Llc Vs Sole Proprietorship Tax Calculator

Llc Vs Sole Proprietorship Tax Calculator - Web $0 learn more » more: Web see your 2023 business taxes. Web the s corp tax calculator is also an s corp vs. Web 4 llc tax benefits. Web our s corp vs.

Read ahead to calculate your s corp tax. Web check each option you'd like to calculate for. Web our s corp vs. Set your business up for success with our free 2023 small business tax calculator. Web october 2, 2023 s corp tax calculator: Web 4 llc tax benefits. Web tax calculations for llcs and sole proprietorships.

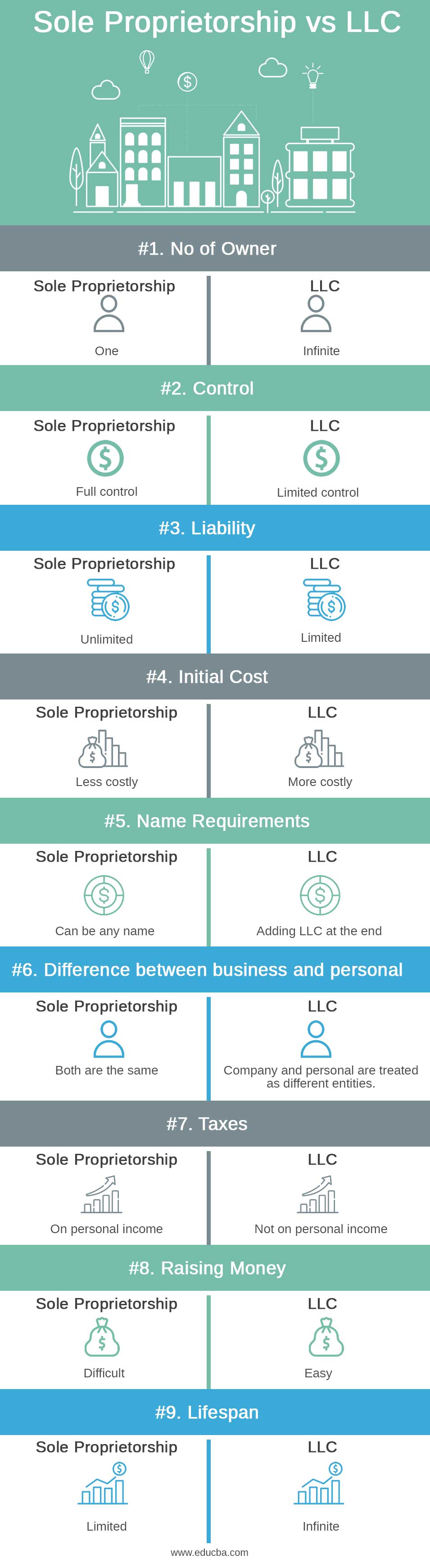

Sole Proprietorship vs LLC Key Differences & Comparison Table

Web 4 llc tax benefits. Set your business up for success with our free 2023 small business tax calculator. If you’re new to personal taxes 15.3% sounds like a lot less than the top bracket of 37%. Web an llc, which stands for “ limited liability company ” is a type of business entity that.

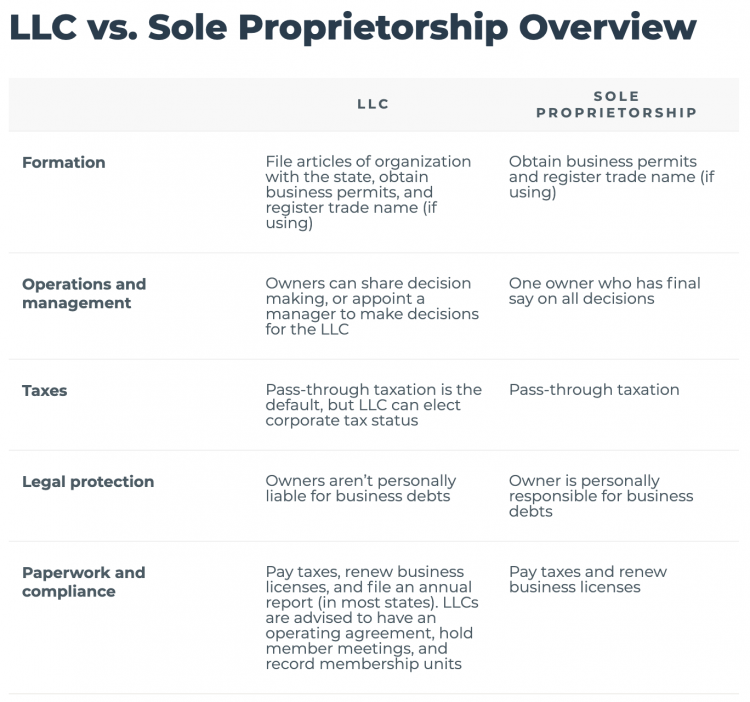

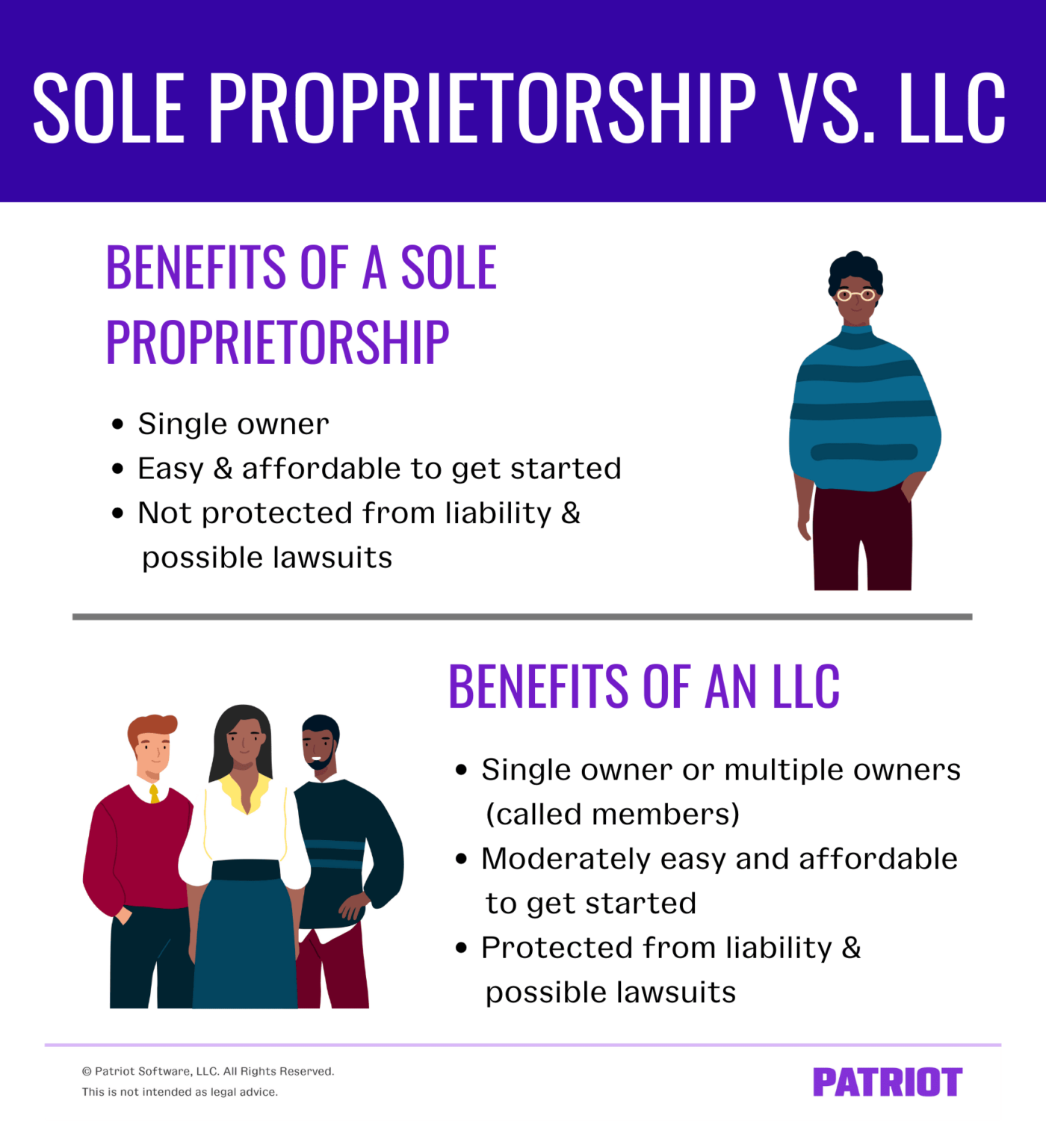

Differences Between Sole Proprietorship and LLC

Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? It can help you compare the potential tax savings between filing as an llc vs. Web talk to a broker use the llc tax calculator below to find out what your company will owe this tax year..

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web this tax calculator shows these values at the top of your results. Set your business up for success with our free 2023 small business tax calculator. Web an llc, which stands for “ limited liability company ” is a type of business entity that combines the tax benefits of sole proprietorships / partnerships with.

Sole Proprietorship vs LLC Similarities, Differences, Pros, Cons

Web talk to a broker use the llc tax calculator below to find out what your company will owe this tax year. Web an llc, which stands for “ limited liability company ” is a type of business entity that combines the tax benefits of sole proprietorships / partnerships with the. Web tax calculations for.

Sole Proprietorship vs. LLC A Comparison Step By Step Business

Web october 2, 2023 s corp tax calculator: Web 4 llc tax benefits. Keep in mind that this is an estimate, and you should. Here are the top four tax advantages business owners are able to use when they form an llc. Llc tax calculator guide will explain how to tell whether an s corp.

LLC Vs Sole Proprietorship Which Is Best for 2023? AtOnce

Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. Web the s corp tax calculator is also an s corp vs. Web however, we have provided this business tax calculator to give you a rough estimate of.

Which is Best for Your Business Sole Proprietorship vs. LLC?

Web tax calculations for llcs and sole proprietorships. Set your business up for success with our free 2023 small business tax calculator. Web however, we have provided this business tax calculator to give you a rough estimate of the types of tax savings your business could have if you incorporate. The following taxes apply to.

Sole Proprietorship vs. LLC A Comparison Step By Step Business

It can help you compare the potential tax savings between filing as an llc vs. The following taxes apply to llcs and sole proprietorships: Web sole proprietorship vs. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Keep in mind that this is an estimate, and.

Sole Proprietorship vs. LLC Which Is Best For You In 2023?

Web our s corp vs. Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Llcs are in the unique. Web s corporation tax savings calculator. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation.

LLC vs Sole Proprietorship The Complete Comparison

Keep in mind that this is an estimate, and you should. Paul sundin, cpa may 8, 2023 we'll show you our 117 tax planning strategies save a. Web now, if an llc has employees in addition to its members, or owners, the llc must collect and pay payroll taxes, which include unemployment, medicare, and social..

Llc Vs Sole Proprietorship Tax Calculator Web however, we have provided this business tax calculator to give you a rough estimate of the types of tax savings your business could have if you incorporate. Web this tax calculator shows these values at the top of your results. Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. The following taxes apply to llcs and sole proprietorships: Web talk to a broker use the llc tax calculator below to find out what your company will owe this tax year.

Web Our S Corp Vs.

Uncover tax savings for your business estimating your savings ever felt like you're paying more taxes than necessary? Web estimate your llc or 1099 taxes in our, zero sign up, tax dashboard. Keep in mind that this is an estimate, and you should. Llc tax calculator guide will explain how to tell whether an s corp election is right for your business.

Web 4 Llc Tax Benefits.

Includes effective tax rate, deductions, and savings. Web sole proprietorship vs. Read ahead to calculate your s corp tax. If you’re new to personal taxes 15.3% sounds like a lot less than the top bracket of 37%.

Llcs Are In The Unique.

Web an s corporation is a tax status of the internal revenue code (irs) subchapter s elected by llc or corporation business owners by filing form 2553. Web check each option you'd like to calculate for. Web s corporation tax savings calculator. Correct your errorssaves you timetrack inventorysend estimates

Web This Tax Calculator Shows These Values At The Top Of Your Results.

Web talk to a broker use the llc tax calculator below to find out what your company will owe this tax year. Web october 2, 2023 s corp tax calculator: Set your business up for success with our free 2023 small business tax calculator. Web see your 2023 business taxes.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)