New Jersey Property Tax Calculator

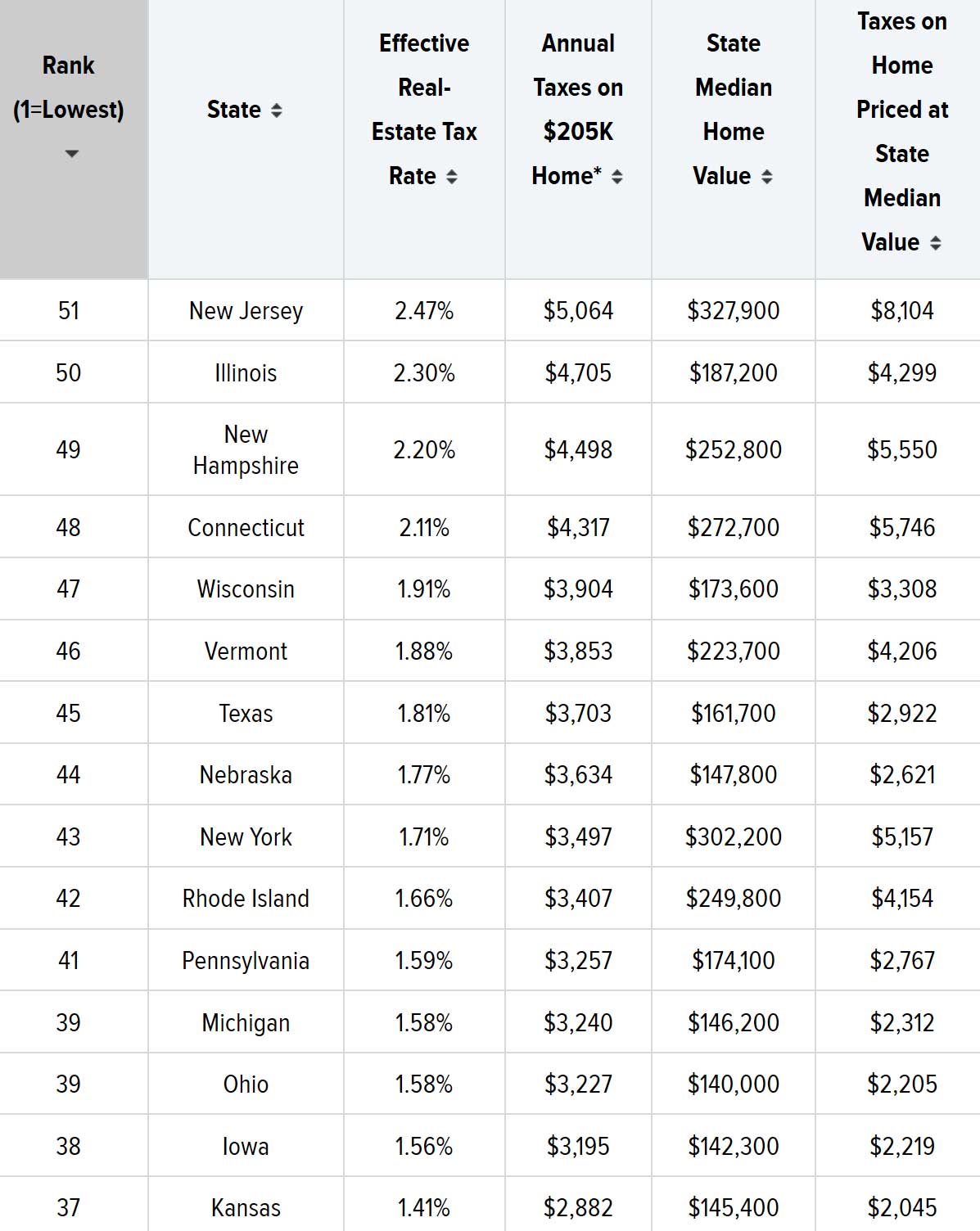

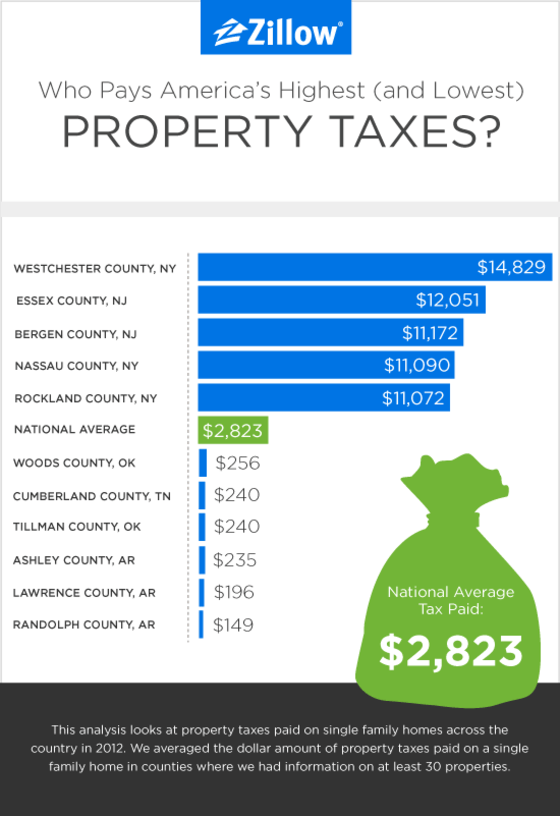

New Jersey Property Tax Calculator - It will likely be listed as a line item on. Web homeowners in new jersey pay an average of $8,797 in property taxes annually, which equals an effective property tax rate of 2.47%, the highest in the nation. Web look at your current mortgage statement and determine if your new jersey real property taxes are paid as part of your monthly mortgage. Simply enter your home’s sales price,. Web property tax calculator tool.

Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. (for mobile home owners, this. Web property tax calculator tool. Compare your rate to the new jersey and u.s. Web to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. Web look at your current mortgage statement and determine if your new jersey real property taxes are paid as part of your monthly mortgage. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

33+ how to calculate nj property tax LadyArisandi

Find the current tax rate for. Web a single new jerseyite will have an income tax bill of $19,236.55. Web to calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. New jersey property tax rates by county and town: Web nj transfer.

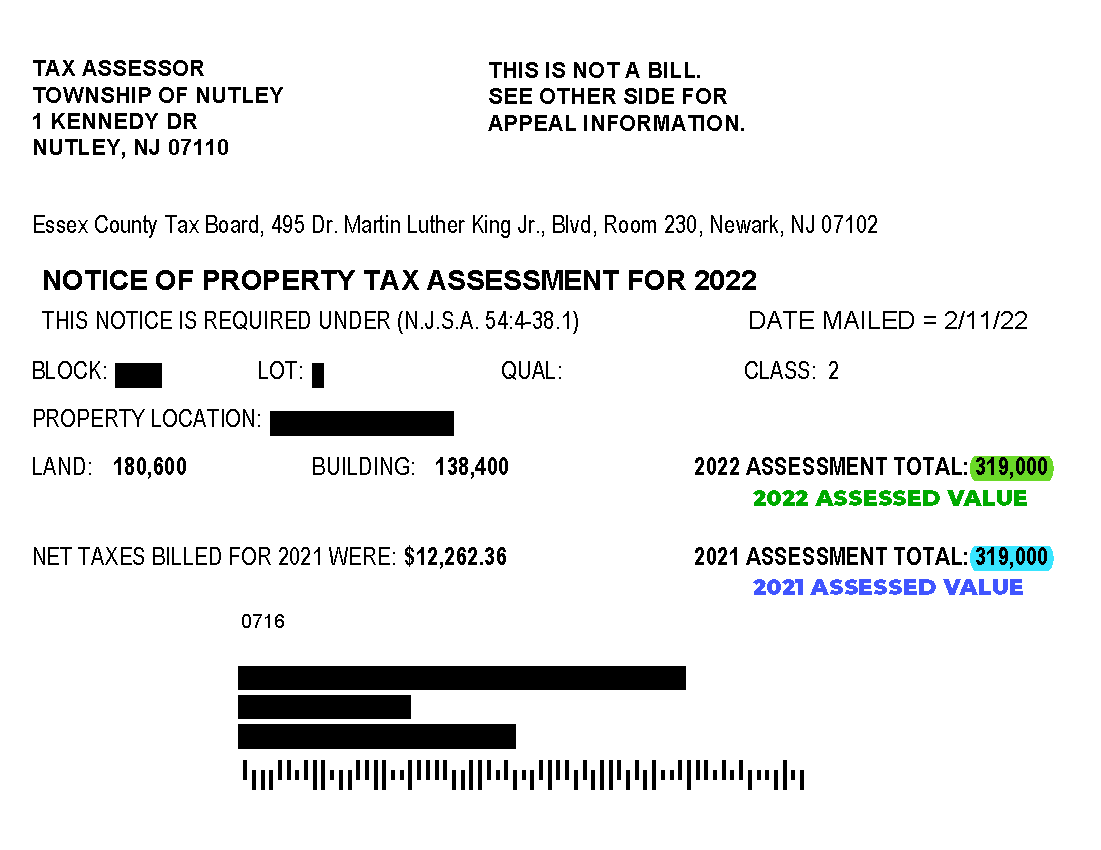

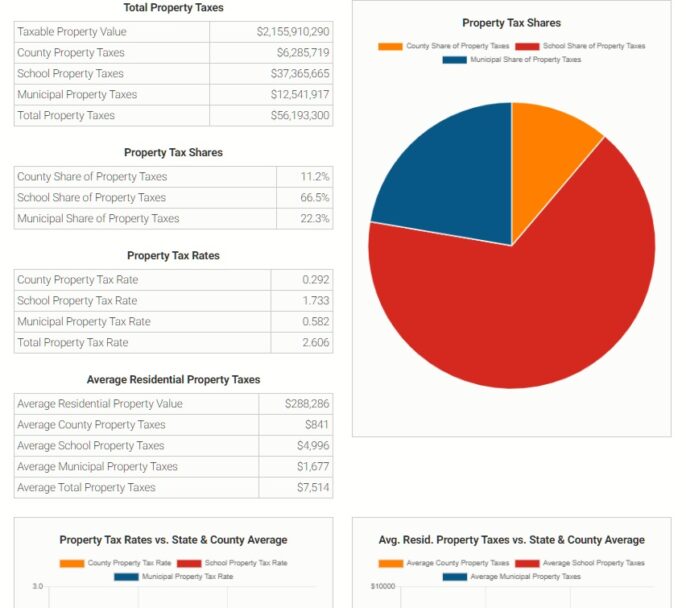

Township of Nutley New Jersey Property Tax Calculator

Enter your info to see your take home pay. Updated on dec 8 2023. Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference.

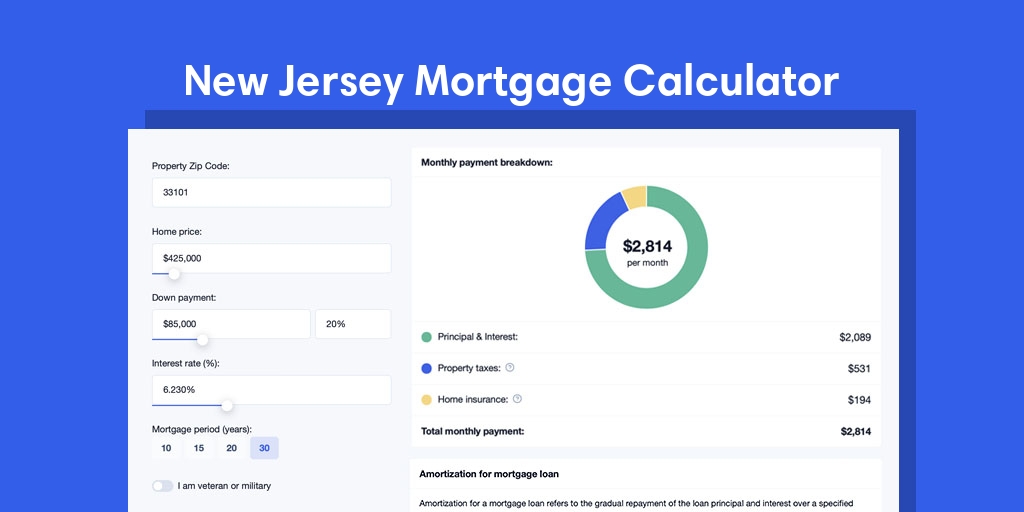

New Jersey Mortgage Calculator with taxes and insurance

Web click here to view. Web estimate my new jersey property tax. Web this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. New jersey property tax rates by county and town: Web a single new jerseyite will have an.

33+ how to calculate nj property tax LadyArisandi

Press calculate to see the average property tax. The realty transfer fee is imposed upon the recording of deeds evidencing transfers of title to real property in the state of new jersey. New jersey property tax rates by county and town: Assessed value x (general tax rate/100)= property tax. Web a town's general tax rate.

Fair Property Taxes for All NJ Launches New “Property Tax Viewer

This makes the take home pay $60,763.45. Web real estate transfer &mansion tax. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. Find the current tax rate for. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and.

Average NJ property tax bill near 9,300 Check your town here

Press calculate to see the average property tax. Web look at your current mortgage statement and determine if your new jersey real property taxes are paid as part of your monthly mortgage. Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your.

Property Taxes By Town In Nj Property Walls

Web nj transfer tax calculator customarily the new jersey transfer tax is paid by the seller and the mansion tax on residential or commercial purchases of $1 million or more is. Web state of new jersey > government > nj taxes. (for mobile home owners, this. Simply enter your home’s sales price,. Determine the assessed.

33+ how to calculate nj property tax LadyArisandi

(for mobile home owners, this. Enter your info to see your take home pay. Web this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. Updated on dec 8 2023. Web homeowners in new jersey pay an average of $8,797.

33+ how to calculate nj property tax LadyArisandi

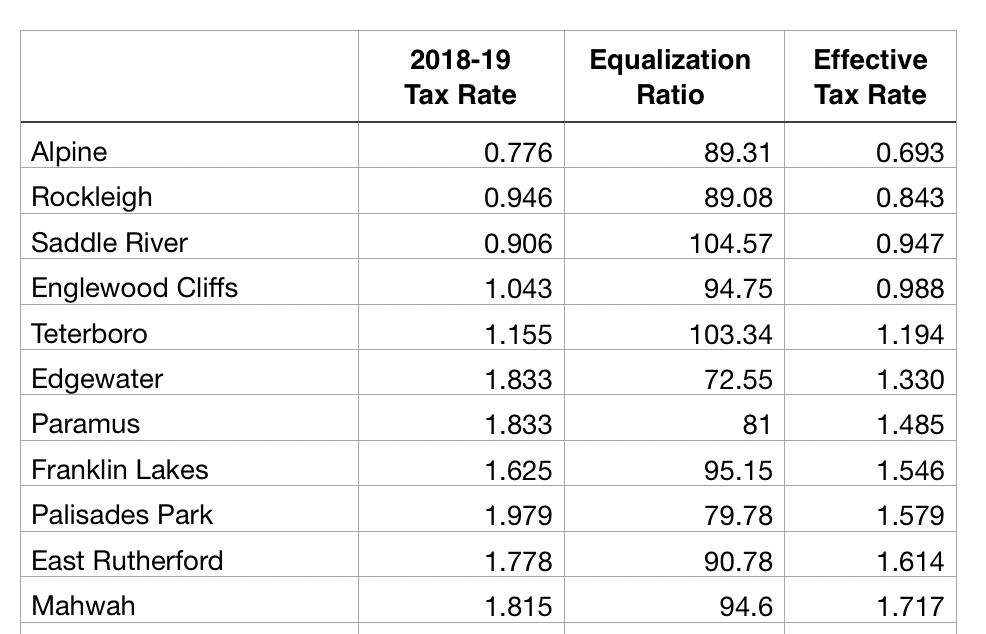

Ratios of assessed to true value by county and town: The total amount of property. New jersey property tax rates by county and town: Web property tax calculator tool. Assessed value x (general tax rate/100)= property tax. The state of nj site may contain optional links, information, services and/or content from other websites operated by.

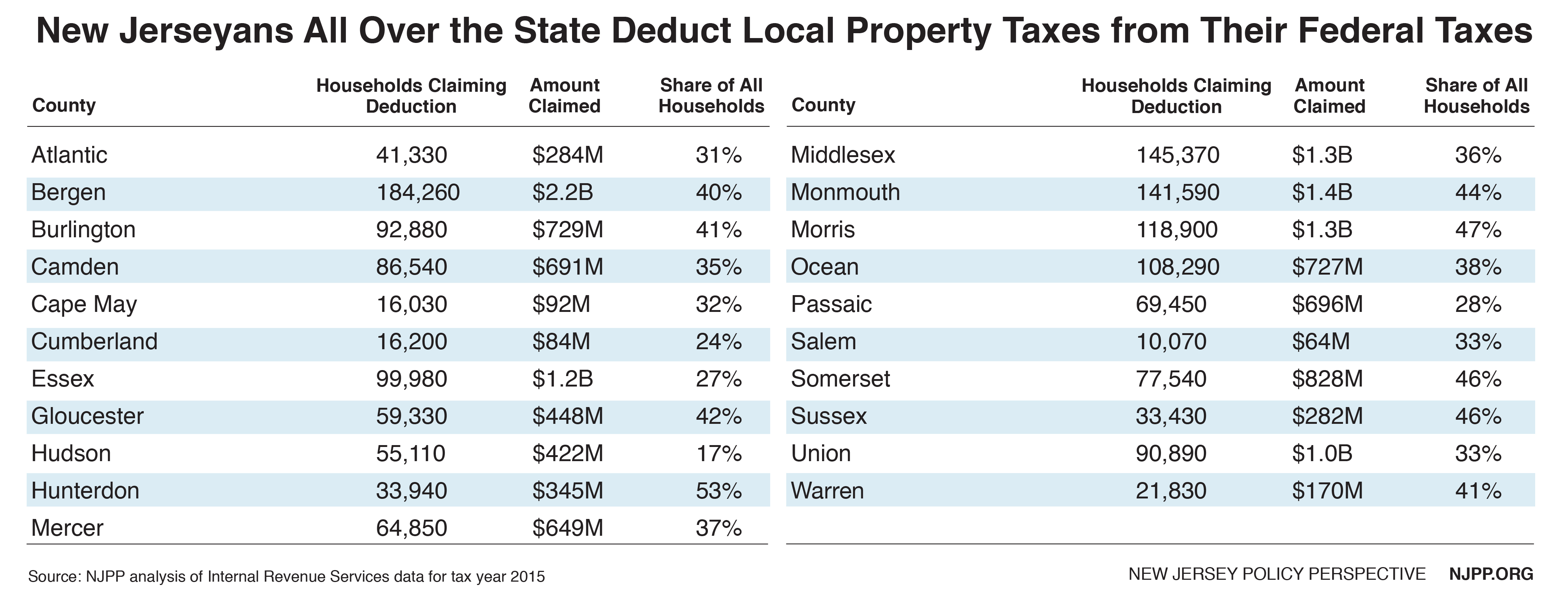

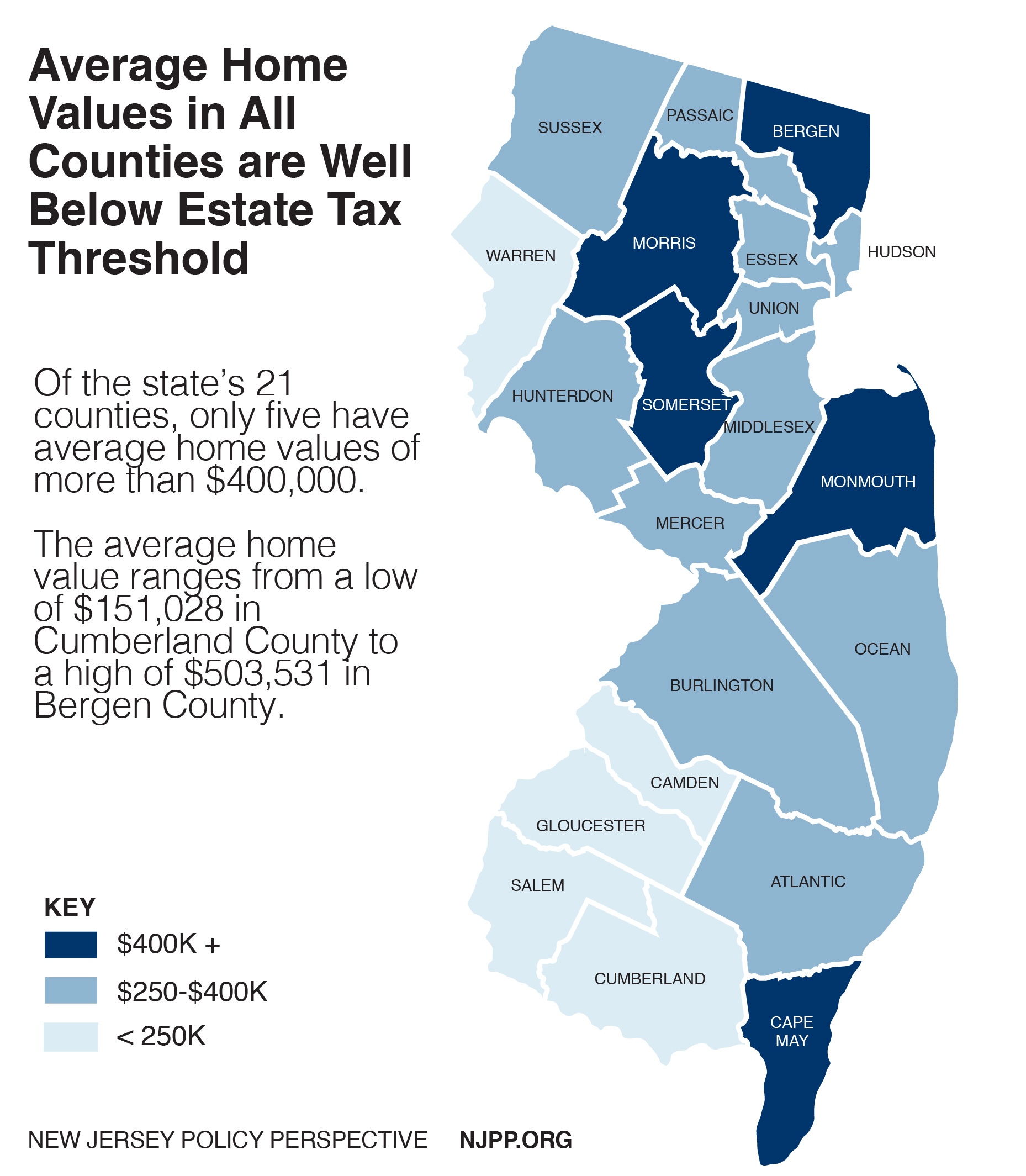

Fast Facts New Jersey’s Average Home Values Are Well Below Estate Tax

Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data. Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. Web to calculate your property taxes, start by typing the county and.

New Jersey Property Tax Calculator Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. Web click here to view. Web property tax calculator tool. Ratios of assessed to true value by county and town: Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your individual.

December 5, 2023 List And Map Of Property Tax Rates For All Nj Municipalities How Are Nj Property Taxes Calculated?

Find the current tax rate for. Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data.

Assessed Value X (General Tax Rate/100)= Property Tax.

Web property tax calculator tool. Press calculate to see the average property tax. This makes the take home pay $60,763.45. New jersey property tax rates by county and town:

Atlantic County Property Taxes Below Is A Town By Town List.

Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your individual. (for mobile home owners, this. Residents clamor for relief every year so they. Updated on dec 8 2023.

Web Nj Transfer Tax Calculator Customarily The New Jersey Transfer Tax Is Paid By The Seller And The Mansion Tax On Residential Or Commercial Purchases Of $1 Million Or More Is.

Web the new jersey tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in new jersey, the calculator allows you to calculate. Web this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. Compare your rate to the new jersey and u.s. Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor.