Nj Real Estate Tax Calculator

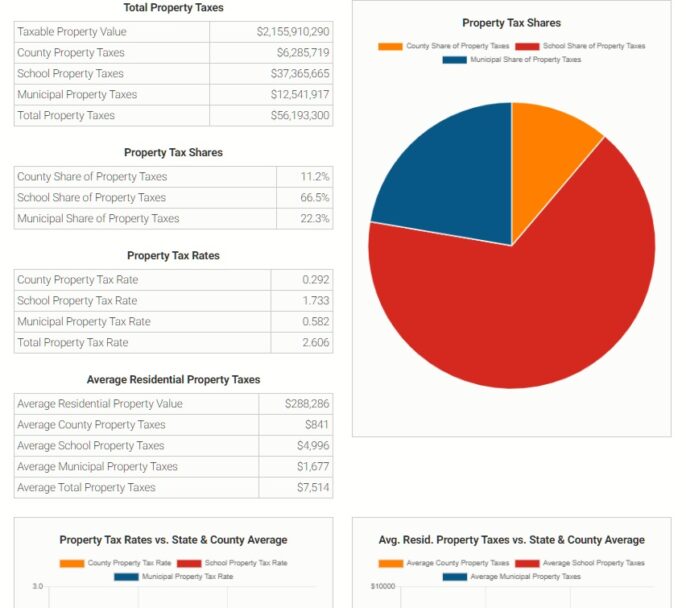

Nj Real Estate Tax Calculator - Web property taxes in nj is calculated using the formula: Assessed value x (general tax rate/100)= property tax. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. All real property is assessed according to the. New jersey's real property tax is an ad valorem tax, or a tax according to value.

Calculate additional transfer fee : Web zillow has 2 photos of this $684,900 3 beds, 4 baths, 2,588 square feet townhouse home located at 119 valentino dr, old bridge, nj 08857 mls #2407118r. Web buying a home in new jersey buying or selling a home can be a big decision, and we want to prepare you with the tax information you may need to know. Web property taxes in nj is calculated using the formula: The median real estate taxes. Enter the appropriate amounts for calendar years 2022 and 2023 as follows: All real property is assessed according to the.

Fair Property Taxes for All NJ Launches New “Property Tax Viewer

The median real estate taxes. Atlantic county property taxes below is a town by town list of. Web the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. New jersey tax calculator 2024. Web new jersey property tax. Tax calculator in order to determine.

How to Calculate Capital Gains Tax on Real Estate Investment Property

Counties in new jersey collect an average of 1.89% of a. Atlantic county property taxes below is a town by town list of. Web estimate my new jersey property tax. New jersey tax calculator 2024. The rtf is calculated based on the amount of consideration recited in. Web buying a home in new jersey buying.

Average NJ property tax bill near 9,300 Check your town here

Web property taxes in nj is calculated using the formula: Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. Assessed value x (general tax rate/100)= property tax. Web as an example, if the assessed value of your home is $200,000, but the market value.

Property Tax Class Codes Nj STAETI

Web general property tax information. Assessed value x (general tax rate/100)= property tax. Web defelice said under the current tax code, the remaining amount of gains will get taxed at 0%, 15% or 20% depending on your income and filing status. Our new jersey property tax calculator can estimate your property taxes based on similar.

NJ Real Estate Taxes Calculator for Tax Appeal

The realty transfer fee is imposed upon the recording of deeds evidencing transfers of title to real property in the state of new jersey. Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your individual. Web buying a home in new jersey.

How to Calculate Property Taxes

The grantee is required to remit additional transfer fee of 1% of the consideration. Web view all tax calculators and tools in the new jersey tax hub or use the new jersey tax calculator for 2024 (2025 tax return). Calculate the taxable value of your property by multiplying the assessed value by the current tax.

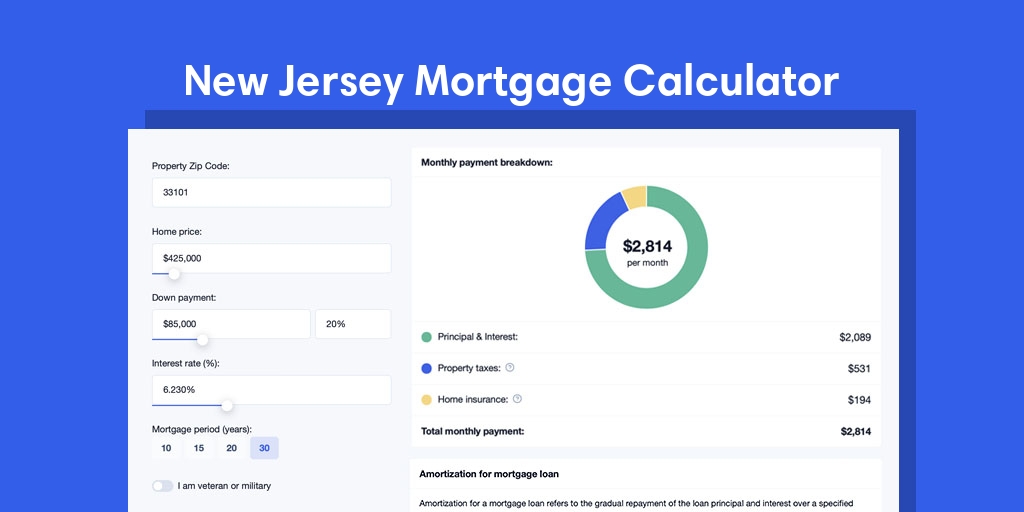

New Jersey Mortgage Calculator with taxes and insurance

The grantee is required to remit additional transfer fee of 1% of the consideration. Web view all tax calculators and tools in the new jersey tax hub or use the new jersey tax calculator for 2024 (2025 tax return). Web our free nj transfer tax calculator provides an estimate of the realty transfer fee (rtf).

33+ how to calculate nj property tax LadyArisandi

Web the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data. Web realty transfer fee calculator. Web property taxes in nj.

New Jersey Real Estate Tax How Much Would You Pay?

Web our free nj transfer tax calculator provides an estimate of the realty transfer fee (rtf) that will be owed when selling real property in new jersey. Web the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. New jersey's real property tax is.

Charting property taxes in New Jersey NJ Spotlight News

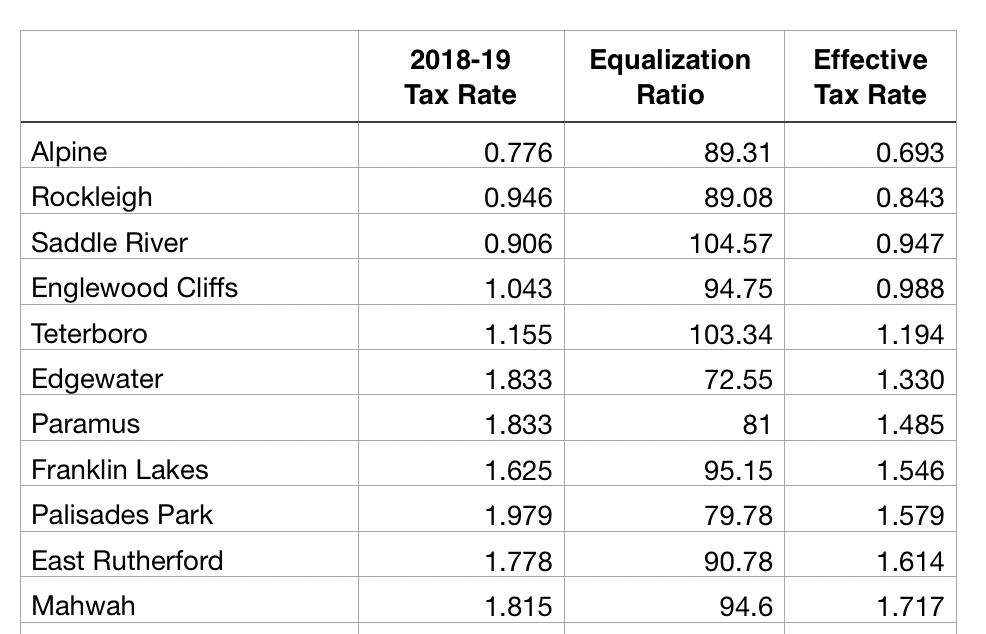

Enter the appropriate amounts for calendar years 2022 and 2023 as follows: Web as an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). Tax calculator in order to determine whether or not you should appeal. Web the median property tax.

Nj Real Estate Tax Calculator Counties in new jersey collect an average of 1.89% of a. Customarily the new jersey transfer tax is paid by the seller and the mansion tax on residential or. Enter the assessed value of the property for. Web property tax calculator tool. The average effective property tax rate is 2.47%.

Nj Real Estate Xfer Tax.

Web property tax calculator tool. Web the median property tax in new jersey is $6,579.00 per year for a home worth the median value of $348,300.00. The average effective property tax rate is 2.47%. (rtf) that will be owed.

Our New Jersey Property Tax Calculator Can Estimate Your Property Taxes Based On Similar Properties, And Show You How Your.

All real property is assessed according to the. File with confidenceeasy and accurateaudit support guaranteeexpense estimator Calculate additional transfer fee : Customarily the new jersey transfer tax is paid by the seller and the mansion tax on residential or.

Web New Jersey Property Tax Calculator Last Updated:

December 5, 2023 list and map of property tax rates for all nj municipalities how are nj property taxes. Web property taxes in nj is calculated using the formula: Counties in new jersey collect an average of 1.89% of a. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data.

Web The State Imposes A Realty Transfer Fee (Rtf) On The Seller Of Real Property For Recording A Deed For The Sale.

Enter the appropriate amounts for calendar years 2022 and 2023 as follows: Web as an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). Enter the assessed value of the property for. Calculate the taxable value of your property by multiplying the assessed value by the current tax rate.