Partial 1031 Exchange Boot Calculator

Partial 1031 Exchange Boot Calculator - 1031crowdfunding.com has been visited by 10k+ users in the past month Our intuitive calculator simplifies this process by accurately determining your 45. Web the following calculator is a useful tool to determine the capital gain tax. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web 1031 exchange date calculator when you’re embarking on a 1031 exchange, timing is critical.

Our intuitive calculator simplifies this process by accurately determining your 45. To pay no tax when executing a 1031 exchange, you must purchase at least. Web partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is boot taxed? Web by evaluating all options according to how they align with your objectives, the partial 1031 exchange calculator can determine whether any roadblocks need to clear. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web partial 1031 exchanges are when the taxpayer does not use all the net equity and debt retired in the new property. The portion of the exchange.

Partial 1031 Exchange [Explained AtoZ] PropertyCashin

In a partial exchange, the taxpayer decides to defer some capital gain taxes and pay potentially recognized gain on the cash. Web boot for §1031 purposes is cash or other property that you receive in a 1031 exchange, additionally to your replacement property, to get compensated for the. Web they simply become “partial” 1031 exchanges.

1031 Exchange Boot Guide to Mortgage Boots 1031 Crowdfunding

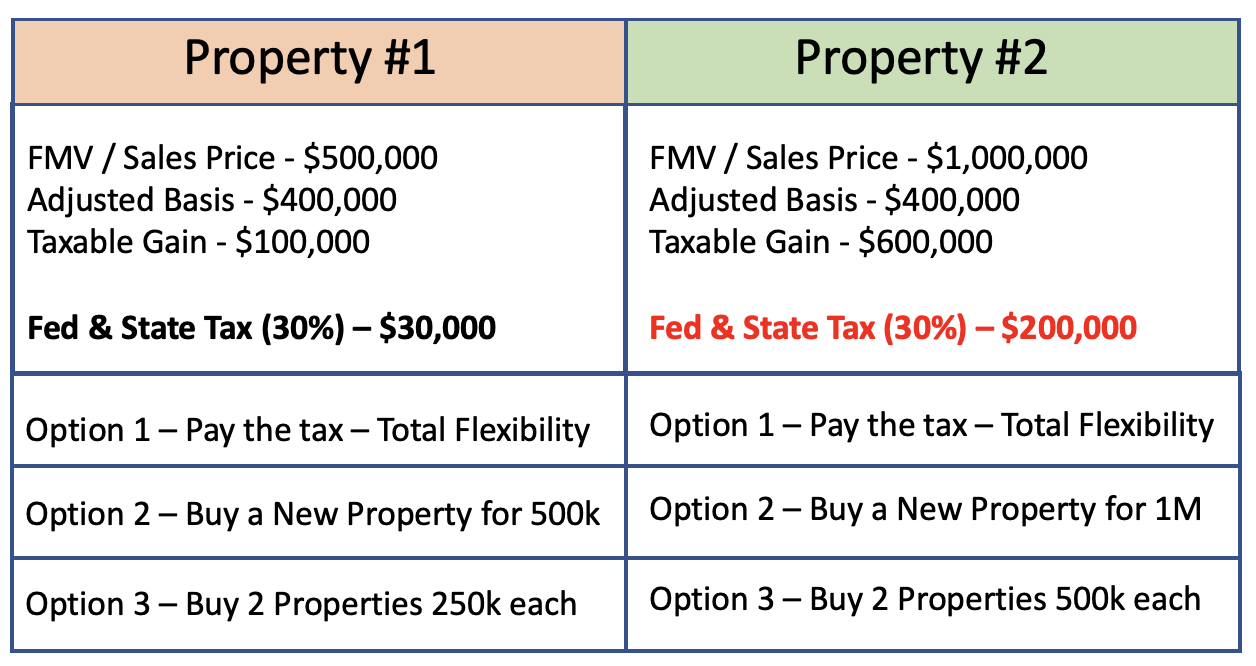

Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). Web what is a partial 1031 exchange? Web you may decide it makes more business sense to own a $900,000 replacement property free and clear and pay taxes on the $100,000.

1031 Exchange When Selling a Business

This tax strategy allows you to exchange a portion of your sales proceeds. Web you can do a partial 1031 exchange, which is also known as a split exchange. To pay no tax when executing a 1031 exchange, you must purchase at least. Cash received (equity boot) or debt not. Web calculating boot can be.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

In a partial exchange, the taxpayer decides to defer some capital gain taxes and pay potentially recognized gain on the cash. The portion of the exchange. This tax strategy allows you to exchange a portion of your sales proceeds. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Web by evaluating all options according to how they align with your objectives, the partial 1031 exchange calculator can determine whether any roadblocks need to clear. Click here to open tax calculator. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is.

Help Create Wealth With a Partial 1031 Exchange — Lifepoint Financial

Web boot for §1031 purposes is cash or other property that you receive in a 1031 exchange, additionally to your replacement property, to get compensated for the. Cash received (equity boot) or debt not. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus.

How to Complete a Partial 1031 Exchange The 1031 Investor

Web partial 1031 exchanges are when the taxpayer does not use all the net equity and debt retired in the new property. This tax strategy allows you to exchange a portion of your sales proceeds. Web boot for §1031 purposes is cash or other property that you receive in a 1031 exchange, additionally to your.

Partial 1031 Exchange Complete Guide (2022)

Web what is a partial 1031 exchange? Web partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is boot taxed? This tax strategy allows you to exchange a portion of your sales proceeds. In a partial exchange, the taxpayer decides to defer some capital gain taxes and pay potentially recognized gain.

How To Do A 1031 Exchange Like A Pro Free Guide

| how to avoid boot | partial 1031 exchange boot faqs. 1031crowdfunding.com has been visited by 10k+ users in the past month Web they simply become “partial” 1031 exchanges where the taxpayer has a partially tax deferred transaction rather than deferring all their taxes. Web you may decide it makes more business sense to own.

When and How to use the 1031 Exchange Mark J. Kohler

Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). | how to avoid boot | partial 1031 exchange boot faqs. Web what is a partial 1031 exchange? Web calculating boot can be complex, but our partial 1031 exchange boot calculator.

Partial 1031 Exchange Boot Calculator Web you may decide it makes more business sense to own a $900,000 replacement property free and clear and pay taxes on the $100,000 of the remaining. Web what is a partial 1031 exchange? Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web boot for §1031 purposes is cash or other property that you receive in a 1031 exchange, additionally to your replacement property, to get compensated for the. Web learn about replacement property rules and how much property value to acquire in order to successfully defer capital gains taxes.

Web Calculating Boot Can Be Complex, But Our Partial 1031 Exchange Boot Calculator Simplifies This Task By Helping Determine The Amount Of Boot And The Associated Tax Rate.

Web the following calculator is a useful tool to determine the capital gain tax. Meet our teamover 20,000 transactionsover 30 years experiencesubmit a message Web partial 1031 exchange boot calculator | partial 1031 exchange boot examples | how is boot taxed? Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.

Web Realty Exchange Corporation Has Created This Simple Capital Gains Calculator And Analysis Form To Estimate The Tax Impact If A Property Is Sold And Not Exchanged, And To.

1031crowdfunding.com has been visited by 10k+ users in the past month Cash received (equity boot) or debt not. To pay no tax when executing a 1031 exchange, you must purchase at least. Web they simply become “partial” 1031 exchanges where the taxpayer has a partially tax deferred transaction rather than deferring all their taxes.

In A Partial Exchange, The Taxpayer Decides To Defer Some Capital Gain Taxes And Pay Potentially Recognized Gain On The Cash.

Web partial 1031 exchanges are when the taxpayer does not use all the net equity and debt retired in the new property. Click here to open tax calculator. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). Web you can do a partial 1031 exchange, which is also known as a split exchange.

To Pay No Tax When Executing A 1031 Exchange, You Must Purchase At Least.

The portion of the exchange. This simplified estimator is for example. Web by evaluating all options according to how they align with your objectives, the partial 1031 exchange calculator can determine whether any roadblocks need to clear. Web what is a partial 1031 exchange?

![Partial 1031 Exchange [Explained AtoZ] PropertyCashin](https://propertycashin.com/wp-content/uploads/2020/11/Partial-1031-Exchange-Explained.png)