Medicare Part D Enrollment Penalty Calculator

Medicare Part D Enrollment Penalty Calculator - Web part d late enrollment penalty calculator number of months you went without coverage months 0 45 90 135 180 estimated monthly penalty for 2024 $0 will i have to. Web the lep is calculated as 1% of the national base medicare part d premium for each month you were without some form of creditable prescription drug coverage. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug. Web part b penalty explained. If you don't see your situation, contact social.

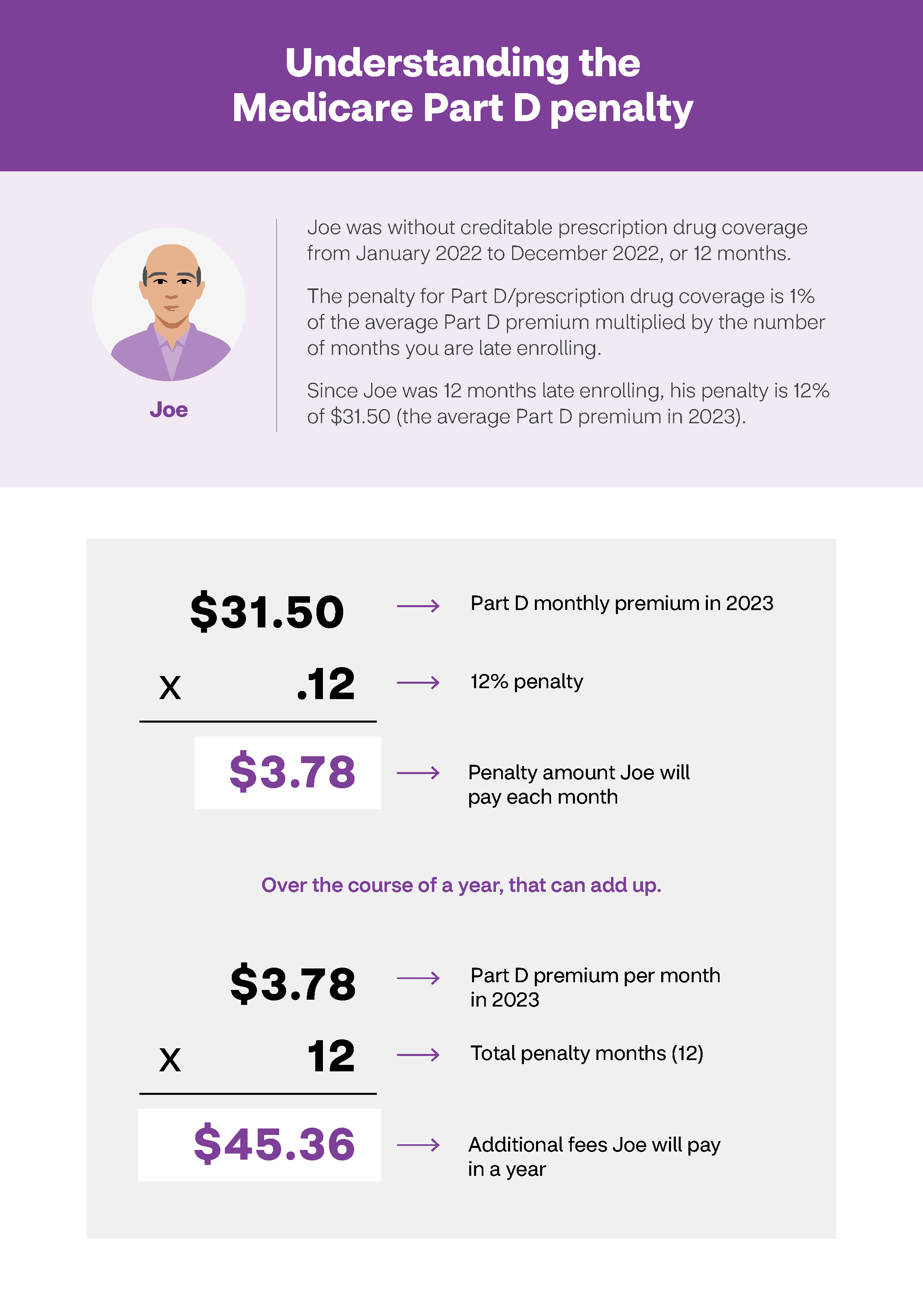

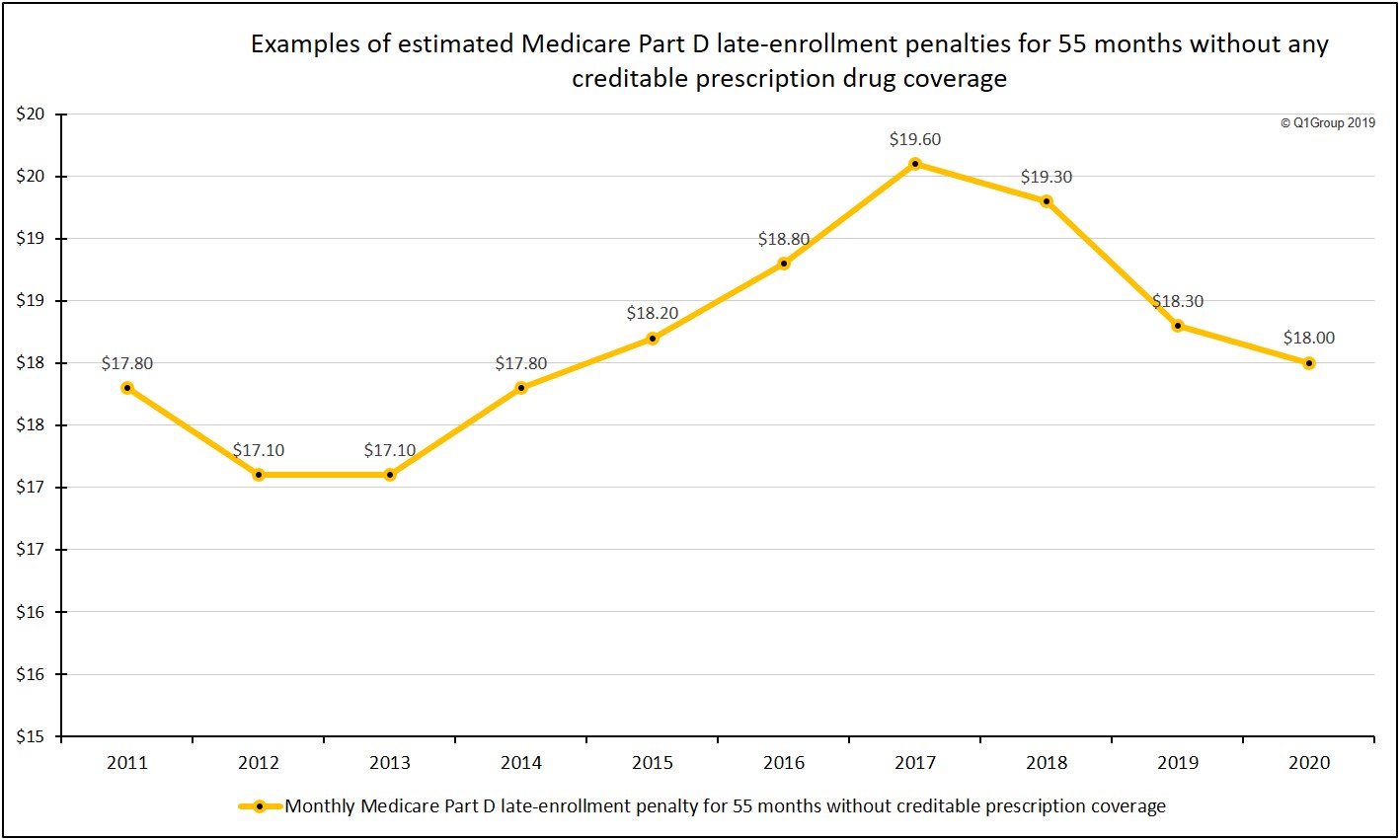

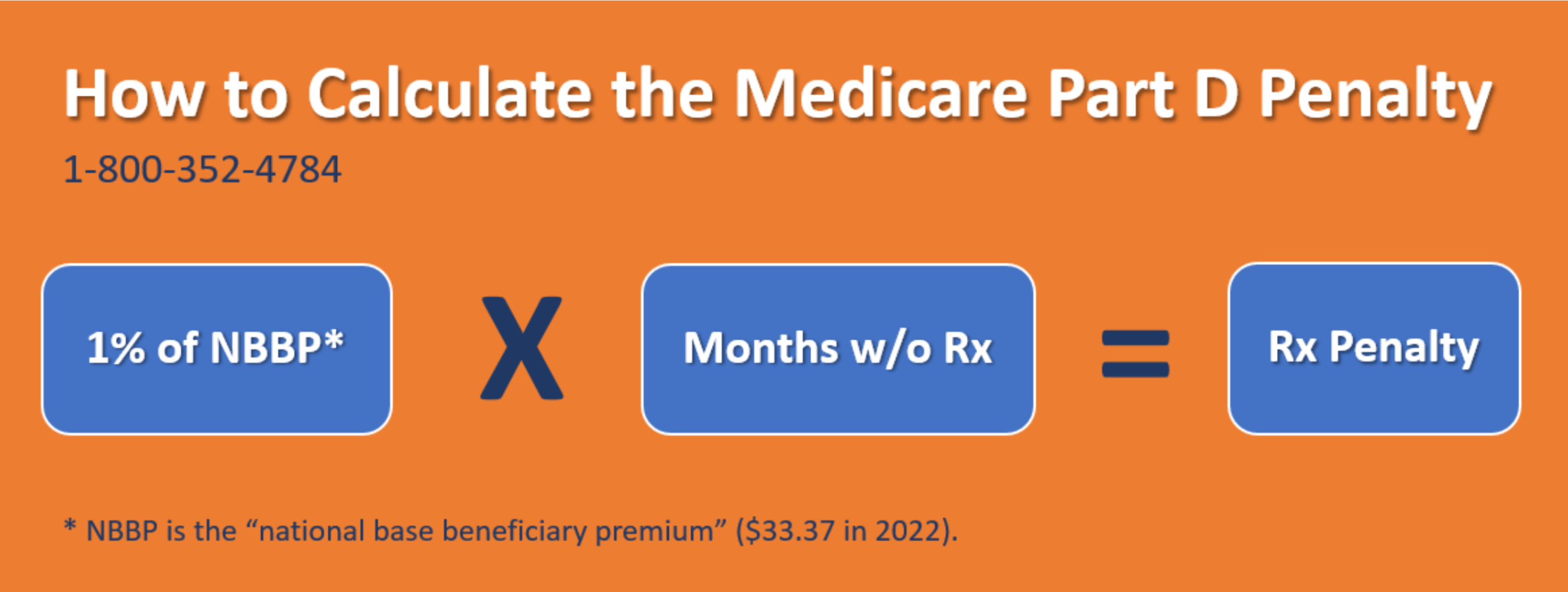

