Paycheck Tax Calculator South Carolina

Paycheck Tax Calculator South Carolina - Free tool to calculate your hourly and salary income. Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known as the additional medicare tax. $13,850 for single or married filing separately. Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in south carolina, the calculator allows you to. Web you can quickly estimate your south carolina state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Web the standard deduction for 2023 is: We’ll do the math for you—all. Just enter the wages, tax withholdings and other. Web last year, more than 420,000 working individuals and families in south carolina received $1.1 billion in earned income tax credits (eitc), an average of $2,641. Enter your info to see your take home pay. Web the livable wage in south carolina for a couple (on working) with two children is $25.61, whereas for a single adult is $11.76., the average salary in south carolina. Simply enter their federal and.

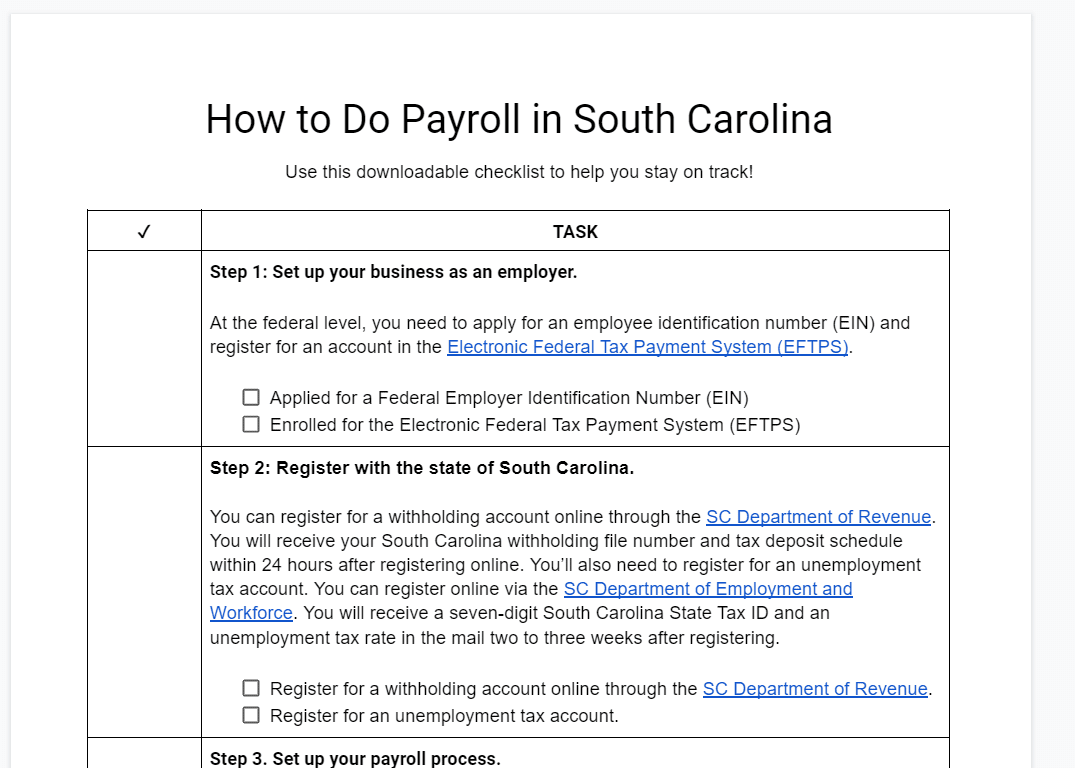

How to Do Payroll in South Carolina Everything Employers Need to Know

Free tool to calculate your hourly and salary income. Web payroll check calculator is updated for payroll year 2024 and new w4. $13,850 for single or married filing separately. Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in south.

Free South Carolina Paycheck Calculator 2024

Web the standard deduction for 2023 is: $27,700 for married couples filing jointly or qualifying surviving spouse. Web south carolina salary tax calculator for the tax year 2023/24. Updated on dec 05 2023. Your federal income tax withholdings are based on your. Web you can quickly estimate your south carolina state tax and federal tax.

A Complete Guide to South Carolina Payroll Taxes

Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in south carolina, the calculator allows you to. Enter your info to see your take home pay. $27,700 for married couples filing jointly or qualifying surviving spouse. Web south carolina salary.

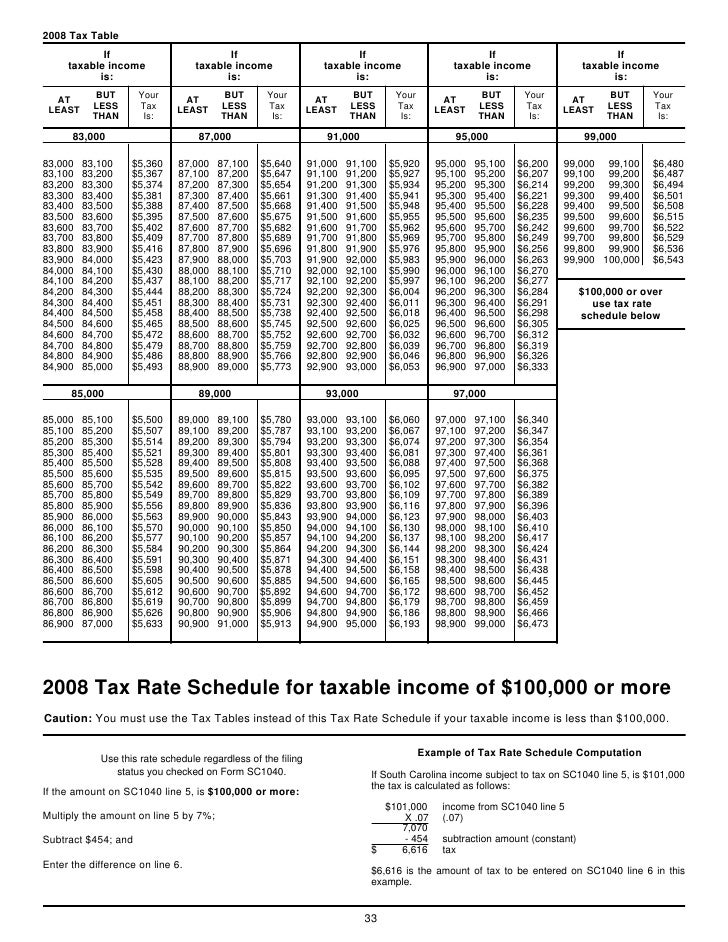

South Carolina Tax Tables

Web last year, more than 420,000 working individuals and families in south carolina received $1.1 billion in earned income tax credits (eitc), an average of $2,641. $27,700 for married couples filing jointly or qualifying surviving spouse. Web south carolina paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other.

SOUTH CAROLINA Individual Tax Fill Out and Sign Printable PDF

Web smartasset's south carolina paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web payroll check calculator is updated for payroll year 2024 and new w4. Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. You are able to.

9+ Taxes Calculator South Carolina MelvaBurt

Web if your gross pay is $62,542.00 per year in the state of south carolina, your net pay (or take home pay) will be $48,396 after tax deductions of 22.62% (or $14,145.83 ). Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025.

State Tax Rates and Brackets, 2021 Tax Foundation

Income level single married south carolina. Web the livable wage in south carolina for a couple (on working) with two children is $25.61, whereas for a single adult is $11.76., the average salary in south carolina. Web you can quickly estimate your south carolina state tax and federal tax by selecting the tax year, your.

South Carolina State Tax Tables 2023 US iCalculator™

It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll. Web payroll check calculator is updated for payroll year 2024 and new w4. $13,850 for single or married filing separately. Web if you earn over $200,000, you can expect an extra tax of.9% of your wages, known.

South Carolina Tax Tables

Enter your info to see your take home pay. Simply enter their federal and. Web south carolina paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web last year, more than 420,000 working individuals and families in south carolina received $1.1 billion in.

Tax Calculator Estimate Your Refund in Seconds for Free

Web smartasset's south carolina paycheck calculator shows your hourly and salary income after federal, state and local taxes. Your federal income tax withholdings are based on your. Web last year, more than 420,000 working individuals and families in south carolina received $1.1 billion in earned income tax credits (eitc), an average of $2,641. We’ll do.

Paycheck Tax Calculator South Carolina Web the standard deduction for 2023 is: Your federal income tax withholdings are based on your. Web south carolina paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Enter your info to see your take home pay. Free tool to calculate your hourly and salary income.

We’ll Do The Math For You—All.

Income level single married south carolina. Web last year, more than 420,000 working individuals and families in south carolina received $1.1 billion in earned income tax credits (eitc), an average of $2,641. Web the standard deduction for 2023 is: Web south carolina hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and.

Web South Carolina Paycheck Calculator Easily Estimate Take Home Pay After Income Tax So You Can Have An Idea Of What To Possibly Expect When Planning Your.

$13,850 for single or married filing separately. Web south carolina salary and tax calculator features the following features are available within this south carolina tax calculator for 2024: Just enter the wages, tax withholdings and other. Web payroll check calculator is updated for payroll year 2024 and new w4.

$27,700 For Married Couples Filing Jointly Or Qualifying Surviving Spouse.

Web use adp’s south carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web the livable wage in south carolina for a couple (on working) with two children is $25.61, whereas for a single adult is $11.76., the average salary in south carolina. You are able to use our south carolina state tax calculator to calculate your total tax costs in the tax year. Web the south carolina tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in south carolina, the calculator allows you to.

Simply Enter Their Federal And.

Enter your info to see your take home pay. Free tool to calculate your hourly and salary income. It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll. Updated on dec 05 2023.