Maine Pers Retirement Calculator

Maine Pers Retirement Calculator - Many of the defined benefit retirement plans offered in the participating local district (pld) consolidated retirement plan (county, municipal, and other public entities) are also offered in lieu of social security. The maximum deduction for individual taxpayers for tax year 2023 is $30,000. Web how much should i save for retirement? If you make $100,000 at retirement, then you’ll need $1 million in savings. Web the amount of the pension income deduction available varies depending on the tax year and will be reduced by social security or railroad retirement benefits you may receive.

At any age, with at least 25 years of creditable service 360 degrees of financial literacy. Serving the public with sound retirement services to maine governments. Web the maine public employees retirement system (mainepers) administers benefits for employees of participating local districts who are members of the system. Please include your name, as well as the name and birth date of your beneficiary with your message. Web the state of maine provides defined benefit retirement plans (state, teacher, legislative, and judicial) in lieu of social security. It cannot replace mainepers’ actual calculation of benefits when you retire.

Maine Public Employees Retirement System (PERS) Landry French

For active members, the most recent. News and updates regarding the program are always communicated to employers via the employer update newsletter. At any age, with at least 25 years of creditable service Web to get you started, mainepers is pleased to present four new videos that provide an overview on frequently asked questions, including.

Maine Retirement

Web use this calculator to determine an individual’s group life insurance premium. This is done in conjunction with employee contribution rate adjustments so that both members and employers share in positive and negative risks, such as investments returns. For active members, the most recent. Web if you just want to see how your tracking and.

The 10 Best Retirement Calculators NewRetirement

But this is a very rough estimate. Web participating in the member portal is optional. Forms may be downloaded by clicking the download links below. Web the amount of the pension income deduction available varies depending on the tax year and will be reduced by social security or railroad retirement benefits you may receive. Web.

The 10 Best Retirement Calculators NewRetirement

Web retirement and related services. The maximum deduction for individual taxpayers for tax year 2023 is $30,000. Benefit payment and tax information. It cannot replace mainepers’ actual calculation of benefits when you retire. Web use this calculator to determine an individual’s group life insurance premium. A rule of thumb is that you’ll need 10 times.

The Best Retirement Calculators You Need to Try

If you are thinking about retiring, we encourage you to request a retirement estimate as soon as possible. Gross income exclusion for eligible retired public safety workers; Serving the public with sound retirement services to maine governments. Forms may be downloaded by clicking the download links below. Web as a member of the maine public.

Retirement Calculator How Much Will I Have in Retirement?

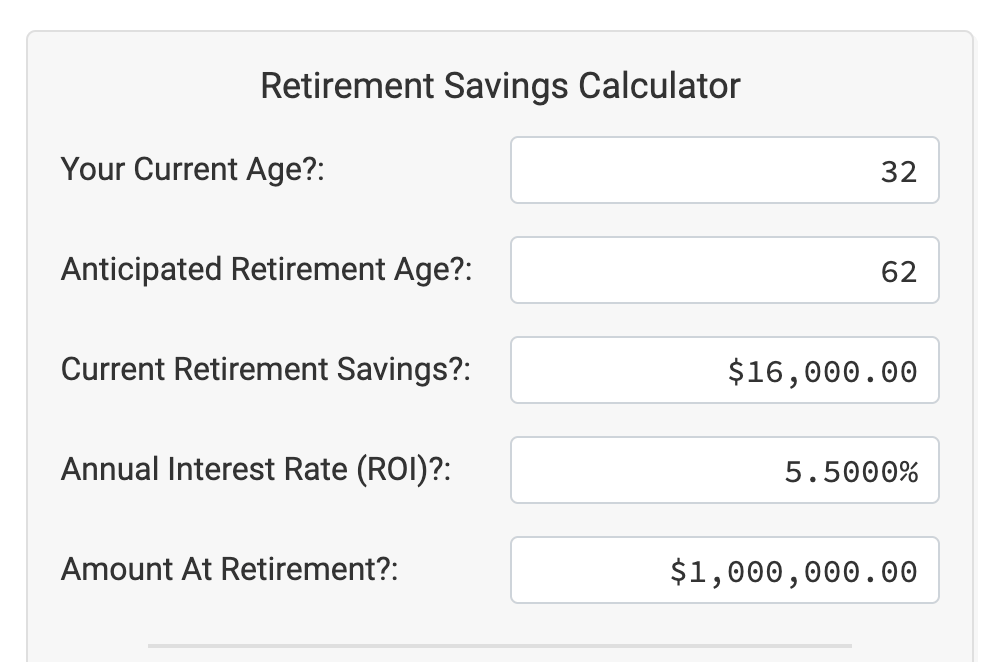

The aarp retirement calculator helps you refine that estimate. Those who choose to create a user account will have access to the following: Choose your employer type to get started. Web if you just want to see how your tracking and how much your current savings could be over time, try our free retirement calculator..

5 Best Retirement Calculators Which Are Totally Free Financial

Web to get you started, mainepers is pleased to present four new videos that provide an overview on frequently asked questions, including when and how to contact mainepers about your approaching retirement, how to select a benefit plan, how benefits are paid, and when benefits may cover the cost of insurance. For a general summary.

Pers retirement calculator KateAnnaleise

The legislature established maine’s state retirement system in 1942 for state employees. Web group life insurance below are links to tables and information commonly used by employers for the mainepers group life insurance program. At any age, with at least 25 years of creditable service Serving the public with sound retirement services to maine governments..

Retirement Savings Calculator

The state’s property taxes are somewhat higher than the national median at a 1.28% effective rate. This estimator does not verify eligibility. Many of the defined benefit retirement plans offered in the participating local district (pld) consolidated retirement plan (county, municipal, and other public entities) are also offered in lieu of social security. To request.

Best free retirement calculator MagnumTaylon

For a general summary of the benefits available, see mainepers benefits for members in the participating local district (pld) consolidated plan. A rule of thumb is that you’ll need 10 times your income at retirement. At age 60, 62 or 65 (your normal retirement age) with at least one (1) year of creditable service immediately.

Maine Pers Retirement Calculator At age 60, 62 or 65 (your normal retirement age) with at least one (1) year of creditable service immediately before retirement, if you have reached your plan’s normal retirement age, or. For a general summary of the benefits available, see mainepers benefits for members in the participating local district (pld) consolidated plan. Web group life insurance below are links to tables and information commonly used by employers for the mainepers group life insurance program. At any age, with at least 25 years of creditable service Web the maine public employees retirement system (mainepers) administers benefits for employees of participating local districts who are members of the system.

If You Have Additional Questions, Please Contact Survivor Services.

News and updates regarding the program are always communicated to employers via the employer update newsletter. But this is a very rough estimate. Qualified domestic relations order (qdro). This estimator does not verify eligibility.

Serving The Public With Sound Retirement Services To Maine Governments.

A rule of thumb is that you’ll need 10 times your income at retirement. In addition to the mainepers benefit estimator, and the windfall elimination provision (wep)/government pension offset (gpo) calculators, the following websites may provide useful information to mainepers active and retired members: Web to get you started, mainepers is pleased to present four new videos that provide an overview on frequently asked questions, including when and how to contact mainepers about your approaching retirement, how to select a benefit plan, how benefits are paid, and when benefits may cover the cost of insurance. Web use this calculator to determine an individual’s group life insurance premium.

Web Requesting A Retirement Estimate.

For a general summary of the benefits available, see mainepers benefits for members in the participating local district (pld) consolidated plan. Web retirement and related services. Web the results are an estimate of the annual and monthly service retirement benefit of a regular plan member under the full benefit option. For active members, the most recent.

Web Group Life Insurance Below Are Links To Tables And Information Commonly Used By Employers For The Mainepers Group Life Insurance Program.

The legislature established maine’s state retirement system in 1942 for state employees. When you can retire depends on your retirement plan. Web as a member of the maine public employees retirement system, you contribute, along with the state of maine, to both retirement and life insurance benefits. In most cases, you can retire: