Ms Payroll Calculator

Ms Payroll Calculator - Web 2024 payroll tax and paycheck calculator for all 50 states and us territories. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Get an accurate picture of the employee’s gross. Its personal duty framework has a top pace of simply 5.00% that applies to all pay above $10,000. Web federal paycheck calculator photo credit:

Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Web federal paycheck calculator photo credit: Get an accurate picture of the employee’s gross. Calculate net payroll amount (after payroll taxes), federal withholding, including social security. Web mississippi hourly paycheck calculator. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes.

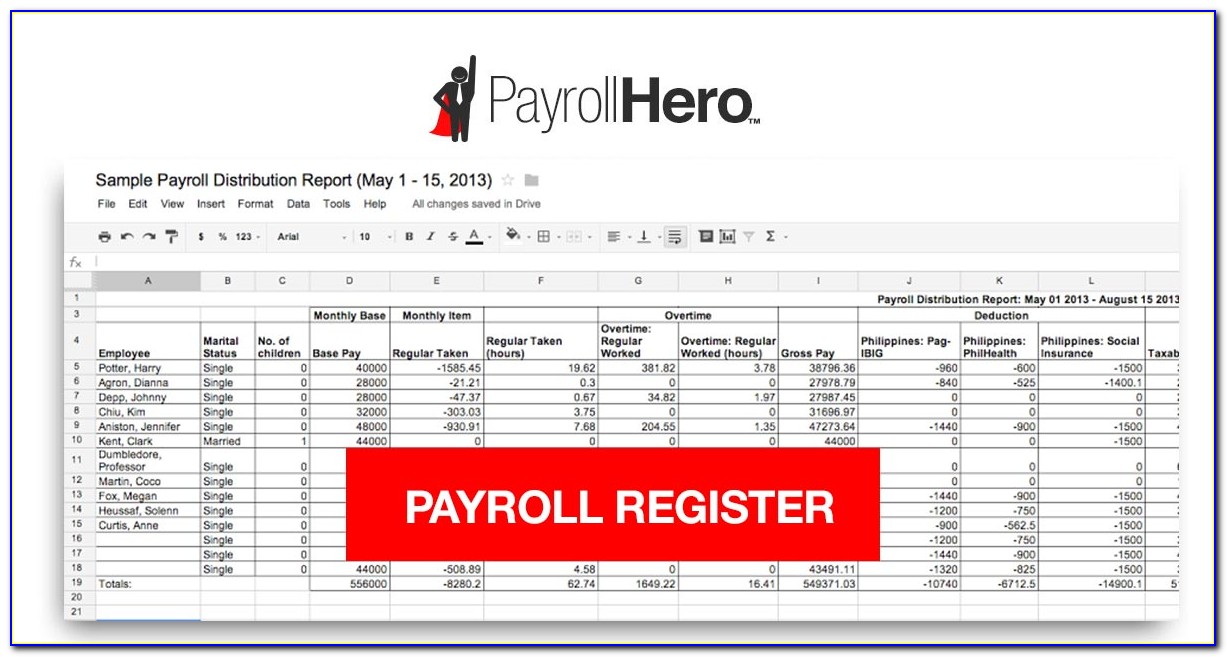

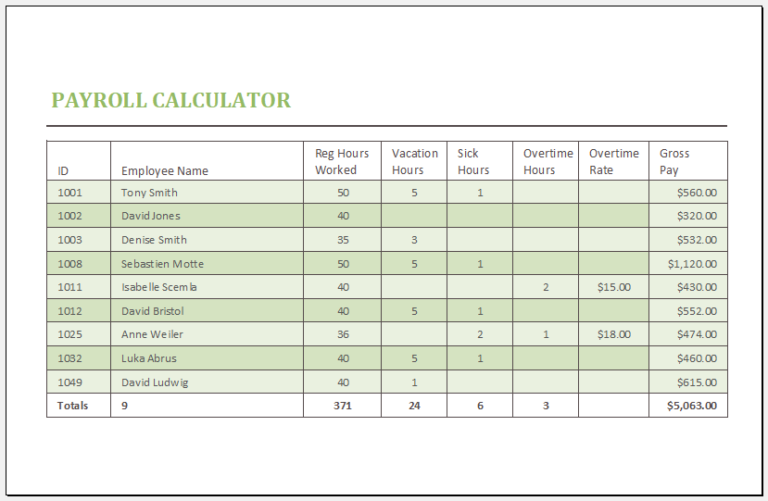

Excel Payroll Calculator Template Free Download

Web mississippi hourly paycheck calculator. Web mississippi hourly paycheck calculator results. Web use icalculator™ us's paycheck calculator tailored for mississippi to determine your net income per paycheck. We’ll do the math for you—all you. Web federal paycheck calculator photo credit: Calculate net payroll amount (after payroll taxes), federal withholding, including social security. ©istock.com/ryanjlane federal paycheck.

