price to calculate your estimated property tax bill. Web if your home or business was damaged by a natural disaster, you may be eligible for property tax relief. Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Web.

Property Tax Calculator

Propertyrecord.com has been visited by 100k+ users in the past month Tax bills are mailed in oct. After a property transfers, state law (proposition 13,. Input details like purchase price to calculate your estimated property tax bill. Web the los angeles county assessor establishes the assessed value of your property by appraising the value of.

How To Check Property Tax Informationwave17

Web estimate your los angeles property taxes with our free los angeles property tax calculator. Propertyrecord.com has been visited by 100k+ users in the past month Web the los angeles county assessor establishes the assessed value of your property by appraising the value of that property under applicable state laws. Web to use the calculator,.

Calculators for Property Taxes

For comparison, the median home value in. Web the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Los angeles county collects, on average, 0.59% of. Web louisiana.

Louisiana Tax Rate LA Tax Calculator Community Tax

Census bureau) number of cities that have local income taxes: Web estimate my louisiana property tax. Web supplemental secured property tax bill an additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of. Web the median property tax in los angeles.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Web the supplemental tax estimator provides an estimate of the amount of supplemental taxes you can expect to pay if you have recently purchased a property. For comparison, the median home value in. Web if your home or business was damaged by a natural disaster, you may be eligible for property tax relief. Input details.

La Property Tax Calculator Use this new orleans property tax calculator to estimate your annual property tax payment. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Web to use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Customize using your filing status, deductions, exemptions and more. Web the los angeles county assessor establishes the assessed value of your property by appraising the value of that property under applicable state laws.

Use This New Orleans Property Tax Calculator To Estimate Your Annual Property Tax Payment.

Customize using your filing status, deductions, exemptions and more. After a property transfers, state law (proposition 13,. Web the los angeles county assessor establishes the assessed value of your property by appraising the value of that property under applicable state laws. Input details like purchase price to calculate your estimated property tax bill.

For Comparison, The Median Home Value In Los.

Our louisiana property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Web general info supplemental tax estimator this tool is designed to help you estimate property taxes after purchasing your home. Web the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800.

Web The Supplemental Tax Estimator Provides An Estimate Of The Amount Of Supplemental Taxes You Can Expect To Pay If You Have Recently Purchased A Property.

Web supplemental secured property tax bill an additional tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of. Web find out how much you'll pay in louisiana state income taxes given your annual income. Web louisiana income tax rate: Web if your home or business was damaged by a natural disaster, you may be eligible for property tax relief.

Calculate Property Taxes Including California Property Taxes.

1st installment due nov 1. That, in turn, reduces the home’s annual tax bill. Web use this louisiana property tax calculator to estimate your annual property tax payment. The calculator will automatically apply local tax rates when known, or give you the ability.