Overtime Pay California Calculator

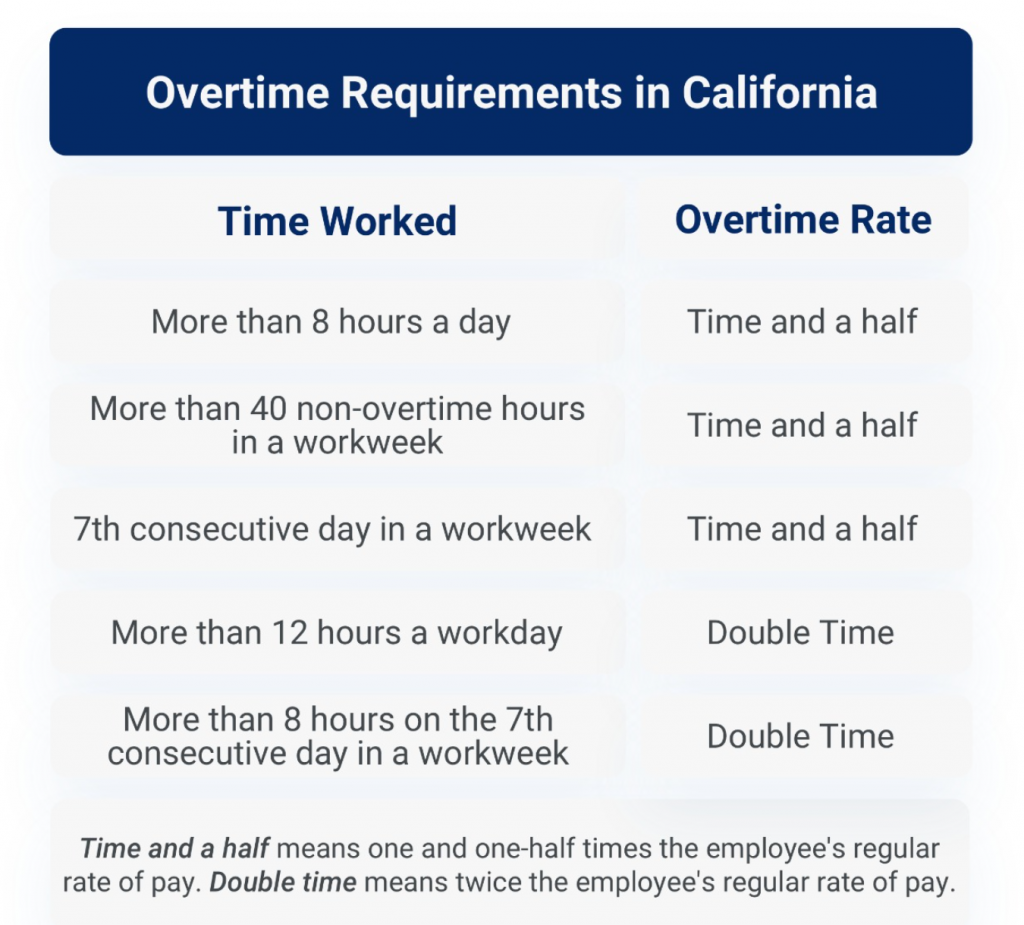

Overtime Pay California Calculator - Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. $600.00 × 52 = $31,200.00 overtime pay per year: (35 hours x $12) + (10 hours x $15) = $570 base pay. Web california employers must calculate both daily and weekly overtime hours for an employee. For example, if an employee.

Just enter the wages, tax withholdings and other. Web california overtime calculator (2024) note: Are you curious whether you're calculating overtime correctly for a california employee? $600.00 × 52 = $31,200.00 overtime pay per year: Most employers will pay time and a half or. Our overtime calculator will automatically find all other. Salary.com has been visited by 10k+ users in the past month

How to Calculate Overtime Pay 8 Steps (with Pictures) wikiHow

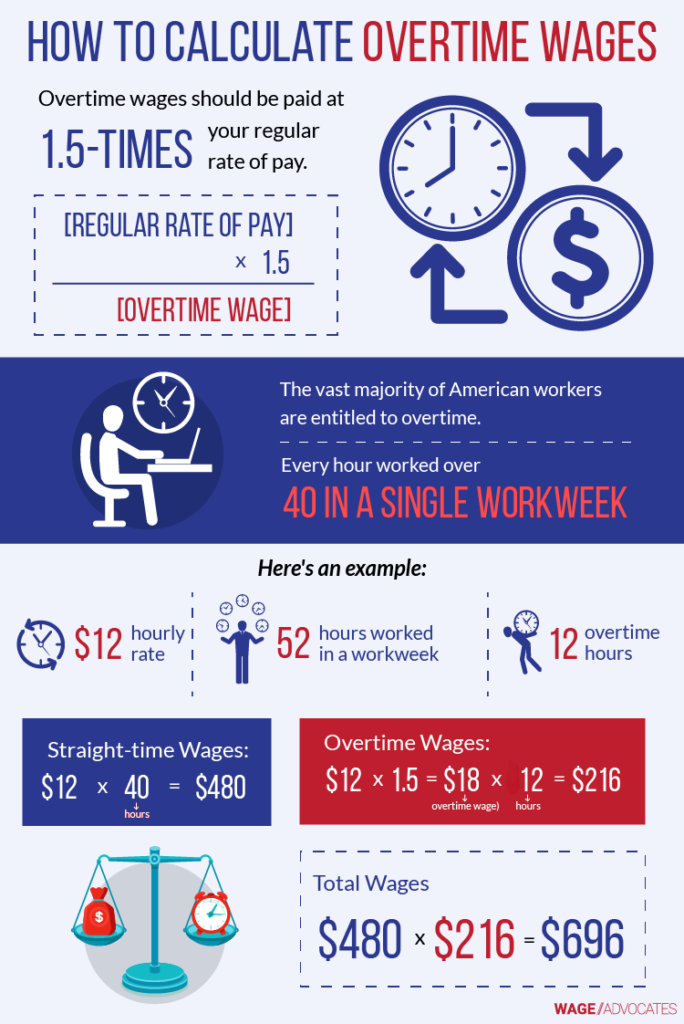

(35 hours x $12) + (10 hours x $15) = $570 base pay. $112.50 × 52 = $5,850.00 total pay per year: Most employers will pay time and a half or. Web some states, like california, calculate overtime daily, which means that overtime is paid for any hours worked over 8 in a given day..

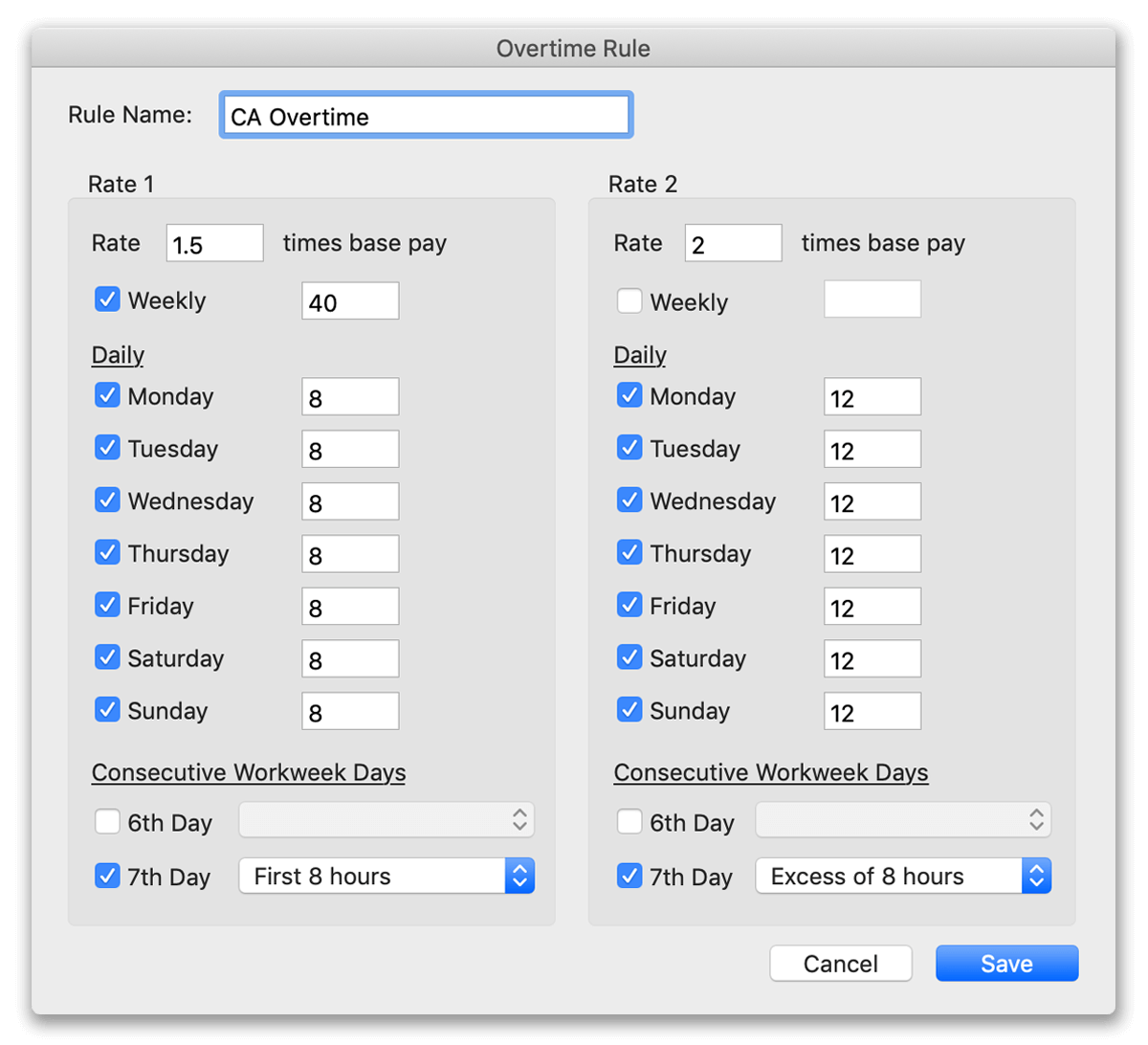

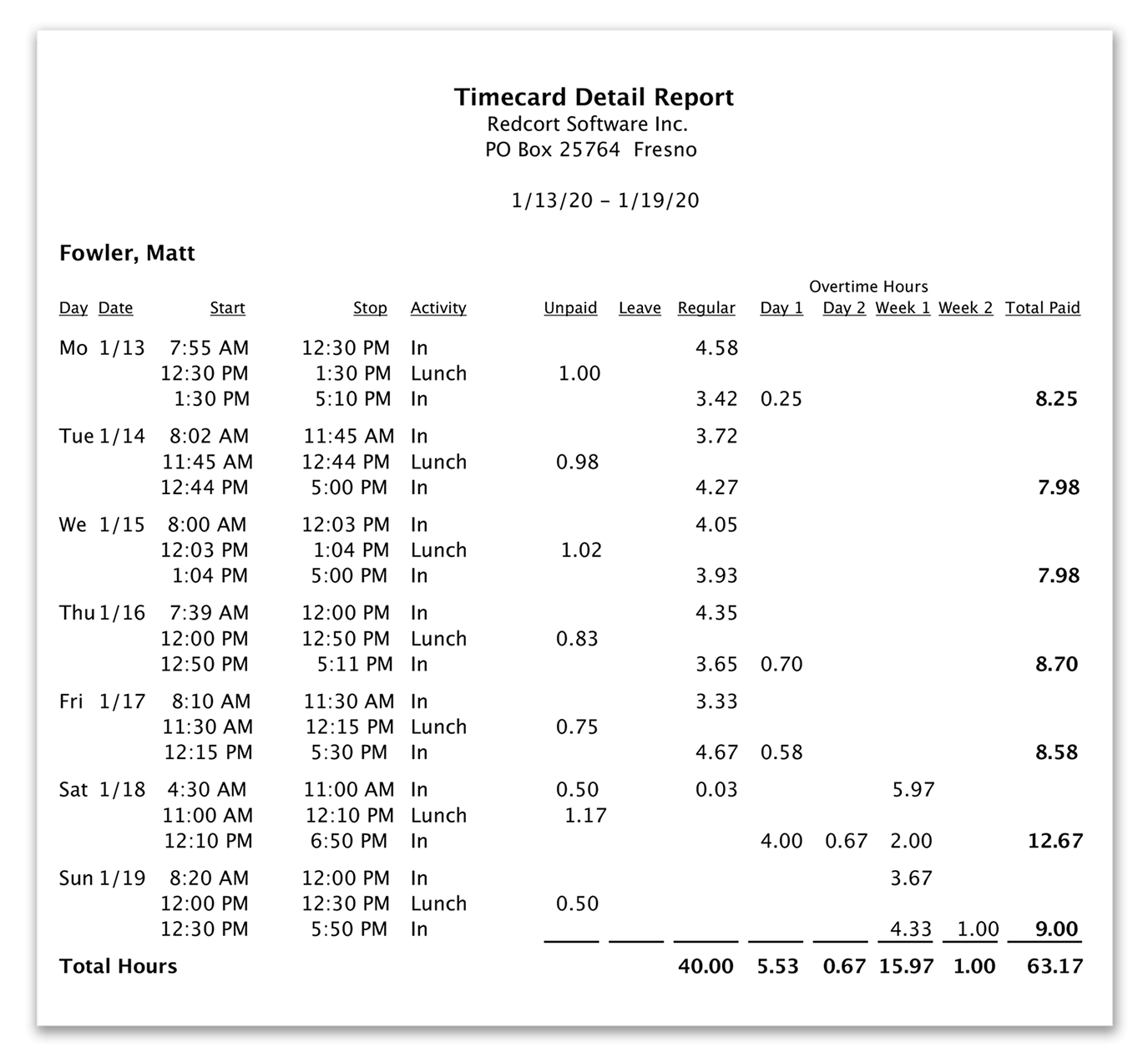

Employee Time Clock with California Overtime

Web some states, like california, calculate overtime daily, which means that overtime is paid for any hours worked over 8 in a given day. $600.00 × 52 = $31,200.00 overtime pay per year: Just enter the wages, tax withholdings and other. For example, if an employee. Web use adp’s california paycheck calculator to estimate net.

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

The calculator will output the regular, overtime and doubletime hours. Most employers will pay time and a half or. Web reviewed by komal rafay table of contents what constitutes overtime? For example, if an employee. Just enter the wages, tax withholdings and other. Web our california overtime calculator is designed to assist you in precisely.

Overtime Wage Calculator for California Employees (2023)

Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. Salary.com has been visited by 10k+ users in the past month Web reviewed by komal rafay table of contents what constitutes overtime? Web ( $20 + $25) / 2 =.

How to Calculate Overtime Pay 8 Steps (with Pictures) wikiHow

(35 hours x $12) + (10 hours x $15) = $570 base pay. Web regular pay per year: Our overtime calculator will automatically find all other. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. $31,200.00 + $5,850.00 =.

Employee Time Clock with California Overtime

The calculator will output the regular, overtime and doubletime hours. Web overtime wage calculator for california employees. Just enter the wages, tax withholdings and other. Web overtime california calculator california overtime calculator enter the total hours worked each day. Web this employee’s total pay due, including the overtime premium, for the workweek can be calculated.

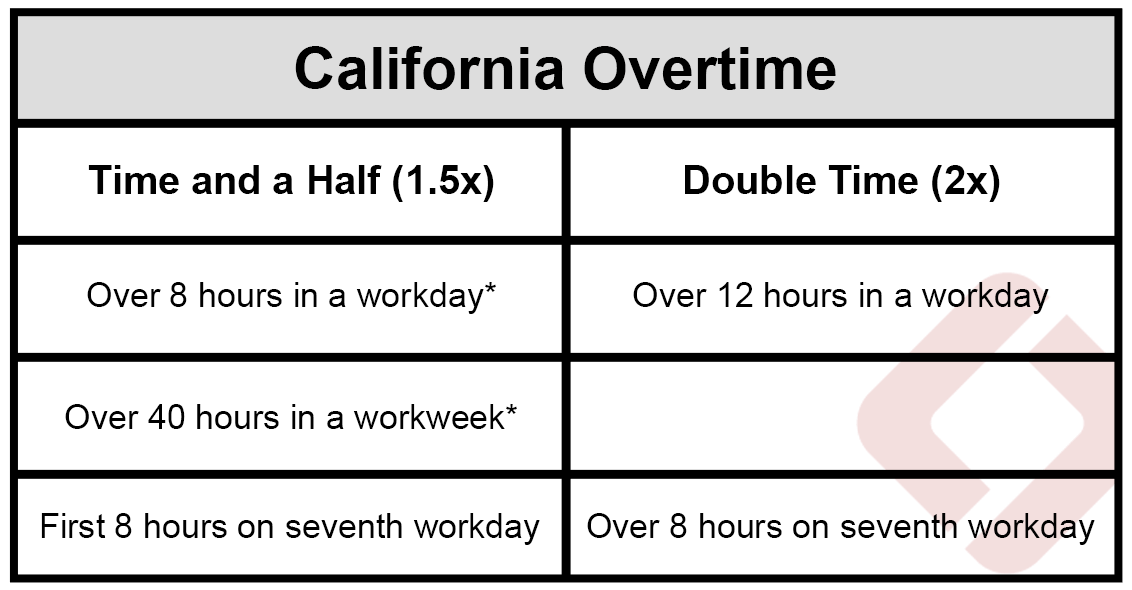

Learn about the basics of California overtime law in 2023 Clockify

Web determine the number of hours you worked overtime this month. Are you curious whether you're calculating overtime correctly for a california employee? Web the standard overtime rate is 1.5 times an employee's regular hourly wage (time and a half). Identify those hours that must be paid on an overtime basis; Web overtime wage calculator.

How to Calculate Overtime in California in 7 Steps California

Most employers will pay time and a half or. (35 hours x $12) + (10 hours x $15) = $570 base pay. This calculator can determine overtime wages, as well as calculate. $112.50 × 52 = $5,850.00 total pay per year: Let's say you worked 30 hours overtime. Web california overtime calculator (2024) note: $31,200.00.

Understanding Overtime Laws in California Legal Reader

Web use adp’s california paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web divide the total by the total number of hours worked during the pay period, by the total pay amount, to get the regular rate of pay. This calculator calculates the maximum amount of overtime and.

Employee Time Clock with California Overtime

$112.50 × 52 = $5,850.00 total pay per year: How to calculate your total pay with overtime? Web this easy and convenient tool will help employers and employees within the state of california to accurately calculate overtime hours worked. Salary.com has been visited by 10k+ users in the past month However, employers do not pay.

Overtime Pay California Calculator Here are some other related calculators. Web california employers must calculate both daily and weekly overtime hours for an employee. Web overtime wage calculator for california employees. Web this easy and convenient tool will help employers and employees within the state of california to accurately calculate overtime hours worked. For example, if an employee.

The Calculator Will Output The Regular, Overtime And Doubletime Hours.

$31,200.00 + $5,850.00 = $37,050.00 explanation of. Are you curious whether you're calculating overtime correctly for a california employee? This calculator can determine overtime wages, as well as calculate. $600.00 × 52 = $31,200.00 overtime pay per year:

Most Employers Will Pay Time And A Half Or.

Web california employers must calculate both daily and weekly overtime hours for an employee. However, employers do not pay overtime twice for the same hours. Web our california overtime calculator is designed to assist you in precisely determining your yearly earnings, factoring in both your standard and additional pay with. Web california overtime calculator (2024) note:

Web Overtime California Calculator California Overtime Calculator Enter The Total Hours Worked Each Day.

Web overtime wage calculator for california employees. How to calculate your total pay with overtime? Web determine the number of hours you worked overtime this month. Web use adp’s california paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

Web ( $20 + $25) / 2 = $22.5 For Salaried Employees, Regular Rates Are Calculated By Dividing The Annual Salary By 52 Weeks In A Year, And 40 Work Hours In A Week, For Example:

Identify those hours that must be paid on an overtime basis; $112.50 × 52 = $5,850.00 total pay per year: Our overtime calculator will automatically find all other. Web reviewed by komal rafay table of contents what constitutes overtime?