Paycheck Calculator Az

Paycheck Calculator Az - Web the current ctc limits their qualifying earnings to $10,500 because their first $2,500 of income isn't counted. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Here’s how to calculate it: This applies to various salary. Web below are your arizona salary paycheck results.

This number is the gross pay per pay period. Updated on dec 05 2023. Just enter the wages, tax. We’ll do the math for you—all you. Multiply that $10,500 by 15%, and the parent's maximum. Use adp’s arizona paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web arizona hourly paycheck calculator.

ReadyToUse Paycheck Calculator Excel Template MSOfficeGeek

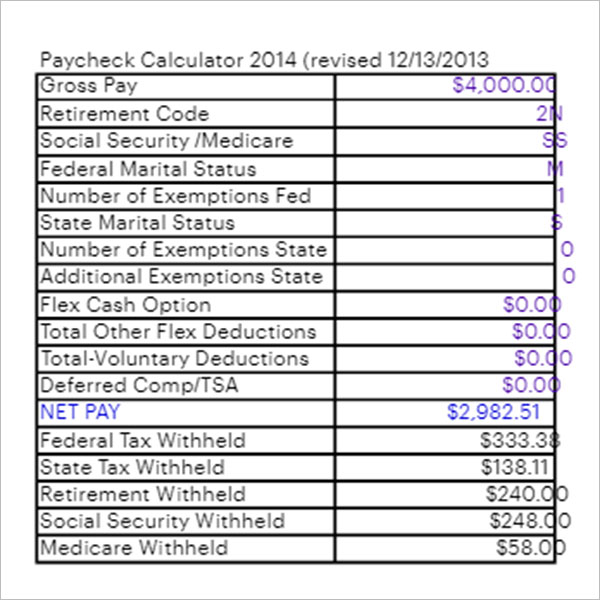

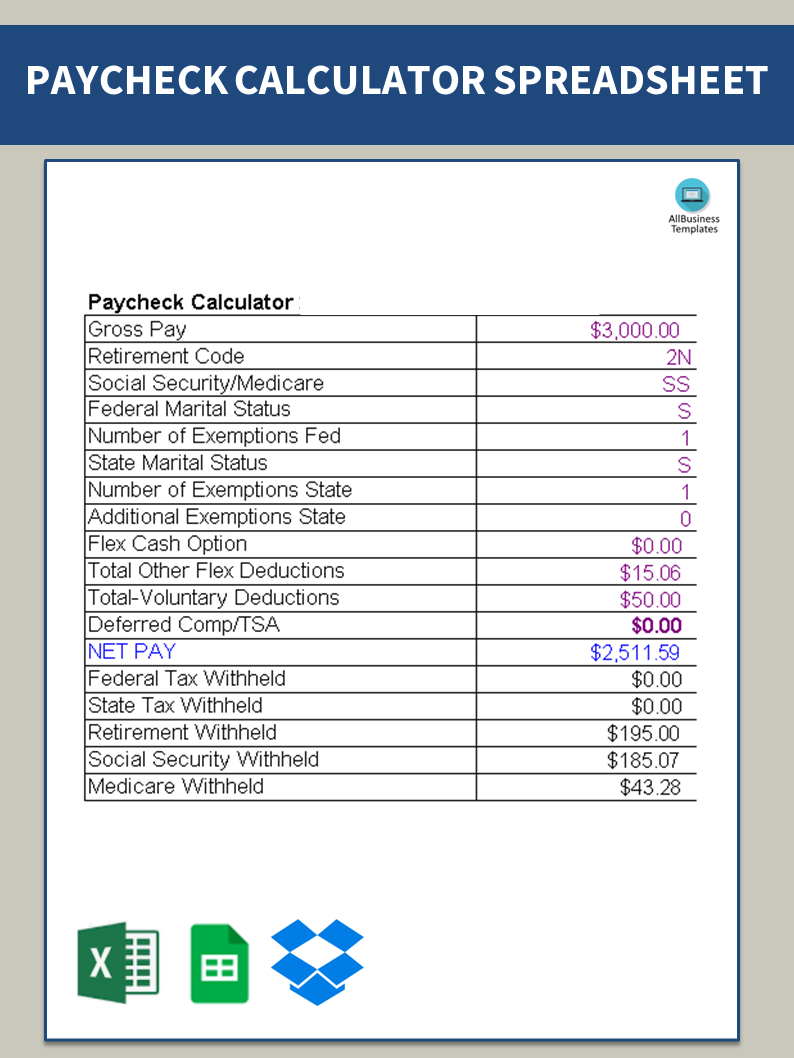

Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Simply enter their federal and state w. Just enter the wages, tax. Paycheck results is your gross pay and specific deductions from your. File taxesrun payrollaccounting toolstax deductions Web $0.00 nan% of gross income total.

FREE 12+ Paycheck Calculator Samples & Templates in Excel PDF

Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Web calculate your net pay and taxes for salary and hourly payment in arizona in 2023. We’ll do.

Top 6 Free Payroll Calculators free paycheck calculator app TimeCamp

Free tool to calculate your hourly and salary income. Web below are your arizona salary paycheck results. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Simply enter their federal and state w. Multiply that $10,500 by 15%, and the parent's maximum. Enter an.

11+ Free Weekly Paycheck Calculator Excel, PDF, Doc, Word Formats

Here’s how to calculate it: Web arizona hourly paycheck calculator. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web below are your arizona salary paycheck results. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and.

Arizona Paycheck Calculator 2023

Web calculate your net pay and taxes for salary and hourly payment in arizona in 2023. Web below are your arizona salary paycheck results. File taxesrun payrollaccounting toolstax deductions This applies to various salary. 16.72% total tax 83.28% net pay. How many income tax brackets are there in arizona? Take home pay is calculated based.

Gratis Paycheck Calculator

Web how much are your employees’ wages after taxes? Web arizona hourly paycheck calculator. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Just enter the wages, tax. Paycheck results is your gross pay and specific.

Free Paycheck Calculator Salary Pay Check Calculator in USA

Paycheck results is your gross pay and specific deductions from your. Web some top $1 million in pay. Here’s how to calculate it: How many income tax brackets are there in arizona? Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state,.

State Of Arizona Withholding Calculator

Just enter the wages, tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web some top $1 million in pay. This applies to various salary. Here’s how to calculate it: Web below are your arizona salary paycheck results..

Arizona Paycheck Calculator

How many income tax brackets are there in arizona? A city administrator who resigned after agreeing to plead guilty to a misdemeanor. The results are broken up into three sections: First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). Web $0.00.

Paycheck Manager Free Payroll Calculator Demo Step 2

Here’s how to calculate it: Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Use adp’s arizona paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web below are your arizona salary paycheck.

Paycheck Calculator Az Updated on dec 05 2023. This applies to various salary. Web how do i calculate hourly rate? How many income tax brackets are there in arizona? Web below are your arizona salary paycheck results.

Simply Enter Their Federal And State W.

Web how do i calculate hourly rate? $0.00 (nan%) total payroll taxes: Web $0.00 nan% of gross income total income taxes: Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

The New W4 Asks For A Dollar Amount.

Web calculate your net pay and taxes for salary and hourly payment in arizona in 2023. Just enter the wages, tax. Free tool to calculate your hourly and salary income. Paycheck results is your gross pay and specific deductions from your.

Take Home Pay Is Calculated Based On Up To Six Different Hourly Pay Rates That You Enter Along With The Pertinent Federal, State, And Local.

First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year (52). We’ll do the math for you—all you. Here’s how to calculate it: Web this paycheck calculator can help estimate your take home pay and your average income tax rate.

File Taxesrun Payrollaccounting Toolstax Deductions

Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Multiply that $10,500 by 15%, and the parent's maximum. Web federal paycheck calculator photo credit: