Maine Income Tax Calculator

Maine Income Tax Calculator - This applies to various salary frequencies including annual,. Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Here, you will find a comprehensive list of income tax calculators, each tailored to. If you make $55,000 a year living in the region of maine, usa, you will be taxed $11,888. Calculate your 2023 maine state.

Web a single filer who earned $57,000 in 2023, will take home $45,304.62 after a $11,695.38 income tax. Updated for 2024 with income tax and social security deductables. This applies to various salary frequencies including annual,. Web calculate your annual take home pay in 2023 (that’s your 2023 annual salary after tax), with the annual maine salary calculator. Affordable pricingstimulus creditreduce your audit riskreal savings The maine tax calculator includes tax. Web what is the income tax rate in maine?

Maine Tax Calculator 2023 2024

Web welcome to the income tax calculator suite for maine, brought to you by icalculator™ us. Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Free tool to calculate your hourly and salary income. Annual state tax credits, withholdings. Earners with.

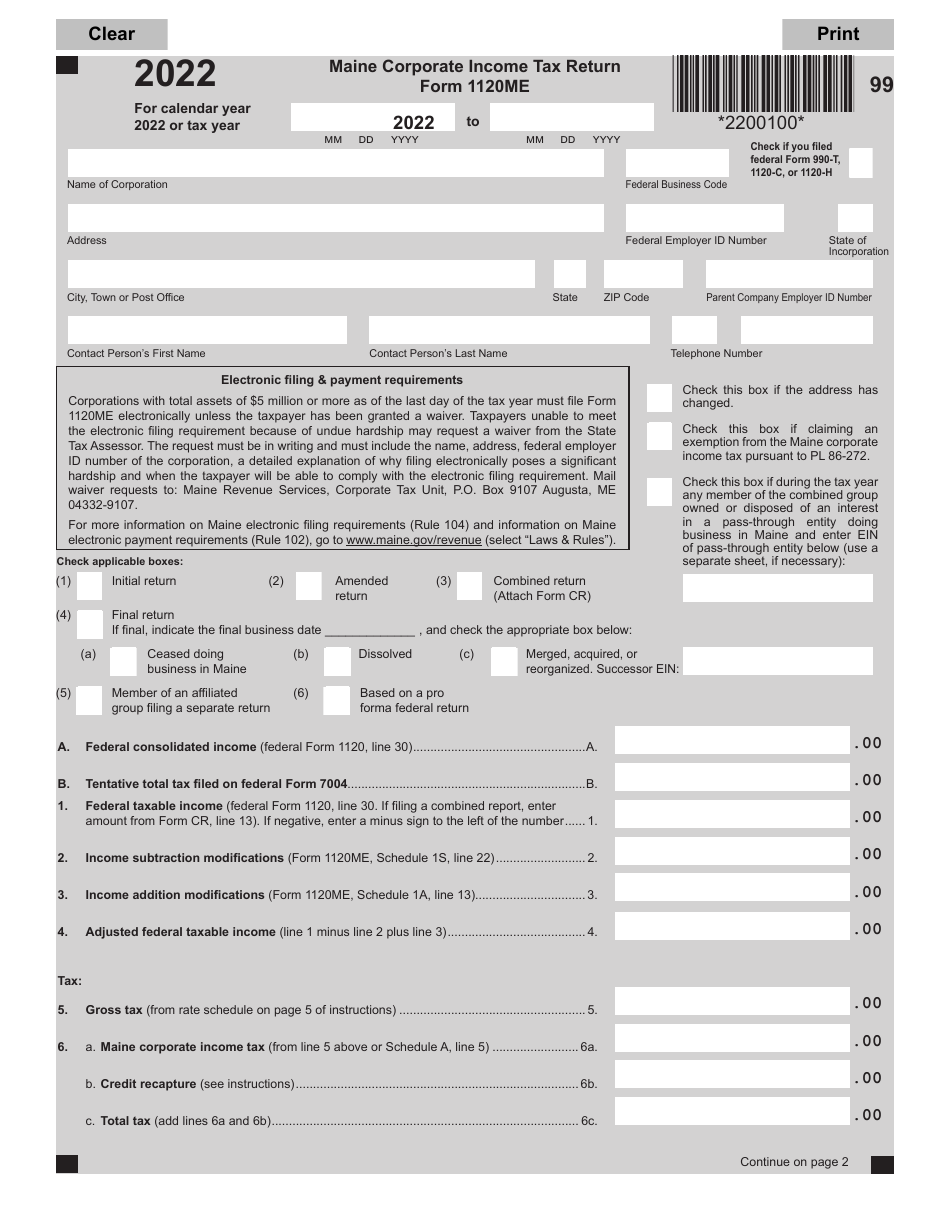

Form 1120ME Download Fillable PDF or Fill Online Maine Corporate

Web the tax tables below include the tax rates, thresholds and allowances included in the maine tax calculator 2023. Web calculate your annual take home pay in 2023 (that’s your 2023 annual salary after tax), with the annual maine salary calculator. You are able to use our maine state tax calculator to calculate your total.

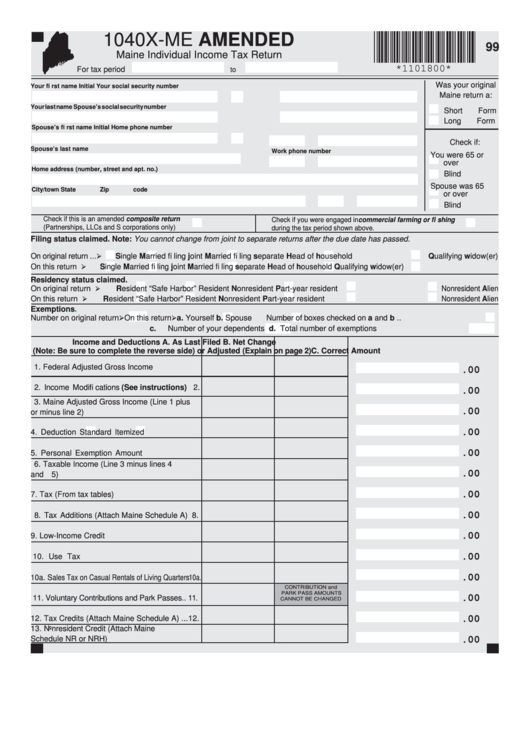

Form 1040xMe Maine Individual Tax Return printable pdf download

Web maine salary tax calculator for the tax year 2023/24. Maine provides a standard personal exemption tax. Here’s how to calculate it: Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Updated on dec 8 2023. Free tool to calculate your hourly and salary income. Property taxes are 3.51%.

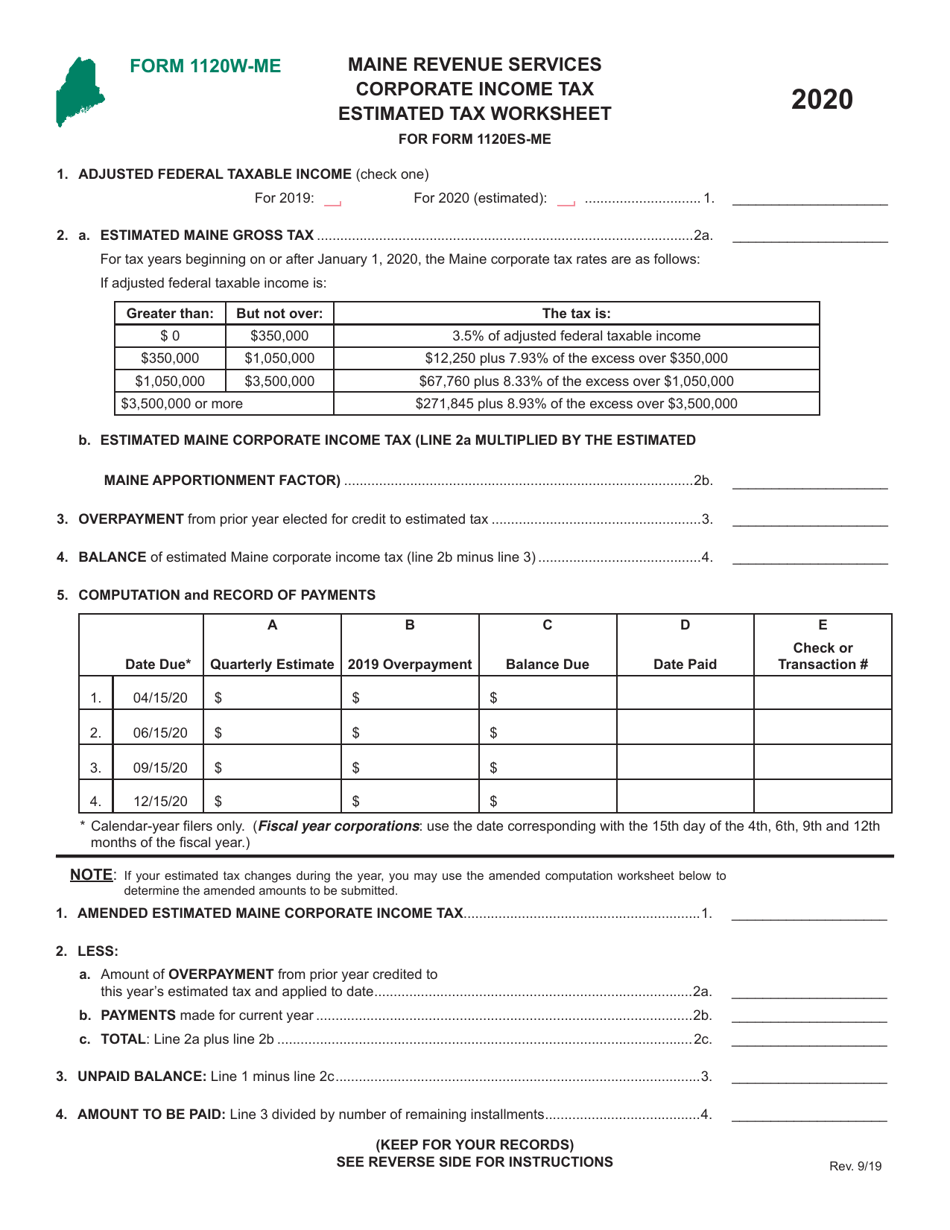

Form 1120WME Download Printable PDF or Fill Online Corporate

Web maine income taxes. Earners with incomes landing in the bottom bracket pay a rate of 5.80%. Annual state tax credits, withholdings. Updated on dec 05 2023. Affordable pricingstimulus creditreduce your audit riskreal savings Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce.

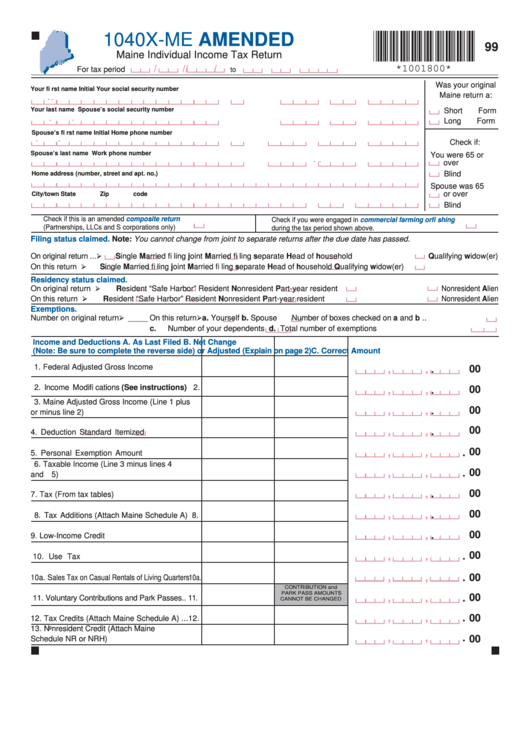

Form 1040Me Maine Individual Tax Return Form printable pdf

Web use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web maine paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Annual state tax credits, withholdings. Use our paycheck tax calculator. That means that.

Maine tax Fill out & sign online DocHub

Affordable pricingstimulus creditreduce your audit riskreal savings Web you can quickly estimate your maine state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. In 2023, the tax brackets were adjusted upward by about 7% to account for last year's.

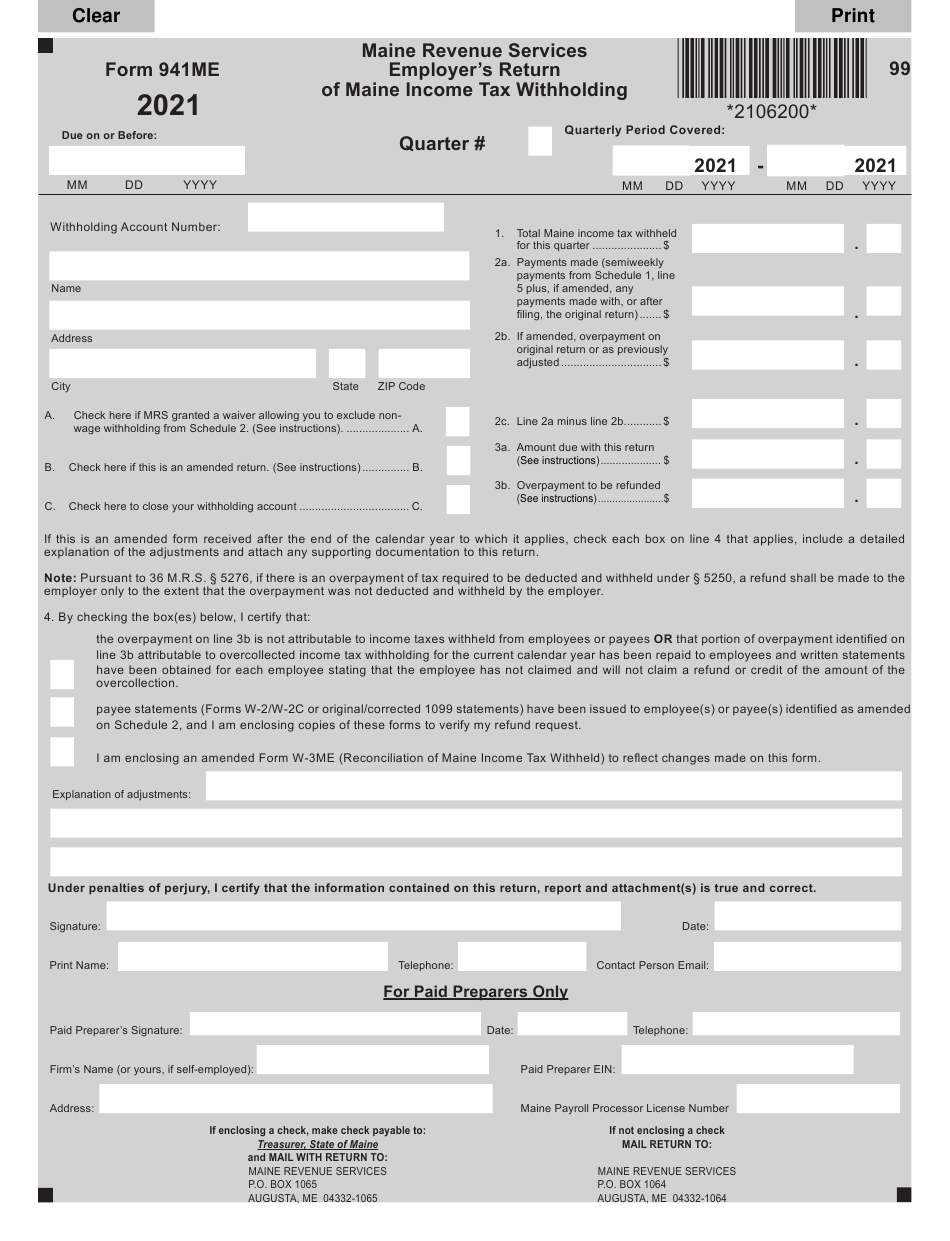

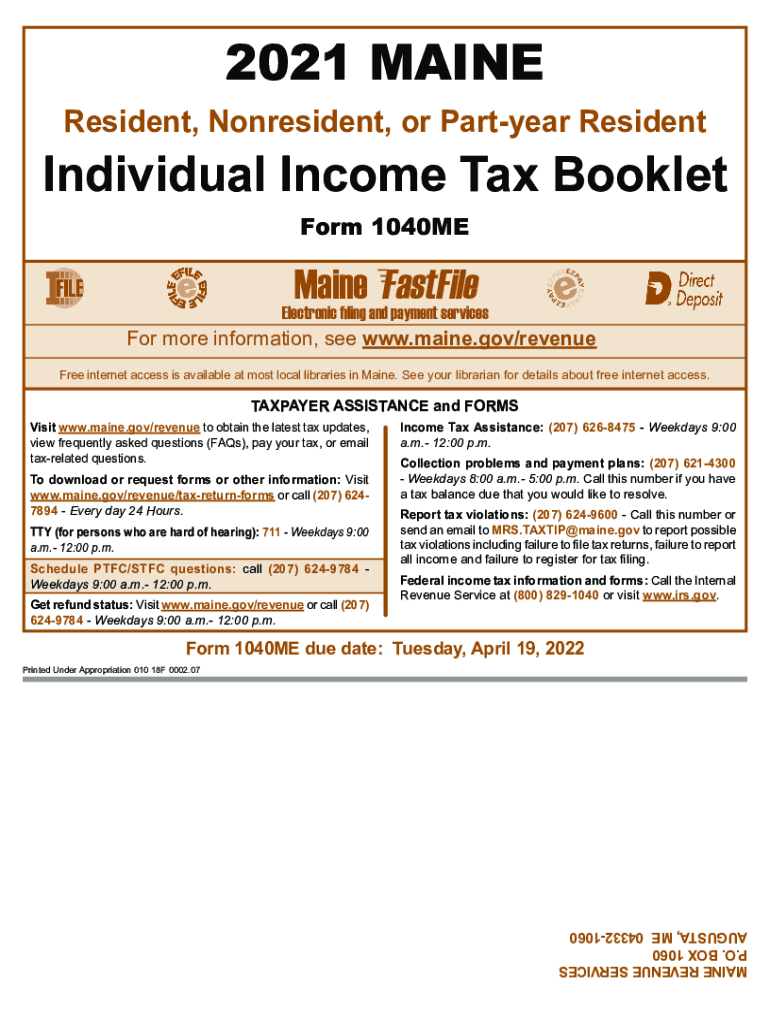

Maine Tax Withholding 2021 2022 W4 Form

Web welcome to the income tax calculator suite for maine, brought to you by icalculator™ us. Enter an amount for dependents.the old w4 used to ask for the number of dependents. This applies to various salary frequencies including annual,. Web a single filer who earned $57,000 in 2023, will take home $45,304.62 after a $11,695.38.

Maine Tax Fill Out and Sign Printable PDF Template signNow

Web maine salary tax calculator for the tax year 2023/24. Web calculate your annual take home pay in 2023 (that’s your 2023 annual salary after tax), with the annual maine salary calculator. Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. Just enter the wages, tax withholdings and other.

Maine Tax ME State Tax Calculator Community Tax

Web the median income in maine is $56,277; Updated on dec 8 2023. Here, you will find a comprehensive list of income tax calculators, each tailored to. The new w4 asks for a dollar amount. A quick and efficient way to compare annual. Web the tax tables below include the tax rates, thresholds and allowances.

Maine State Tax Tables 2023 US iCalculator™

You are able to use our maine state tax calculator to calculate your total tax costs in the tax year 2023/24. Web the tax tables below include the tax rates, thresholds and allowances included in the maine tax calculator 2023. Updated on dec 8 2023. Free tool to calculate your hourly and salary income. Affordable.

