Medicare Penalty Calculator

Medicare Penalty Calculator - Web if you do have to pay premiums for part a, the late enrollment penalty is 10 percent of either $278 or $505 in 2024, added to that monthly premium. Web the part b penalty is calculated by taking 10% of the monthly part b premium and multiplying it by the number of 12 months periods someone has gone without creditable. If you disagree with your penalty, you can. Web the fee kicks in if you make more than $97,000 (going up to $103,000 in 2024) or if you and your spouse collectively earn over $194,000 (going up to $206,000 in. Instead, it’s an additional amount paid directly to the centers for medicare and medicaid services.

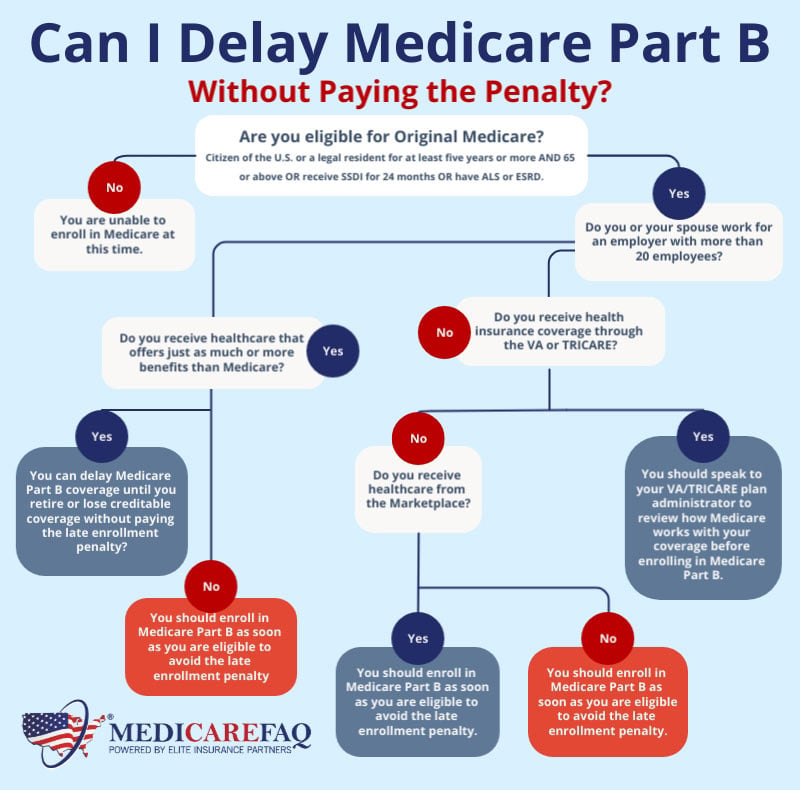

Web use these medicare tools to calculate your penalties and determine your correct enrollment periods. It doesn’t seem like a lot of money—just an extra $24 for a year. Web understanding the medicare penalty calculator. Web the fee kicks in if you make more than $97,000 (going up to $103,000 in 2024) or if you and your spouse collectively earn over $194,000 (going up to $206,000 in. Find out when you should sign up, how much you may have to pay, and what conditions may. Since you have a 30% late enrollment penalty, your monthly premium will be the standard monthly premium. Original, or traditional, medicare consists of medicare parts a and b.

How To Calculate The Medicare Part D Penalty

Since you have a 30% late enrollment penalty, your monthly premium will be the standard monthly premium. Web with this calculator, you can enter your income, age, and family size to estimate your household’s individual mandate penalty, any financial assistance you may. Web the late enrollment penalty (also called the “lep” or “penalty”) is an.

Use our Medicare Part D Penalty Calculator to estimate your penalty

Web the fee kicks in if you make more than $97,000 (going up to $103,000 in 2024) or if you and your spouse collectively earn over $194,000 (going up to $206,000 in. Web including both socioeconomic status and race in the calculation showed even greater penalty reduction for both safety net hospitals (40 percent reduction).

How To Calculate Medicare Part B Late Enrollment

Web learn how to avoid late enrollment penalties for part a, part b, and part d coverage. This practical device is more than just numbers and percentages—it’s your personal guide helping you. Web if you do have to pay premiums for part a, the late enrollment penalty is 10 percent of either $278 or $505.

How do I calculate my Medicare Part D LateEnrollment Penalty?

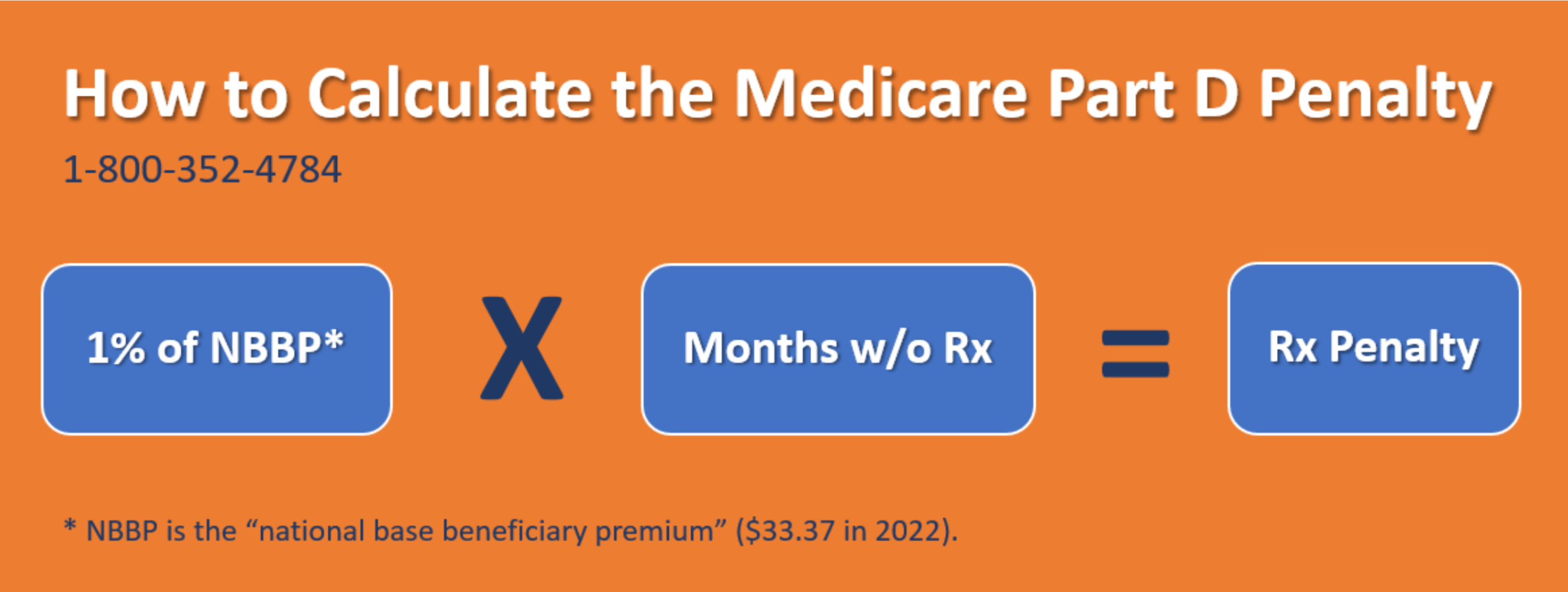

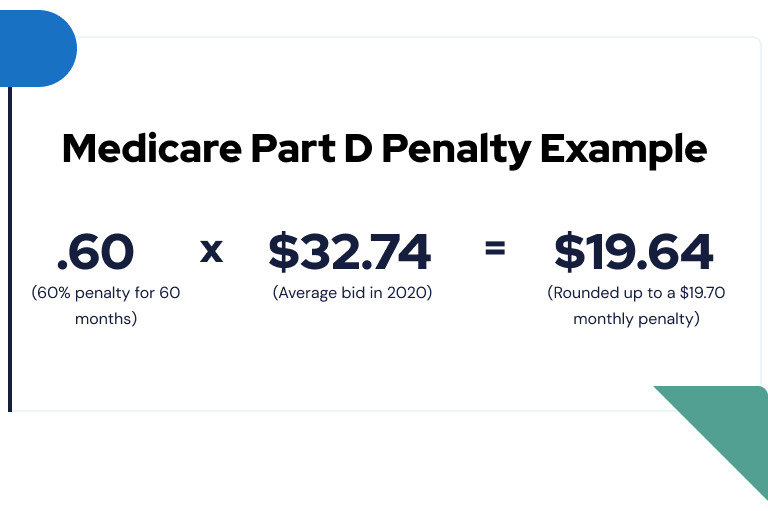

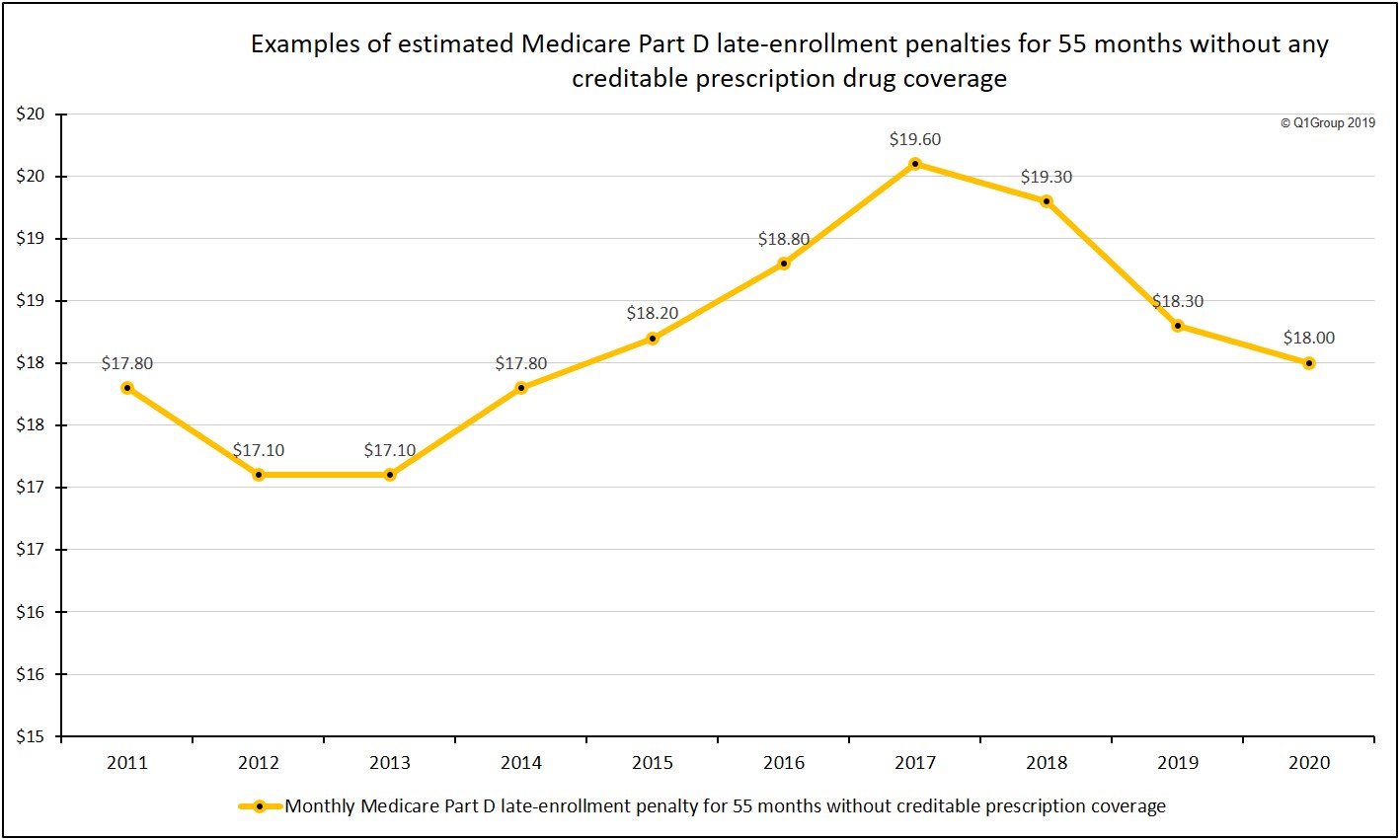

Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web in most cases, if you don’t sign up for medicare when you’re first eligible, you may have to pay a higher monthly premium. The medicare part d late enrollment. If you’ve ever wondered how much a.

How to calculate Medicare Part D late enrollment penalty? YouTube

Find out when you should sign up, how much you may have to pay, and what conditions may. Web learn how to calculate the medicare part d late enrollment penalty, an additional cost on top of your monthly premium for not having creditable drug coverage. Web welcome to your new ally: If you disagree with.

Medicare Part B Late Enrollment Penalty How to Avoid It MedicareFAQ

Web the irmaa isn’t part of your medicare premium plan. Web use this tool to calculate when you're eligible for medicare and your premium amount based on your situation. Web learn how to calculate the medicare part d late enrollment penalty, an additional cost on top of your monthly premium for not having creditable drug.

Medicare Prescription Drug Coverage (Part D) Health for California

Web the late enrollment penalty (also called the “lep” or “penalty”) is an amount that may be permanently added to a person’s monthly premium for medicare drug coverage (part d). Original, or traditional, medicare consists of medicare parts a and b. Web the part b penalty is calculated by taking 10% of the monthly part.

How Is Medicare Part B Penalty Calculated

Web the cms rounds the total to the nearest 10 cents, so your penalty would be $2 per month. This practical device is more than just numbers and percentages—it’s your personal guide helping you. Web welcome to your new ally: Web in most cases, if you don’t sign up for medicare when you’re first eligible,.

Medicare Drug Coverage Penalty How the Part D Penalty For Not

Trusted companiesget a free quotesearch plans by zip codefind medicare plans Indiana medicare plans$0 monthly premium$0 copay for primary care Web the late enrollment penalty (also called the “lep” or “penalty”) is an amount that may be permanently added to a person’s monthly premium for medicare drug coverage (part d). Web dena bunis, published february.

How To Calculate The Medicare Part D Penalty

Web learn how to avoid late enrollment penalties for part a, part b, and part d coverage. It doesn’t seem like a lot of money—just an extra $24 for a year. Web use this tool to calculate when you're eligible for medicare and your premium amount based on your situation. Web drugmakers that refuse to.

Medicare Penalty Calculator Trusted companiesget a free quotesearch plans by zip codefind medicare plans Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug. This practical device is more than just numbers and percentages—it’s your personal guide helping you. Web learn how to avoid late enrollment penalties for part a, part b, and part d coverage. It doesn’t seem like a lot of money—just an extra $24 for a year.

If You’ve Ever Wondered How Much A Late Enrollment In Part D Could Cost, Then Meet Your New Best Friend:

Web if you do have to pay premiums for part a, the late enrollment penalty is 10 percent of either $278 or $505 in 2024, added to that monthly premium. If you disagree with your penalty, you can. Web welcome to your new ally: Web use these medicare tools to calculate your penalties and determine your correct enrollment periods.

Web Use This Tool To Calculate When You're Eligible For Medicare And Your Premium Amount Based On Your Situation.

This practical device is more than just numbers and percentages—it’s your personal guide helping you. Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web learn how to calculate your premium penalty for delaying enrollment in medicare part b, the federal health insurance program for seniors. You will need to obtain part d prescription drug coverage.

Web Learn How To Calculate The Medicare Part D Late Enrollment Penalty, An Additional Cost On Top Of Your Monthly Premium For Not Having Creditable Drug Coverage.

The medicare part d late enrollment. Web understanding the medicare penalty calculator. Web including both socioeconomic status and race in the calculation showed even greater penalty reduction for both safety net hospitals (40 percent reduction) and non. Web the part b penalty is calculated by taking 10% of the monthly part b premium and multiplying it by the number of 12 months periods someone has gone without creditable.

Web The Cms Rounds The Total To The Nearest 10 Cents, So Your Penalty Would Be $2 Per Month.

Find out when you should sign up, how much you may have to pay, and what conditions may. Web medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. Web learn how to avoid late enrollment penalties for part a, part b, and part d coverage. It doesn’t seem like a lot of money—just an extra $24 for a year.