Non-Qualified Stretch Annuity Calculator

Non-Qualified Stretch Annuity Calculator - Gainbridge.io has been visited by 10k+ users in the past month Continuous learningretirement products160 years strongadvice Web use this calculator to help determine how you can stretch out your payments for as long as possible. Colorful, interactive, simply the best financial calculators! Web get a rmd & stretch ira calculator branded for your website!

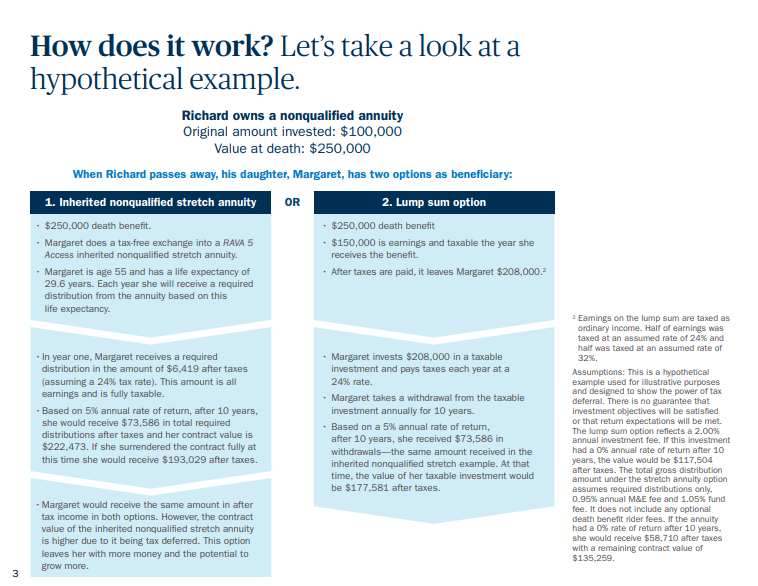

Gainbridge.io has been visited by 10k+ users in the past month » sat mar 13, 2021 4:37 pm. Please enter a value for owner's birth date, beneficiary birth date * indicates. Richard owns a nonqualified annuity original amount invested: Let’s take a look at a hypothetical example. Web use this calculator to help determine how you can stretch out your payments for as long as possible. * part taxed at 22% and the balance at 24%.

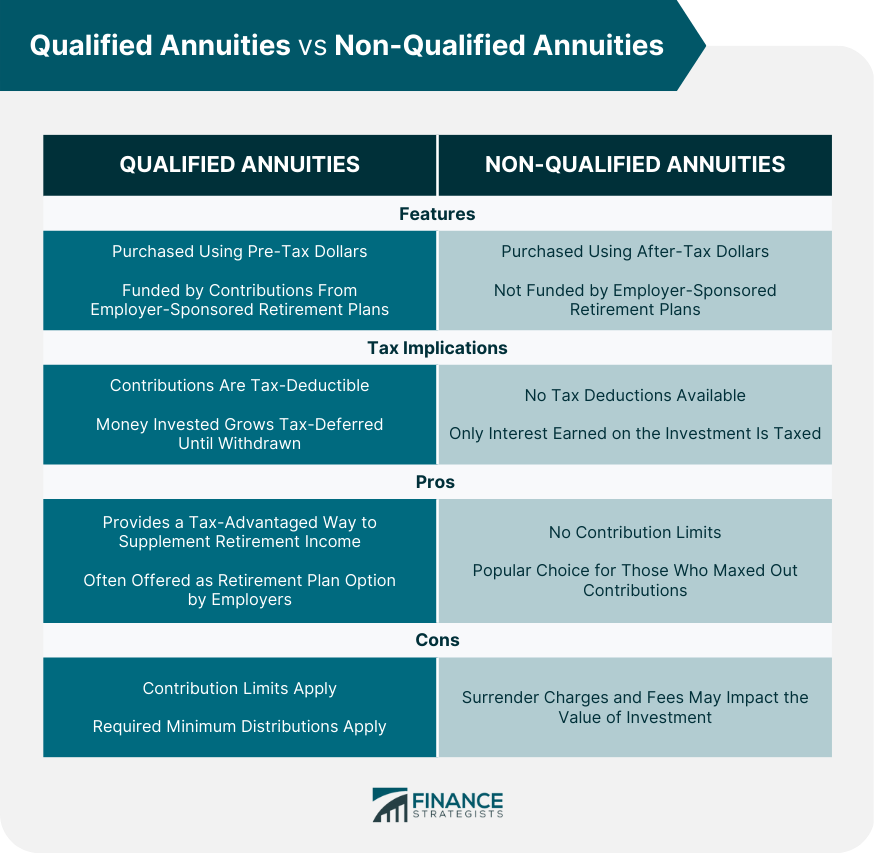

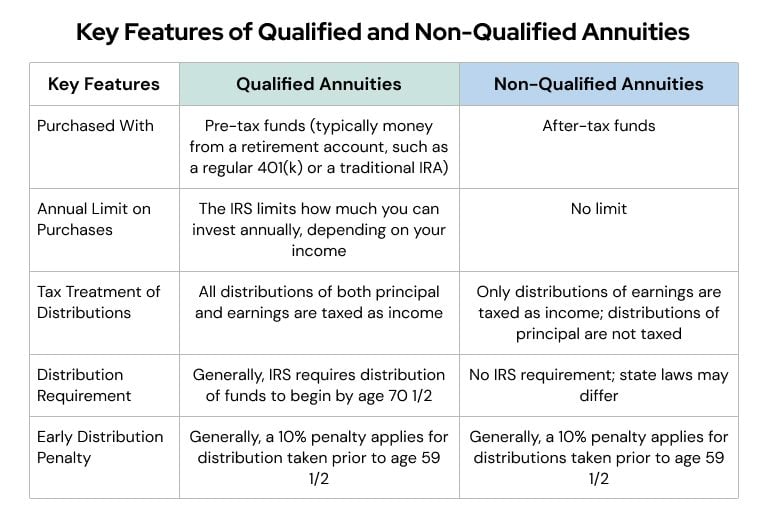

NonQualified vs Qualified Annuities Differences, Pros & Cons

Nq annuities were not affected by the secure act, however. Colorful, interactive, simply the best financial calculators! Web how does it work? » sat mar 13, 2021 4:37 pm. Key takeaways a stretch annuity (legacy annuity) allows for. The irs requires that you withdraw at least a minimum. Richard owns a nonqualified annuity original amount.

What is a Nonqualified Stretch, and How Does It Work? (2023)

For instance, both types of retirement planning vehicles are funded with money that has already been taxed. Richard owns a nonqualified annuity original amount invested: Web how to use nonqualified stretch to stretch out an annuity's tax and income. If you would like to use this tool, please. Continuous learningretirement products160 years strongadvice Web rmd.

Qualified Vs NonQualified Annuities Safe Wealth Plan

Although typically they are still lifetime contracts used. Web get a rmd & stretch ira calculator branded for your website! * part taxed at 22% and the balance at 24%. Please enter a value for owner's birth date, beneficiary birth date * indicates. • can provide beneficiaries with increased flexibility for withdrawal options • may.

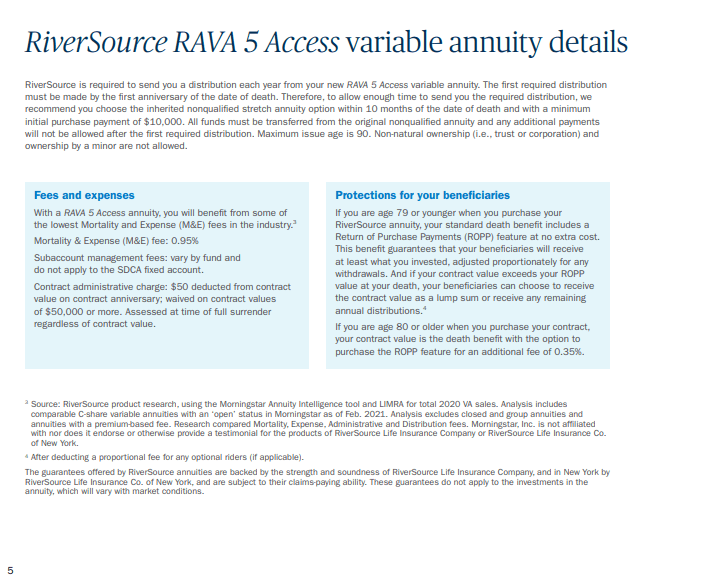

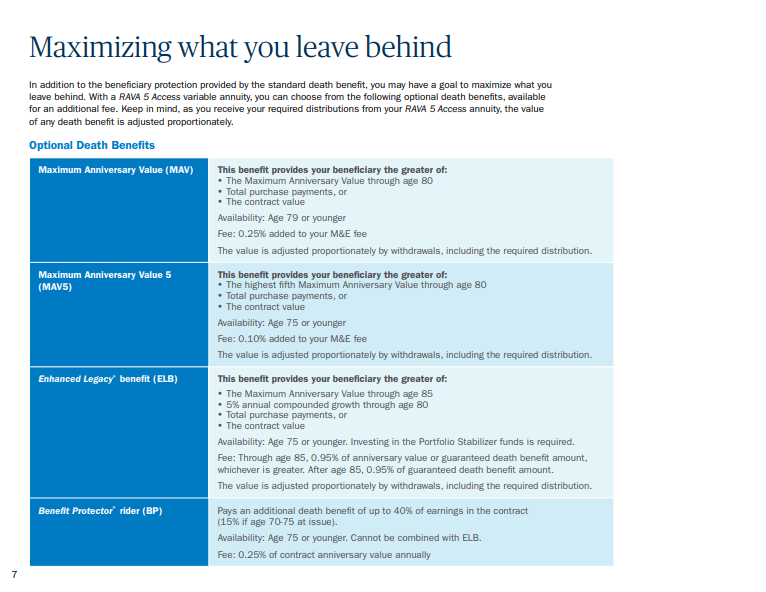

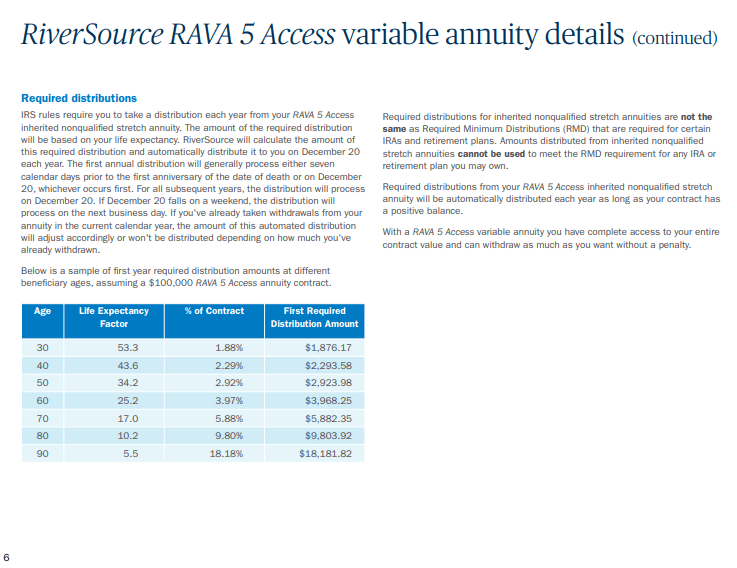

Ameriprise Financial Nonqualified stretch option for nonspouse

Nq annuities were not affected by the secure act, however. Web use this calculator to help determine how you can stretch out your payments for as long as possible. Web get a rmd & stretch ira calculator branded for your website! » sat mar 13, 2021 4:37 pm. Web how to use nonqualified stretch to.

