New York State Payroll Calculator

New York State Payroll Calculator - Web new york paycheck calculator 2023 new york paycheck calculator has a progressive income tax system, with rates that range between 4% and 10.9% based on taxpayers’. Web calculate your net pay and taxes for salary and hourly payment in new york in 2023. Gusto.com has been visited by 100k+ users in the past month Consequently, their net pay will. Web use icalculator™ us's paycheck calculator tailored for new york to determine your net income per paycheck.

Web if you’re a single new york resident with $50,000 in taxable income, your state income tax would be: Web the office of the new york state comptroller has implemented nys payroll online, a service that allows you to view and update your employee payroll information and opt. We’ll do the math for you—all you. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in new york. Enter your info to see your take home pay. Web new york paycheck calculator 2023 new york paycheck calculator has a progressive income tax system, with rates that range between 4% and 10.9% based on taxpayers’. Web calculate your new york paycheck.

New York State Payroll Online The City University of New York

Direct depositcase evaluationpersonal injuryroof replacement Web calculate your new york paycheck. Web the state income tax rate in new york is progressive and ranges from 4% to 10.9% while federal income tax rates range from 10% to 37% depending on your. Web the new york payroll calculator includes current and historical tax years, this is.

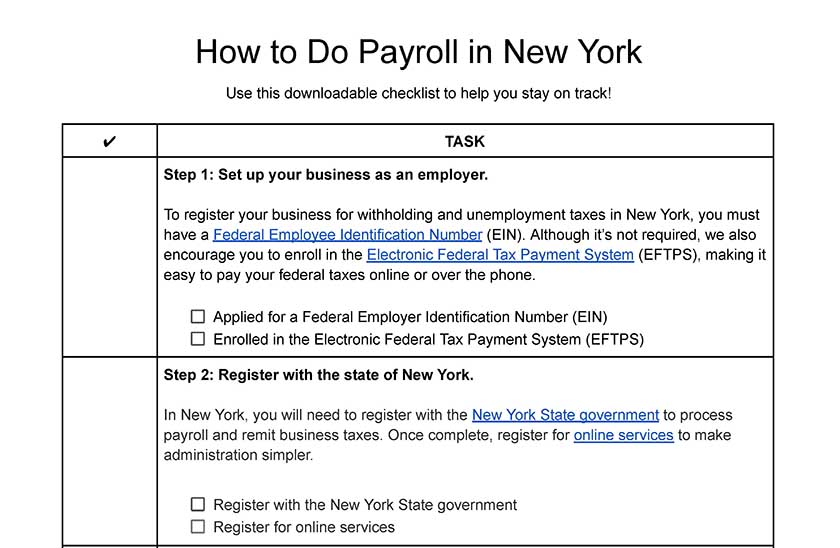

How to Do Payroll in New York State

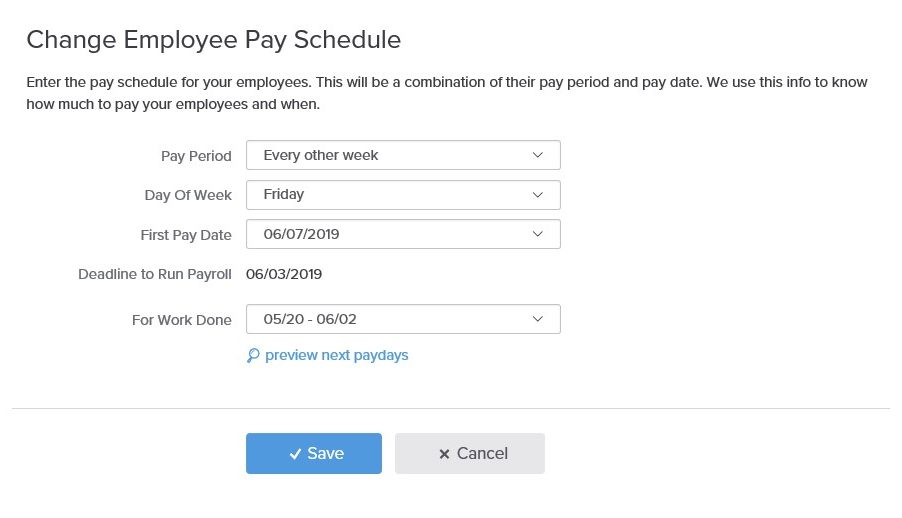

Consequently, their net pay will. Input the employee’s payment schedule, hourly wage or salary, pay. Direct depositcase evaluationpersonal injuryroof replacement Just enter the wages, tax withholdings and other. Web using a payroll tax service. Web new york paycheck calculator 2023 new york paycheck calculator has a progressive income tax system, with rates that range between.

How to Do Payroll in New York State

Calculating your new york state income tax is similar to the steps we listed on our federal paycheck calculator:. Web use adp’s new york paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web if an individual earns $55,000 annually while residing in the new york region of the.

New York Paycheck Calculator 2023

Web smartasset's new york paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web the new york payroll calculator includes current and historical tax years, this is particularly useful for looking at payroll trends (is your initial payroll cost going to. Web if an individual earns $55,000 annually while residing.

New York State Payroll Online The City University of New York

Web using a payroll tax service. Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings, helping you plan your expenses, savings, and investments better. Web the state income tax rate in new york is progressive and ranges from 4% to 10.9% while federal income tax.

The Complete Guide To New York Payroll & Payroll Taxes

Enter any employee's full name and select the state where they work. This applies to various salary frequencies including annual,. Web the new york payroll calculator includes current and historical tax years, this is particularly useful for looking at payroll trends (is your initial payroll cost going to. Web if you’re a single new york.

New York State Payroll Online The City University of New York

Web new york paycheck calculator 2023 new york paycheck calculator has a progressive income tax system, with rates that range between 4% and 10.9% based on taxpayers’. Web the office of the new york state comptroller has implemented nys payroll online, a service that allows you to view and update your employee payroll information and.

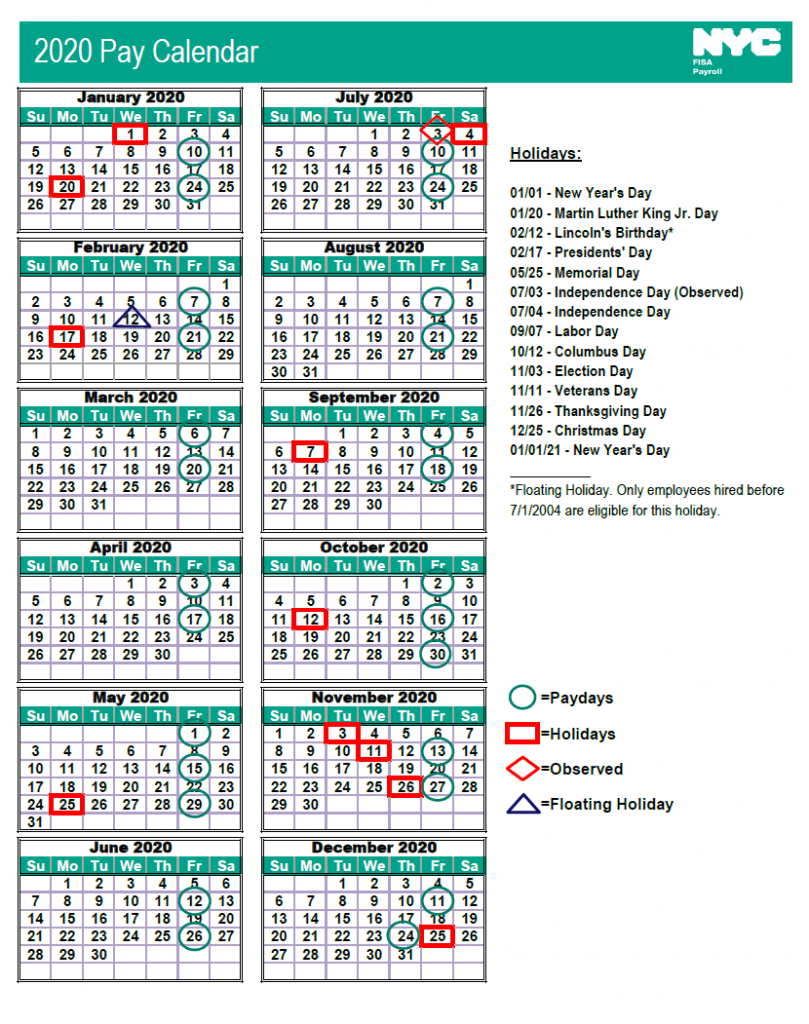

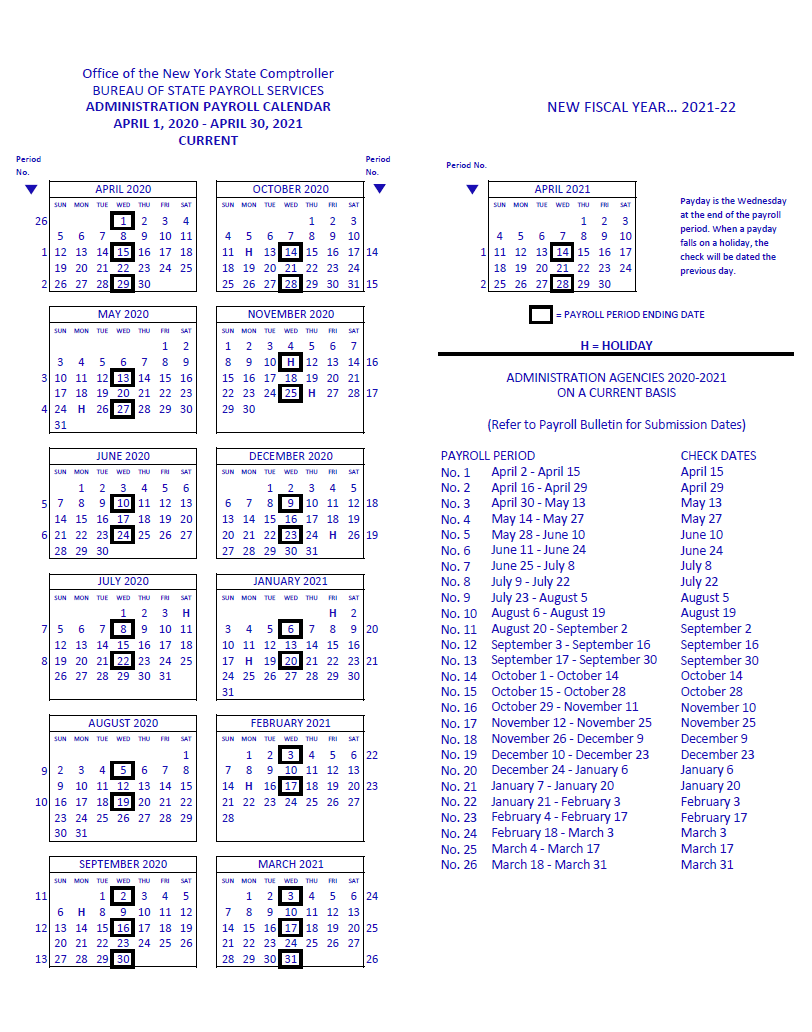

State of New York Payroll 2024 2024 Payroll Calendar

Web smartasset's new york paycheck calculator shows your hourly and salary income after federal, state and local taxes. Gusto.com has been visited by 100k+ users in the past month On the first $8,500 of your income, you pay 4%, which is. Web if you’re a single new york resident with $50,000 in taxable income, your.

How to Do Payroll in New York State

Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings, helping you plan your expenses, savings, and investments better. Web visit paycheckcity.com for new york hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web calculate your new york paycheck. You can also access.

State of New York Payroll 2024 2024 Payroll Calendar

Web the state income tax rate in new york is progressive and ranges from 4% to 10.9% while federal income tax rates range from 10% to 37% depending on your. Web calculate your new york paycheck. Direct depositcase evaluationpersonal injuryroof replacement Web use icalculator™ us's paycheck calculator tailored for new york to determine your net.

New York State Payroll Calculator On the first $8,500 of your income, you pay 4%, which is. Web if an individual earns $55,000 annually while residing in the new york region of the united states, they will be subject to a tax amount of $11,959. This applies to various salary frequencies including annual,. Enter any employee's full name and select the state where they work. You can also access historic tax.

Enter Any Employee's Full Name And Select The State Where They Work.

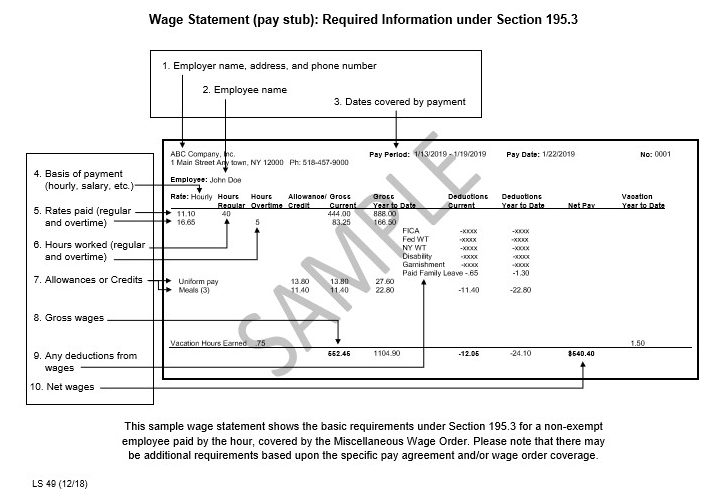

Web the office of the new york state comptroller has implemented nys payroll online, a service that allows you to view and update your employee payroll information and opt. Consequently, their net pay will. You can also access historic tax. Web this section provides factors and formulas for the calculation of salary and wages and charts for decimal equivalents or parts of an hour and parts of a day.

Just Enter The Wages, Tax Withholdings And Other.

Web use icalculator™ us's paycheck calculator tailored for new york to determine your net income per paycheck. Web using a payroll tax service. Web use our easy payroll tax calculator to quickly run payroll in new york, or look up 2024 state tax rates. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in new york.

On The First $8,500 Of Your Income, You Pay 4%, Which Is.

Web use adp’s new york paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web if you’re a single new york resident with $50,000 in taxable income, your state income tax would be: Web state sales tax rates. We’ll do the math for you—all you.

Web New York Paycheck Calculator 2023 New York Paycheck Calculator Has A Progressive Income Tax System, With Rates That Range Between 4% And 10.9% Based On Taxpayers’.

Web smartasset's new york paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web use this new york gross pay calculator to gross up wages based on net pay. Web if an individual earns $55,000 annually while residing in the new york region of the united states, they will be subject to a tax amount of $11,959. Knowing your salary after tax or take home pay can give you a clearer picture of your actual earnings, helping you plan your expenses, savings, and investments better.