Paycheck Calculator Tn

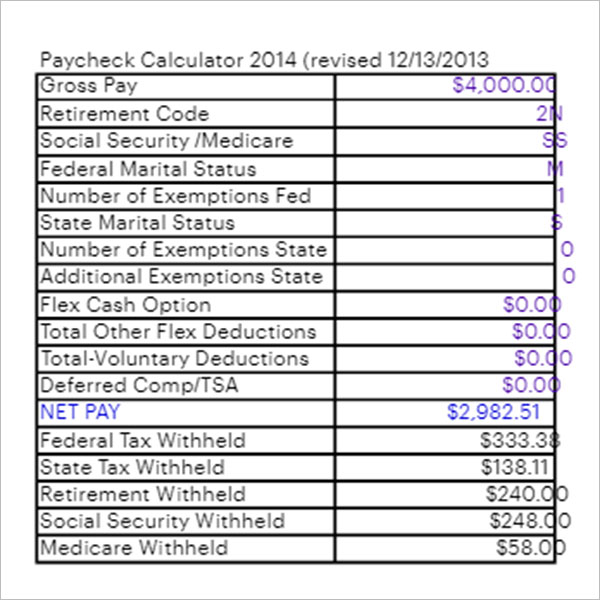

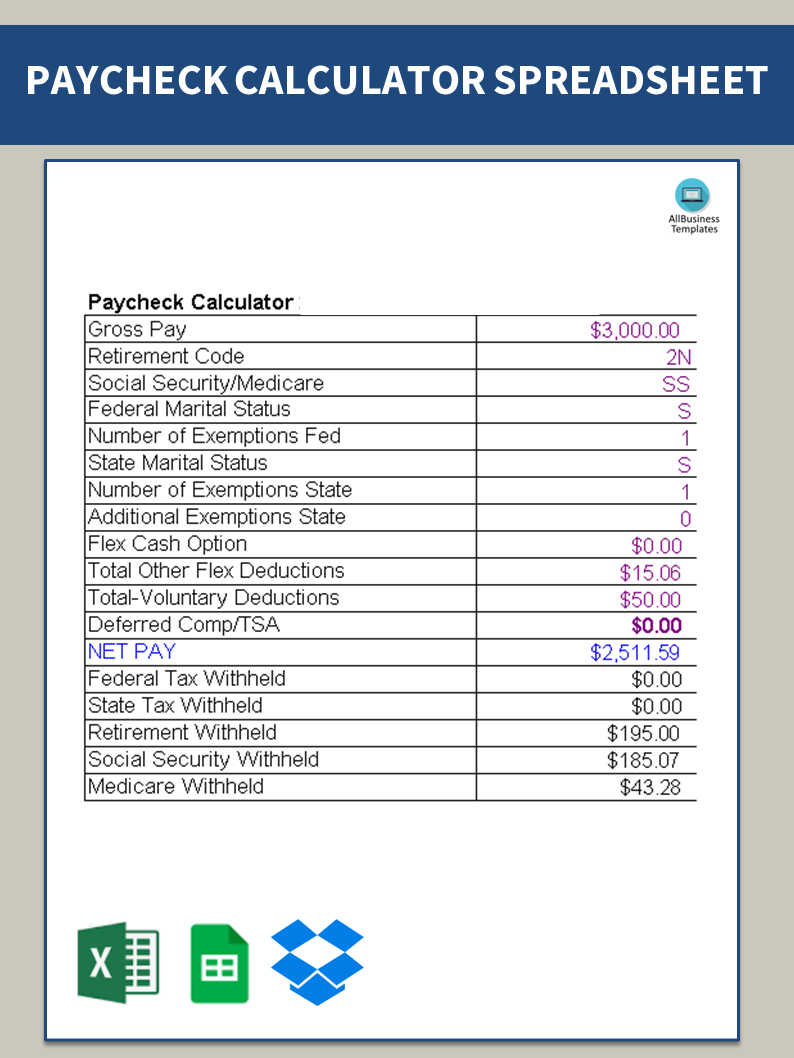

Paycheck Calculator Tn - This number is the gross pay per pay period. 7.65% total tax 92.35% net pay. The gross pay in the hourly. Gross pay amount is earnings before taxes and deductions are withheld by the employer. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Web tennessee hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. The gross pay in the hourly. Web the state income tax rate in tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income. The result is the percentage. This number is the gross pay per pay period. Divide the sum of all applicable taxes by the employee’s gross pay. Simply enter their federal and state.

11+ Free Weekly Paycheck Calculator Excel, PDF, Doc, Word Formats

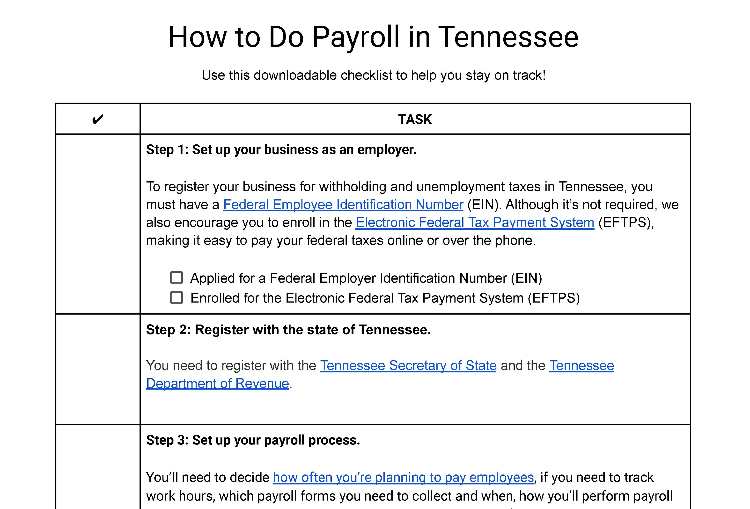

Web determine if state income tax and other state and local taxes and withholdings apply. We’ll do the math for you—all you. Estimate your federal, state and local taxes, deductions and other expenses with this online tool. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29.

Top 6 Free Payroll Calculators free paycheck calculator app TimeCamp

Simply enter their federal and state. Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. Web determine if state income tax and other state and local taxes and withholdings apply. Web calculate how your paycheck works what is gross pay? We’ll do the math for you—all you. Web use.

Free Paycheck Calculator Salary Pay Check Calculator in USA

Web use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Gross pay amount is earnings before taxes and deductions are withheld by the employer. Enter your info to see your take home pay. Calculate your net salary jose january 9, 2024 · 7 min read.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Gross pay amount is earnings before taxes and deductions are withheld by the employer. In comparison, those earning over. Web tennessee hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web to calculate a paycheck start.

Paycheck Calculator Gratis

Divide the sum of all applicable taxes by the employee’s gross pay. The gross pay in the hourly. Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. This paycheck calculator can help. Calculate your net salary jose january 9, 2024 · 7 min read legal & finance calculate your.

How to Do Payroll in Tennessee What Every Employer Needs to Know

The gross pay in the hourly. Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. 7.65% total tax 92.35% net pay. Web to calculate a paycheck start with the annual salary amount.

Free Tennessee Paycheck Calculator 2023 TN Paycheck Calculator

Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. We’ll do the math for you—all you. Simply enter their federal and state. Enter your info to see your take home pay. Suta tax rates in tennessee range from 0.01% to 10% for.

Tennessee Paycheck Calculator Paycheck, Calculator, Finance

Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Suta tax rates in tennessee range from 0.01% to 10% for established. Estimate your federal, state and local taxes, deductions and other expenses with this online tool. Web the state income tax rate.

19+ Tn Paycheck Calculator XenoYazdan

7.65% total tax 92.35% net pay. Updated on dec 05 2023. We’ll do the math for you—all you. Enter your info to see your take home pay. Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. Web the state income tax rate in tennessee is 0% while federal income.

Excel Paycheck Calculator Template

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Divide the sum of all applicable taxes by the employee’s gross pay. This number is the gross pay per pay period. Web use this calculator to estimate.

Paycheck Calculator Tn We’ll do the math for you—all you. In comparison, those earning over. Suta tax rates in tennessee range from 0.01% to 10% for established. Web calculate your net pay in tennessee for salary and hourly payment in 2023. Enter your info to see your take home pay.

Divide The Sum Of All Applicable Taxes By The Employee’s Gross Pay.

The result is the percentage. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). The gross pay in the hourly. Updated on dec 05 2023.

Web The State Income Tax Rate In Tennessee Is 0% While Federal Income Tax Rates Range From 10% To 37% Depending On Your Income.

Gross pay amount is earnings before taxes and deductions are withheld by the employer. Calculate your net salary jose january 9, 2024 · 7 min read legal & finance calculate your paycheck in 7 steps!. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

We’ll Do The Math For You—All You.

Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. Web calculate how your paycheck works what is gross pay? Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. In comparison, those earning over.

Web Determine If State Income Tax And Other State And Local Taxes And Withholdings Apply.

Enter your info to see your take home pay. Just enter the wages, tax withholdings and other. This number is the gross pay per pay period. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.