Oklahoma Payroll Tax Calculator

Oklahoma Payroll Tax Calculator - Web oklahoma paycheck calculator advertiser disclosure oklahoma paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other. Web the rates range from 0% to a top rate of 4.75%, based on the income brackets shown below. Simply enter their federal and state. We’ll do the math for you—all you. Web oklahoma salary and tax calculators.

Updated on dec 05 2023. Calculate net payroll amount (after payroll taxes), federal withholding,. Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax. Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Payroll check calculator is updated for payroll year 2023 and new w4. Web for a single oklahoman with a wage of $50,000 in 2023, the take home pay is $40,229.75 with a total income tax of $9,770.25. It also does fica, medicare,.

Oklahoma State Tax Tables 2023 US iCalculator™

Updated on dec 8 2023. Calculate net payroll amount (after payroll taxes), federal withholding,. Web how to use the oklahoma paycheck calculator. The 2023, the oklahoma standard deduction is $6,350 for single filers or. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking.

Oklahoma Employee Tax Withholding Form 2023

We’ll do the math for you—all you. Web visit paycheckcity.com for oklahoma hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Updated on dec 8 2023. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. Web the state income tax rate.

How to calculate payroll taxes 2021 QuickBooks

Updated on dec 8 2023. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. Web visit paycheckcity.com for oklahoma hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

The 2023, the oklahoma standard deduction is $6,350 for single filers or. Web the state income tax rate in oklahoma is progressive and ranges from 0.25% to 4.75% while federal income tax rates range from 10% to 37% depending on. Web oklahoma paycheck calculator generate paystubs with accurate oklahoma state tax withholding calculations. We’ll do.

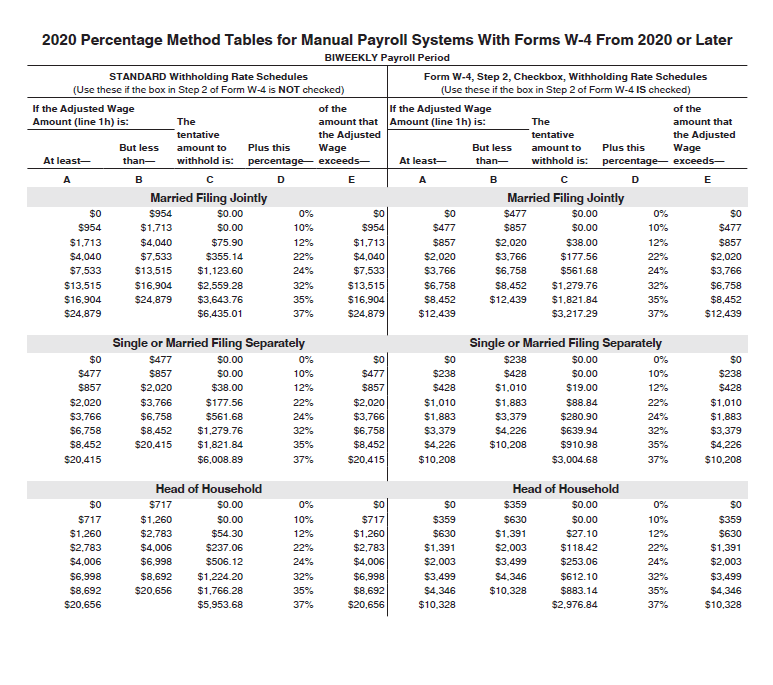

Federal Payroll Tax Tables Bi Weekly Review Home Decor

Web use adp’s oklahoma paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Free tool to calculate your hourly and salary income. File taxesaccounting toolsdirect deposittax deductions Just enter the wages, tax withholdings and other. Calculate net payroll amount (after payroll taxes), federal withholding,. Simply enter their federal and.

Oklahoma Withholding Tables 2021 Federal Withholding Tables 2021

Web oklahoma paycheck calculator generate paystubs with accurate oklahoma state tax withholding calculations. Web oklahoma paycheck calculator advertiser disclosure oklahoma paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other. Web the state income tax rate in oklahoma is progressive and ranges from 0.25% to 4.75% while federal income.

6 Free Payroll Tax Calculators for Employers

Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. It will calculate net paycheck amount that an employee will receive. Web for a single oklahoman with a wage of $50,000 in 2023, the.

6 Free Payroll Tax Calculators for Employers

Web oklahoma paycheck calculator generate paystubs with accurate oklahoma state tax withholding calculations. Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web oklahoma paycheck calculator advertiser disclosure oklahoma paycheck calculator for salary.

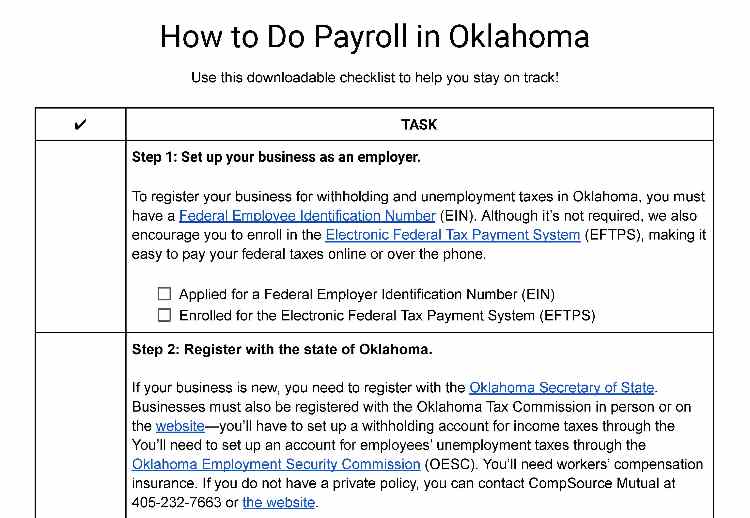

How to Do Payroll in Oklahoma An Employer’s Guide

It will calculate net paycheck amount that an employee will receive. Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Updated on dec 8 2023. Web how to use the oklahoma paycheck calculator..

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

It will calculate net paycheck amount that an employee will receive. Web for a single oklahoman with a wage of $50,000 in 2023, the take home pay is $40,229.75 with a total income tax of $9,770.25. Web oklahoma salary and tax calculators. It also does fica, medicare,. Web use our simple paycheck calculator to estimate.

Oklahoma Payroll Tax Calculator Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web federal and oklahoma payroll withholding. For landscapers1099 tax formfor online sellersfor consultants Just enter the wages, tax withholdings and other. Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Enter Your Gross Salary, Pay Frequency, And Other Relevant Details To Calculate Your Net Income After All State And Federal Taxes.

Updated on dec 8 2023. Alabama alaska arizona arkansas california colorado. Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax. Simply enter their federal and state.

Web How To Use The Oklahoma Paycheck Calculator.

Web oklahoma paycheck and payroll calculator. Free tool to calculate your hourly and salary income. Updated on dec 05 2023. Web oklahoma salary and tax calculators.

Free Paycheck Calculator To Calculate Net Amount And Payroll Taxes From A Gross Paycheck Amount.

Web oklahoma paycheck calculator advertiser disclosure oklahoma paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other. Web federal and oklahoma payroll withholding. Web you can quickly estimate your oklahoma state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Web the state income tax rate in oklahoma is progressive and ranges from 0.25% to 4.75% while federal income tax rates range from 10% to 37% depending on.

Just Enter The Wages, Tax Withholdings And Other.

Web the rates range from 0% to a top rate of 4.75%, based on the income brackets shown below. File taxesaccounting toolsdirect deposittax deductions Web use adp’s oklahoma paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web visit paycheckcity.com for oklahoma hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more.