P Tax Calculation

P Tax Calculation - This calculation allows a business to determine whether a distribution paid to shareholders would be treated as a taxable dividend, a nontaxable return of capital, or. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local. Web profession tax is a direct tax which is levied on persons earning an income by way of either practising a profession, employment, calling or trade. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. What is my tax rate?

Web calculation of taxable interest on p.f. Apr 3rd, 2023 | 10 min read contents [ show] the central board of direct taxes (cbdt) issued a notification on. In this video, i have shown you how you can calculate professional tax in an. As a result, the form of payment may differ from one state to the. Simply enter your taxable income, filing status and the state you. 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1. This calculation allows a business to determine whether a distribution paid to shareholders would be treated as a taxable dividend, a nontaxable return of capital, or.

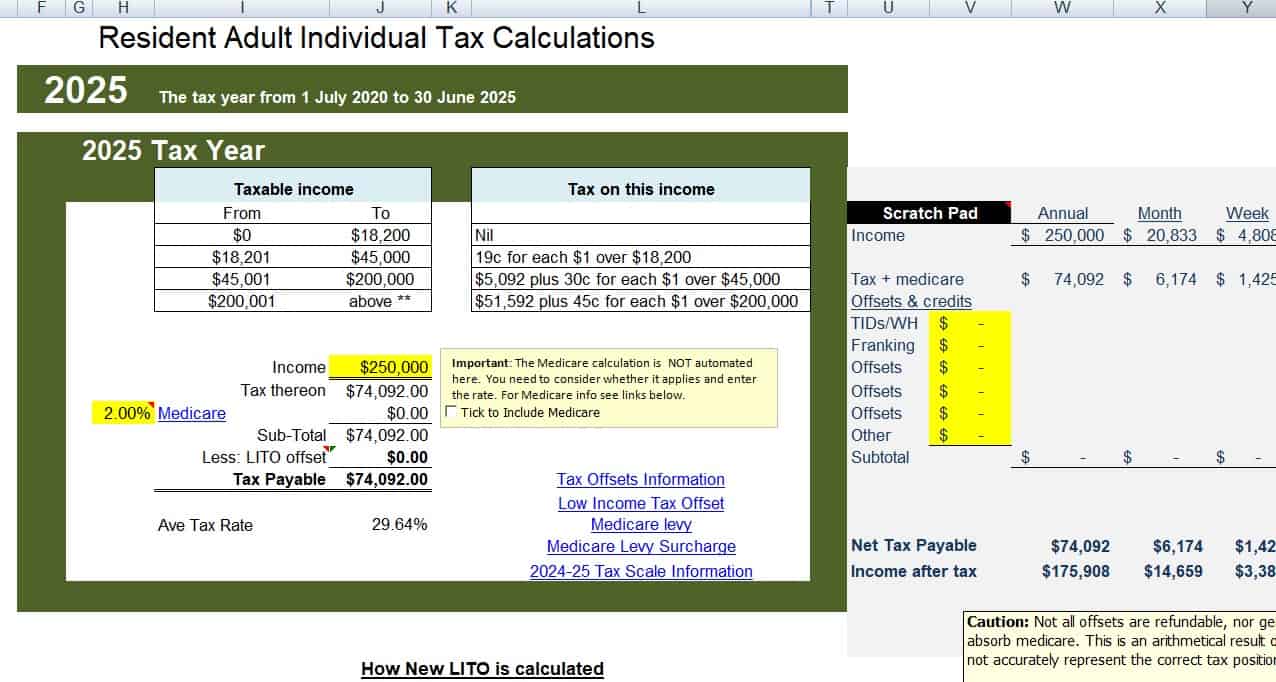

Tax Calculator atotaxrates.info

Use our united states salary tax calculator to determine how much tax will be paid on your. It is a tax levied by the state. Web professional tax is a direct tax that is deducted from your gross salary by your employer. Web calculation of taxable interest on p.f. Web earnings & profits (e&p) is.

Federal Tax Calculator 2021 Tax Withholding Estimator 2021

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Answer questions to learn about your tax situation & refund estimate. Web here’s what it means for you. Web professional tax is a direct tax that is.

2023 Tax Calculator Excel Printable Forms Free Online

Profession tax, directorate of commercial taxes,government of west bengal. Web if your 2024 earnings are similar to 2023, you’ll want your federal paycheck withholdings at roughly last year’s effective tax rate, loyd said. You are visitor # 27870440 since 24/03/16. Web earnings & profits (e&p) is the measure of a corporation’s economic ability to pay.

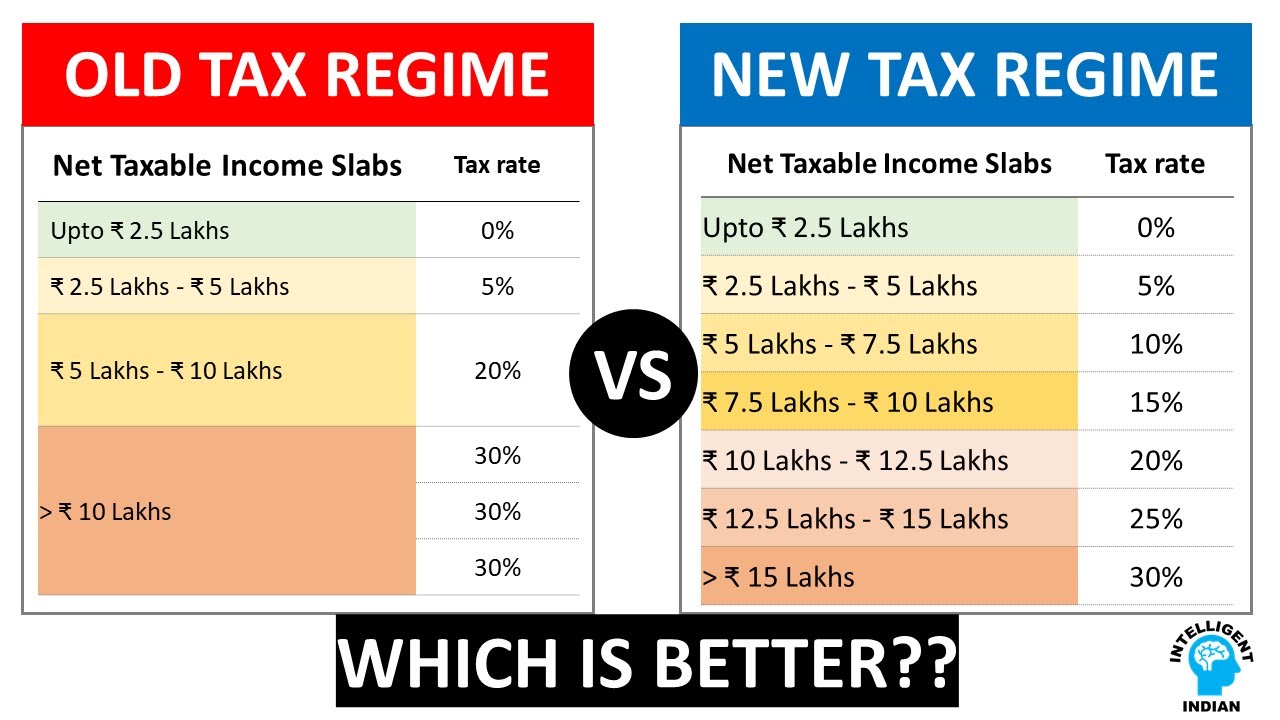

How To Calculate Tax FY 202021 EXAMPLES New Tax

1 min read 25 may 2021 it is. Web calculate your potential tax liability — or refund — with our free income tax calculator. Plug in your expected income, deductions and credits, and the calculator. Web earnings & profits (e&p) is the measure of a corporation’s economic ability to pay dividends to its shareholders. You.

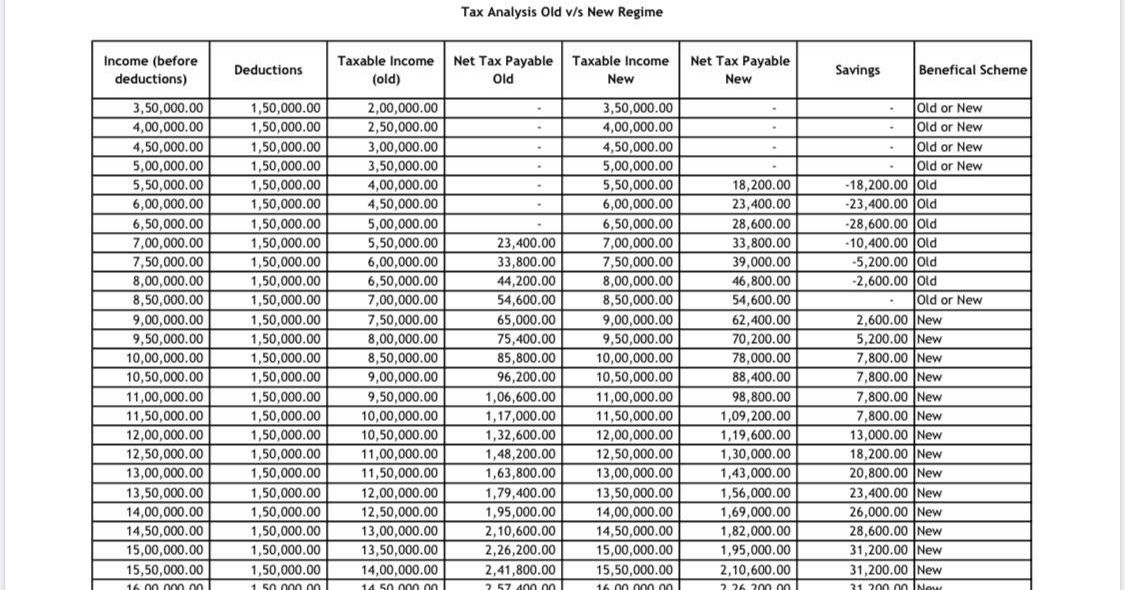

Tax Calculation for FY 202324 [Examples] FinCalC Blog

Answer questions to learn about your tax situation & refund estimate. 1 min read 25 may 2021 it is. Web profession tax is a direct tax which is levied on persons earning an income by way of either practising a profession, employment, calling or trade. Thomsonreuters.com has been visited by 10k+ users in the past.

Tax Calculator Center on Budget and Policy Priorities

Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local. Web the tax calculator shows that somebody earning £35,000 a year would pay £945 more in taxes under tory tax plans, while somebody earning £70,000 would pay £2,488 more. The annual penalty is calculated as follows: 0 1 2 3 4.

tax calculator Excel sheet for salaried individuals YouTube

Web how it works use this tool to: Use our united states salary tax calculator to determine how much tax will be paid on your. As a result, the form of payment may differ from one state to the. Web here’s what it means for you. Web you can use our income tax calculator to.

How to Create an Tax Calculator in Excel YouTube

Web 8 rows enter your tax year filing status and taxable income to calculate your estimated tax rate: Mar 14th, 2023 | 9 min read contents [ show] if you are a salaried professional, you will notice a particular deduction on your payslip known as professional. Web here’s what it means for you. Hello friends,.

Tax Calculator New Regime 2023 24 Excel Printable Forms Free

Web profession tax is a direct tax which is levied on persons earning an income by way of either practising a profession, employment, calling or trade. Use our united states salary tax calculator to determine how much tax will be paid on your. The annual penalty is calculated as follows: Web calculate your potential tax.

P.TAX Professional Tax Calculation formula in Excel PTAX(STATE,SALARY

Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. Answer questions to learn about your tax situation & refund estimate. Thomsonreuters.com has been visited by 10k+ users in the past month © 2024 smartasset, all rights reserved. Web how is professional tax.

P Tax Calculation Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. Web how is professional tax calculated on salary? © 2024 smartasset, all rights reserved. Web if your 2024 earnings are similar to 2023, you’ll want your federal paycheck withholdings at roughly last year’s effective tax rate, loyd said. What is my tax rate?

It Is A Tax Levied By The State.

Mar 14th, 2023 | 9 min read contents [ show] if you are a salaried professional, you will notice a particular deduction on your payslip known as professional. Expense estimatoreasy and accuratemaximum refund guaranteed Web if your 2024 earnings are similar to 2023, you’ll want your federal paycheck withholdings at roughly last year’s effective tax rate, loyd said. Web 8 rows enter your tax year filing status and taxable income to calculate your estimated tax rate:

Web Calculation Of Taxable Interest On P.f.

The annual penalty is calculated as follows: Web the tax calculator shows that somebody earning £35,000 a year would pay £945 more in taxes under tory tax plans, while somebody earning £70,000 would pay £2,488 more. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Web how is professional tax calculated on salary?

0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1.

In this video, i have shown you how you can calculate professional tax in an. This calculation allows a business to determine whether a distribution paid to shareholders would be treated as a taxable dividend, a nontaxable return of capital, or. The house of representatives voted wednesday to approve a roughly $80 billion deal to expand the federal child tax credit. What is my tax rate?

Web Professional Tax Is A Direct Tax Levied By The State Rather Than The Federal Government.

Thomsonreuters.com has been visited by 10k+ users in the past month Web how it works use this tool to: Web profession tax is a direct tax which is levied on persons earning an income by way of either practising a profession, employment, calling or trade. Web profession tax rates, goa.

![Tax Calculation for FY 202324 [Examples] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video.webp)