NonQualified Annuities (Everything You Need to Know) Safe Wealth Plan

Web use this calculator to help determine how you can stretch out your payments for as long as possible. Nq annuities were not affected by the secure act, however. Continuous learningretirement products160 years strongadvice Please enter a value for owner's birth date, beneficiary birth date * indicates. Key takeaways a stretch annuity (legacy annuity) allows.

Ameriprise Financial Nonqualified stretch option for nonspouse

Let’s take a look at a hypothetical example. Gainbridge.io has been visited by 10k+ users in the past month Key takeaways a stretch annuity (legacy annuity) allows for. Web use this calculator to help determine how you can stretch out your payments for as long as possible. Colorful, interactive, simply the best financial calculators! Please.

Ameriprise Financial Nonqualified stretch option for nonspouse

Nq annuities were not affected by the secure act, however. * part taxed at 22% and the balance at 24%. For instance, both types of retirement planning vehicles are funded with money that has already been taxed. Web get a rmd & stretch ira calculator branded for your website! • can provide beneficiaries with increased.

Qualified vs. NonQualified Annuities Taxes & Distribution

Web how does it work? The irs requires that you withdraw at least a minimum. Colorful, interactive, simply the best financial calculators! Web use this calculator to help determine how you can stretch out your payments for as long as possible. Please enter a value for owner's birth date, beneficiary birth date * indicates. *.

Ameriprise Financial Nonqualified stretch option for nonspouse

Let’s take a look at a hypothetical example. Richard owns a nonqualified annuity original amount invested: Web how does it work? * part taxed at 22% and the balance at 24%. Web get a rmd & stretch ira calculator branded for your website! Gainbridge.io has been visited by 10k+ users in the past month Web.

Qualified vs NonQualified Annuities Taxation and Distribution

Web rmd & stretch ira calculator. Continuous learningretirement products160 years strongadvice Although typically they are still lifetime contracts used. * part taxed at 22% and the balance at 24%. Gainbridge.io has been visited by 10k+ users in the past month Colorful, interactive, simply the best financial calculators! • can provide beneficiaries with increased flexibility for.

Non-Qualified Stretch Annuity Calculator Key takeaways a stretch annuity (legacy annuity) allows for. Let’s take a look at a hypothetical example. Web use this calculator to help determine how you can stretch out your payments for as long as possible. Please enter a value for owner's birth date, beneficiary birth date * indicates. Colorful, interactive, simply the best financial calculators!

Web How Does It Work?

Gainbridge.io has been visited by 10k+ users in the past month Web how to use nonqualified stretch to stretch out an annuity's tax and income. Web use this calculator to help determine how you can stretch out your payments for as long as possible. Web get a rmd & stretch ira calculator branded for your website!

Continuous Learningretirement Products160 Years Strongadvice

If you would like to use this tool, please. Colorful, interactive, simply the best financial calculators! For instance, both types of retirement planning vehicles are funded with money that has already been taxed. • can provide beneficiaries with increased flexibility for withdrawal options • may allow beneficiaries to.

Let’s Take A Look At A Hypothetical Example.

Web use this calculator to help determine how you can stretch out your payments for as long as possible. » sat mar 13, 2021 4:37 pm. Although typically they are still lifetime contracts used. The irs requires that you withdraw at least a minimum.

Richard Owns A Nonqualified Annuity Original Amount Invested:

Key takeaways a stretch annuity (legacy annuity) allows for. * part taxed at 22% and the balance at 24%. Web unique method of distribution, the jackson® nonqualified stretch option, permits beneficiaries of nonqualified annuities to “stretch” distributions over a period not to. Web rmd & stretch ira calculator.