Overtime California Calculator

Overtime California Calculator - This calculator calculates the maximum amount of overtime and double overtime pay owed under all methodologies as required by california labor laws. Determine your workdays and workweeks workday because nonexempt employees are entitled to overtime pay if they work more than 8 hours in a. Web the department of labor enforces united states overtime rules. Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of. Let's look at a quick breakdown of the overtime rules in california:

Most employers will pay time and a half or. So, according to the california. Web a california attorney explains the law on overtime wages. Web calculating overtime pay in california. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. Generally, united states law requires employers to pay overtime after 40 hours of work during a single work. Web for more information on california overtime law, refer to the following:

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

This easy and convenient tool will help employers and employees within the. Determine your workdays and workweeks workday because nonexempt employees are entitled to overtime pay if they work more than 8 hours in a. Most employers will pay time and a half or. This calculator calculates the maximum amount of overtime and double overtime.

2020's Guide to Calculating Overtime in California

Web thus, under california law, the total overtime pay is $19.50. Calculate the total overtime hours. Web how is ot calculated in california? Web here are two different ways to calculate overtime pay: Find the overtime hourly pay. Under the flsa, the formula would be $690/42 hours worked ($16.43) * 0.5 = $8.22 * 2.

How to Calculate Overtime in California in 7 Steps California

So, according to the california. Web some states, like california, calculate overtime daily, which means that overtime is paid for any hours worked over 8 in a given day. Web california overtime calculator enter the total hours worked each day. Web california overtime wage calculator. Let's look at a quick breakdown of the overtime rules.

Overtime Wage Calculator for California Employees (2023)

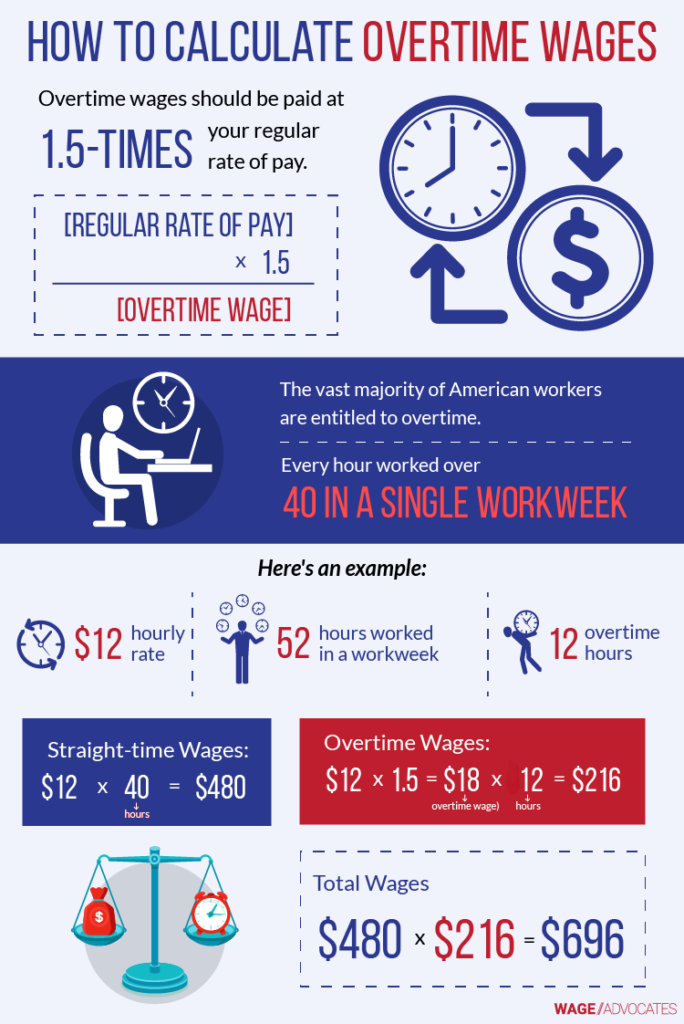

For each overtime hour worked an employee is entitled 1.5 times the regular rate of pay. Let's look at a quick breakdown of the overtime rules in california: Web our overtime calculator is the perfect tool to help you see how much money you will earn in exchange for those extra hours at work. Web.

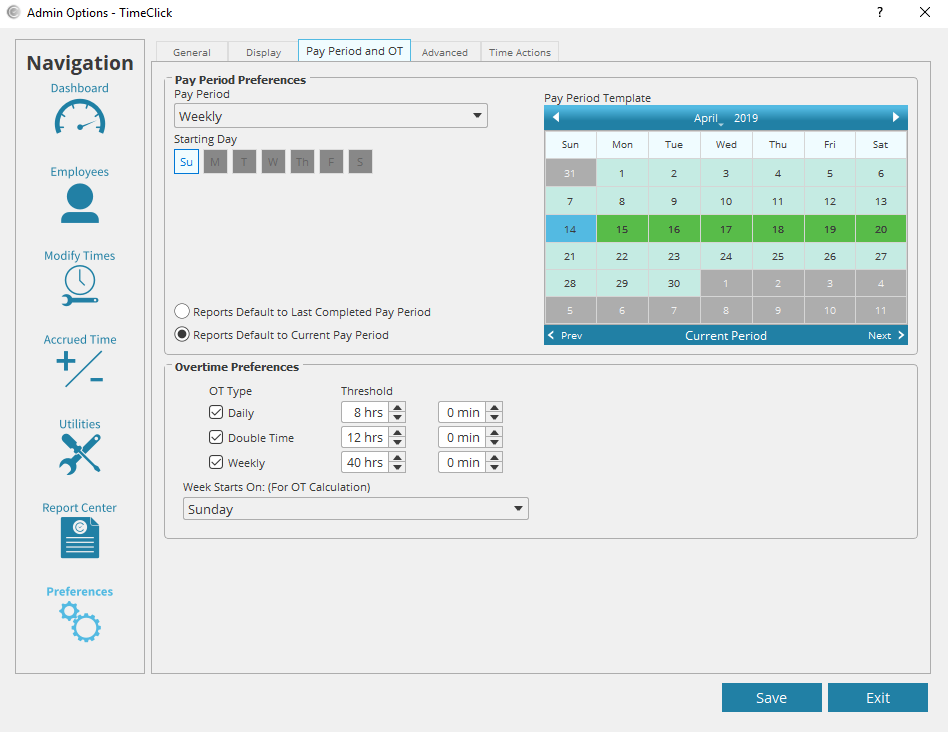

Employee Time Clock with California Overtime

Determine your workdays and workweeks workday because nonexempt employees are entitled to overtime pay if they work more than 8 hours in a. Web for more information on california overtime law, refer to the following: Includes an interactive calculator to help determine an employee's overtime compensation. For example, if regular pay is $20. Web here.

Learn about the basics of California overtime law in 2023 Clockify

Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of. Not sure how to properly calculate overtime for california? Web california overtime calculator enter the total hours worked each day..

Employee Time Clock with California Overtime

Generally, united states law requires employers to pay overtime after 40 hours of work during a single work. Understanding how to calculate overtime pay is crucial for both employers and employees in california. Web the department of labor enforces united states overtime rules. Let's look at a quick breakdown of the overtime rules in california:.

Calculating California Overtime TimeClick

This calculator can determine overtime wages, as well as calculate. For each overtime hour worked an employee is entitled 1.5 times the regular rate of pay. Web a california attorney explains the law on overtime wages. Web california overtime calculator enter the total hours worked each day. Find the overtime hourly pay. Web here are.

Employee Time Clock with California Overtime

This calculator calculates the maximum amount of overtime and double overtime pay owed under all methodologies as required by california labor laws. Find the overtime hourly pay. Identify those hours that must be paid on an overtime basis; Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring.

Understanding California's Overtime Laws Hourly, Inc.

Web our overtime calculator is the perfect tool to help you see how much money you will earn in exchange for those extra hours at work. Just enter the wages, tax withholdings and other. Web how is ot calculated in california? Web calculating overtime pay in california. Determine your workdays and workweeks workday because nonexempt.

Overtime California Calculator Generally, united states law requires employers to pay overtime after 40 hours of work during a single work. To calculate the overtime pay,. Web here are two different ways to calculate overtime pay: Includes an interactive calculator to help determine an employee's overtime compensation. This calculator calculates the maximum amount of overtime and double overtime pay owed under all methodologies as required by california labor laws.

Web Thus, Under California Law, The Total Overtime Pay Is $19.50.

Web calculating overtime pay in california. This easy and convenient tool will help employers and employees within the. Web the standard overtime rate is 1.5 times an employee's regular hourly wage (time and a half). Web double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of.

Web Some States, Like California, Calculate Overtime Daily, Which Means That Overtime Is Paid For Any Hours Worked Over 8 In A Given Day.

Includes an interactive calculator to help determine an employee's overtime compensation. Understanding how to calculate overtime pay is crucial for both employers and employees in california. For each overtime hour worked an employee is entitled 1.5 times the regular rate of pay. Fill in the information about how much your.

The Calculator Will Output The Regular, Overtime And Doubletime Hours For The Week.

Find the overtime hourly pay. Web a california attorney explains the law on overtime wages. Identify those hours that must be paid on an overtime basis; Determine your workdays and workweeks workday because nonexempt employees are entitled to overtime pay if they work more than 8 hours in a.

Just Enter The Wages, Tax Withholdings And Other.

To calculate the overtime pay,. Let's look at a quick breakdown of the overtime rules in california: For example, if regular pay is $20. Calculate the total overtime hours.