Paycheck Calculator Hawaii

Paycheck Calculator Hawaii - Web determine if state income tax and other state and local taxes and withholdings apply. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in hawaii. Surepayroll.com has been visited by 10k+ users in the past month It will calculate net paycheck amount that an employee will receive based. Web this hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses.

Paycheck results is your gross pay and specific deductions from your. Web hawaii hourly paycheck calculator. Web use adp’s hawaii paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web with hawaii paycheck calculator 2023, you can easily calculate your net pay after tax deductions according to the hawaii legislation, which, has 12 tax bands income tax. Web this hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web below are your hawaii salary paycheck results.

Hawaii Payroll Tax Calculator CALCULATOR NBG

Payroll check calculator is updated for payroll year 2024 and new w4. We’ll do the math for you—all you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web calculate your take home pay. Divide the sum of all.

Hawaii paycheck tax calculator WilliamMatteo

Payroll check calculator is updated for payroll year 2024 and new w4. Paycheck results is your gross pay and specific deductions from your. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. The result is the.

Free Hawaii Paycheck Calculator 2023

Web hawaii paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web use adp’s hawaii paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. It will calculate net paycheck amount that an employee will receive based. Smartasset's.

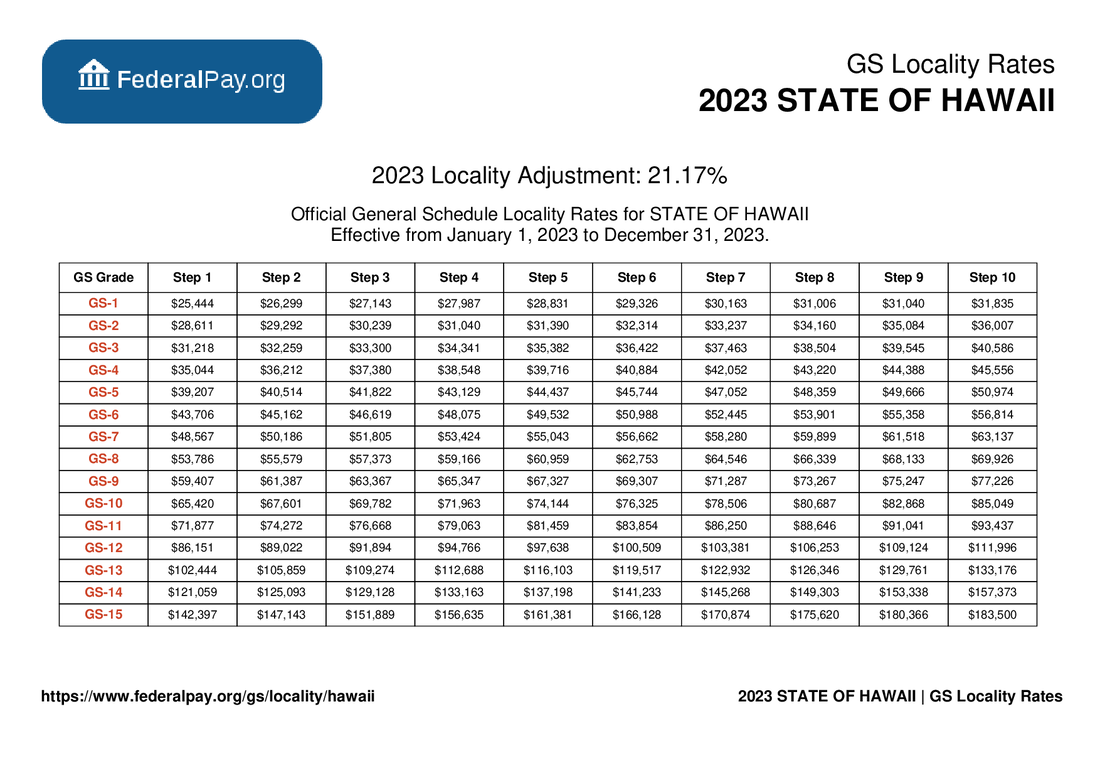

Hawaii Pay Locality General Schedule Pay Areas

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Smartasset's hawaii paycheck calculator shows your hourly and salary income after federal, state and local. Web hawaii paycheck calculator for salary & hourly payment 2023 curious to.