Medicare beneficiaries may incur a late enrollment penalty (lep) if there is a continuous period of 63 days or more at any time after the end of the. Web the lep is calculated as 1% of the national base medicare part d premium for each month you were without some form of creditable prescription drug coverage. Web with extra help, your part d premium and deductible are both $0 and you’ll pay no more than $4.50 for each generic drug and a maximum of $11.20 for each brand. Web in most cases, if you don’t sign up for medicare when you’re first eligible, you may have to pay a higher monthly premium. Web part b penalty explained. Web §whole age and whole years of service used to calculate examples: Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug.

How to avoid late enrollment penalties Aetna Medicare

Web with extra help, your part d premium and deductible are both $0 and you’ll pay no more than $4.50 for each generic drug and a maximum of $11.20 for each brand. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10 = $9.70 $9.70 = mrs. Web.

How To Calculate The Medicare Part D Penalty

Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your part b monthly premium for 2024. Web §whole age and whole years of service used to calculate examples: Web with extra help, your part d premium and deductible are both $0 and you’ll pay no more.

How To Calculate The Medicare Part D Penalty

Web estimate my medicare eligibility & premium. If you don't see your situation, contact social. Web how is the part d penalty calculated? It’s a tool that helps. (grab your calculator!) avoid the part d late. Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your.

How to calculate Medicare Part D late enrollment penalty? YouTube

Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your part b monthly premium for 2024. Web your medicare part d penalty would be 24 percent of the national base premium, one percent for each of the 24 months you waited. (grab your calculator!) avoid the.

How is the Part D Late Enrollment Penalty Calculated? Total Benefit

§you will have to pay a part b late enrollment penalty if you decide to delay enrolling in medicare. Web how is the part d penalty calculated? Web with extra help, your part d premium and deductible are both $0 and you’ll pay no more than $4.50 for each generic drug and a maximum of.

Late Enrollment Penalty (LEP) Calculator Part D ConvertCalculator

Web if you’ve ever wondered how much a late enrollment in part d could cost, then meet your new best friend: The cost of the late enrollment penalty depends on how long you went without part d or creditable prescription drug coverage. More information on medicare late enrollment. Web your medicare drug plan (part d).

How do I calculate my Medicare Part D LateEnrollment Penalty?

Original, or traditional, medicare consists of medicare parts a and b. You will need to obtain part d prescription drug coverage. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10 = $9.70 $9.70 = mrs. §you will have to pay a part b late enrollment penalty if.

Medicare Prescription Drug Coverage (Part D) Health for California

If you don't see your situation, contact social. Certain deductions are added back. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug. Web part d late enrollment penalty calculator number of months you.

Use our Medicare Part D Penalty Calculator to estimate your penalty

Web if you were without part d or creditable drug coverage for more than 63 days while eligible for medicare, you may face a part d late enrollment penalty (lep).the purpose of the. Web in most cases, if you don’t sign up for medicare when you’re first eligible, you may have to pay a higher.

How To Calculate & Avoid Medicare Late Enrollment Penalties Legacy

Web part d late enrollment penalty calculator number of months you went without coverage months 0 45 90 135 180 estimated monthly penalty for 2024 $0 will i have to. (grab your calculator!) avoid the part d late. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10.

Medicare Part D Enrollment Penalty Calculator Medicare beneficiaries may incur a late enrollment penalty (lep) if there is a continuous period of 63 days or more at any time after the end of the. Web part b penalty explained. Get an estimate of when you're eligible for medicare and your premium amount. Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other. The part b penalty is calculated by taking 10% of the monthly part b premium and multiplying it by the number of 12 months periods someone has.

If You Don't See Your Situation, Contact Social.

Web if you were without part d or creditable drug coverage for more than 63 days while eligible for medicare, you may face a part d late enrollment penalty (lep).the purpose of the. Original, or traditional, medicare consists of medicare parts a and b. Medicare calculates the part d penalty by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) times the. §you will have to pay a part b late enrollment penalty if you decide to delay enrolling in medicare.

Web The Medicare Part D Late Enrollment Penalty Is 1% Of That National Base Beneficiary Premium For Each Full Month That You Didn’t Have Medicare Part D Or Other.

Find medicare plansenrollment optionsget personalized quotesget a free quote Web in most cases, if you don’t sign up for medicare when you’re first eligible, you may have to pay a higher monthly premium. Web your medicare part d penalty would be 24 percent of the national base premium, one percent for each of the 24 months you waited. Get an estimate of when you're eligible for medicare and your premium amount.

Web $174.70 (2024 Part B Standard Premium) + $34.94 (20% [Of $174.70] Late Enrollment Penalty) $209.60 Will Be Your Part B Monthly Premium For 2024.

More information on medicare late enrollment. Web the lep is calculated as 1% of the national base medicare part d premium for each month you were without some form of creditable prescription drug coverage. Web this reduction will help address concerns about the substantial increase in medicare’s reinsurance payments to part d plans over time, which accounted for close. Certain deductions are added back.

You Will Need To Obtain Part D Prescription Drug Coverage.

Web but in case you already missed your deadline, we’ll help you calculate your part d late enrollment penalty. Web for each month you delay enrollment in medicare part d, you will have to pay a 1% part d late enrollment penalty (lep), unless you: Medicare calculates the penalty by multiplying 1% of the national base beneficiary premium($34.70 in 2024) times the number of full, uncovered months you didn't have. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10 = $9.70 $9.70 = mrs.