Nj Tax Calculator Paycheck

Nj Tax Calculator Paycheck - Web the standard deduction for 2023 is: Salary rate annual month weekly day. Please adjust your save more with these rates that beat the. Enter your info to see your take home pay. Web paycheck calculator new jersey.

Hourly & salary take home after taxes you can't withhold more than your earnings. Web new jersey paycheck calculator. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Divide the sum of all applicable taxes by the employee’s gross pay. Web new jersey operates under a progressive income tax system, with tax rates ranging from 1.40% to 10.75%, making the top rate one of the highest in the united states. Web income tax calculator new jersey find out how much your salary is after tax enter your gross income per where do you work? Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

New Jersey Paycheck Calculator 2023 NJ Paycheck Calculator

The deadline to file returns in 2024 is april 15 (this. Hourly & salary take home after taxes you can't withhold more than your earnings. Web to use our new jersey salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. $27,700 for married couples filing.

Paycheck Calculator New Jersey Adp NREQUA

The deadline to file returns in 2024 is april 15 (this. Web paycheck calculator new jersey. Multiply that $10,500 by 15%, and the parent's. Gusto.com has been visited by 100k+ users in the past month Use adp’s new jersey paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Hourly.

A Complete Guide to New Jersey Payroll Taxes

The cash minimum wage rate for tipped employees is $3.13, with a. You can also access historic tax. Hourly & salary take home after taxes you can't withhold more than your earnings. Web the new jersey tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax.

New Jersey Payroll Setup CFS Tax Software, Inc.

Gusto.com has been visited by 100k+ users in the past month Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web to use our new jersey salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Web.

New Jersey Paycheck Calculator 2023 2024

Please adjust your save more with these rates that beat the. After a few seconds, you will be provided with. Web the new jersey tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in new jersey, the calculator allows you to calculate. Web new.

2023 New Jersey Payroll Tax Rates Abacus Payroll

Use adp’s new jersey paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Before we jump in, who are you using this. Salary rate annual month weekly day. $13,850 for single or married filing separately. The deadline to file returns in 2024 is april 15 (this. Web paycheck calculator.

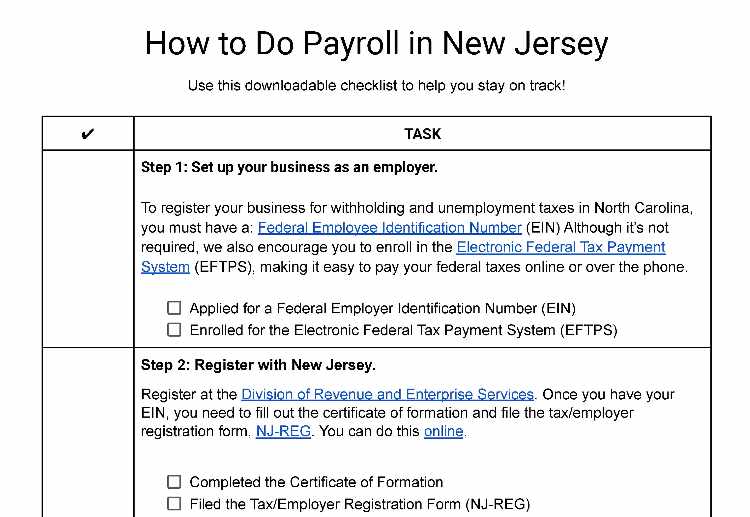

How to Do Payroll in New Jersey A Guide for Small Businesses

The cash minimum wage rate for tipped employees is $3.13, with a. Multiply that $10,500 by 15%, and the parent's. Salary rate annual month weekly day. Web the new jersey tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in new jersey, the calculator.

New Jersey Tax Calculator 2023 2024

The deadline to file returns in 2024 is april 15 (this. After a few seconds, you will be provided with. Before we jump in, who are you using this. Web new jersey paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Divide the.

Free Nj Payroll Calculator

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. We’ll do the math for you—all you. Please adjust your save more with these rates that beat the. The irs started accepting and processing income tax returns.

Done with taxes? Nope. Here's what you need to know now for your 2018

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Multiply that $10,500 by 15%, and the parent's. Before we jump in, who are you using this. Web to use our new jersey salary tax calculator, all.

Nj Tax Calculator Paycheck Hourly & salary take home after taxes you can't withhold more than your earnings. The deadline to file returns in 2024 is april 15 (this. Multiply that $10,500 by 15%, and the parent's. Please adjust your save more with these rates that beat the. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Use Adp’s New Jersey Paycheck Calculator To Estimate Net Or “Take Home” Pay For Either Hourly Or Salaried Employees.

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). You can also access historic tax. Web income tax calculator new jersey find out how much your salary is after tax enter your gross income per where do you work? Web new jersey income tax calculator estimate your new jersey income tax burden updated for 2023 tax year on dec 8, 2023 what was updated?

Web Paycheck Calculator New Jersey.

Web new jersey operates under a progressive income tax system, with tax rates ranging from 1.40% to 10.75%, making the top rate one of the highest in the united states. Enter your info to see your take home pay. $13,850 for single or married filing separately. The deadline to file returns in 2024 is april 15 (this.

Web The New Jersey Tax Calculator Is For The 2024 Tax Year Which Means You Can Use It For Estimating Your 2025 Tax Return In New Jersey, The Calculator Allows You To Calculate.

Hourly & salary take home after taxes you can't withhold more than your earnings. $27,700 for married couples filing jointly or qualifying surviving spouse. Surepayroll.com has been visited by 10k+ users in the past month We’ll do the math for you—all you.

Web To Use Our New Jersey Salary Tax Calculator, All You Need To Do Is Enter The Necessary Details And Click On The Calculate Button.

Gusto.com has been visited by 100k+ users in the past month Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Please adjust your save more with these rates that beat the. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted.