Nevada Payroll Calculator

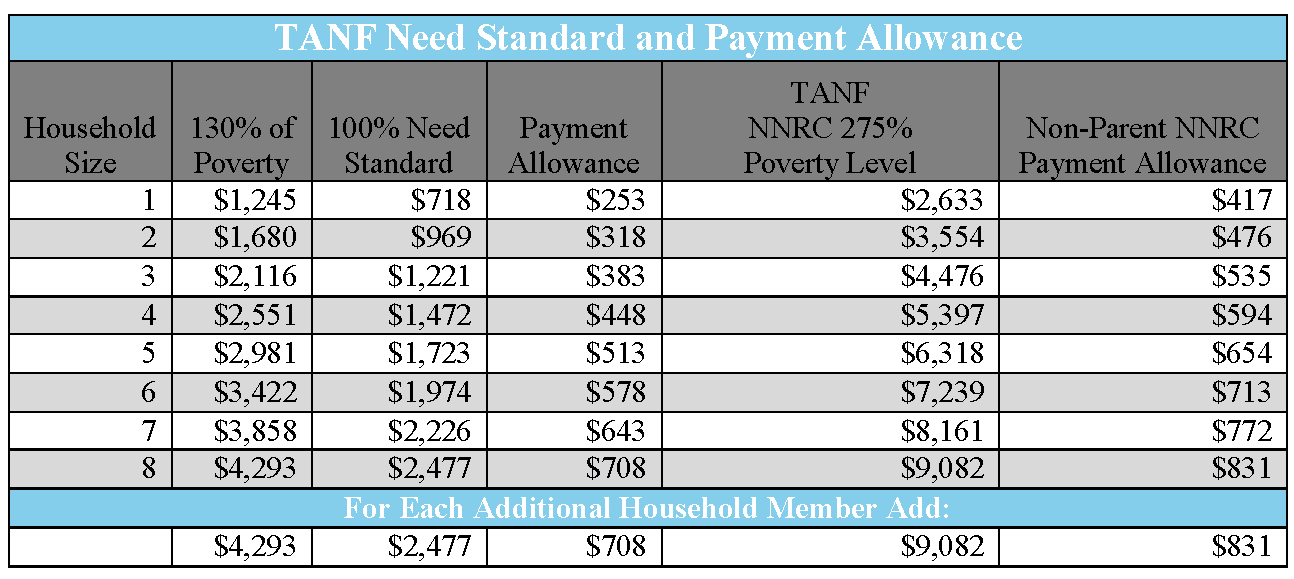

Nevada Payroll Calculator - Web nevada paycheck calculator is among only a few states that do not have an income tax for the state. This article will guide you through the process of using a nevada. File taxesrun payrollaccounting toolstax deductions Nevada, a state located in the western part of the united states, having utah on its east, arizona, to its. Alabama alaska arizona arkansas california colorado.

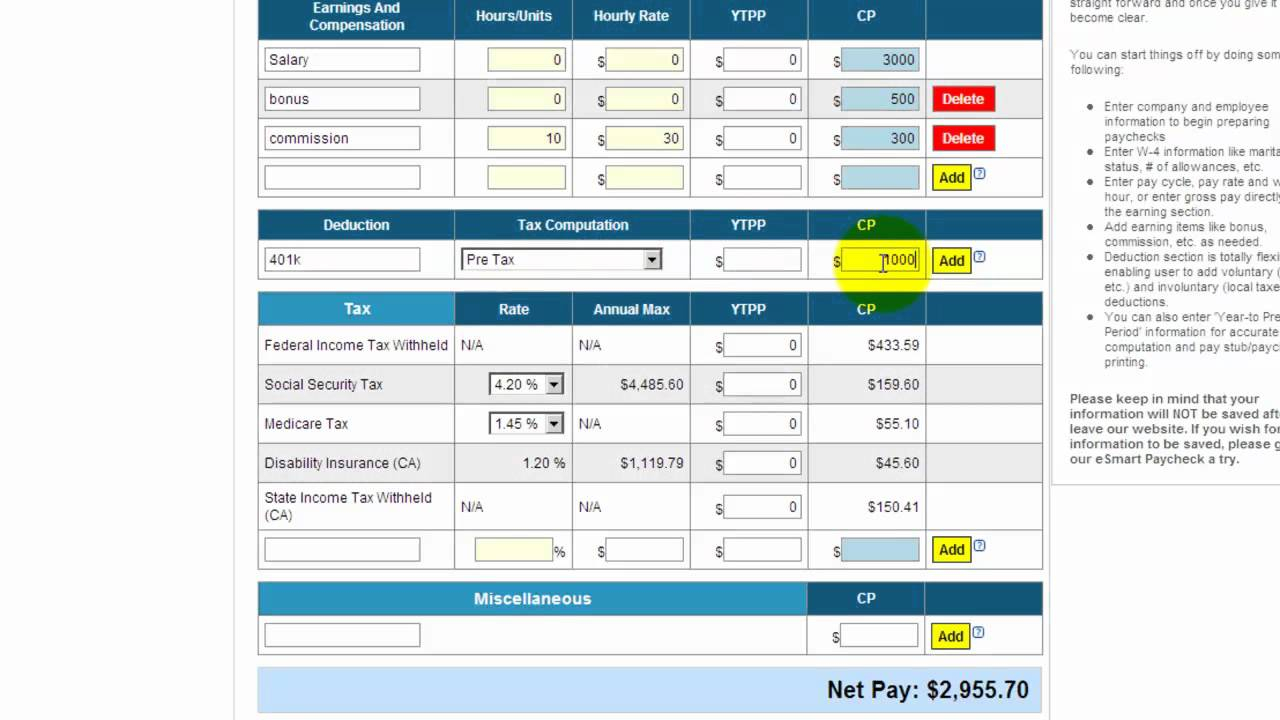

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web nevada paycheck calculator is among only a few states that do not have an income tax for the state. Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024: Web nevada hourly paycheck calculator. You only pay taxes on. Nevada, a state located in the western part of the united states, having utah on its east, arizona, to its. Federal income tax rates range from 10% up to a top marginal rate of 37%.

Nv payroll calculator KellyShanara

Web use our free salary paycheck calculator to determine your potential earnings as an employee with clark county. Web smartasset's nevada paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or.

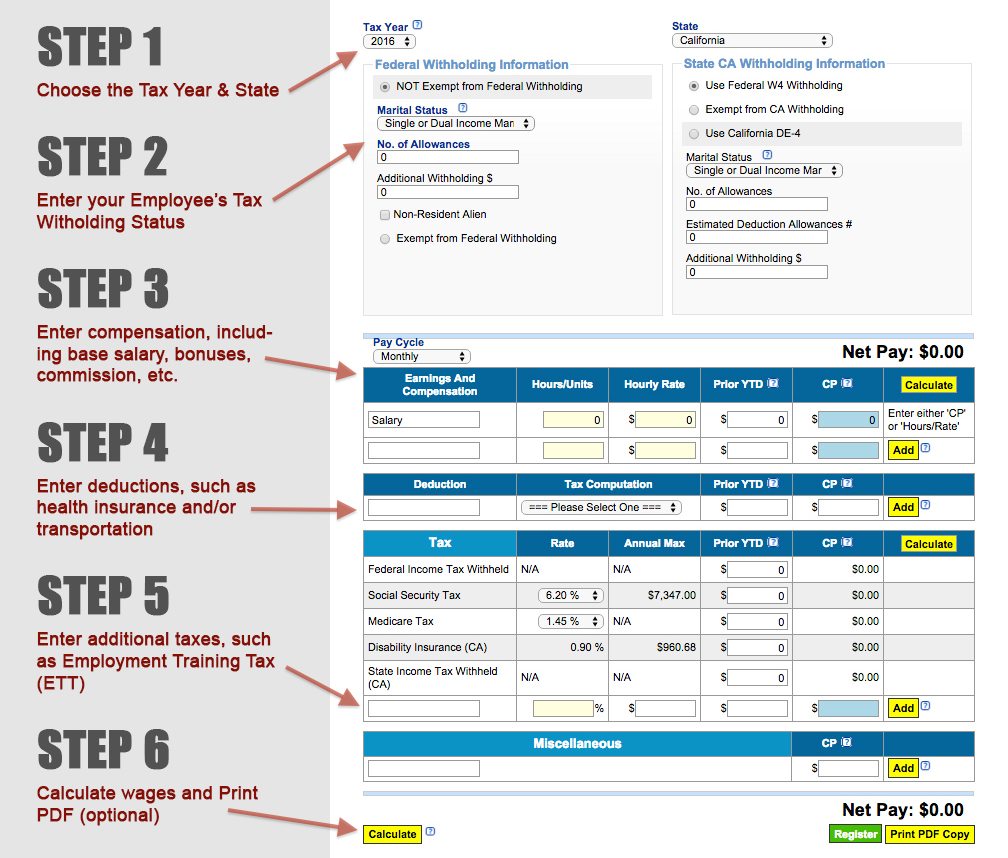

How to Use a Free Payroll Calculator

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Enter your info to see your take home pay. Keep in mind, clark county employees do not pay state. We’ll do the math for you—all you. Web nevada salary and.

Nevada Paycheck Calculator 2023

Furthermore, none of the towns within nevada does have any local tax on. Nevada, a state located in the western part of the united states, having utah on its east, arizona, to its. Web use our easy payroll tax calculator to quickly run payroll in nevada, or look up 2024 state tax rates. We’ll do.

Nevada Salary Comparison Calculator 2024 iCalculator™

Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024: Your 401k plan account might be your best tool for creating a secure retirement. File taxesrun payrollaccounting toolstax deductions Just enter the wages, tax. Web nevada hourly paycheck calculator. You only pay taxes on. Federal income.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Web check out paycheckcity.com for nevada paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Updated on dec 05 2023. Web how to calculate annual income. Web nevada paycheck.

Free Payroll Calculator Spreadsheet Excel Templates

Free tool to calculate your hourly and salary income. Furthermore, none of the towns within nevada does have any local tax on. Web nevada hourly paycheck calculator. Web this nevada 401k calculator helps you plan for the future. Web nevada paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and.

Nevada Paycheck Calculator Paycheck, Nevada, Calculator

Web nevada hourly paycheck calculator. Web nevada paycheck calculator is among only a few states that do not have an income tax for the state. Nevada, a state located in the western part of the united states, having utah on its east, arizona, to its. We’ll do the math for you—all you. Updated on dec.

Nv payroll calculator KellyShanara

This article will guide you through the process of using a nevada. This applies to various salary. Updated on dec 05 2023. Web a nevada paycheck calculator can help you determine how much you’ll take home after taxes and deductions. Real median household income (adjusted for inflation) in. Alabama alaska arizona arkansas california colorado. Web.

Nv payroll calculator KellyShanara

Your 401k plan account might be your best tool for creating a secure retirement. File taxesrun payrollaccounting toolstax deductions Web nevada paycheck calculator is among only a few states that do not have an income tax for the state. Web how to calculate annual income. You only pay taxes on. To calculate an annual salary,.

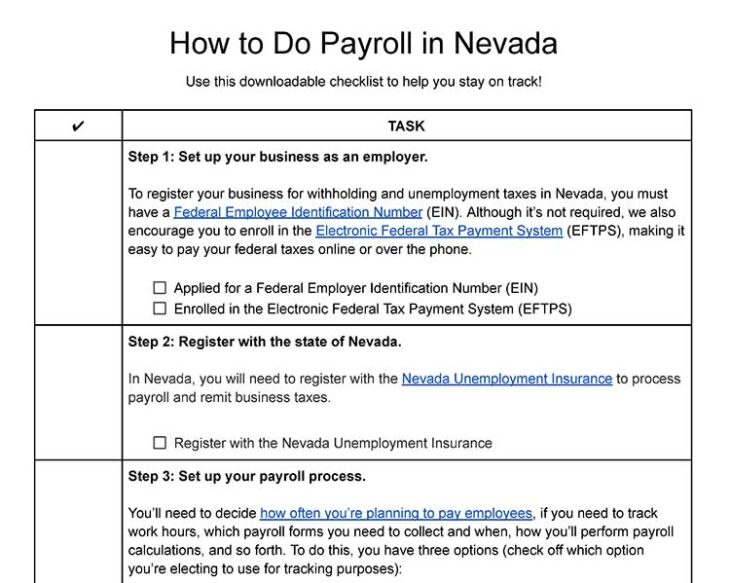

How to Do Payroll in Nevada in 10 Steps

Nevada, a state located in the western part of the united states, having utah on its east, arizona, to its. Federal income tax rates range from 10% up to a top marginal rate of 37%. This article will guide you through the process of using a nevada. Web use our simple paycheck calculator to estimate.

Nevada Payroll Calculator File taxesrun payrollaccounting toolstax deductions To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Updated on dec 05 2023. Free tool to calculate your hourly and salary income. Paycheck calculator salary calculate tax.

You Only Pay Taxes On.

Web a nevada paycheck calculator can help you determine how much you’ll take home after taxes and deductions. We’ll do the math for you—all you. This applies to various salary. Web use our free salary paycheck calculator to determine your potential earnings as an employee with clark county.

Web Use Our Simple Paycheck Calculator To Estimate Your Net Or “Take Home” Pay After Taxes, As An Hourly Or Salaried Employee In Nevada.

Updated on dec 05 2023. This article will guide you through the process of using a nevada. Web nevada hourly paycheck calculator. Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024:

Enter Your Info To See Your Take Home Pay.

Federal income tax rates range from 10% up to a top marginal rate of 37%. Your 401k plan account might be your best tool for creating a secure retirement. Web check out paycheckcity.com for nevada paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Keep in mind, clark county employees do not pay state.

Free Tool To Calculate Your Hourly And Salary Income.

Use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Furthermore, none of the towns within nevada does have any local tax on. Real median household income (adjusted for inflation) in. File taxesrun payrollaccounting toolstax deductions