Paycheck Calculator Ky

Paycheck Calculator Ky - We’ll do the math for you—all you. Web this should be the total salary per payment period as selected at step 2. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. You can add multiple rates. Your paycheck withholdings also depend on the information you gave to your employer when you started your job.

Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. Web kentucky paycheck calculator: Your paycheck withholdings also depend on the information you gave to your employer when you started your job. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky. Enter your info to see your take. Use icalculator™ us's paycheck calculator tailored for kentucky to determine your net income per paycheck. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate.

Kentucky Paycheck Calculator 2023 2024

Smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes. Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. The kentucky payroll calculator will then produce your payroll cost calculation. This applies to various salary. Web calculate your net pay and taxes.

ReadyToUse Paycheck Calculator Excel Template MSOfficeGeek

Web use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other. Enter your info to see your take. Web in comparison, those earning over $200,000 are subject to a combined rate of 16.2%. Paycheck calculator calculate tax pay. Your.

Kentucky Payroll Calculator 2024 iCalculator™ US

Formula to calculate take home pay jose january 15, 2024 · 7 min read legal & finance calculate your paycheck in 7. Web in comparison, those earning over $200,000 are subject to a combined rate of 16.2%. Use icalculator™ us's paycheck calculator tailored for kentucky to determine your net income per paycheck. Simply enter their.

Kentucky Paycheck Calculator 2023

Paycheck calculator calculate tax pay. Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. We’ll do the math for you—all you. Web kentucky paycheck calculator the state of kentucky implements a flat income tax rate of 4.5%, regardless of the filing status utilized by taxpayers. Web the gross.

Kentucky Salary Comparison Calculator 2024 iCalculator™

Your paycheck withholdings also depend on the information you gave to your employer when you started your job. The results are broken up into three sections: Web this should be the total salary per payment period as selected at step 2. Simply enter their federal and state w. Web use adp’s kentucky paycheck calculator to.

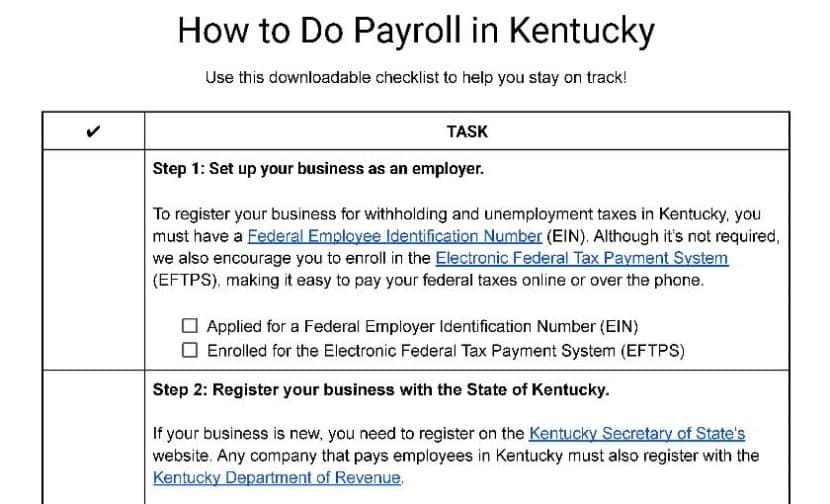

How to Do Payroll in Kentucky What Employers Need to Know

Web kentucky paycheck calculator the state of kentucky implements a flat income tax rate of 4.5%, regardless of the filing status utilized by taxpayers. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Web the gross.

Gs Pay Scale 2021 Kentucky GS Pay Scale 2022/2023

Web calculate your net pay and taxes for salary and hourly payment in kentucky in 2023. Think back to when you were first hired. Web use the kentucky paycheck calculator to estimate net or “take home” pay for salaried employees. Enter your info to see your take. Web unlimited companies, employees, and payroll runs for.

Kentucky Paycheck Tax Calculator CALCKP

Web use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Paycheck results is your gross pay and specific deductions from your. Web kentucky paycheck calculator the state of kentucky implements a flat income tax rate of 4.5%, regardless of the filing status utilized by taxpayers. The.

Kentucky Paycheck Calculator 2022 2023

Pay stub · employee handbook · resources · security · healthcare · health Use icalculator™ us's paycheck calculator tailored for kentucky to determine your net income per paycheck. You can add multiple rates. Your paycheck withholdings also depend on the information you gave to your employer when you started your job. Paycheck results is your.

Payroll Calculator Free Employee Payroll Template for Excel

Web this should be the total salary per payment period as selected at step 2. Simply enter their federal and state w. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web in comparison, those earning over $200,000 are subject to a combined rate of 16.2%. Web.

Paycheck Calculator Ky Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky. Paycheck calculator calculate tax pay. Pay stub · employee handbook · resources · security · healthcare · health Updated on dec 05 2023. Formula to calculate take home pay jose january 15, 2024 · 7 min read legal & finance calculate your paycheck in 7.

Enter Your Info To See Your Take.

Web in comparison, those earning over $200,000 are subject to a combined rate of 16.2%. Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. Web use the kentucky paycheck calculator to estimate net or “take home” pay for salaried employees. Just enter the wages, tax withholdings and other.

Your Paycheck Withholdings Also Depend On The Information You Gave To Your Employer When You Started Your Job.

Simply enter their federal and state w. Use icalculator™ us's paycheck calculator tailored for kentucky to determine your net income per paycheck. This applies to various salary. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.

Web Kentucky Paycheck Calculator The State Of Kentucky Implements A Flat Income Tax Rate Of 4.5%, Regardless Of The Filing Status Utilized By Taxpayers.

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web this should be the total salary per payment period as selected at step 2. The results are broken up into three sections: Web use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

Free Tool To Calculate Your Hourly And Salary Income After.

Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky. Pay stub · employee handbook · resources · security · healthcare · health Web below are your kentucky salary paycheck results. Web unlimited companies, employees, and payroll runs for 1 low price.