Pay Calculator Nj

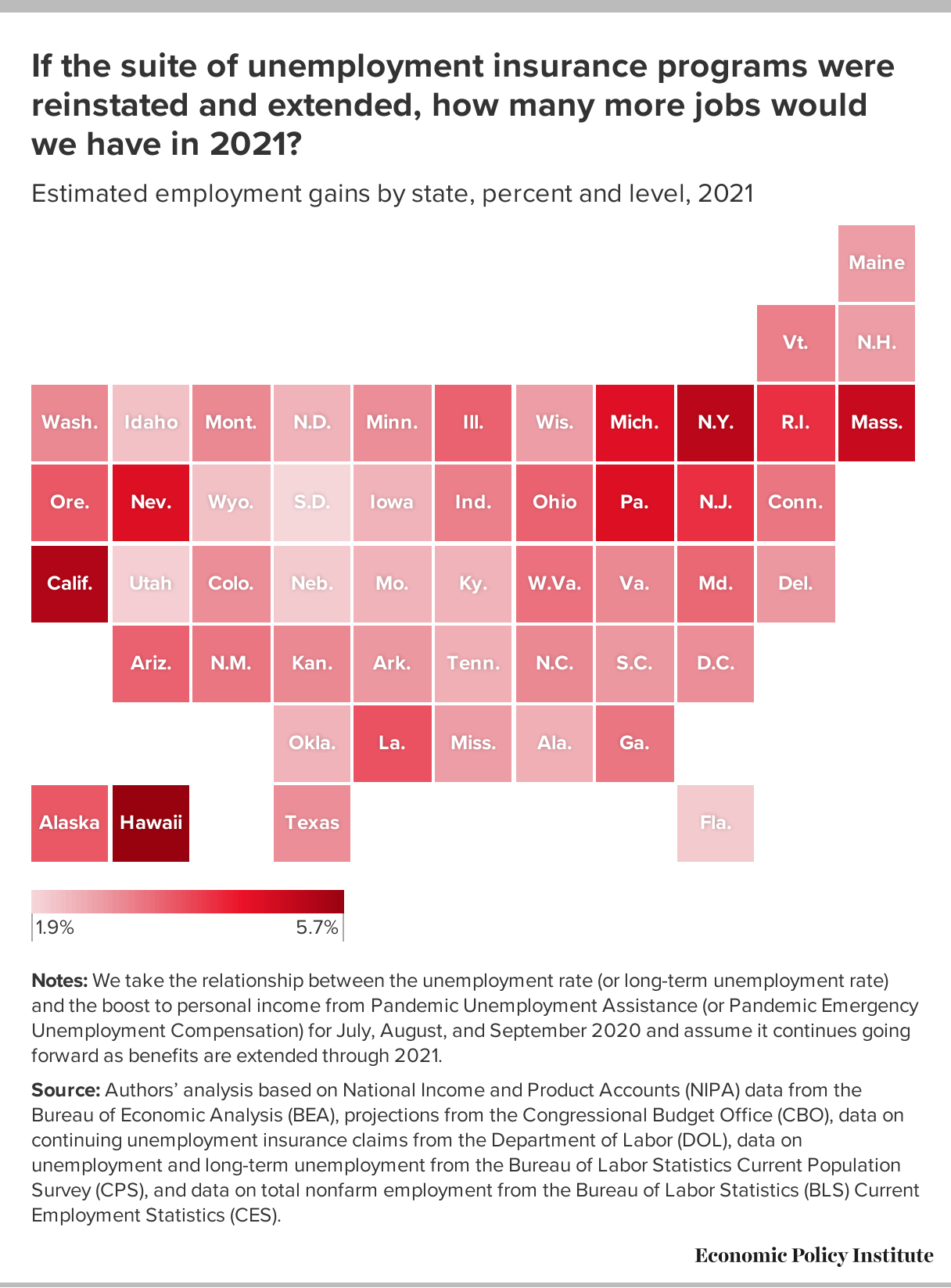

Pay Calculator Nj - A tax is a mandatory. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Just enter the wages, tax withholdings and other. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web new jersey paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

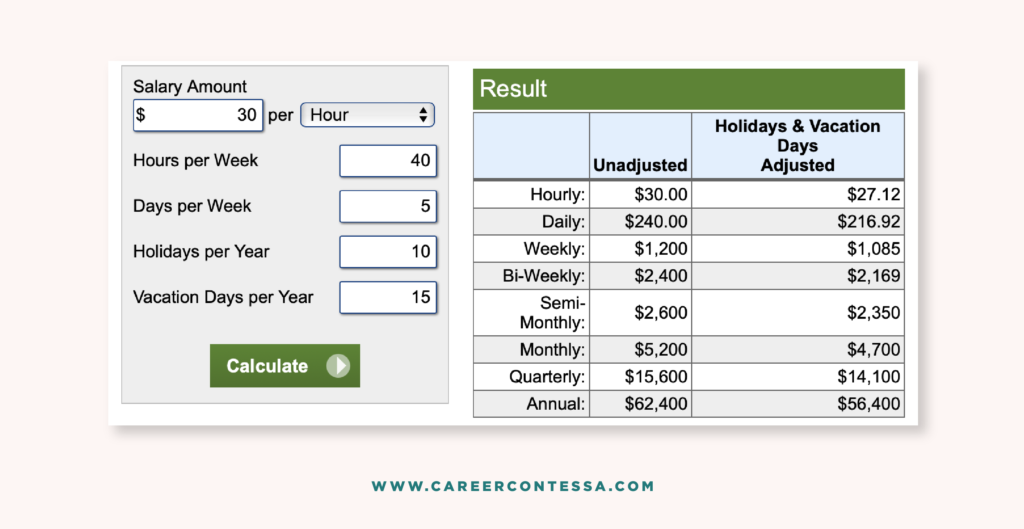

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Just enter the wages, tax withholdings and other. A tax is a mandatory. Web below are your new jersey salary paycheck results. Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Paycheck results is your gross pay and specific deductions from your. We’ll do the math for you—all you.

Annual to biweekly salary calculator EmelieNelleh

Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web if you’re wondering, “how do i figure out how much money i take home in new jersey” we’ve got you covered. Take home pay is calculated based on up to six different hourly pay rates that.

Free Nj Payroll Calculator

Web how much are your employees’ wages after taxes? Web if you’re wondering, “how do i figure out how much money i take home in new jersey” we’ve got you covered. Multiply that $10,500 by 15%, and the parent's maximum. Web for salaried employees, the number of payrolls in a year is used to determine.

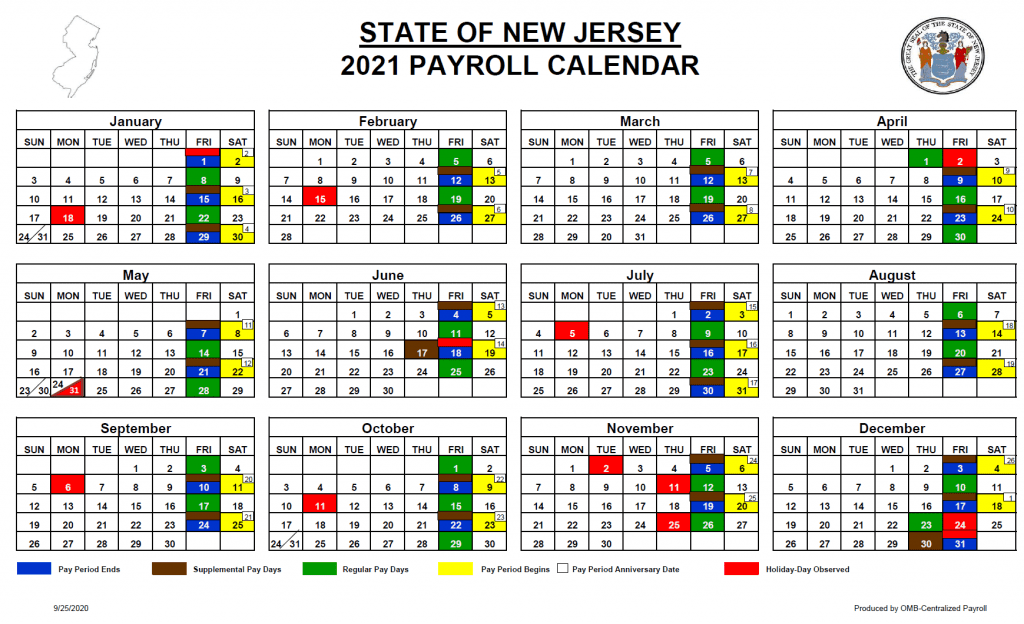

State of New Jersey Payroll Calendar 2024 2024 Payroll Calendar

Enter your info to see your take home pay. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web select a specific new jersey tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax.

Pay Scale Calculator GS Pay Scale 2022/2023

Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. Web new jersey hourly paycheck calculator. The results are broken up into three sections: Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for.

Top 6 Free Payroll Calculators free paycheck calculator app TimeCamp

A tax is a mandatory. Web new jersey hourly paycheck calculator. If this employee’s pay frequency is weekly the calculation is: Web below are your new jersey salary paycheck results. Simply enter their federal and state. Web select a specific new jersey tax calculator from the list below to calculate your annual gross salary and.

The 15 Best Salary Calculators to Help Achieve Fair Pay The Salary

Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. A tax is a mandatory. Multiply that $10,500 by 15%, and the parent's maximum. Customize using your filing status, deductions, exemptions and more. Use our simple paycheck calculator.

New Jersey Payroll Setup CFS Tax Software, Inc.

Customize using your filing status, deductions, exemptions and more. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Web below are your new jersey salary paycheck results. Use our simple paycheck calculator to estimate your net or. Enter your info to see your take home.

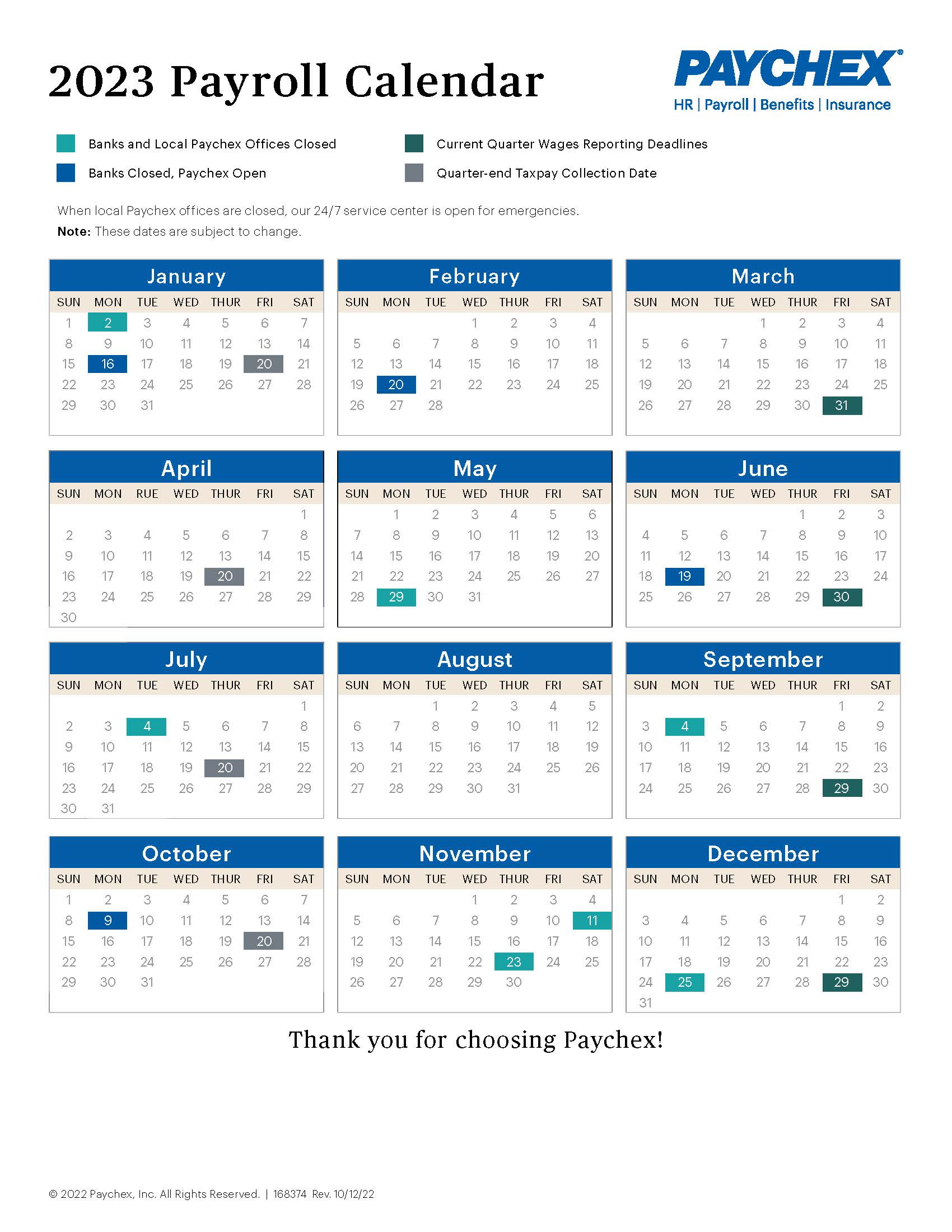

2023/2024 Payroll Calendar How Many Pay Periods Are There? Paychex

Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. We’ll do the math for you—all you. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web fill.

New Jersey Paycheck Calculator (Updated for 2024)

Web new jersey hourly paycheck calculator. Customize using your filing status, deductions, exemptions and more. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web select a specific new jersey tax calculator from the list below to calculate your annual gross salary and net take home.

27+ Payroll Calculator New Jersey RashadBonnie

Web smartasset's new jersey paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web find out how much you'll pay in new jersey state income taxes given your annual income. We’ll do the math for you—all you. Enter your info to see your take home pay. First, determine the total.

Pay Calculator Nj Use our simple paycheck calculator to estimate your net or. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). If this employee’s pay frequency is weekly the calculation is: Simply enter their federal and state. Web how much are your employees’ wages after taxes?

Customize Using Your Filing Status, Deductions, Exemptions And More.

Web fill out our contact form or call. Web use adp’s new jersey paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Use our simple paycheck calculator to estimate your net or. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local.

Enter Your Info To See Your Take Home Pay.

Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Web new jersey paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. If this employee’s pay frequency is weekly the calculation is:

Web Find Out How Much You'll Pay In New Jersey State Income Taxes Given Your Annual Income.

Simply enter their federal and state. Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. Web if you’re wondering, “how do i figure out how much money i take home in new jersey” we’ve got you covered. Web select a specific new jersey tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year.

A Tax Is A Mandatory.

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web new jersey paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? The results are broken up into three sections: Web new jersey payroll calculator.