Hawaii Paycheck Calculator 2023

Divide the sum of all applicable taxes by the employee’s gross pay. Web this hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes,.

Hawaii Paycheck Calculator (Update for 2024)

Web use hawaii paycheck calculator to estimate net or “take home” pay for salaried employees. The result is the percentage. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web calculate your take home pay. Paycheck results is your.

Hawaii Paycheck Calculator 2023 2024

Divide the sum of all applicable taxes by the employee’s gross pay. Web this hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. We’ll do the math for you—all you. Web use smartasset's paycheck calculator to calculate your take.

Results · Hawaii GrossUp Paycheck Calculator · PaycheckCity

Surepayroll.com has been visited by 10k+ users in the past month Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. It will calculate net paycheck amount that an employee will receive based. Divide the sum of.

Hawaii Payroll Tax Calculator CALCULATOR NBG

The result is the percentage. The results are broken up into three sections: Web with hawaii paycheck calculator 2023, you can easily calculate your net pay after tax deductions according to the hawaii legislation, which, has 12 tax bands income tax. Web hawaii paycheck calculator easily estimate take home pay after income tax so you.

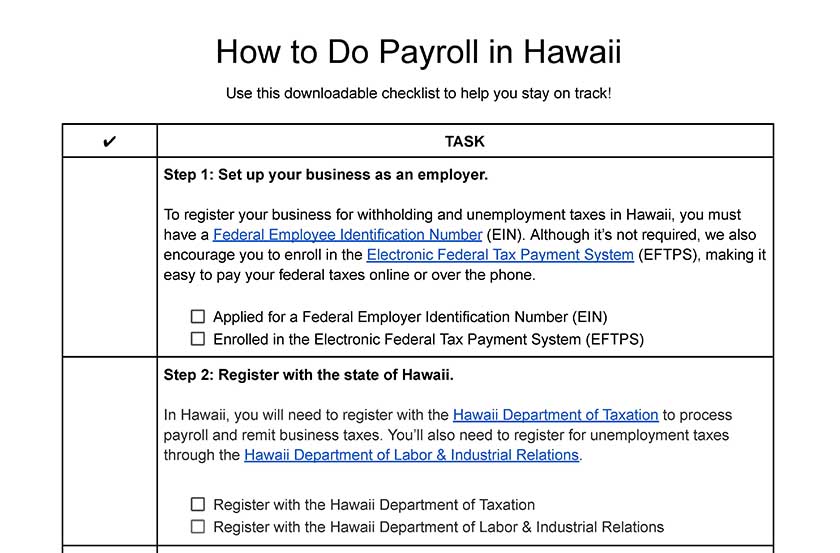

Payroll in Hawaii Everything Employers Need to Know

Smartasset's hawaii paycheck calculator shows your hourly and salary income after federal, state and local. Web determine if state income tax and other state and local taxes and withholdings apply. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state.

Paycheck Calculator Hawaii We’ll do the math for you—all you. Web calculate your take home pay. Divide the sum of all applicable taxes by the employee’s gross pay. Web hawaii paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget last. It will calculate net paycheck amount that an employee will receive based.

Web Below Are Your Hawaii Salary Paycheck Results.

Web this hawaii bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. The results are broken up into three sections: Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in hawaii. Web hawaii paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

Web Use Adp’s Hawaii Paycheck Calculator To Estimate Net Or “Take Home” Pay For Either Hourly Or Salaried Employees.

Surepayroll.com has been visited by 10k+ users in the past month Simply input salary details, benefits and deductions, and any other. Smartasset's hawaii paycheck calculator shows your hourly and salary income after federal, state and local. Web with hawaii paycheck calculator 2023, you can easily calculate your net pay after tax deductions according to the hawaii legislation, which, has 12 tax bands income tax.

It Will Calculate Net Paycheck Amount That An Employee Will Receive Based.

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Web determine if state income tax and other state and local taxes and withholdings apply. Payroll check calculator is updated for payroll year 2024 and new w4. Web calculate your take home pay.

Web Hawaii Paycheck Calculator Easily Estimate Take Home Pay After Income Tax So You Can Have An Idea Of What To Possibly Expect When Planning Your Budget Last.

We’ll do the math for you—all you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Just enter the wages, tax withholdings and other. Divide the sum of all applicable taxes by the employee’s gross pay.