Nso Tax Calculator

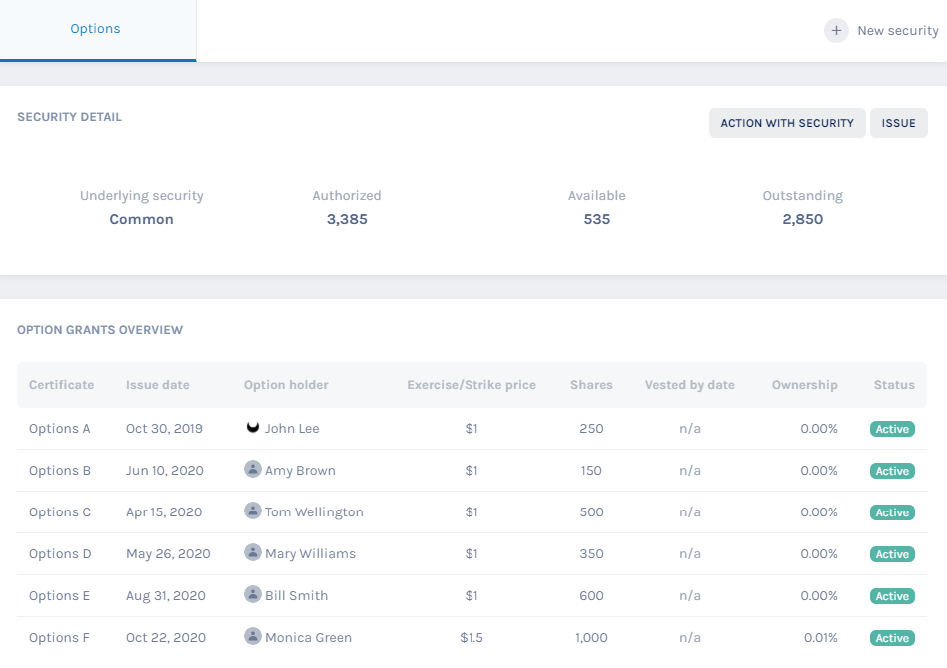

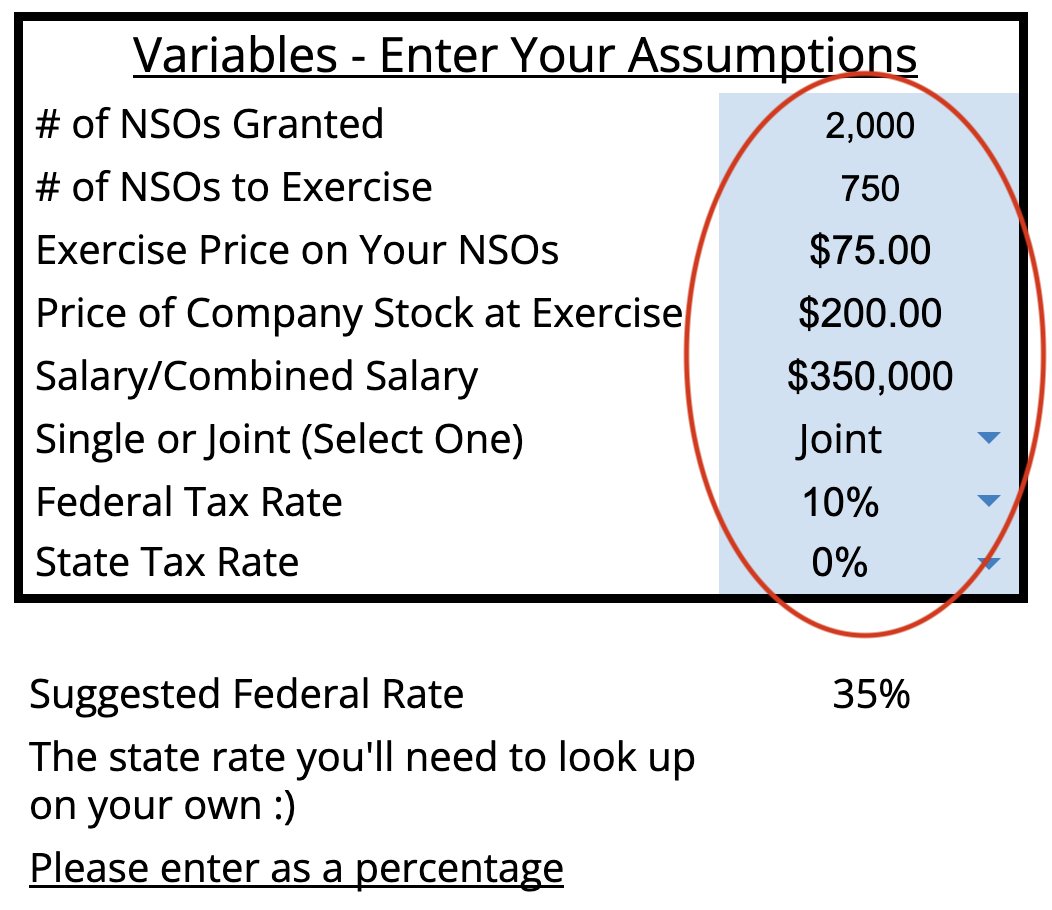

Nso Tax Calculator - The market value of the stock is the stock price on the day you. The distinction between them lies in. Web an nso is an option that doesn’t qualify for the special tax treatment afforded incentive stock options (isos). Web nonqualified stock options receive less favorable tax treatment vs. Therefore, the total tax she needs to pay is equal to.

The distinction between them lies in. Web non qualified stock options calculator want to know what you'd get if you were to exercise your options? Taxact.com has been visited by 100k+ users in the past month Web nonqualified stock options (nsos) incentive stock options ( isos ). Web a nso is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the strike price. To help you figure out how to calculate the taxes you might owe from exercising nsos or selling stock after. Web you calculate the compensation element by subtracting the exercise price from the market value.

Nonqualified Stock Option (NSO) Tax Calculator — Equity FTW

Web non qualified stock options calculator want to know what you'd get if you were to exercise your options? Taxact.com has been visited by 100k+ users in the past month This discussion centers on nonqualified stock options. This calculator illustrates the tax benefits of exercising your stock options before ipo. The market value of the.

Nso Stock Option Tax Calculator

Web a nso is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the strike price. Web taxable ordinary income for nso: Web non qualified stock options calculator want to know what you'd get if you were to exercise your options? Web your.

Detailed Comparison of ISOs vs NSOs — EquityFTW

To help you figure out how to calculate the taxes you might owe from exercising nsos or selling stock after. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950. You exercise your options and hold.

2015 To 2016 Tax Calculator CALCULATORUK HJW

Web a nso is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the strike price. Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built.

Nso Stock Option Tax Calculator

You can then find your taxes by dividing assessed value by 100 and multiplying by the rate, 0.80. Suppose that the flat income tax rate for sarah is 30%. Please enter your option information below to see your. This calculator illustrates the tax benefits of exercising your stock options before ipo. This discussion centers on.

Nso Stock Option Tax Calculator

Therefore, the total tax she needs to pay is equal to. You exercise your options and hold at least one year before selling; The market value of the stock is the stock price on the day you. Zillow has 36 photos of this $499,900 4 beds, 3 baths, 3,112 square feet single family home located..

Nonqualified Stock Option (NSO) Tax Calculator — Equity FTW

Web your assessed value would be $60,000 (60% of market value). Despite the potential tax advantages of isos, most. Suppose that the flat income tax rate for sarah is 30%. Zillow has 36 photos of this $499,900 4 beds, 3 baths, 3,112 square feet single family home located. The market value of the stock is.

New Mexico State Tax Tables 2023 US iCalculator™

Zillow has 31 photos of this $250,000 4 beds, 2 baths, 2,384 square feet single family home located at 104 s grafton st, romney, wv 26757 built in 1950. You exercise your options and sell in under one. Please enter your option information below to see your. Web non qualified stock options calculator want to.

What is Sales Tax Nexus Learn all about Nexus

Taxact.com has been visited by 100k+ users in the past month Nsos do not require employment. Web nonqualified stock options receive less favorable tax treatment vs. This calculator illustrates the tax benefits of exercising your stock options before ipo. Web your assessed value would be $60,000 (60% of market value). Knowing when and how they’re.

Nonqualified Stock Option (NSO) Tax Treatment and Scenarios — EquityFTW

Knowing when and how they’re taxed can help maximize their benefit. This calculator illustrates the tax benefits of exercising your stock options before ipo. Web non qualified stock options calculator want to know what you'd get if you were to exercise your options? Web you calculate the compensation element by subtracting the exercise price from.

Nso Tax Calculator You exercise your options and sell in under one. Therefore, the total tax she needs to pay is equal to. Taxact.com has been visited by 100k+ users in the past month This calculator illustrates the tax benefits of exercising your stock options before ipo. Web nonqualified stock option (nso) tax examples.

Despite The Potential Tax Advantages Of Isos, Most.

Web non qualified stock options calculator want to know what you'd get if you were to exercise your options? Web if you want a personalized figure, use our stock option tax calculator. Web you calculate the compensation element by subtracting the exercise price from the market value. The market value of the stock is the stock price on the day you.

Web Taxable Ordinary Income For Nso:

This calculator illustrates the tax benefits of exercising your stock options before ipo. Web nonqualified stock options (nsos) incentive stock options ( isos ). Web nonqualified stock option (nso) tax examples. The distinction between them lies in.

You Exercise Your Options And Sell In Under One.

You exercise your options and hold at least one year before selling; Zillow has 36 photos of this $499,900 4 beds, 3 baths, 3,112 square feet single family home located. Please enter your option information below to see your. Web a nso is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the strike price.

Nsos Do Not Require Employment.

To help you figure out how to calculate the taxes you might owe from exercising nsos or selling stock after. You can then find your taxes by dividing assessed value by 100 and multiplying by the rate, 0.80. Enter your information below to see what you'd receive before and after. Web your assessed value would be $60,000 (60% of market value).

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg)