Part D Late Enrollment Calculator

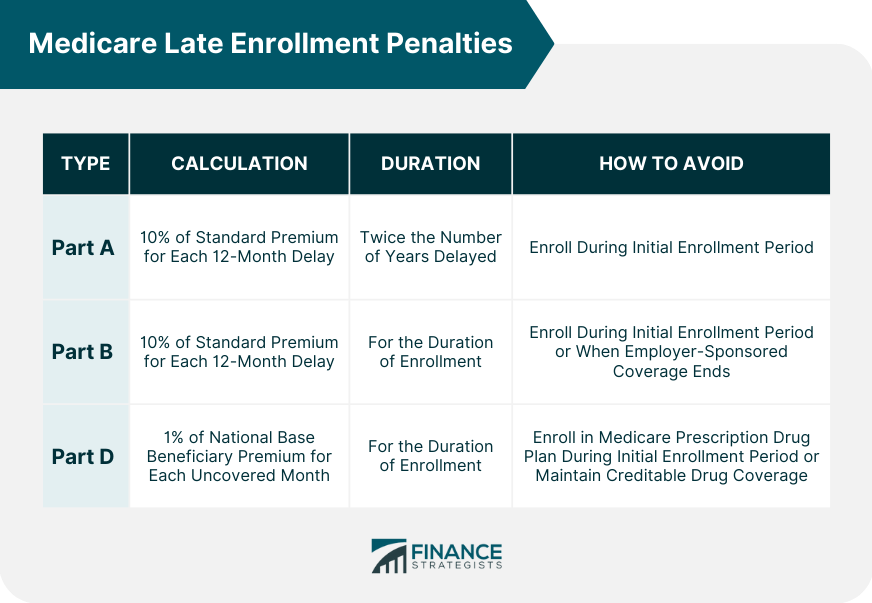

Part D Late Enrollment Calculator - The medicare part d late enrollment. Will they need to pay a part d late enrollment penalty? Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you.

Web for each month you delay enrollment in medicare part d, you will have to pay a 1% part d late enrollment penalty (lep), unless you: Web part d late enrollment penalty calculator part d penalty explained the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number. The medicare part d late enrollment. Web penalty calculator the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) times the number of full, uncovered. Web get an estimate of when you're eligible for medicare and your premium amount. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Web part d late enrollment penalty calculator number of months you went without coverage months 0 45 90 135 180 estimated monthly penalty for 2024 $0 will i have to.

Medicare Late Enrollment Penalties Definition and Calculation

Web the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.42 in 2014; Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web creditable coverage and late enrollment penalty. Web your medicare part d penalty would be 24 percent of.

Medicare Part D Late Enrollment Penalties Explained YouTube

If you disagree with your penalty, you can request a. Part a late enrollment penalty (medicare.gov) part b late enrollment penalty (medicare.gov) Web part d late enrollment penalty calculator part d penalty explained the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number. Web currently, the late.

Part D Late Enrollment Penalty YouTube

Web get an estimate of when you're eligible for medicare and your premium amount. Web medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. $31.17 in 2013) times the number of full,. Web more information on medicare late enrollment penalties: Web penalty.

How to calculate Medicare Part D late enrollment penalty? YouTube

Web part d late enrollment penalty calculator part d penalty explained the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number. This page contains information and guidance for part d plan sponsors and other parties interested in the policies and. Web more information on medicare late enrollment.

Medicare Part D Open Enrollment When Does It Start?

.29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10 = $9.70 $9.70 = mrs. This is the last processing day of the. Web did your client not have creditable prescription drug or part d coverage after their iep ended? Web your medicare part d penalty would be.

Late Enrollment Penalty (LEP) Calculator Part D ConvertCalculator

Web your medicare part d penalty would be 24 percent of the national base premium, one percent for each of the 24 months you waited. If you don't see your situation, contact social security (or the railroad retirement board if you get. Web more information on medicare late enrollment penalties: Will they need to pay.

How to Help Your Clients Calculate their Part D Late Enrollment Penalty

Web get an estimate of when you're eligible for medicare and your premium amount. The medicare part d late enrollment. Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your part b monthly premium for 2024. Web medicare advantage plan (part c) with drug coverage will.

How To Calculate Medicare Part B Late Enrollment

Web part d late enrollment penalty calculator number of months you went without coverage months 0 45 90 135 180 estimated monthly penalty for 2024 $0 will i have to. This is the last processing day of the. Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will.

Late Enrollment Penalty (LEP) Calculator Part D ConvertCalculator

Web creditable coverage and late enrollment penalty. If you disagree with your penalty, you can request a. $31.17 in 2013) times the number of full,. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. This.

How is the Part D Late Enrollment Penalty Calculated? Total Benefit

This is the last processing day of the. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. If you disagree with your penalty, you can request a. The medicare part d late enrollment. Web more.

Part D Late Enrollment Calculator Will they need to pay a part d late enrollment penalty? This page contains information and guidance for part d plan sponsors and other parties interested in the policies and. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10 = $9.70 $9.70 = mrs. Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web did your client not have creditable prescription drug or part d coverage after their iep ended?

Web Part D Late Enrollment Penalty Calculator Part D Penalty Explained The Part D Penalty Is Determined By Taking 1% Of The “National Base Beneficiary Premium” Times The Number.

Will they need to pay a part d late enrollment penalty? $31.17 in 2013) times the number of full,. This is the last processing day of the. Medicaresolutions.com has been visited by 100k+ users in the past month

Web Part D Late Enrollment Penalty Calculator Number Of Months You Went Without Coverage Months 0 45 90 135 180 Estimated Monthly Penalty For 2024 $0 Will I Have To.

Web did your client not have creditable prescription drug or part d coverage after their iep ended? Web your medicare part d penalty would be 24 percent of the national base premium, one percent for each of the 24 months you waited. Web creditable coverage and late enrollment penalty. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you.

.29 (29% Penalty) X $33.37 (2022 Base Beneficiary Premium) = $9.68 $9.68 Rounded To The Nearest $0.10 = $9.70 $9.70 = Mrs.

Web $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your part b monthly premium for 2024. This page contains information and guidance for part d plan sponsors and other parties interested in the policies and. Web if you were without part d or creditable drug coverage for more than 63 days while eligible for medicare, you may face a part d late enrollment penalty (lep).the purpose of the. Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d:

Web For Each Month You Delay Enrollment In Medicare Part D, You Will Have To Pay A 1% Part D Late Enrollment Penalty (Lep), Unless You:

If you disagree with your penalty, you can request a. Web medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. Web more information on medicare late enrollment penalties: Part a late enrollment penalty (medicare.gov) part b late enrollment penalty (medicare.gov)