Nevada Paycheck Calculator

Nevada Paycheck Calculator - Web smartasset's nevada paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations. Gusto.com has been visited by 100k+ users in the past month Calculate your net pay if you’re wondering, “ how do i figure out how much money i take home in nevada ? The amount you take home from work is using up to six hourly pay rates you enter with pertinent federal, state, and local w4 data.

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Alabama alaska arizona arkansas california colorado. The results are broken up into three sections: Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Enter your info to see your take home pay. Just enter the wages, tax withholdings and other. Your 401k plan account might be your best tool for creating a secure retirement.

Nevada Paystub Generator PayCheck Stub Online

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Web smartasset's nevada paycheck calculator shows your hourly and salary income after federal, state and local taxes. ” we’ve got you covered. Web nevada hourly paycheck calculator. Web nevada hourly paycheck calculator. Enter information about.

Nevada Paycheck Calculator Paycheck, Nevada, Calculator

Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web nevada hourly paycheck calculator. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations. This applies to various salary. Use icalculator™ us's paycheck calculator tailored for nevada to determine your net income.

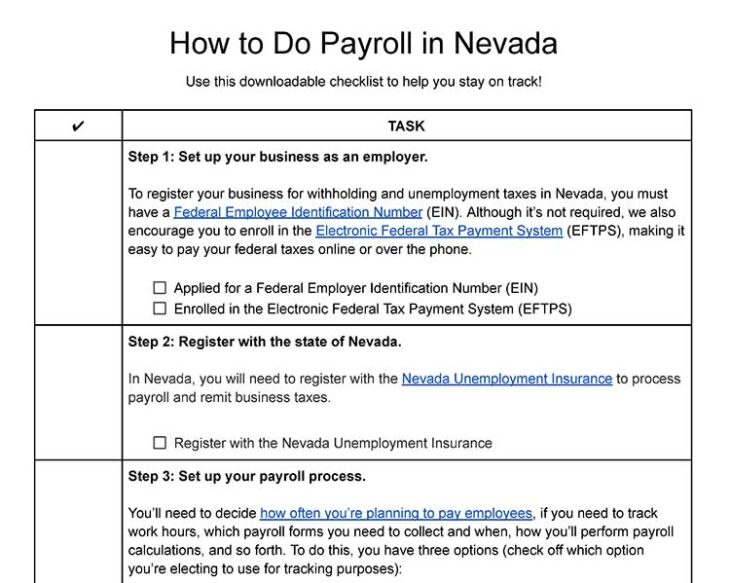

How to Do Payroll in Nevada in 10 Steps

Alabama alaska arizona arkansas california colorado. Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. The following features are available within this nevada tax calculator.

Nevada Paycheck Calculator 2023 2024

Web nevada salary and tax calculator features. Enter information about federal and state taxes,. You only pay taxes on. Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. This applies to various salary. Learn how your nevada paycheck is calculated, from federal taxes to state.

Nv payroll calculator KellyShanara

The results are broken up into three sections: Paycheck results is your gross. Gusto.com has been visited by 100k+ users in the past month Web calculate your net pay in nevada with federal, state and voluntary deductions. Learn how your nevada paycheck is calculated, from federal taxes to state payroll. Web nevada paycheck calculator generate.

Maximizing Your How to Use a Salary Paycheck Calculator

The amount you take home from work is using up to six hourly pay rates you enter with pertinent federal, state, and local w4 data. Gusto.com has been visited by 100k+ users in the past month ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of.

Nevada Paycheck Calculator 2023 2024

The results are broken up into three sections: Web nevada salary paycheck calculator results below are your nevada salary paycheck results. Learn how to use a nevada paycheck calculator, what taxes are withheld. Alabama alaska arizona arkansas california colorado. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top.

Nv payroll calculator KellyShanara

Calculate your net pay if you’re wondering, “ how do i figure out how much money i take home in nevada ? Just enter the wages, tax withholdings and other. The amount you take home from work is using up to six hourly pay rates you enter with pertinent federal, state, and local w4 data..

Nevada Paycheck Calculator 2023

Learn how to use a nevada paycheck calculator, what taxes are withheld. Web nevada salary and tax calculator features. Your 401k plan account might be your best tool for creating a secure retirement. Web nevada paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly.

Nevada Paycheck Calculator 2024 Investomatica

Just enter the wages, tax withholdings and other. Alabama alaska arizona arkansas california colorado. Web nevada hourly paycheck calculator. Your 401k plan account might be your best tool for creating a secure retirement. Web nevada salary and tax calculator features. The following features are available within this nevada tax calculator for 2024: Use icalculator™ us's.

Nevada Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web nevada salary paycheck calculator results below are your nevada salary paycheck results. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations. Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

This Applies To Various Salary.

Web federal paycheck calculator photo credit: ” we’ve got you covered. Gusto.com has been visited by 100k+ users in the past month Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

The Amount You Take Home From Work Is Using Up To Six Hourly Pay Rates You Enter With Pertinent Federal, State, And Local W4 Data.

Calculate your net pay if you’re wondering, “ how do i figure out how much money i take home in nevada ? The results are broken up into three sections: Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations. Web nevada salary and tax calculator features.

You Only Pay Taxes On.

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Enter your info to see your take home pay. Web nevada hourly paycheck calculator.

Web How To Calculate Annual Income.

Use icalculator™ us's paycheck calculator tailored for nevada to determine your net income per paycheck. The following features are available within this nevada tax calculator for 2024: Learn how your nevada paycheck is calculated, from federal taxes to state payroll. Enter information about federal and state taxes,.