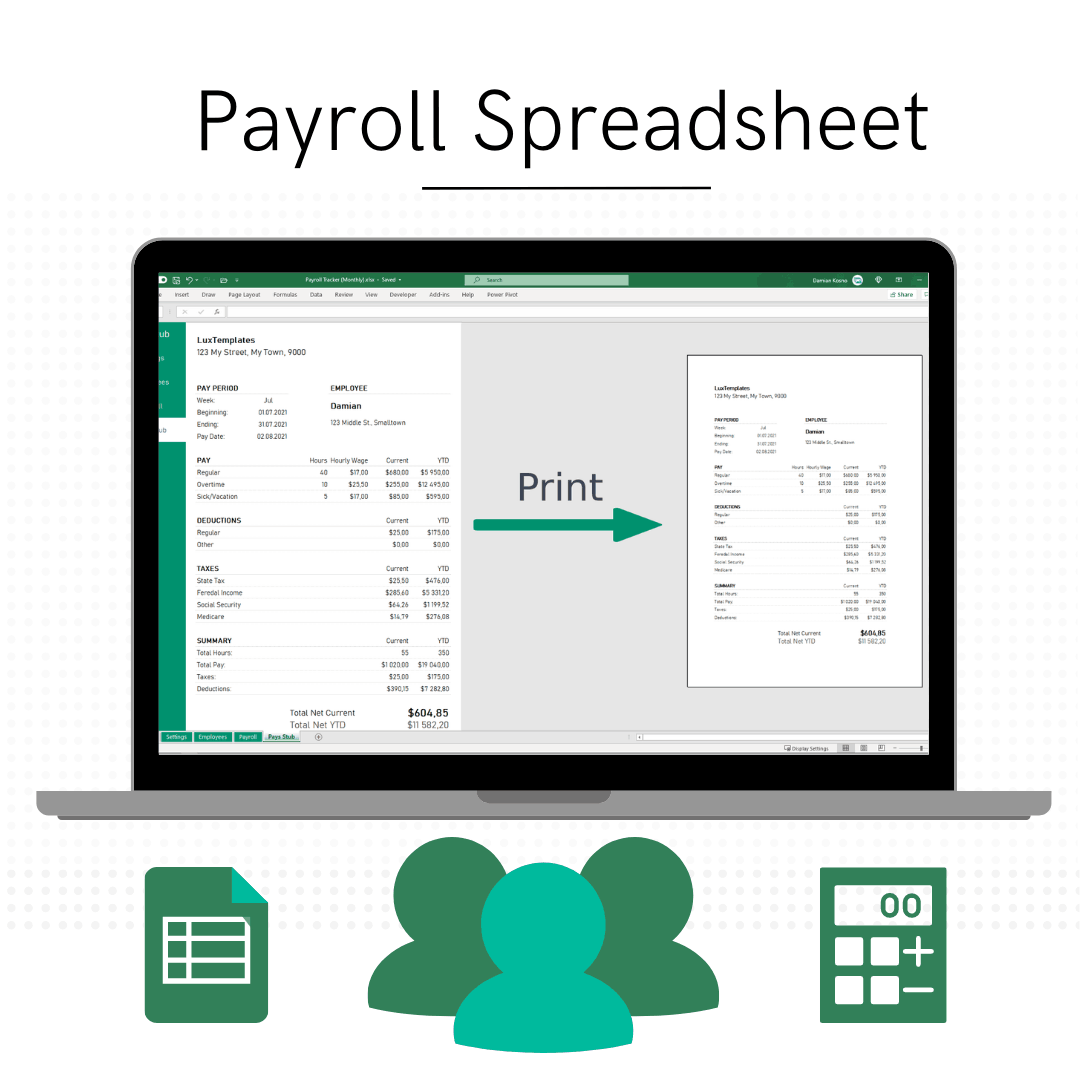

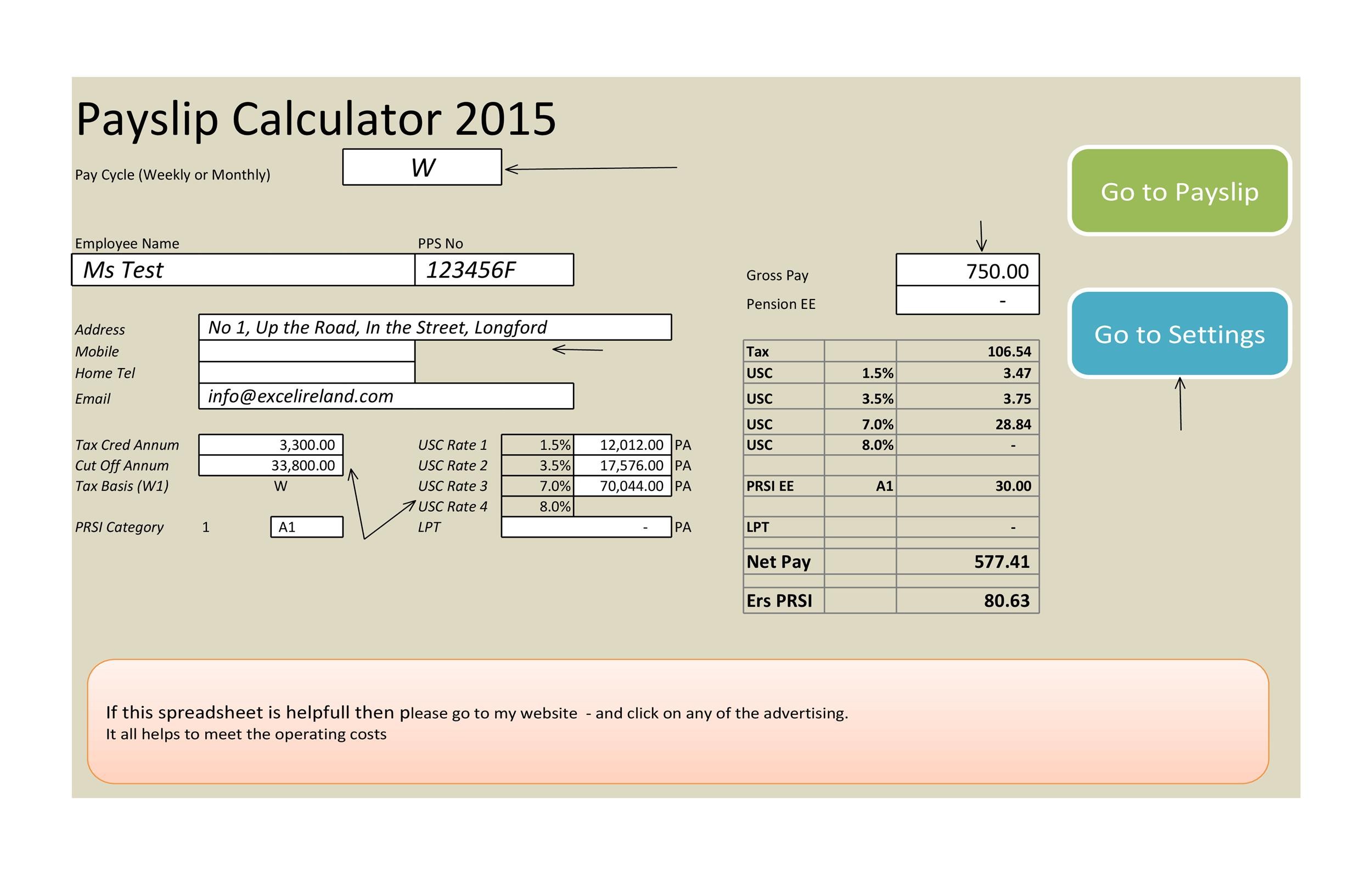

Payroll Calculator Spreadsheet with Pay Stubs Eloquens

Web use our mississippi payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web use icalculator™ us's paycheck calculator tailored for mississippi to.

Payroll Calculator Free Employee Payroll Template for Excel

Get an accurate picture of the employee’s gross. This applies to various salary frequencies including annual,. Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Simply enter their federal and state. Web federal paycheck calculator photo credit: Mississippi has a generally.

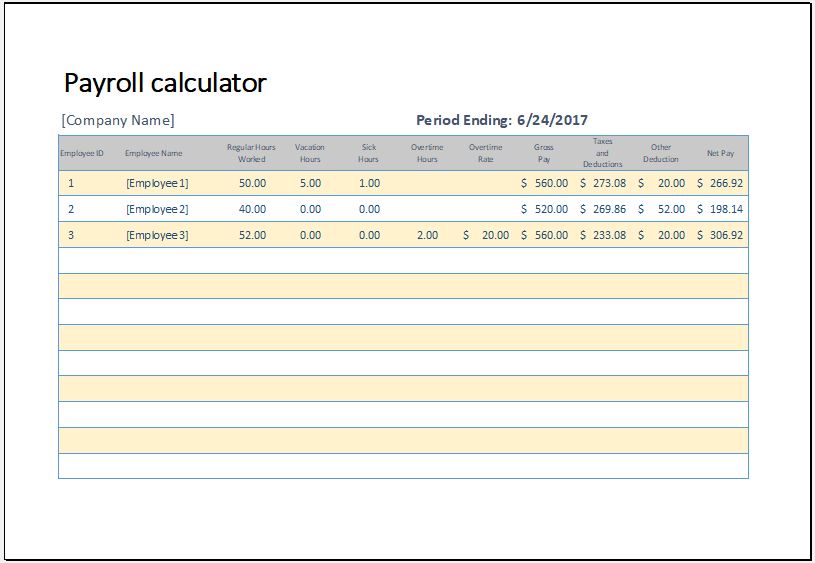

Excel Payroll Calculator 2022 Free Excel Paycheck Template

Its personal duty framework has a top pace of simply 5.00% that applies to all pay above $10,000. Web 2024 payroll tax and paycheck calculator for all 50 states and us territories. The results are broken up into three sections: Calculate net payroll amount (after payroll taxes), federal withholding, including social security. We’ll do the.

Payroll Calculator Template for MS Excel Word & Excel Templates

Web mississippi hourly paycheck calculator results. Simply enter their federal and state. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Web use our mississippi payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web federal paycheck calculator photo credit: Web mississippi hourly paycheck calculator. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount..

Payroll Calculator Free Employee Payroll Template for Excel

The results are broken up into three sections: Simply enter their federal and state. Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web 2023 payroll tax and paycheck calculator for all 50 states and us territories. Web mississippi hourly paycheck.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Web use our mississippi payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. If this employee’s pay frequency is weekly the calculation is: Web mississippi hourly paycheck calculator. Web we offer a variety of calculators to suit your specific needs, these include tax.

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Simply input salary details, benefits and deductions, and any other. We’ll do the math for you—all you. Web use icalculator™ us's paycheck calculator tailored for mississippi to determine your net income per.

Payroll Calculator Template for MS Excel Excel Templates

Below are your mississippi salary paycheck results. Mississippi has a generally low taxation rate. The results are broken up into three sections: Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web federal paycheck calculator photo credit: Web use.

Ms Payroll Calculator Web federal paycheck calculator photo credit: Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. We’ll do the math for you—all you. Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

We’ll Do The Math For You—All You.

Simply input salary details, benefits and deductions, and any other. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. If this employee’s pay frequency is weekly the calculation is: Web use our mississippi payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions.

Below Are Your Mississippi Salary Paycheck Results.

Get an accurate picture of the employee’s gross. Calculate net payroll amount (after payroll taxes), federal withholding, including social security. Enter your info to see your take home pay. Web mississippi hourly paycheck calculator.

Web Use Icalculator™ Us's Paycheck Calculator Tailored For Mississippi To Determine Your Net Income Per Paycheck.

Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Simply enter their federal and state. Web we offer a variety of calculators to suit your specific needs, these include tax calculators which are based on payroll timeframes and how salary packages and wages are. Web use mississippi paycheck calculator to estimate net or “take home” pay for salaried employees.

Web This Free Hourly And Salary Paycheck Calculator Can Estimate An Employee’s Net Pay, Based On Their Taxes And Withholdings.

Mississippi has a generally low taxation rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Calculate net payroll amount (after payroll taxes), federal withholding, including social security. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%.