Paycheck Calculator Ms

Paycheck Calculator Ms - Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. The state income tax rate in mississippi is progressive and ranges from 0% to 5% while federal income tax rates. We’ll do the math for you—all you. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Free tool to calculate your hourly and salary income.

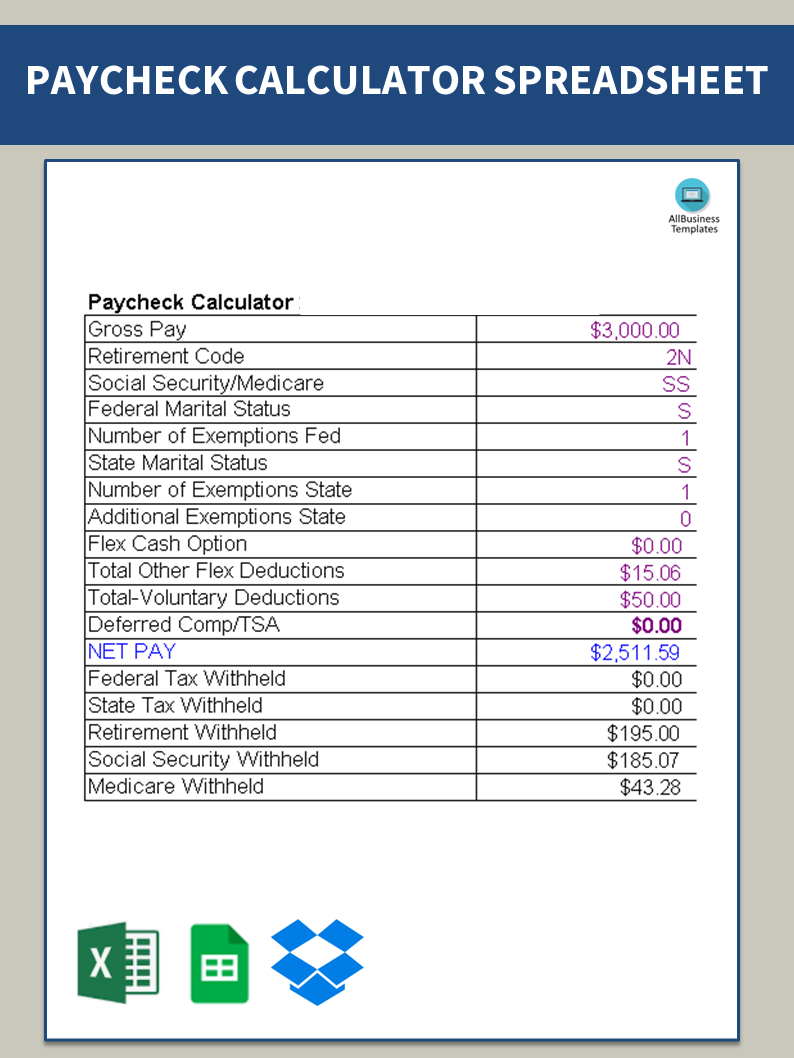

The state income tax rate in mississippi is progressive and ranges from 0% to 5% while federal income tax rates. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Paycheck results is your gross pay and specific deductions from your. Choosing the right paycheck calculator. This calculator will take a gross pay and calculate the net. Web use icalculator™ us's paycheck calculator tailored for mississippi to determine your net income per paycheck. You can add multiple rates.

Paycheck Calculator Templates at

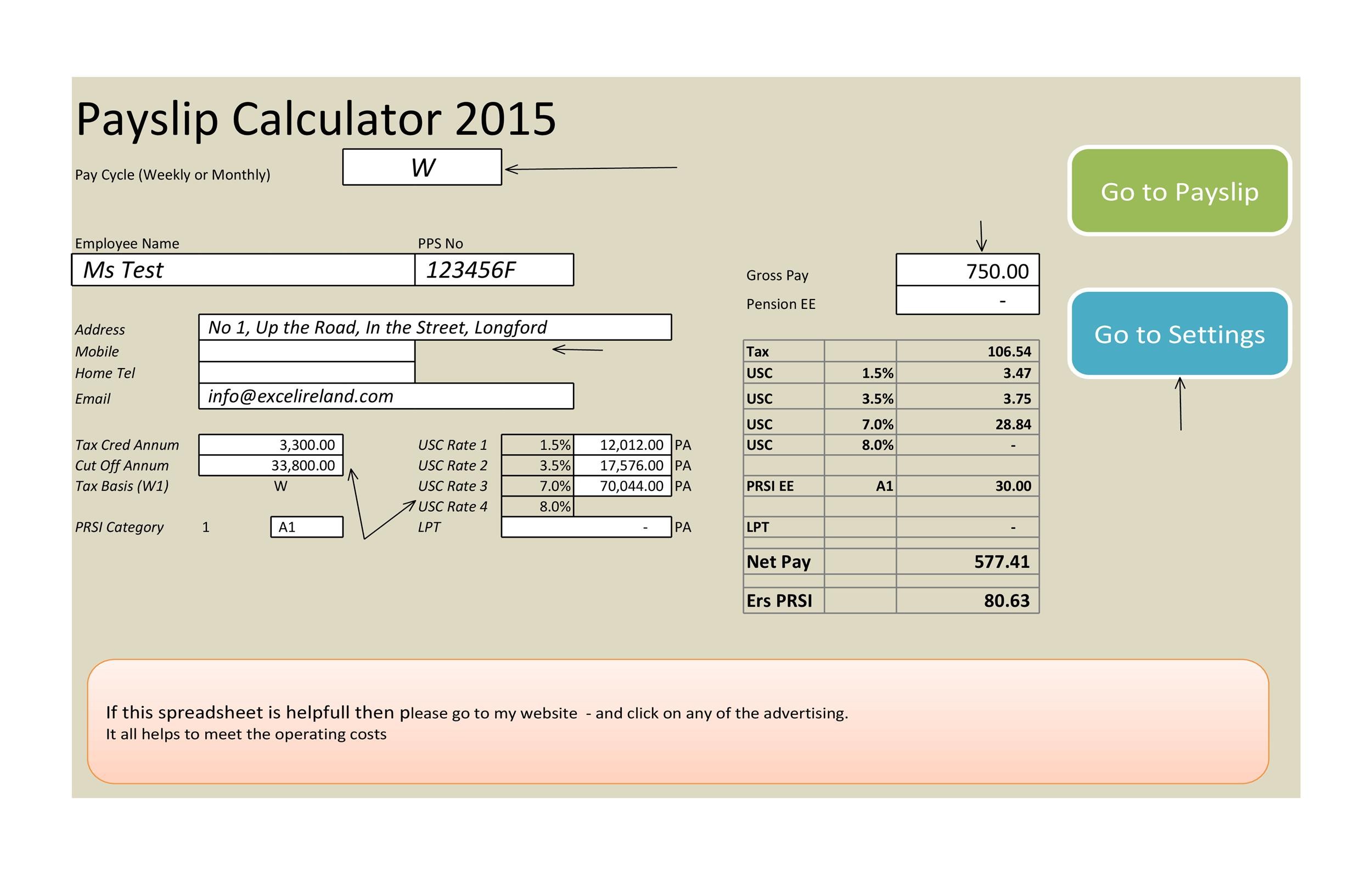

Updated on dec 05 2023. Simply input salary details, benefits and deductions, and any other. This applies to various salary frequencies including annual,. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Web what is the income tax rate in mississippi? This calculator will take.

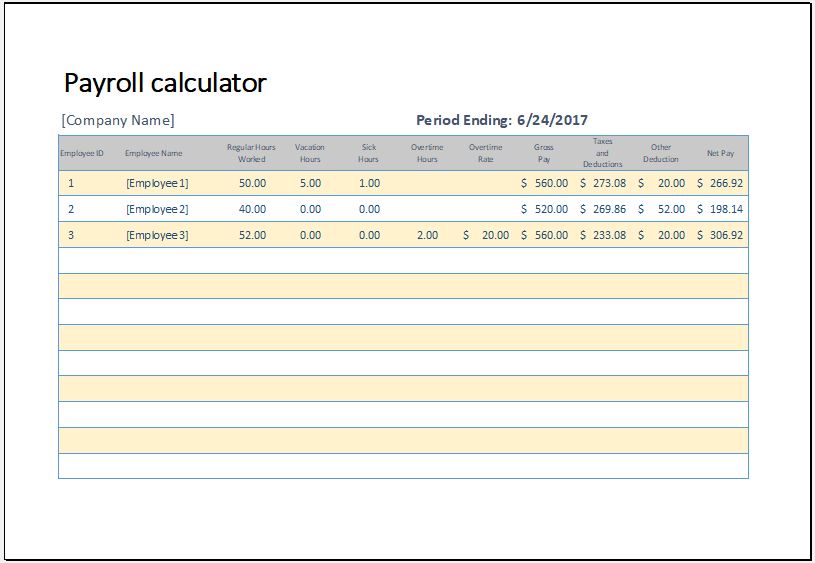

MS Excel Printable Payroll Calculator Template Excel Templates

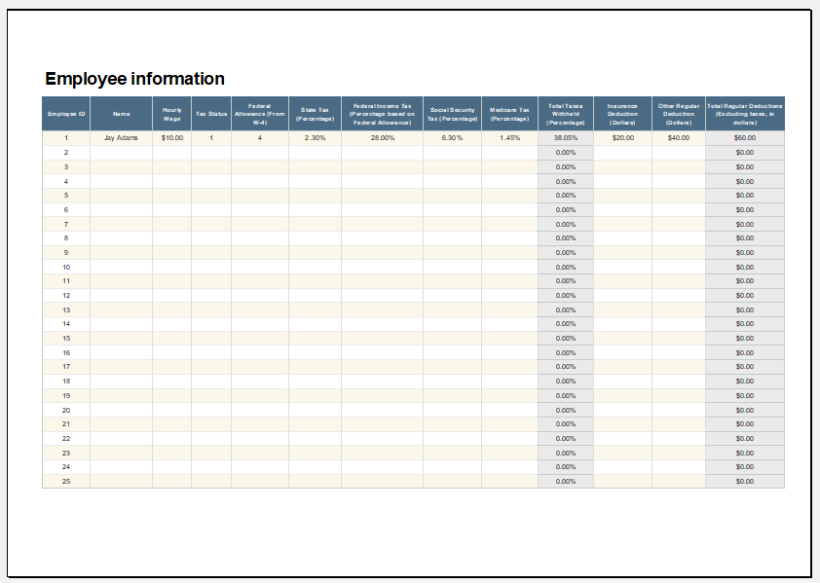

Web if your gross pay is $46,637.00 per year in the state of mississippi, your net pay (or take home pay) will be $36,900 after tax deductions of 20.88% (or $9,736.52 ). Paycheck results is your gross pay and specific deductions from your. The state income tax rate in mississippi is progressive and ranges from.

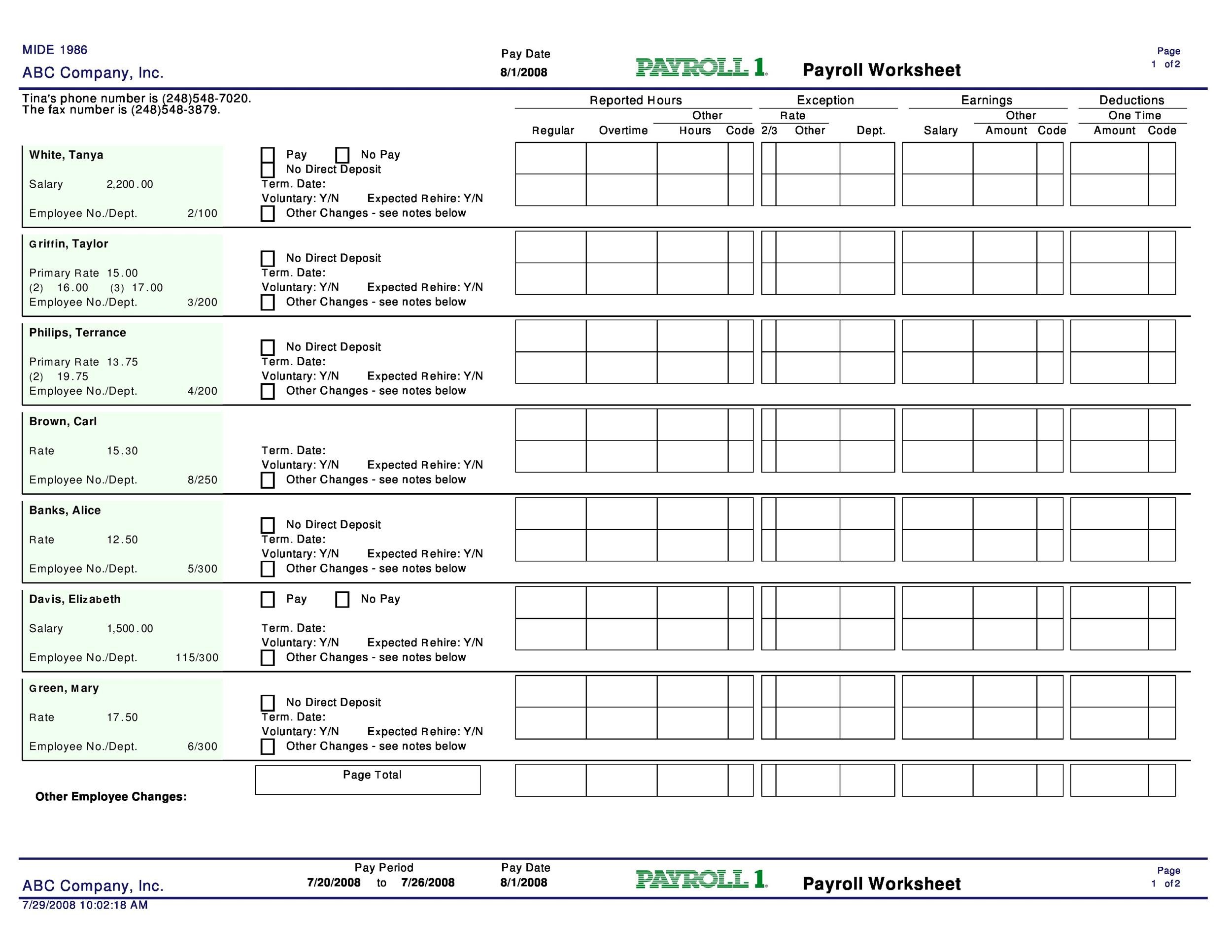

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

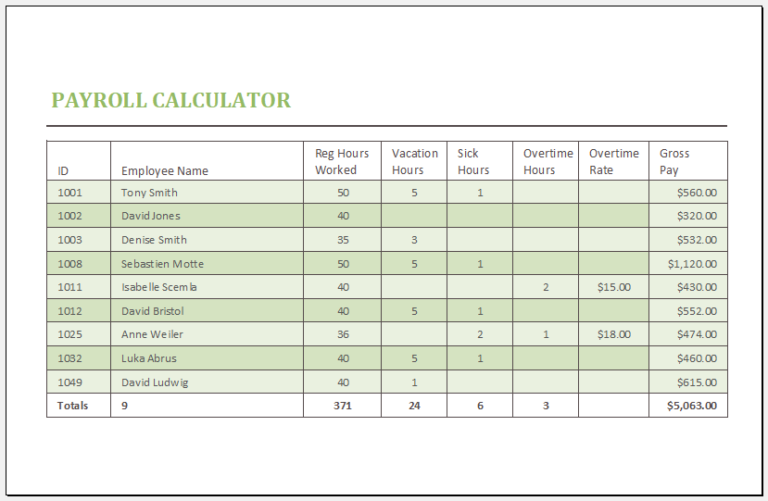

Free tool to calculate your hourly and salary income. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web a paycheck calculator can help you understand how different tax credits and deductions affect your tax burden. You can add multiple rates. Web if your gross pay is.

Payroll Calculator Template for MS Excel Excel Templates

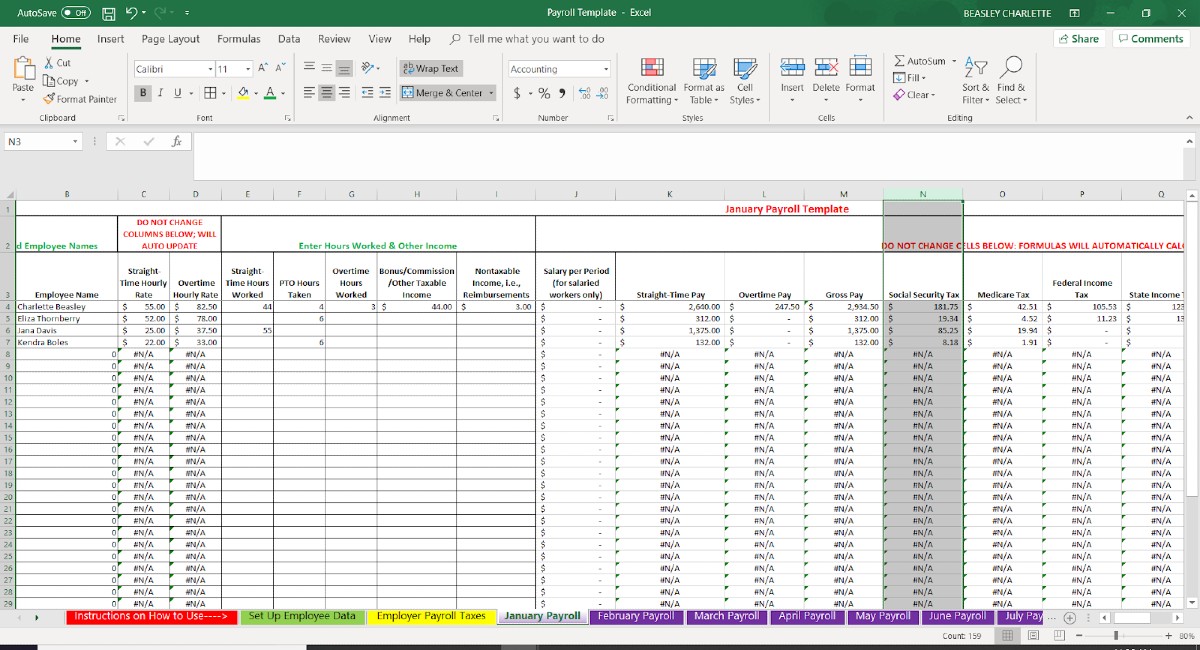

This applies to various salary frequencies including annual,. Choosing the right paycheck calculator. Simply input salary details, benefits and deductions, and any other. If this employee’s pay frequency is weekly the calculation is: Web a paycheck calculator can help you understand how different tax credits and deductions affect your tax burden. Web us tax 2024.

Payroll Calculator Template for MS Excel Word & Excel Templates

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. You can add multiple rates. Web use mississippi paycheck calculator to estimate net or “take home” pay for salaried employees. Simply enter their federal and state. The results are broken up into three sections: This applies to various.

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web use icalculator™ us's paycheck calculator tailored for mississippi to determine your net income per paycheck. The results are broken up into three sections: You can add multiple rates. Web the gross pay in the hourly calculator is.

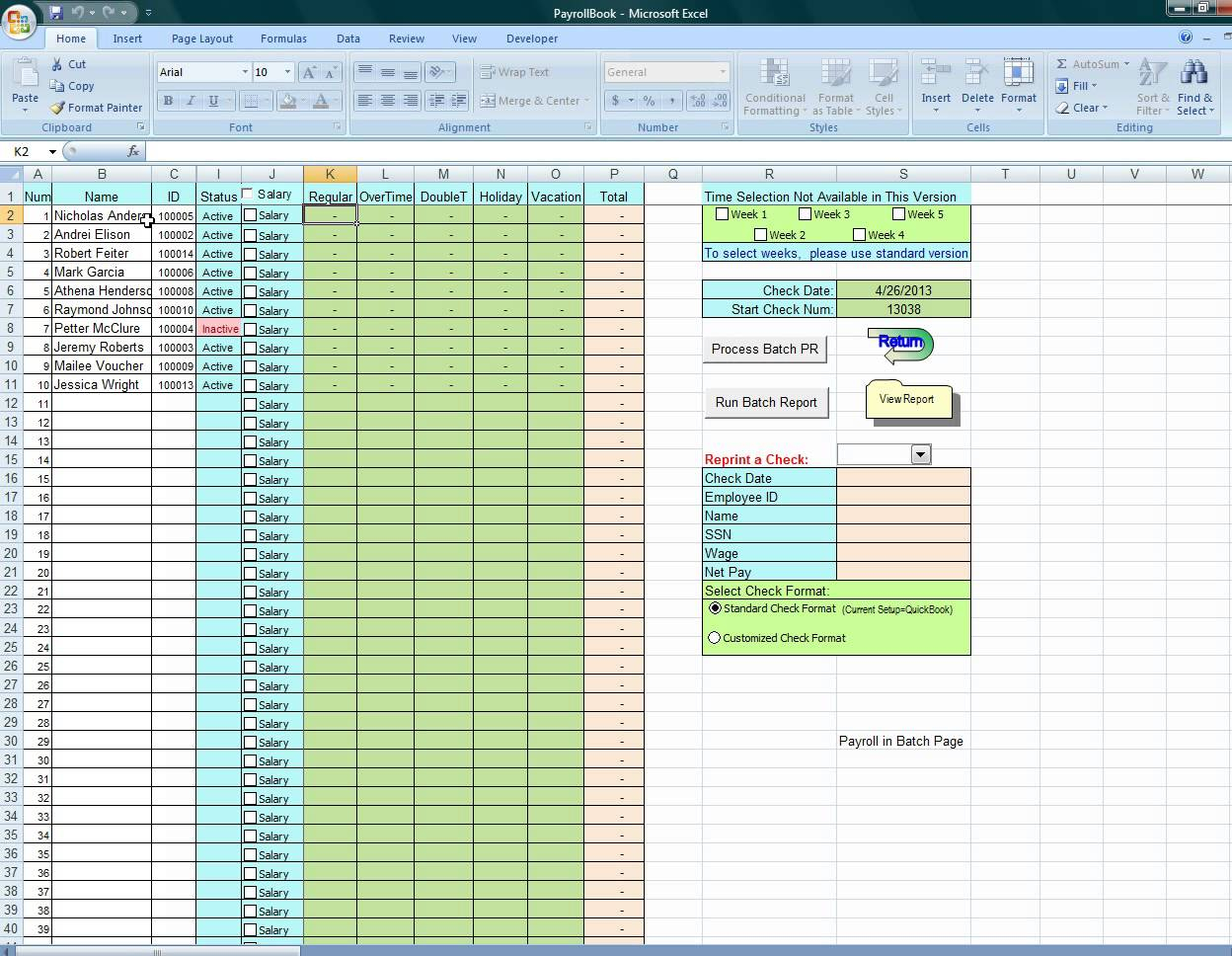

Payroll Spreadsheets Excel Templates Excel Templates

Enter your info to see your take home pay. This calculator will take a gross pay and calculate the net. Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web how to calculate annual income. Web for salaried employees, the number.

29+ Mississippi Paycheck Calculator NaziahChelsi

You can add multiple rates. Choosing the right paycheck calculator. We’ll do the math for you—all you. Web a paycheck calculator can help you understand how different tax credits and deductions affect your tax burden. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year..

ReadyToUse Paycheck Calculator Excel Template MSOfficeGeek

You can add multiple rates. If this employee’s pay frequency is weekly the calculation is: Free tool to calculate your hourly and salary income. This calculator will take a gross pay and calculate the net. Enter your info to see your take home pay. This applies to various salary frequencies including annual,. Web smartasset's mississippi.

Paycheck Calculator Excel Template

Web how to calculate annual income. Web if your gross pay is $46,637.00 per year in the state of mississippi, your net pay (or take home pay) will be $36,900 after tax deductions of 20.88% (or $9,736.52 ). Web mississippi paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and.

Paycheck Calculator Ms This applies to various salary frequencies including annual,. Web a paycheck calculator can help you understand how different tax credits and deductions affect your tax burden. This calculator will take a gross pay and calculate the net. The state income tax rate in mississippi is progressive and ranges from 0% to 5% while federal income tax rates. Web how to calculate annual income.

Paycheck Results Is Your Gross Pay And Specific Deductions From Your.

Web use mississippi paycheck calculator to estimate net or “take home” pay for salaried employees. Web how to calculate annual income. We’ll do the math for you—all you. Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Choosing The Right Paycheck Calculator.

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Enter your info to see your take home pay. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. This calculator will take a gross pay and calculate the net.

Web The Gross Pay In The Hourly Calculator Is Calculated By Multiplying The Hours Times The Rate.

The results are broken up into three sections: Simply enter their federal and state. Web what is the income tax rate in mississippi? Web if your gross pay is $46,637.00 per year in the state of mississippi, your net pay (or take home pay) will be $36,900 after tax deductions of 20.88% (or $9,736.52 ).

Web Mississippi Paycheck Calculator For Salary & Hourly Payment 2023 Curious To Know How Much Taxes And Other Deductions Will Reduce Your Paycheck?

You can add multiple rates. Simply input salary details, benefits and deductions, and any other. Updated on dec 05 2023. If this employee’s pay frequency is weekly the calculation is: