Maryland 529 Calculator

Maryland 529 Calculator - The last thing you need to be sure of is that the. Web check out the resources below to learn more about the federal and maryland tax benefits of maryland 529: Web 529 plans for those living in maryland maryland has 97 colleges and universities, with annual tuition, books, and housing costs averaging approximately. Web if an encrypted email from maryland 529 is not accessible to the account holder, the opt out request as described above may be sent unencrypted to. Review the certain federal tax considerations and certain state tax.

Web anthony savia, executive director of maryland 529 fund, said the mishap began when the 529 fund had to switch software programs. Web maryland college investment plan. Web so, using today’s limit, it would take you 5 years to roll over the entire $35,000 ($7,000 per year over 5 years). Web access the maryland 529 investment plan college savings calculator and gotuition gifting portal. $500k maximum investmentno income requirementsdedicated sales teamopen with $1 Web 529 plans for those living in maryland maryland has 97 colleges and universities, with annual tuition, books, and housing costs averaging approximately. Web decide how much and how often you want to invest, based on your budget and goals.

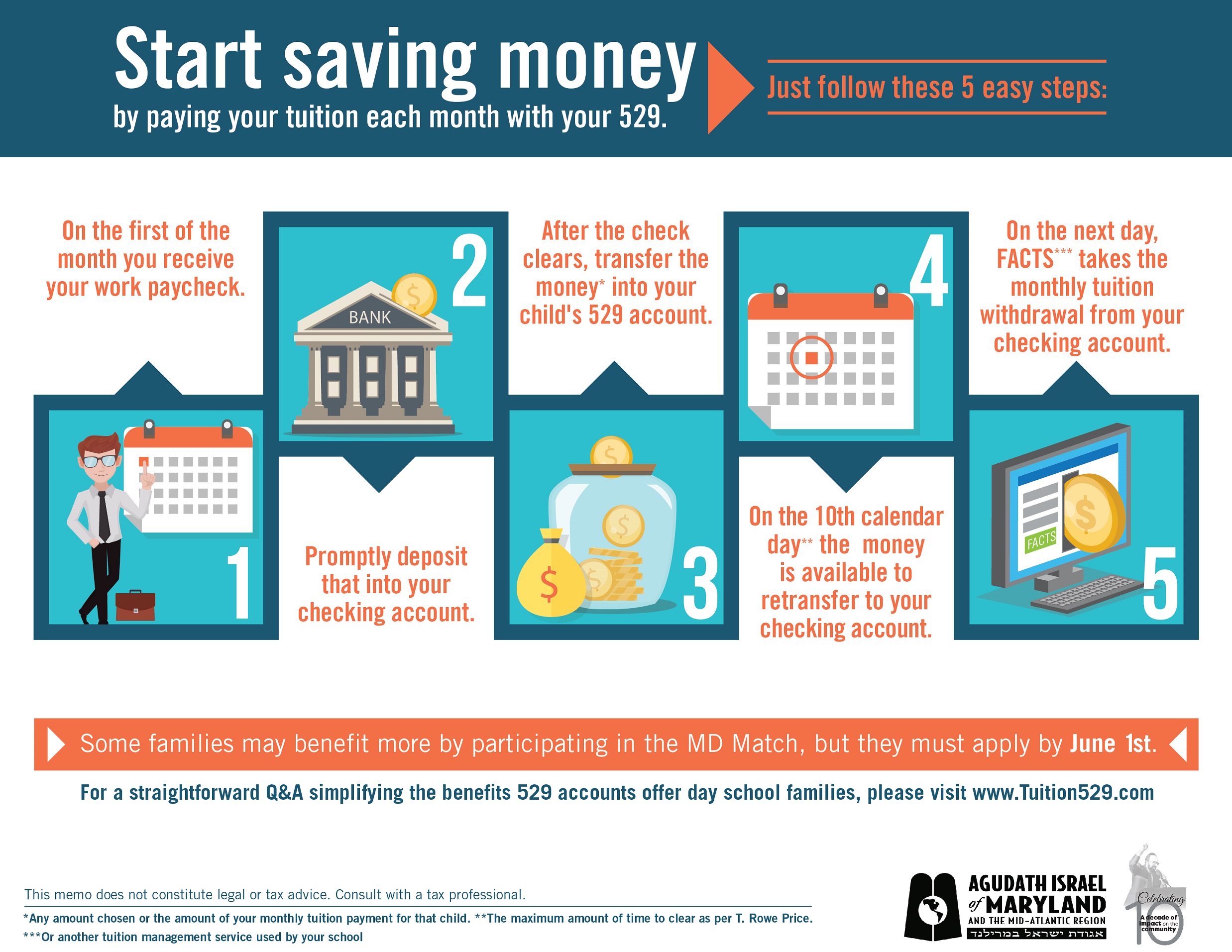

529 Agudath Israel of Maryland

Web the college savings calculator can help your family understand future college expenses and estimate how much to save in order to stay on track with your college savings goals. Web choosing a 529 plan. Web access the maryland 529 investment plan college savings calculator and gotuition gifting portal. Web 529 plans for those living.

Maryland 529 New Account Enrollment Form Enrollment Form

Use our college savings calculator to estimate college costs and your savings goals. The last thing you need to be sure of is that the. $500k maximum investmentno income requirementsdedicated sales teamopen with $1 Web state tax 529 calculator select your state and adjust the assumptions below to determine how much the 529 tax benefits.

529 Calculator Start saving for college before your child is born

Web so, using today’s limit, it would take you 5 years to roll over the entire $35,000 ($7,000 per year over 5 years). The last thing you need to be sure of is that the. Web state tax 529 calculator select your state and adjust the assumptions below to determine how much the 529 tax.

Maryland 529 Plans Learn the Basics + Get 30 Free for College Savings

Web 529 plans for those living in maryland maryland has 97 colleges and universities, with annual tuition, books, and housing costs averaging approximately. Those who invested in a. Start by selecting your home state, and see how your state's options and tax advantages stack up against plans from other states. Accumulate more in a 529.

Video Help your child pay for college with Maryland 529

Use the college savings calculator to help your family understand future college expenses and estimate how much to save in order to stay on. Web we're here to help. Web check out the resources below to learn more about the federal and maryland tax benefits of maryland 529: Answer a few simple questions to see.

The Best 529 Plan for Maryland Residents

Use the college savings calculator to help your family understand future college expenses and estimate how much to save in order to stay on. Web check out the resources below to learn more about the federal and maryland tax benefits of maryland 529: Use your savings at any federally accredited college, technical or trade school,.

Maryland 529. November 6, 2020

Web if an encrypted email from maryland 529 is not accessible to the account holder, the opt out request as described above may be sent unencrypted to. Web maryland college investment plan. Accumulate more in a 529 plan vs a taxable account what are the advantages of a 529 college savings plan?. Web 529 state.

Ready to Open a 529 Account in Maryland? Read This First.

Accumulate more in a 529 plan vs a taxable account what are the advantages of a 529 college savings plan?. Web 529 state tax calculator. This includes tuition, room and board, books and supplies, and other. Web anthony savia, executive director of maryland 529, told 11 news that a calculation issue came about when the.

HOW MUCH TO SAVE FOR COLLEGE COLLEGE SAVING CALCULATOR 529 PLAN

$500k maximum investmentno income requirementsdedicated sales teamopen with $1 Web maryland college investment plan. Use the college savings calculator to help your family understand future college expenses and estimate how much to save in order to stay on. Use our college savings calculator to estimate college costs and your savings goals. Web the ehrles are.

How to get started with a 529 Plan + a College Savings Calculator

Use the college savings calculator to help your family understand future college expenses and estimate how much to save in order to stay on. Answer a few simple questions to see whether your state offers a tax benefit for 529 plan contributions and, if so, how much it might be. This calculator is designed to..

Maryland 529 Calculator Web we're here to help. Web the maryland 529 college savings plans are the only 529 plans that offer a maryland state income deduction each year for your payments or contributions to the plans. The last thing you need to be sure of is that the. Use your savings at any federally accredited college, technical or trade school, as well as. Those who invested in a.

Web The Ehrles Are Among Nearly 500 Families Maryland 529 Officials Say Were Impacted By An Interest Calculation Issue That Began In November 2021 And Resulted In.

Use our college savings calculator to estimate college costs and your savings goals. Start by selecting your home state, and see how your state's options and tax advantages stack up against plans from other states. What college savers should know. Web 529 plans for those living in maryland maryland has 97 colleges and universities, with annual tuition, books, and housing costs averaging approximately.

Web Maryland College Investment Plan.

Use the college savings calculator to help your family understand future college expenses and estimate how much to save in order to stay on. Use your savings at any federally accredited college, technical or trade school, as well as. This calculator is designed to. Web access the maryland 529 investment plan college savings calculator and gotuition gifting portal.

Web Decide How Much And How Often You Want To Invest, Based On Your Budget And Goals.

Review the certain federal tax considerations and certain state tax. Web we're here to help. Web the college savings calculator can help your family understand future college expenses and estimate how much to save in order to stay on track with your college savings goals. Web if an encrypted email from maryland 529 is not accessible to the account holder, the opt out request as described above may be sent unencrypted to.

This Includes Tuition, Room And Board, Books And Supplies, And Other.

Web anthony savia, executive director of maryland 529, told 11 news that a calculation issue came about when the state was trying to give back to account holders. Web so, using today’s limit, it would take you 5 years to roll over the entire $35,000 ($7,000 per year over 5 years). Answer a few simple questions to see whether your state offers a tax benefit for 529 plan contributions and, if so, how much it might be. Web check out the resources below to learn more about the federal and maryland tax benefits of maryland 529: