Owners Draw S Corp

Owners Draw S Corp - Llcs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of. This list includes the largest broad. Web if an owner takes a draw from the business account, it increases the business’s liabilities and decreases the owner’s equity. However, owners who do not oversee daily operations are classified only. Web example 1 :

In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. It's a way for them to pay themselves instead of taking a salary. However, owners who do not oversee daily operations are classified only. Web an owner’s draw is when a business owner takes funds out of their business for personal use. It found that many attorneys were violating the reasonable compensation. S generates $100,000 of taxable income in 2011, before considering a’s compensation. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly).

owner draw quickbooks scorp Anton Mintz

Web an owner’s draw is when a business owner takes funds out of their business for personal use. It is vital to note that an owner’s draw differs from a salary. Llcs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of. This list includes the largest.

owner draw quickbooks scorp Arlinda Lundberg

The distributions are subject only to regular income tax. One as a shareholder and another as an employee. Reduce your basis (ownership interest) in the company because they are. Web example 1 : Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web an owner's draw is an amount.

owner draw quickbooks scorp Anton Mintz

Web you are able to take an owner’s draw from your business if your business is part of: A is also s’s president and only employee. Reduce your basis (ownership interest) in the company because they are. I take it that you've already entered the withdrawal as an expense transaction. Llcs are popular because, similar.

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. Web an owner’s draw is when a business owner takes funds out of their business for personal use. Web example 1 : It.

owner draw quickbooks scorp Arlinda Lundberg

However, corporations might be able to take similar profits, such as distributions or dividends. It found that many attorneys were violating the reasonable compensation. Typically, corporations, like an s corp, can’t take owner’s withdrawals. Web owner’s draw s corp if you run your business as an s corp, you won’t be able to take an.

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

Web the owner of the s corporation is also allowed to take distributions of current profit. If a draws a $100,000 salary, s’s taxable income will be reduced to zero. In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. Web the two.

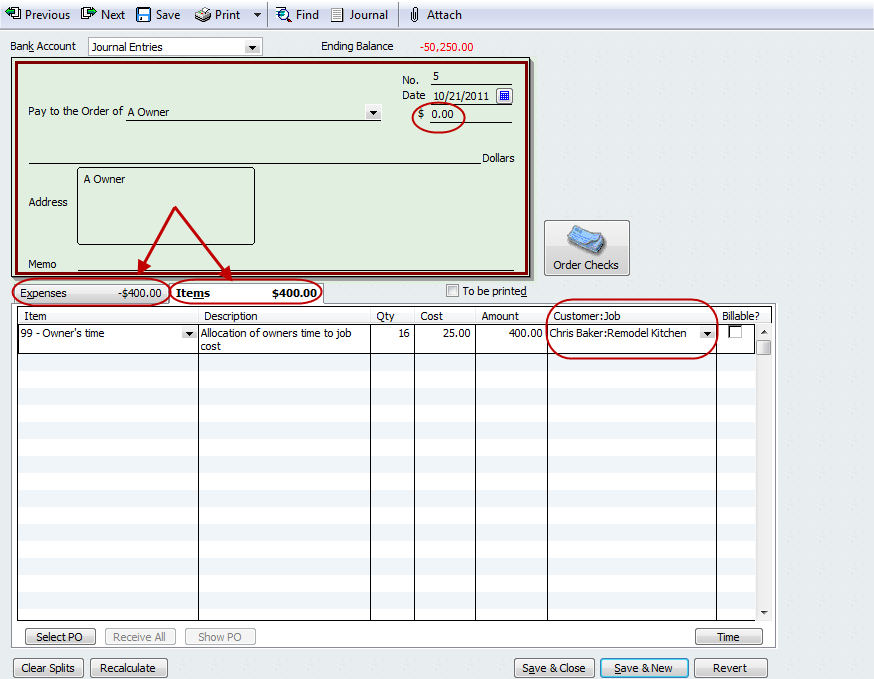

How to pay invoices using owner's draw?

The money is used for personal. The distributions are subject only to regular income tax. About five years ago, the irs created an audit project aimed at attorneys who were incorporated as sub s corporations. Web an owner’s draw refers to an owner taking funds out of the business for personal use. It found that.

Owners draw balances

Web an owner’s draw is when a business owner takes funds out of their business for personal use. Web s t er i ng b usiness s tructures and r egistration 38 az ee limited liability company (llc) a limited liability company (llc) is a flexible form of enterprise that blends elements of the partnership.

owner draw quickbooks scorp Arlinda Lundberg

The distributions are subject only to regular income tax. Most on the list are 100%. Learn more about this practice with paychex. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). Web s t er i ng b usiness.

owner's drawing account definition and Business Accounting

A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Web if an owner takes a draw from the business account, it increases the business’s liabilities and decreases the owner’s equity. S corp shareholder distributions are the earnings by s corporations that are paid out.

Owners Draw S Corp Most on the list are 100%. Web the owner of the s corporation is also allowed to take distributions of current profit. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their personal use. Learn more salary method vs. Llcs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of.

Llcs Are Popular Because, Similar To A Corporation, Owners Have Limited Personal Liability For The Debts And Actions Of.

A owns 100% of the stock of s corp., an s corporation. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). For sole proprietors, an owner’s draw is the only option for payment. Patty could withdraw profits from her business or take out funds that she previously contributed to her company.

I Take It That You've Already Entered The Withdrawal As An Expense Transaction.

Inactivate the compensation of officers account if necessary. Web owner’s draw s corp if you run your business as an s corp, you won’t be able to take an owner’s draw like you can with the other business structures we’ve discussed. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Web example 1 :

Web An Owner's Draw Is An Amount Of Money Taken Out From A Sole Proprietorship, Partnership, Limited Liability Company (Llc), Or S Corporation By The Owner For Their Personal Use.

In this post, we’ll look at a few different ways small business owners pay themselves, and which method is right for you. Most on the list are 100%. Consider your profits, business structure, and business growth when deciding how to pay yourself as a business owner. It's a way for them to pay themselves instead of taking a salary.

This List Includes The Largest Broad.

The distributions are subject only to regular income tax. Are usually either for estimated taxes, due to a specific event, or from business growth. Web the owner of the s corporation is also allowed to take distributions of current profit. Reduce your basis (ownership interest) in the company because they are.