Part D Penalty Calculator 2024

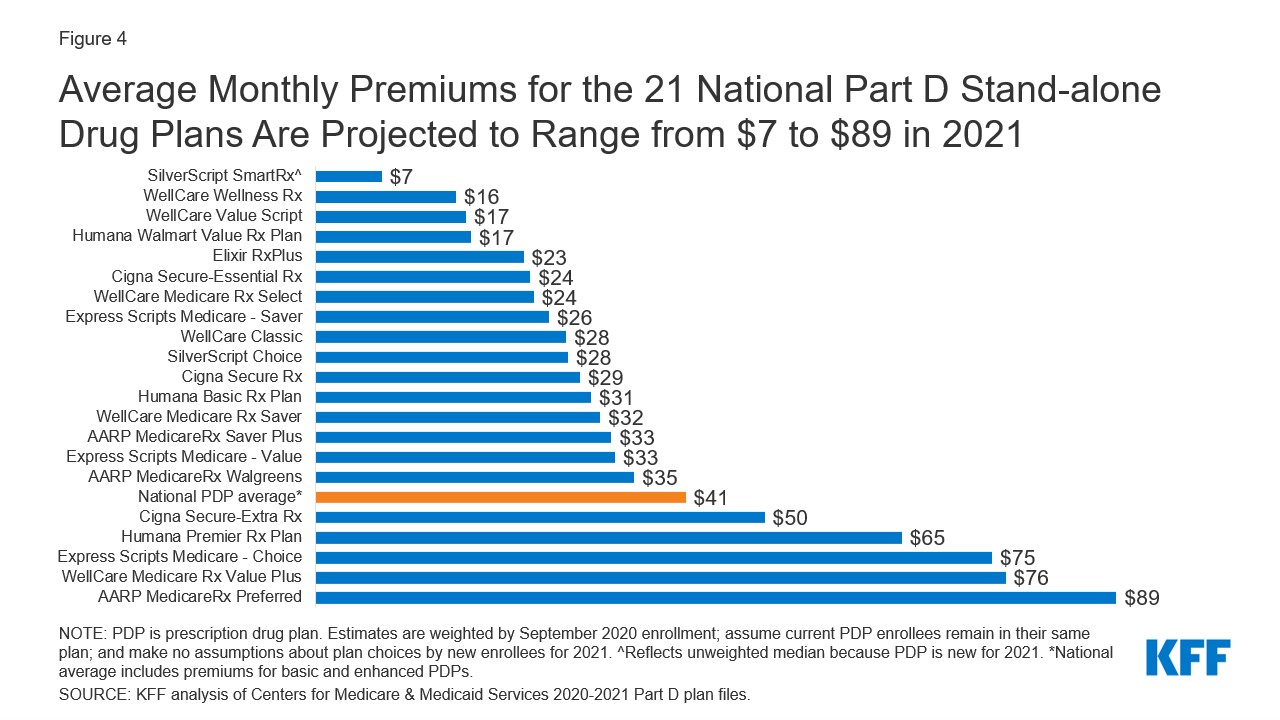

Part D Penalty Calculator 2024 - Web the average social security retirement benefit at age 65, though, is $1,504.98 based on the latest data from ssa. Less than $103,000 (<$97,000 in 2023) $0: Web the standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. Web find medicare plans in 3 easy steps we can help find the right medicare plans for you today table of contents: Web 2024 part d irmaa for individuals;

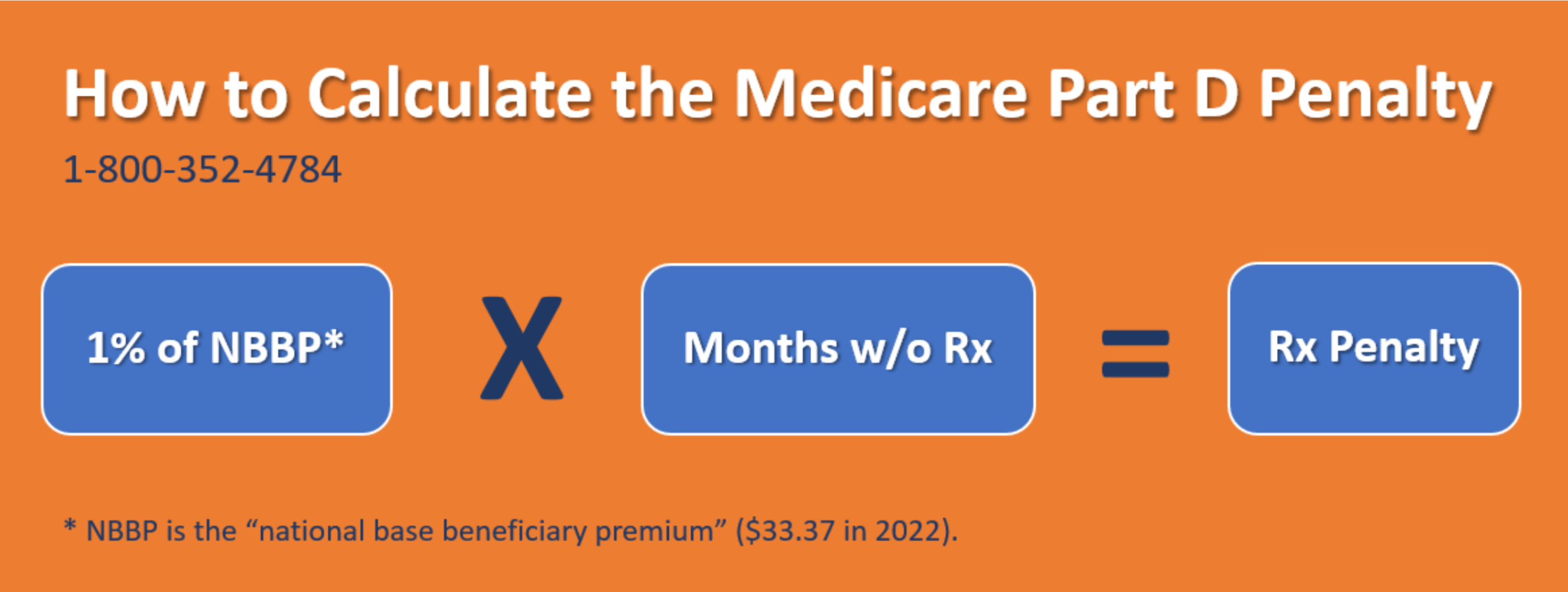

Prescription drug plansget a free quotefind medicare planstrusted companies In the same time frame, the share of income taxes paid. Web how part d works with other insurance. Web here’s how to calculate the penalty: The annual deductible for all. Web the standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. Web the national base beneficiary premium in 2024 is $34.70 a month.

Alternate text

Web currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you. Learn about how medicare part d (drug coverage) works with other coverage, like employer or union health coverage. Get rewarded for going green. Less than $103,000.

How to Avoid the Medicare Part D Late Enrollment Penalty GoodRx

Web furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. Web view more information here. Web for this final rule in 2024, where the applicable inflation factor is 1.03241, the existing penalty of $13,508 is multiplied by 1.03241 and rounded to the nearest dollar..

IRS Penalty Calculator 2024 IRS

If you have a higher income, you might pay more for your medicare. Web the projected average total part d beneficiary premium is projected to decrease by 1.8% in 2024, from $56.49 in 2023 to $55.50 in 2024. Web view more information here. The averages are different for the two. The annual penalty is calculated.

Medicare Drug Coverage Penalty How the Part D Penalty For Not

The averages are different for the two. Less than $103,000 (<$97,000 in 2023) $0: Web find medicare plans in 3 easy steps we can help find the right medicare plans for you today table of contents: If you don't see your situation, contact social. Federal mileage rates and luxury vehicle limits for 2024; Web 2024.

Part D Late Enrollment Penalty YouTube

Web october 10, 2022 10:29 it is not advised that you calculate the part d penalty for your customer, as a mathematical error could result in a complaint. Federal mileage rates and luxury vehicle limits for 2024; Less than $103,000 (<$97,000 in 2023) $0: If you have a higher income, you might pay more for.

Use our Medicare Part D Penalty Calculator to estimate your penalty

Web furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: If you go more than 63 days without creditable drug coverage you may have to pay.

Medicare Prescription Drug Coverage (Part D) Health for California

The averages are different for the two. Web find medicare plans in 3 easy steps we can help find the right medicare plans for you today table of contents: Web furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. Web here’s how to calculate.

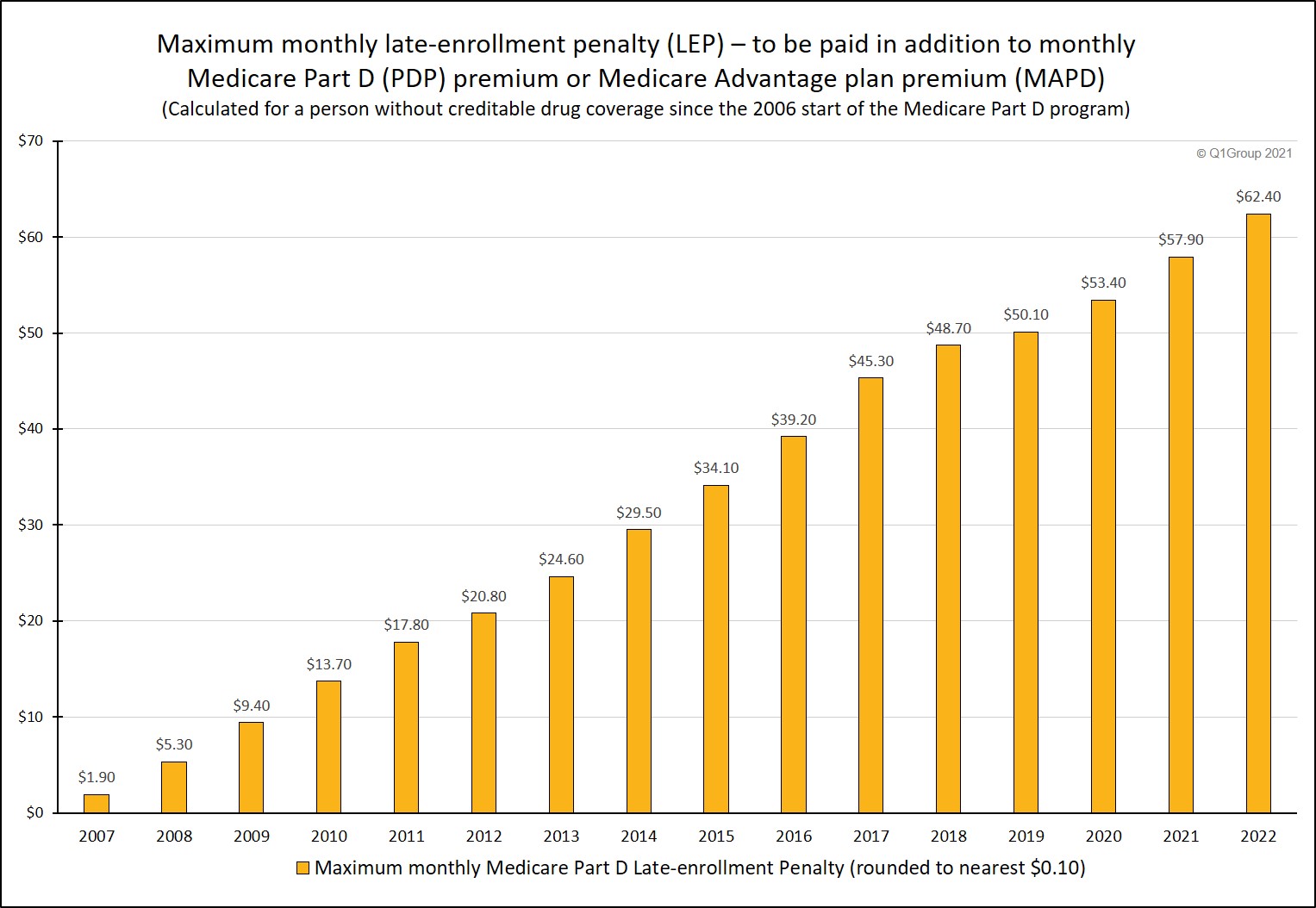

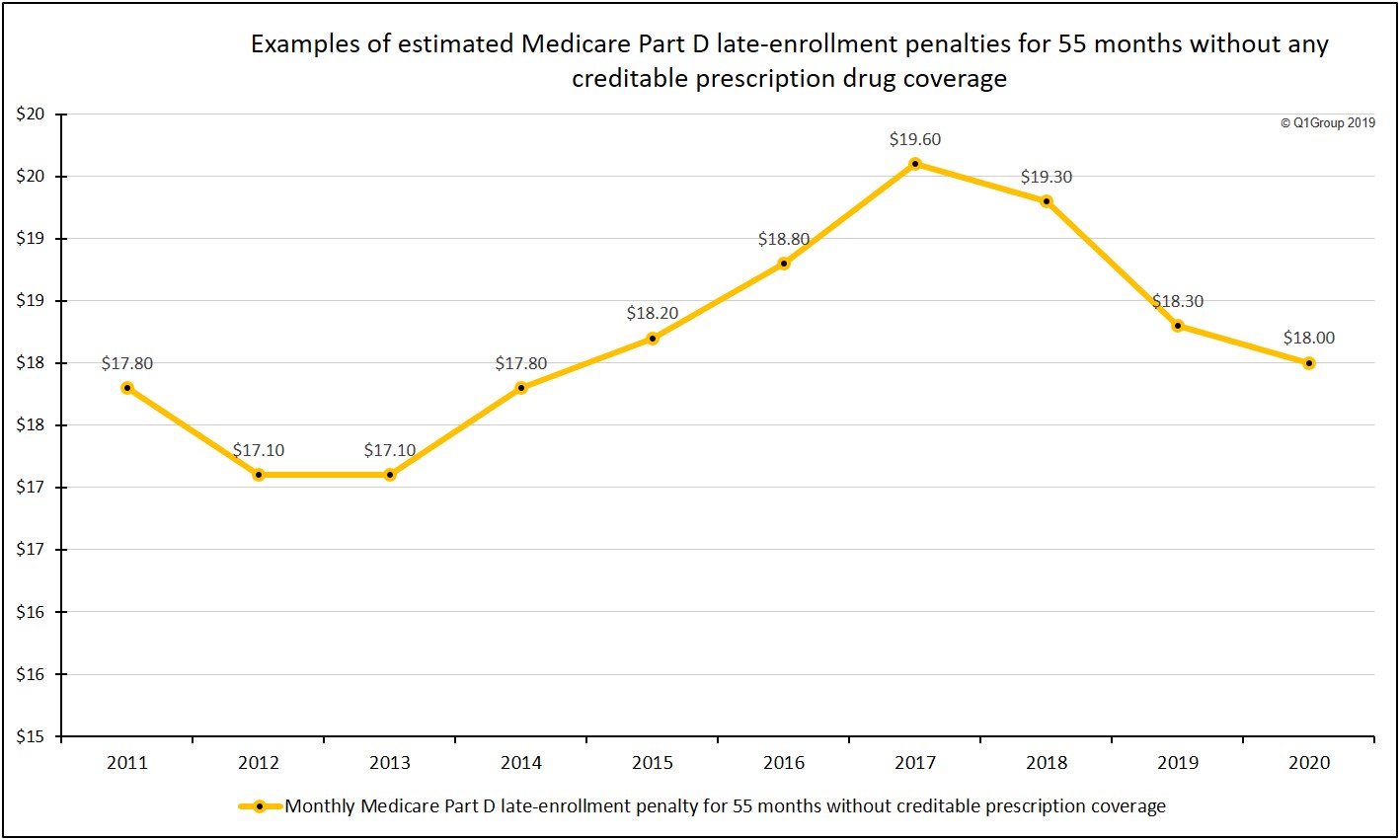

2022 Medicare Part D LateEnrollment Penalties will increase slightly

What is the medicare part d late enrollment. The averages are different for the two. Web the penalty is calculated in part based on the national base beneficiary premium for medicare part d: Web the average social security retirement benefit at age 65, though, is $1,504.98 based on the latest data from ssa. Web here’s.

How To Calculate The Medicare Part D Penalty

The annual deductible for all. If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Learn about how medicare part d (drug coverage) works with other coverage, like employer or union health coverage. Web how part d works with other insurance..

How To Calculate The Medicare Part D Penalty

Web the average social security retirement benefit at age 65, though, is $1,504.98 based on the latest data from ssa. If you go more than 63 days without creditable drug coverage you may have to pay a part d late. If you have a higher income, you might pay more for your medicare. Web furthermore,.

Part D Penalty Calculator 2024 Web 2024 part d irmaa for individuals; If you don't see your situation, contact social. Web october 10, 2022 10:29 it is not advised that you calculate the part d penalty for your customer, as a mathematical error could result in a complaint. What is the medicare part d late enrollment. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug.

.21 (Multiply 1% By The Number Of Months You Went Without Coverage Even Though You Were Eligible To Enroll) X $34.70 (2024 National Base.

Web the average social security retirement benefit at age 65, though, is $1,504.98 based on the latest data from ssa. Web the national base beneficiary premium in 2024 is $34.70 a month. Web estimate my medicare eligibility & premium get an estimate of when you're eligible for medicare and your premium amount. Web the part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug.

What Is The Medicare Part D Late Enrollment.

Web furthermore, the share of income taxes paid by the top 1% increased from 33.2% in 2001 to 42.3% in 2020. If you have a higher income, you might pay more for your medicare. In the same time frame, the share of income taxes paid. If you go more than 63 days without creditable drug coverage you may have to pay a part d late.

Web How Part D Works With Other Insurance.

Your monthly premium penalty would therefore be $2.43 ($34.70 x 0.07 = $2.43) per month, which you would. Web for this final rule in 2024, where the applicable inflation factor is 1.03241, the existing penalty of $13,508 is multiplied by 1.03241 and rounded to the nearest dollar. Prescription drug plansget a free quotefind medicare planstrusted companies Web estimated monthly penalty for 2024 $0 will i have to pay a part d penalty?

Web Find Medicare Plans In 3 Easy Steps We Can Help Find The Right Medicare Plans For You Today Table Of Contents:

If you decided 2023 was the year to tackle some home improvements, you could reap the reward of tax credits worth up to $3,200. Less than $103,000 (<$97,000 in 2023) $0: Web october 10, 2022 10:29 it is not advised that you calculate the part d penalty for your customer, as a mathematical error could result in a complaint. Web the projected average total part d beneficiary premium is projected to decrease by 1.8% in 2024, from $56.49 in 2023 to $55.50 in 2024.