Maine Income Tax Calculator If you make $55,000 a year living in the region of maine, usa, you will be taxed $11,888. Maine provides a standard personal exemption tax. Web a single filer who earned $57,000 in 2023, will take home $45,304.62 after a $11,695.38 income tax. The income tax rates and personal allowances in maine are updated annually with new tax tables published for resident and non. Web maine income taxes.

Web Calculate Your Annual Take Home Pay In 2023 (That’s Your 2023 Annual Salary After Tax), With The Annual Maine Salary Calculator.

The maine tax calculator includes tax. A quick and efficient way to compare annual. Affordable pricingstimulus creditreduce your audit riskreal savings Enter an amount for dependents.the old w4 used to ask for the number of dependents.

Generally, Property Taxes Are Higher In The More Southern.

The state income tax in maine is based on just three brackets. Calculate your 2023 maine state. If you make $55,000 a year living in the region of maine, usa, you will be taxed $11,888. Just enter the wages, tax withholdings and other information.

Web Use Icalculator™ Us's Paycheck Calculator Tailored For Maine To Determine Your Net Income Per Paycheck.

Use our paycheck tax calculator. Web you can quickly estimate your maine state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. Web what is the income tax rate in maine? That means that your net pay will be $43,113 per year, or $3,593 per month.

The New W4 Asks For A Dollar Amount.

Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. The income tax rates and personal allowances in maine are updated annually with new tax tables published for resident and non. Web use adp’s maine paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web the median income in maine is $56,277;