Llc Vs S Corp Tax Calculator

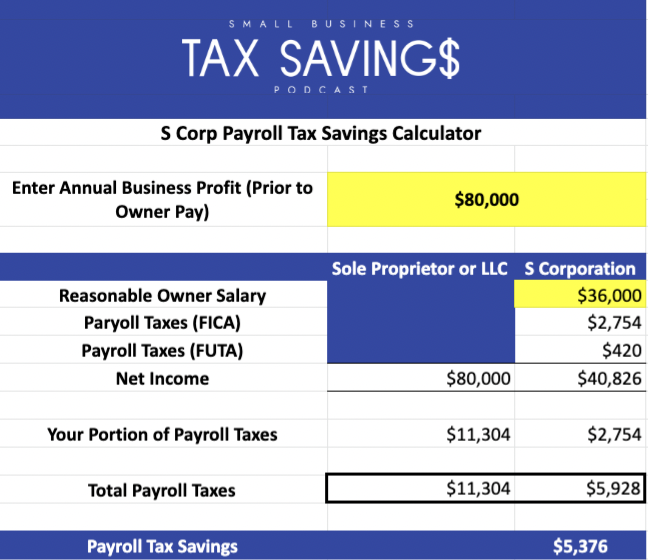

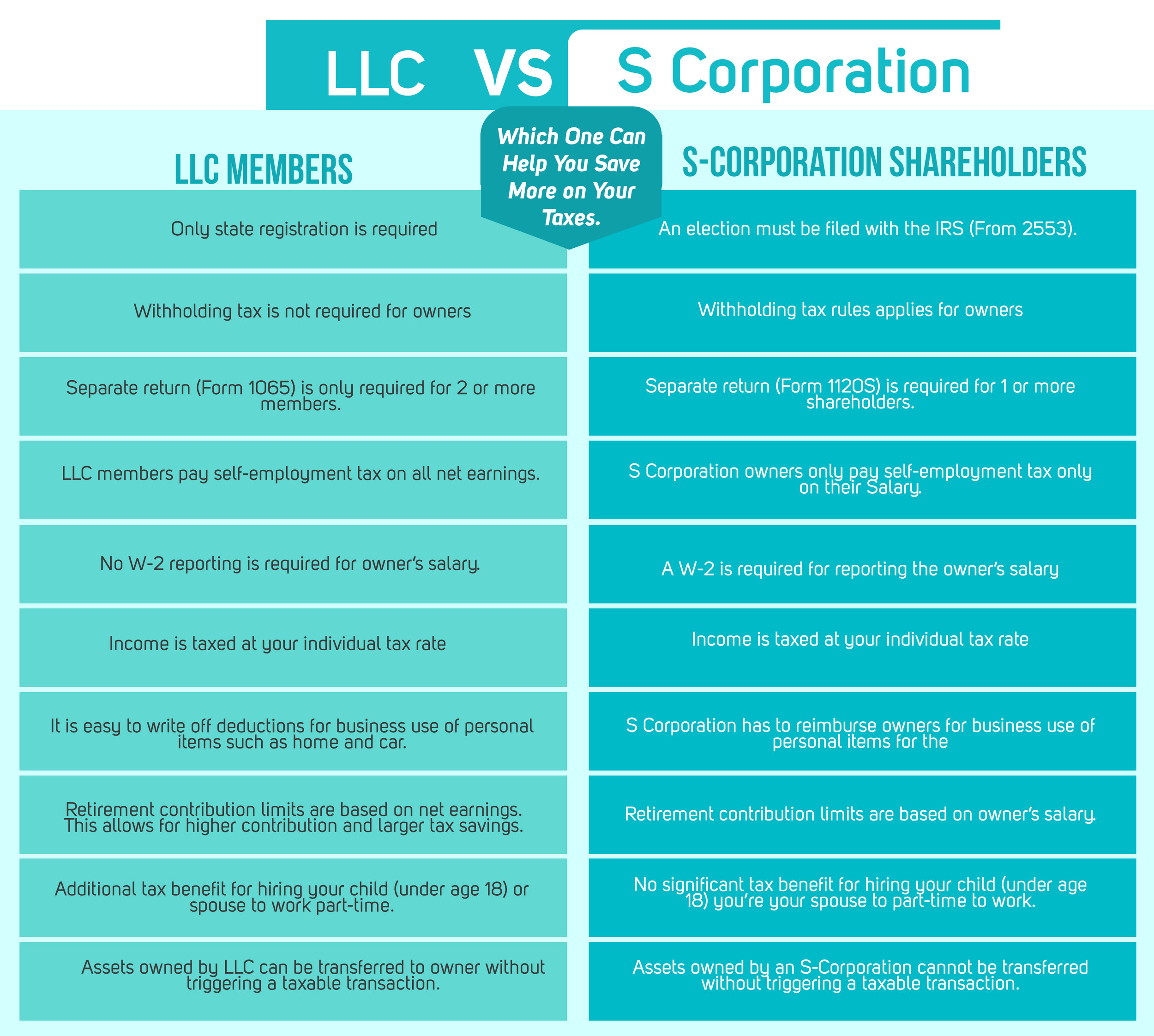

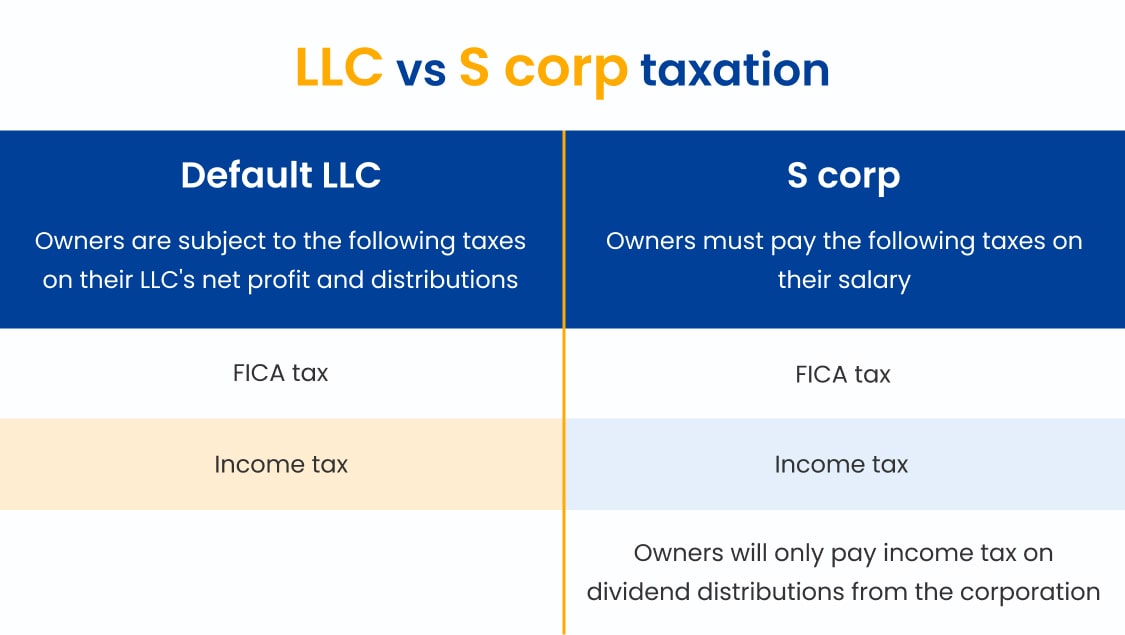

Llc Vs S Corp Tax Calculator - Web the biggest difference between s corporations and llcs is how they are taxed. Web llc tax calculator. Web the s corp tax calculator is also an s corp vs. Want to know how this could look for your business? Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200.

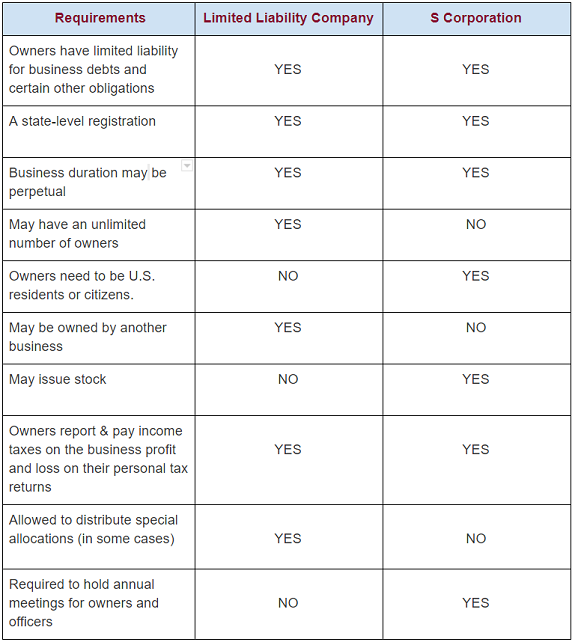

The business must make at. Web updated july 7, 2020: Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. From the authors of limited liability companies for dummies. Web profit and distribution. Web our llc vs. Web a limited liability company (llc) is a legal business structure.

LLC vs SCorporation Which One Can Save You More On Your Taxes? — RBA

Enter your estimated annual business net income and the. Web llc tax calculator. Web profit and distribution. Web shareholders must then pay tax on their dividend shares. Web updated july 7, 2020: Web this s corp tax calculator reveals your biggest costs, which can derail how much you could save. Enter your information into our.

S Corp Tax Calculator LLC vs C Corp vs S Corp

Web profit and distribution. Web the biggest difference between s corporations and llcs is how they are taxed. Web llc tax calculator. Web this s corp tax calculator reveals your biggest costs, which can derail how much you could save. Web business formations > s corporations > s corporation cost calculate your s corporation tax.

S Corporation, CCorporation Versus LLC Tax Comparison USA Corporate

Web shareholders must then pay tax on their dividend shares. Read ahead to calculate your s corp tax. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Owners can deduct a greater array of personal medical expenses, and it’s the easiest structure to attract investors..

Detailed Explanation For Difference Between LLC and S Corp

Enter your information into our tax savings calculator to see how much you. Both companies offer liability protection against the owners'. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web a limited liability company (llc) and an s corporation (s corp) are.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web business formations > s corporations > s corporation cost calculate your s corporation tax savings forming an s corporation may enable you to reduce self. Web updated july 7, 2020: Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web our.

What Is An S Corp?

Both companies offer liability protection against the owners'. $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Read ahead to calculate your s corp tax. Normally these taxes are withheld by your employer. Enter your information into our tax savings calculator to see how much you. Web.

What Entrepreneurs Should Know About SCorps Pixel Law

Web business formations > s corporations > s corporation cost calculate your s corporation tax savings forming an s corporation may enable you to reduce self. Web total s corp tax estimator: $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Web profit and distribution. The business.

S Corp vs. LLC Q&A, Pros & Cons of Each, and More

Web our s corp vs. It can help you compare the potential tax savings between filing as an llc vs. Increased liability protection over an llc. Owners can deduct a greater array of personal medical expenses, and it’s the easiest structure to attract investors. To compare an llc vs s corporation here’s the general formula..

S Corp vs. LLC What’s the Difference? TRUiC

Normally these taxes are withheld by your employer. Web the se tax rate for business owners is 15.3% tax of the first $160,200 of income and 2.9% of everything over $160,200. $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Web check each option you'd like to.

