Part D Late Enrollment Penalty Calculator

Part D Late Enrollment Penalty Calculator - Web learn how to calculate the medicare part d late enrollment penalty, an additional cost on top of your monthly premium for not having creditable drug coverage. Even if you’re healthy at age 65, it’s usually safer financially to make. The penalty is always rounded up to the. Web medicare drug plan (part d) or. Web learn how to avoid late enrollment penalties for part a, b and d when you sign up for medicare.

Web how do you calculate your premium penalty? Medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Web an overview of a late enrollment penalty (lep) assessed when a medicare beneficiary had a continuous period of 63 days or more at any time after the end of the individual's part. $0 copay for primary care$0 monthly premiumfree benefits guide Part a late enrollment penalty (medicare.gov) part b late enrollment penalty (medicare.gov) part d late.

How do I calculate my Medicare Part D LateEnrollment Penalty?

Web learn how to calculate the medicare part d late enrollment penalty, an additional cost on top of your monthly premium for not having creditable drug coverage. Web learn how to avoid late enrollment penalties for part a, b and d when you sign up for medicare. The late enrollment penalty is calculated by multiplying.

How to calculate Medicare Part D late enrollment penalty? YouTube

Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having.

Part D Late Enrollment Penalty YouTube

Web if you went 29 months without creditable coverage, your penalty would be $10.10. Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other. Web the part d penalty is determined by taking 1% of the.

How To Calculate The Medicare Part D Penalty

The late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) times the number of full,. Web the average total monthly premium for part d is projected to be about $55.50 in 2024. Web if you went 29 months without creditable coverage, your penalty would be $10.10. $0.

Medicare Part D Late Enrollment Penalties Explained YouTube

Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other. Web if you went 29 months without creditable coverage, your penalty would be $10.10. Web part d late enrollment penalty calculator number of months you went.

Late Enrollment Penalty (LEP) Calculator Part D ConvertCalculator

The late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) times the number of full,. Part a late enrollment penalty (medicare.gov) part b late enrollment penalty (medicare.gov) part d late. .29 (29% penalty) x $33.37 (2022 base beneficiary premium) = $9.68 $9.68 rounded to the nearest $0.10.

Late Enrollment Penalty (LEP) Calculator Part D ConvertCalculator

The late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) times the number of full,. Web learn how to avoid late enrollment penalties for part a, b and d when you sign up for medicare. $0 copay for primary care$0 monthly premiumfree benefits guide Web how do.

How To Calculate & Avoid Medicare Late Enrollment Penalties Legacy

Web get an estimate of when you're eligible for medicare and your premium amount. Web medicare calculates the penalty by multiplying 1% of the national base beneficiary premium ($33.37 in 2022) times the number of full, uncovered months you. The penalty is always rounded up to the. Web how is the medicare part d lep.

How is the Part D Late Enrollment Penalty Calculated? Total Benefit

The late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($32.74 in 2020) times the number of full,. Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other. Web an overview.

How to Help Your Clients Calculate their Part D Late Enrollment Penalty

$0 copay for primary care$0 monthly premiumfree benefits guide The penalty is always rounded up to the. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Web learn how to calculate the medicare part d.

Part D Late Enrollment Penalty Calculator Part a late enrollment penalty (medicare.gov) part b late enrollment penalty (medicare.gov) part d late. Web the penalty is 1% of the national base beneficiary premium ($34.70 in 2024) for every month you did not have part d or certain other types of drug coverage while eligible for. Web the average total monthly premium for part d is projected to be about $55.50 in 2024. Web medicare calculates the penalty by multiplying 1% of the national base beneficiary premium ($33.37 in 2022) times the number of full, uncovered months you. Let’s say you delayed enrollment in part d for seven months (and you do not meet any of the exceptions listed above).

Web How Is The Medicare Part D Lep Calculated?

29 x 0.3470 = $10.063; Web learn how to avoid late enrollment penalties for part a, b and d when you sign up for medicare. Web the penalty is 1% of the national base beneficiary premium ($34.70 in 2024) for every month you did not have part d or certain other types of drug coverage while eligible for. Web the medicare part d late enrollment penalty is 1% of that national base beneficiary premium for each full month that you didn’t have medicare part d or other.

Web Medicare Calculates The Penalty By Multiplying 1% Of The National Base Beneficiary Premium ($33.37 In 2022) Times The Number Of Full, Uncovered Months You.

Web if you went 29 months without creditable coverage, your penalty would be $10.10. Web how do you calculate your premium penalty? Prescription drug plansfind medicare plansenrollment options Web an overview of a late enrollment penalty (lep) assessed when a medicare beneficiary had a continuous period of 63 days or more at any time after the end of the individual's part.

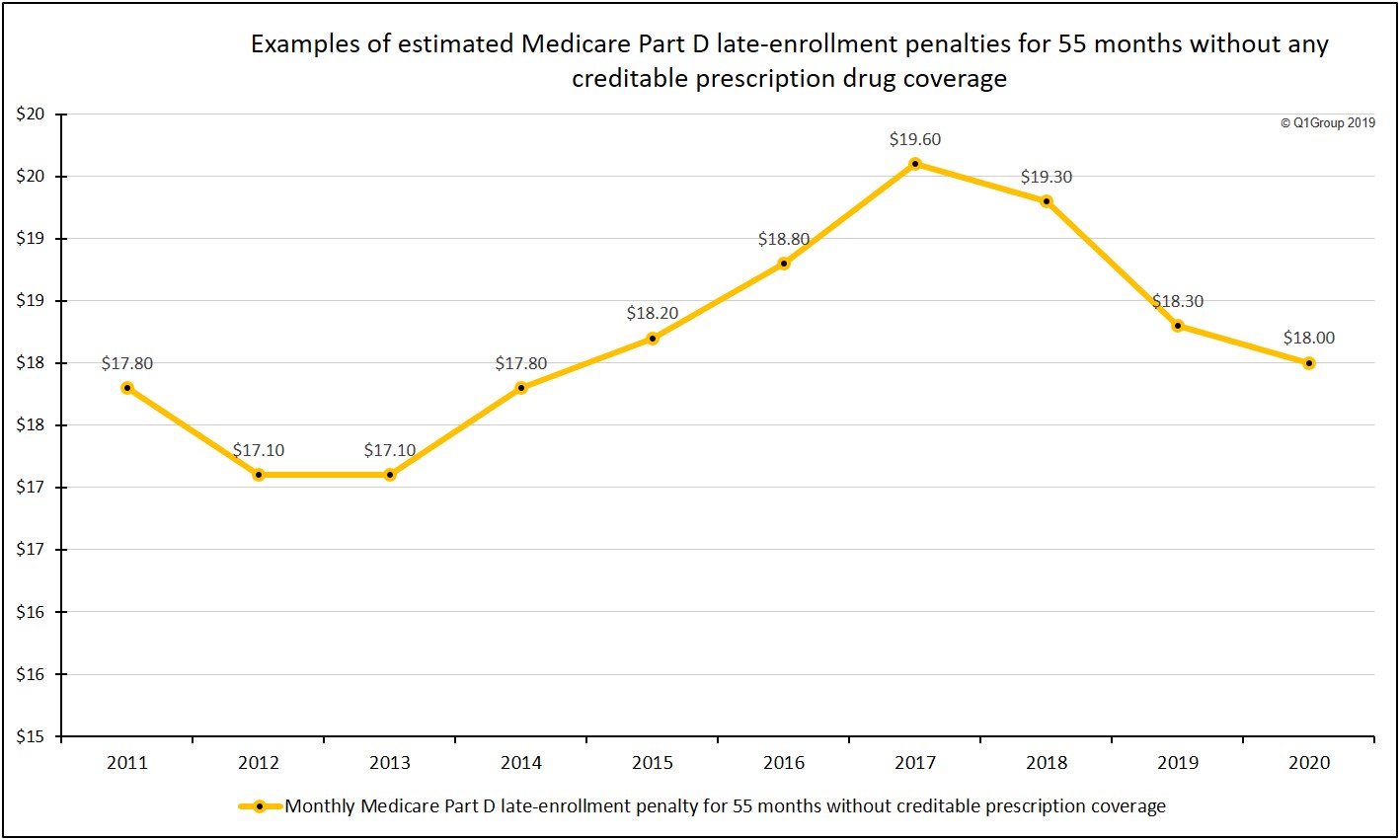

The Late Enrollment Penalty Is Calculated By Multiplying 1% Of The “National Base Beneficiary Premium” ($32.42 In 2014;.

Web more information on medicare late enrollment penalties: $0 copay for primary care$0 monthly premiumfree benefits guide The penalty is always rounded up to the. Web medicare drug plan (part d) or.

Web The Average Total Monthly Premium For Part D Is Projected To Be About $55.50 In 2024.

Let’s say you delayed enrollment in part d for seven months (and you do not meet any of the exceptions listed above). Web learn how to calculate the medicare part d late enrollment penalty, an additional cost on top of your monthly premium for not having creditable drug coverage. Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug.