Nevada Payroll Tax Calculator

Nevada Payroll Tax Calculator - Web the results are broken up into three sections: Web our payroll calculator simplifies the payroll process, so you can spend more time focusing on growing your small business and less time pulling your hair out. The results are broken up into three sections: Expense estimatorfor rideshare driversfor gig workersfor consultants Enter your info to see your take home pay.

Web unlimited companies, employees, and payroll runs for 1 low price. Customize using your filing status, deductions, exemptions and more. Enter your info to see your take home pay. Calculate take home pay : Web nevada paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in nevada. The results are broken up into three sections:

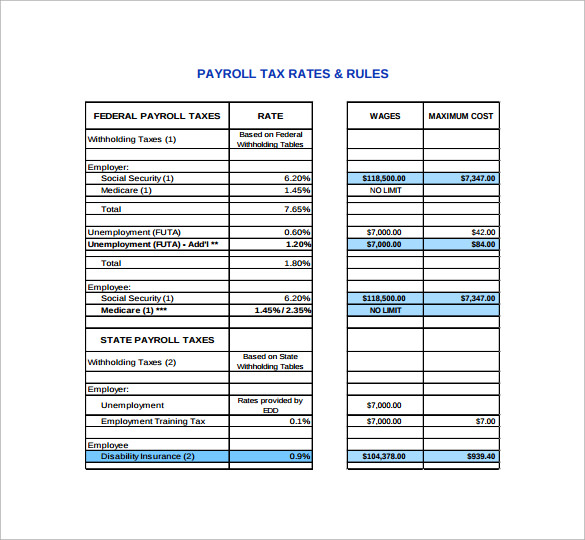

How to Calculate Payroll Taxes StepbyStep Instructions OnPay

The nevada bonus tax percent calculator will. The results are broken up into three sections: Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in nevada. The state income tax rate in nevada is 0% while federal income tax rates range from.

Guide to Nevada Payroll Taxes CAVU HCM

Web check out paycheckcity.com for nevada paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Just enter the wages, tax withholdings and other. Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web nevada paycheck calculator is among only a few states that do not have an income tax for the state. Web what is the income tax rate in nevada? Paycheck calculator salary calculate tax. Alabama alaska arizona arkansas california colorado. Enter your info to see your take home pay. Enter your info to see your.

How to calculate payroll taxes 2021 QuickBooks

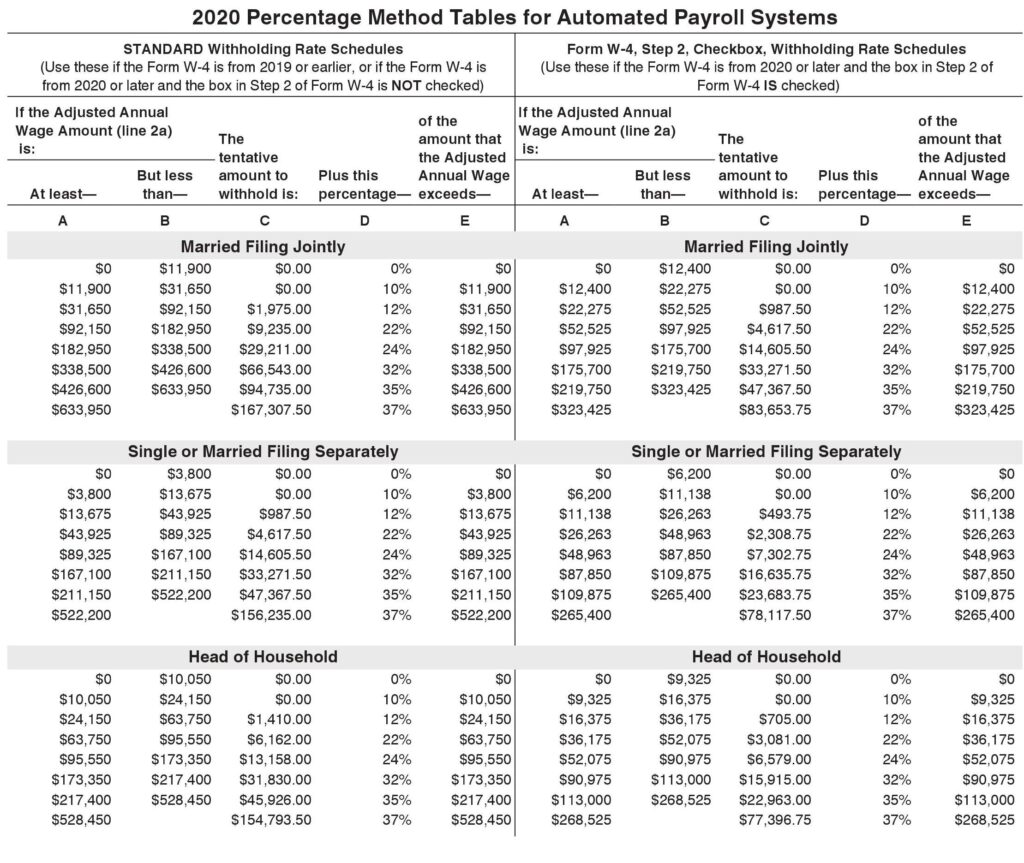

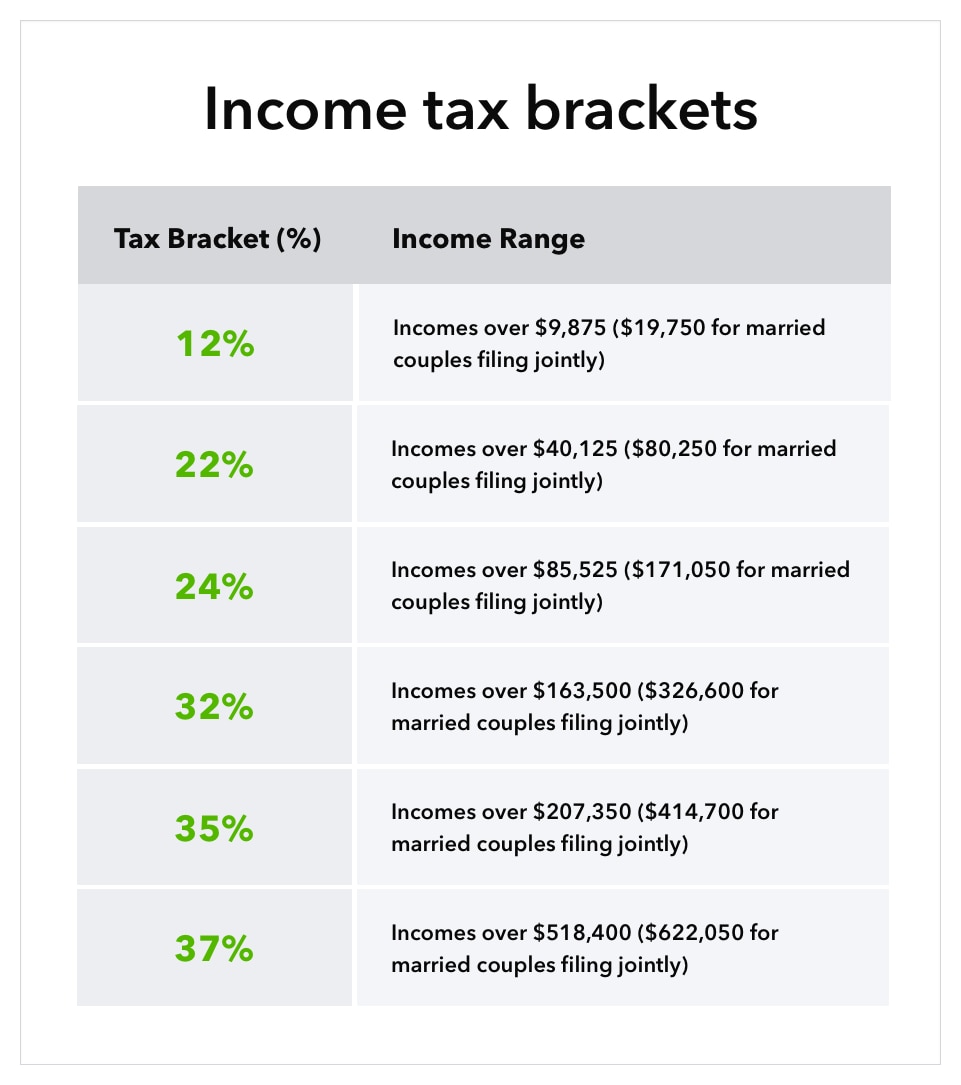

Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024: Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. The state income tax rate in nevada is 0% while federal income tax rates range from 10% to 37% depending.

6 Free Payroll Tax Calculators for Employers

Web visit paycheckcity.com for nevada hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024: Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web.

Nv payroll calculator KellyShanara

Web use adp’s nevada paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web the calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year. Enter your info to see your take home pay. Web check out paycheckcity.com for nevada.

Nv payroll calculator KellyShanara

Web find out how much you'll pay in nevada state income taxes given your annual income. Web check out paycheckcity.com for nevada paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web unlimited companies, employees, and payroll runs for 1 low price. Web this nevada bonus tax calculator uses supplemental tax rates to calculate.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Expense estimatorfor rideshare driversfor gig workersfor consultants Paycheck calculator salary calculate tax. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations. Free tool to calculate your hourly and salary income. Enter your info to see your take home pay. The nevada bonus tax percent calculator will. Web unlimited companies, employees, and.

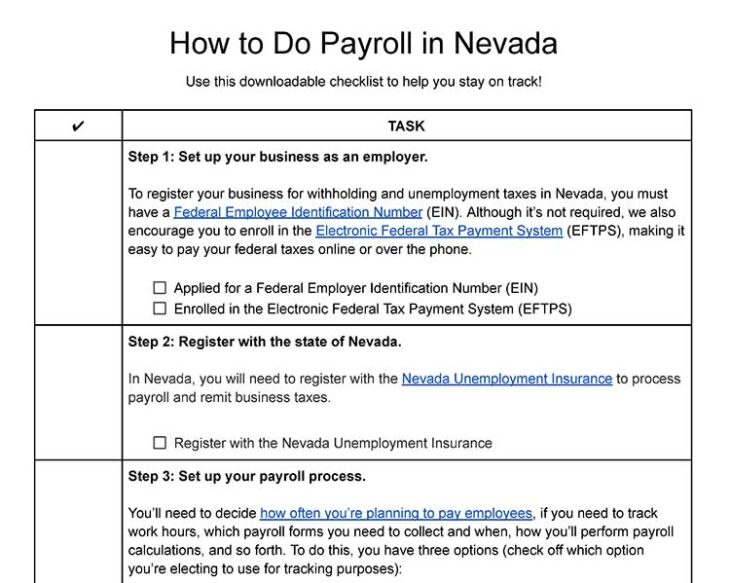

How to Do Payroll in Nevada in 10 Steps

We’ll do the math for you—all you. Web this nevada bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Web nevada paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web visit paycheckcity.com for nevada.

Guide to Nevada Payroll Taxes CAVU HCM

Paycheck calculator salary calculate tax. Web this nevada bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The state income tax rate in nevada is 0% while federal income tax rates range from 10% to 37% depending on your income. Enter your info to see your take.

Nevada Payroll Tax Calculator The results are broken up into three sections: Updated on dec 05 2023. Web unlimited companies, employees, and payroll runs for 1 low price. Customize using your filing status, deductions, exemptions and more. Web the calculator accurately accounts for federal, state, and local taxes, alongside standard deductions, tax credits, and exemptions for the year.

Free Tool To Calculate Your Hourly And Salary Income.

Web check out paycheckcity.com for nevada paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Paycheck results is your gross pay and specific deductions from your. Web nevada salary and tax calculator features the following features are available within this nevada tax calculator for 2024: Web our payroll calculator simplifies the payroll process, so you can spend more time focusing on growing your small business and less time pulling your hair out.

Customize Using Your Filing Status, Deductions, Exemptions And More.

We’ll do the math for you—all you. Web the results are broken up into three sections: Web this nevada bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Web nevada paycheck calculator generate paystubs with accurate nevada state tax withholding calculations.

Web What Is The Income Tax Rate In Nevada?

Enter your info to see your take home pay. Paycheck calculator salary calculate tax. The results are broken up into three sections: Web below are your nevada salary paycheck results.

Web Use Our Simple Paycheck Calculator To Estimate Your Net Or “Take Home” Pay After Taxes, As An Hourly Or Salaried Employee In Nevada.

Web smartasset's nevada paycheck calculator shows your hourly and salary income after federal, state and local taxes. The nevada bonus tax percent calculator will. Calculate take home pay : Web find out how much you'll pay in nevada state income taxes given your annual income.