LLC vs S Corp Taxes, Ownership & Formation Requirements

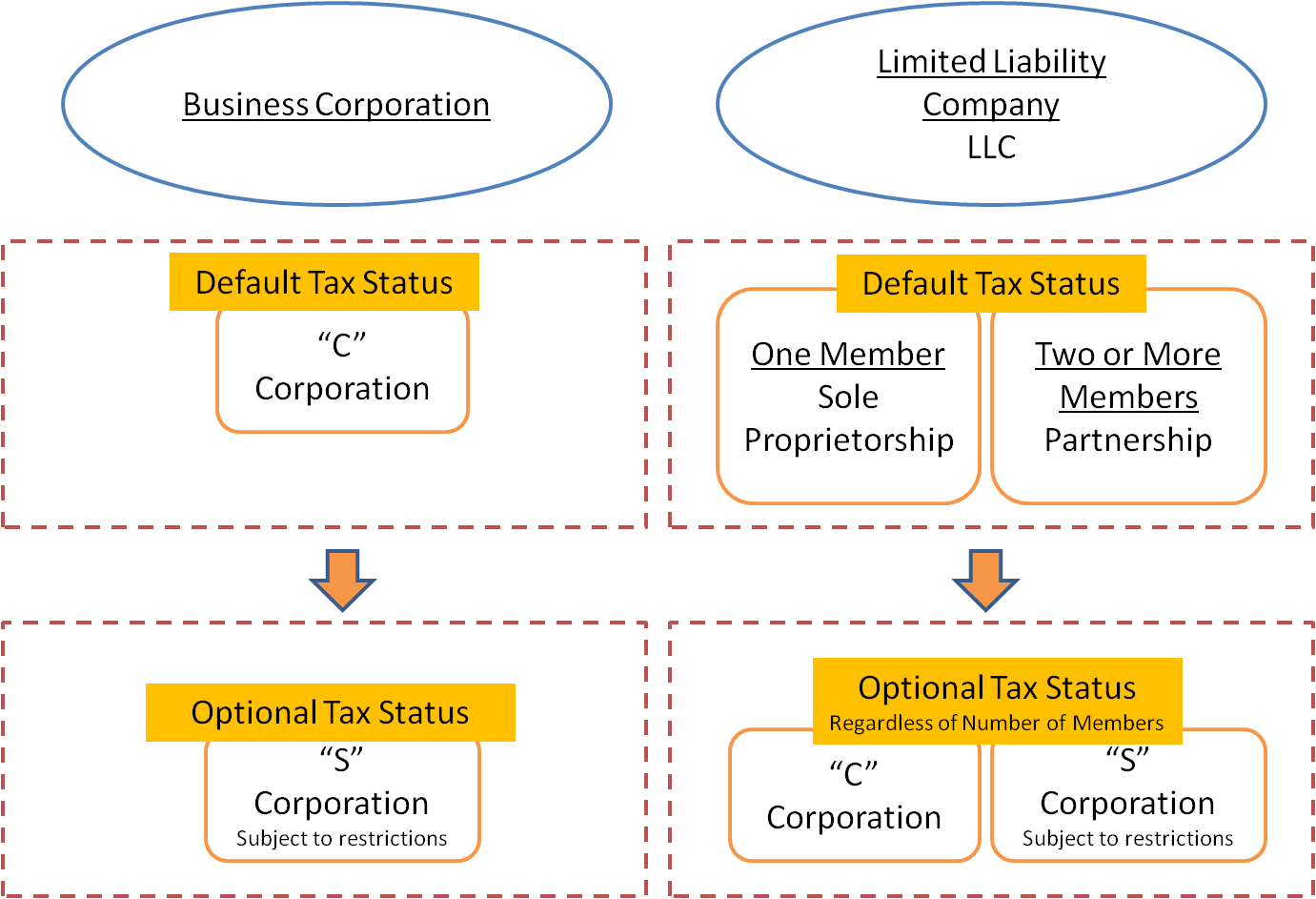

Corporation table below offers a quick reference to these three most common business formation options outside of sole proprietorships or partnerships. It can help you compare the potential tax savings between filing as an llc vs. 4/5 (17k reviews) Enter your information into our tax savings calculator to see how much you. Web updated july.

Llc Vs S Corp Tax Calculator S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. This calculator helps you estimate your potential savings. Owners can deduct a greater array of personal medical expenses, and it’s the easiest structure to attract investors. Both companies offer liability protection against the owners'. Web the biggest difference between s corporations and llcs is how they are taxed.

Enter Your Estimated Annual Business Net Income And The.

Web the biggest difference between s corporations and llcs is how they are taxed. From the authors of limited liability companies for dummies. Free small business & llc tax estimates. Web check each option you'd like to calculate for.

It Can Help You Compare The Potential Tax Savings Between Filing As An Llc Vs.

To compare an llc vs s corporation here’s the general formula. Web a limited liability company (llc) and an s corporation (s corp) are two types of business structures. Owners can deduct a greater array of personal medical expenses, and it’s the easiest structure to attract investors. Web the s corp tax calculator is also an s corp vs.

Enter Your Information Into Our Tax Savings Calculator To See How Much You.

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business. Want to know how this could look for your business? Read ahead to calculate your s corp tax.

Get The Spreadsheet Template Here:.

Web total s corp tax estimator: Normally these taxes are withheld by your employer. S corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to. Web this s corp tax calculator reveals your biggest costs, which can derail how much you could save.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)