Paycheck Calculator Ri

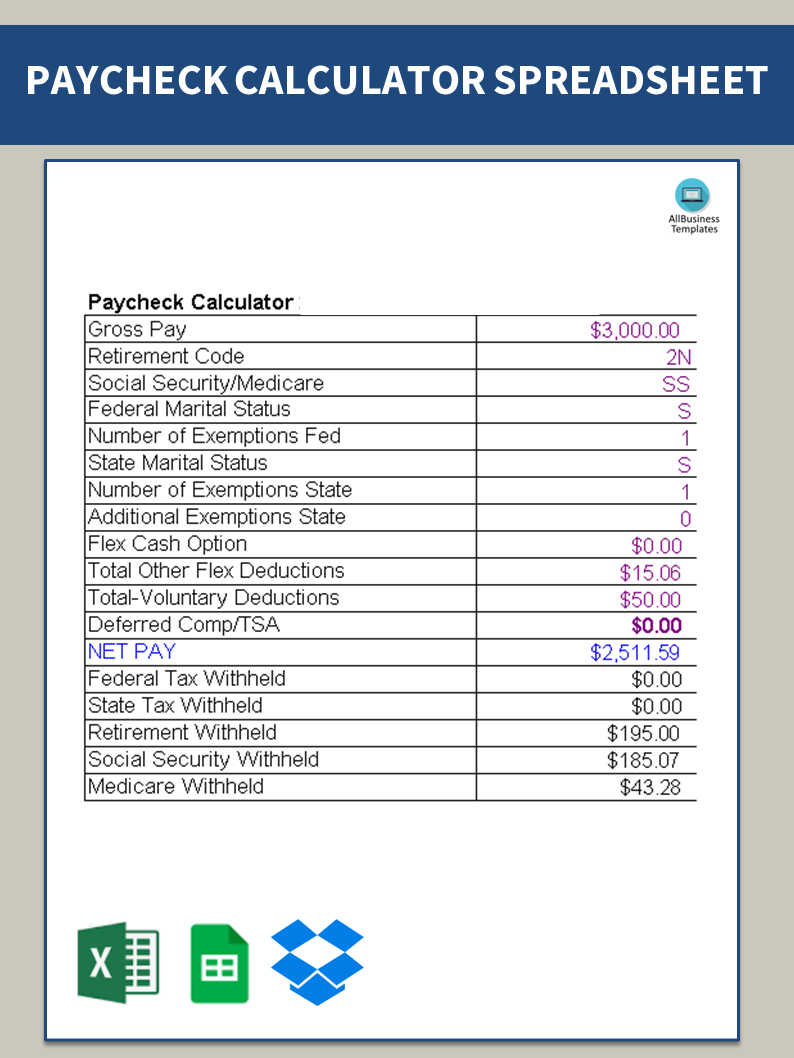

Paycheck Calculator Ri - Web rhode island paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. Web rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Use our simple paycheck calculator to estimate your net or. This calculator will take a gross pay and calculate the net. Web rhode island paycheck calculator generate paystubs with accurate rhode island state tax withholding calculations.

Pay your teammore money, more timeautomated tax calculationhappy employees Web rhode island paycheck and payroll calculator. Web if you’re wondering, “how do i figure out how much money i take home in rhode island” we’ve got you covered. Web use this rhode island gross pay calculator to gross up wages based on net pay. Web use adp’s rhode island paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web rhode island paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your. Use our simple paycheck calculator to estimate your net or.

Any company’s accounting staff can use a paycheck calculator to ensure

Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for. We’ll do the math for you—all. Web use adp’s rhode island paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web rhode island.

Free Paycheck Calculator Salary Pay Check Calculator in USA

This calculator will take a gross pay and calculate the net. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for. Web federal paycheck calculator photo credit: Your federal income tax withholdings are based on your income. Pay your.

Paycheck Calculator Retire Ready Solutions

We’ll do the math for you—all. Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Web federal paycheck calculator photo credit: Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for. Web use this calculator to estimate.

Free Rhode Island Paycheck Calculator 2023

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web use this rhode island gross pay calculator to gross up wages based on net pay. Web rhode island paycheck and payroll calculator. You can add multiple rates. We’ll do the math for you—all. Web rhode island hourly.

22+ ri paycheck calculator ConaireRainn

Just enter the wages, tax withholdings and other. Web rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web rhode island paycheck and payroll calculator. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web.

Free online paycheck calculator GraemeRhuby

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web rhode island paycheck calculator generate paystubs with accurate rhode island state tax withholding calculations. Web how much are your employees’ wages after taxes? Web use this rhode island gross pay calculator to gross up.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Web how much are your employees’ wages after taxes? Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. Web smartasset's rhode island paycheck calculator shows your hourly.

Kostenloses Paycheck Calculator

This calculator will take a gross pay and calculate the net. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Just enter the wages, tax withholdings and other. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web use this rhode.

ReadyToUse Paycheck Calculator Excel Template MSOfficeGeek

Pay your teammore money, more timeautomated tax calculationhappy employees Web how much are your employees’ wages after taxes? Enter your info to see your take home pay. Alabama alaska arizona arkansas california colorado. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web use this rhode island gross pay.

Paycheck Calculator Ri Web use this rhode island gross pay calculator to gross up wages based on net pay. Web use adp’s rhode island paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate.

Web Federal Paycheck Calculator Photo Credit:

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount.

Just Enter The Wages, Tax Withholdings And Other.

Web rhode island paycheck and payroll calculator. You can add multiple rates. This calculator will take a gross pay and calculate the net. Web use adp’s rhode island paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

Your Federal Income Tax Withholdings Are Based On Your Income.

Use our simple paycheck calculator to estimate your net or. Enter your info to see your take home pay. Web use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Web if you’re wondering, “how do i figure out how much money i take home in rhode island” we’ve got you covered.

Web Smartasset's Rhode Island Paycheck Calculator Shows Your Hourly And Salary Income After Federal, State And Local Taxes.

Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web use this rhode island gross pay calculator to gross up wages based on net pay. Pay your teammore money, more timeautomated tax calculationhappy employees Web rhode island paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your.