Nh Property Tax Calculator

Nh Property Tax Calculator - This calendar reflects the process and dates for a property tax levy for one tax year in. King county, washington property tax calculator. (click here to find your assessment) enter assessed property value: Tax rates (pdf) tax rates (excel) village tax rates (pdf) village tax rates (excel) tax rate calculation. 0% (4% tax on interest and dividends) median household.

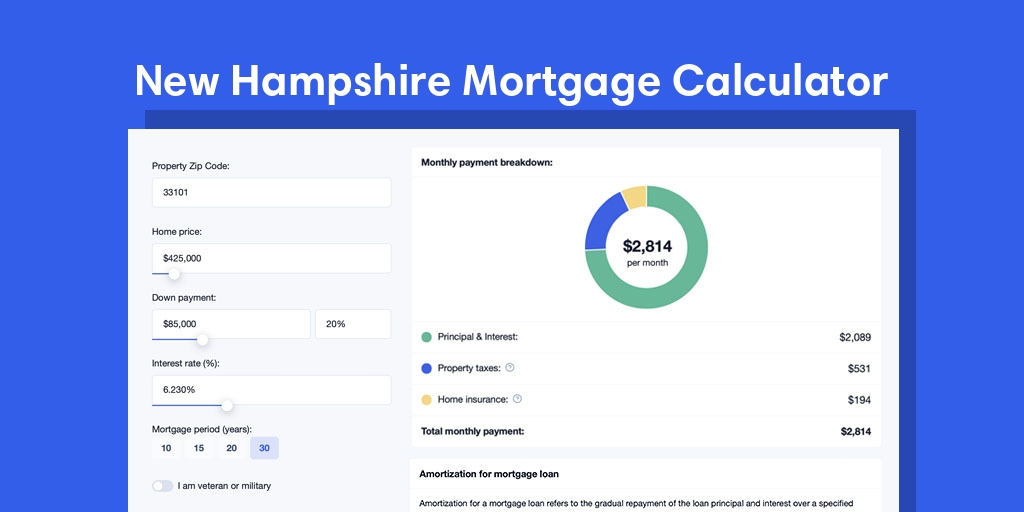

Web loudoun county, virginia property tax calculator. 1.86% of home value tax amount varies by county the median property tax in new hampshire is $4,636.00 per year for a home worth the median value of. Real estate tax ratethe 2023 real estate tax. New hampshire has both state and local liegenschaften taxes. Web our new hampshire property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Tax rates (pdf) tax rates (excel) village tax rates (pdf) village tax rates (excel) tax rate calculation.

nh property tax rates per town Keila Danner

Web the median property tax homeowners in new hampshire pay is $6,097. In fact, any given property can pay up to four other eigen taxe: Web new hampshire paycheck calculator new hampshire paycheck quick facts new hampshire income tax rate: Web our new hampshire property tax calculator can estimate your property taxes based on similar.

how to calculate nh property tax Good Inside Forum Slideshow

Web town of londonderry, nh tax calculator. Web enter your assessed property value = $ calculate tax. Web how new hampshire property taxes work. Web 2022 new hampshire property tax rates | nh town property taxes click here for a map of new hampshire property tax rates if you have any comments or. Compare your.

how to calculate nh property tax Wilfredo Doss

Web how to calculate your nh property tax bill. Web loudoun county, virginia property tax calculator. Assessed home value x effective property tax rate = annual property. 0% (4% tax on interest and dividends) median household. The assessed value multiplied by the tax rate equals the. Web the 2022 real estate tax rate for the.

how to calculate nh property tax Good Inside Forum Slideshow

This calendar reflects the process and dates for a property tax levy for one tax year in. Web how to calculate your nh property tax bill. July 5, 2023 about the new hampshire real estate transfer tax the state of nh imposes a. Web how new hampshire property taxes work. Web the median property tax.

nh property tax rates per town Keila Danner

See what your taxes in retirement will be. Web the median property tax homeowners in new hampshire pay is $6,097. Web our new hampshire property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. 0% (4% tax on interest and dividends).

How To Calculate Nh Property Tax

This calendar reflects the process and dates for a property tax levy for one tax year in. Compare your rate to the newer hampshire and u.s. Web loudoun county, virginia property tax calculator. Web new hampshire paycheck calculator new hampshire paycheck quick facts new hampshire income tax rate: 2023 tax rate (per 1,000): (click here.

New Hampshire Mortgage Calculator with taxes and insurance Mintrates

Web to calculate your property tax for 2024 in new hampshire, you can use the following formula: Web new hampshire paycheck calculator new hampshire paycheck quick facts new hampshire income tax rate: This calendar reflects the process and dates for a property tax levy for one tax year in. Compare your rate to the newer.

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101

Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Assessed home value x effective property tax rate = annual property. Web state education property tax warrants (all municipalities) 2022. Web how new hampshire property taxes work. Compare your rate to one new hampshire and u.s..

nh property tax rates per town Warner Partridge

(select either concord or penacook) assessing department tax calculator. Web new hampshire real estate transfer tax calculator last updated: Web our new hampshire property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average. 0% (4% tax on interest and dividends) median.

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101

Web 2022 new hampshire property tax rates | nh town property taxes click here for a map of new hampshire property tax rates if you have any comments or. Check out our mortgage guide for. Web enter your assessed property value = $ calculate tax. The assessed value of the property. Web 234 rows new.

Nh Property Tax Calculator 1.86% of home value tax amount varies by county the median property tax in new hampshire is $4,636.00 per year for a home worth the median value of. Compare your rate to the newer hampshire and u.s. Your total tax bill is: New hampshire has both state and local liegenschaften taxes. 2023 taxes = $ the property tax calculated does not include any exemptions (elderly, veterans, etc.) that you may be.

The Assessed Value Multiplied By The Tax Rate Equals The.

Property tax bills in new hampshire are determined using these factors: The towns with the highest property taxes in nh are claremont. Assessed home value x effective property tax rate = annual property. Web how to calculate your nh property tax bill.

Check Out Our Mortgage Guide For.

Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Web new hampshire real estate transfer tax calculator last updated: Compare your rate to one new hampshire and u.s. 0% (4% tax on interest and dividends) median household.

Web New Hampshire Paycheck Calculator New Hampshire Paycheck Quick Facts New Hampshire Income Tax Rate:

Web state education property tax warrants (all municipalities) 2022. This calendar reflects the process and dates for a property tax levy for one tax year in. Tax rates (pdf) tax rates (excel) village tax rates (pdf) village tax rates (excel) tax rate calculation. New hampshire has both state and local liegenschaften taxes.

2023 Taxes = $ The Property Tax Calculated Does Not Include Any Exemptions (Elderly, Veterans, Etc.) That You May Be.

Web the 2022 real estate tax rate for the town of stratham, nh is $18.71 per $1,000 of your property's assessed value. Web calculate how much you'll pay inside property duties on to home, given your company and assessed household value. King county, washington property tax calculator. Web enter your assessed property value = $ calculate tax.