Payroll Accrual Calculator

Payroll Accrual Calculator - Get an accurate picture of the employee’s gross. Web this calculator can help you find the amount to accrue for each accrual period and then calculate the total accrual over a date range. Web the key components of accrued payroll are salaries, wages, commissions, bonuses, and payroll taxes. How to calculate accrued payroll. Ideal for businessestax complianceunlimited payroll runsonline access anywhere

$15 x 20 = $200. Run payroll in minutessimple hr managementunlimited payroll runs Note the date on which you have calculated your payroll accrual. Salary and hourly wages gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions. Enter the number of hours your employee. Web how do i calculate payroll accrual? Web how do you calculate the payroll accrual?

How to Make a Payroll Accrual Calculator in Excel

Decide how much pto to provide employees. Accordingly, accrued payroll is how much the organization still has to pay its. 7.65% of $200 = $15.30. Get an accurate picture of the employee’s gross. Below are the detailed steps to calculate the payroll. Web how to calculate accrued payroll. Web the key components of accrued payroll.

Free Payroll Calculator Spreadsheet —

Calculate your fica tax expense: Web the pto accrual rate is how much pto an employee earns over a given period. Web it could be “one day off per two weeks worked” or “one hour earned for every 25 hours worked” — the exact accrual rate is up to your organization. Accordingly, accrued payroll is.

Payroll Accrual 3 Steps to Calculate Eddy

Web this calculator can help you find the amount to accrue for each accrual period and then calculate the total accrual over a date range. Web it could be “one day off per two weeks worked” or “one hour earned for every 25 hours worked” — the exact accrual rate is up to your organization..

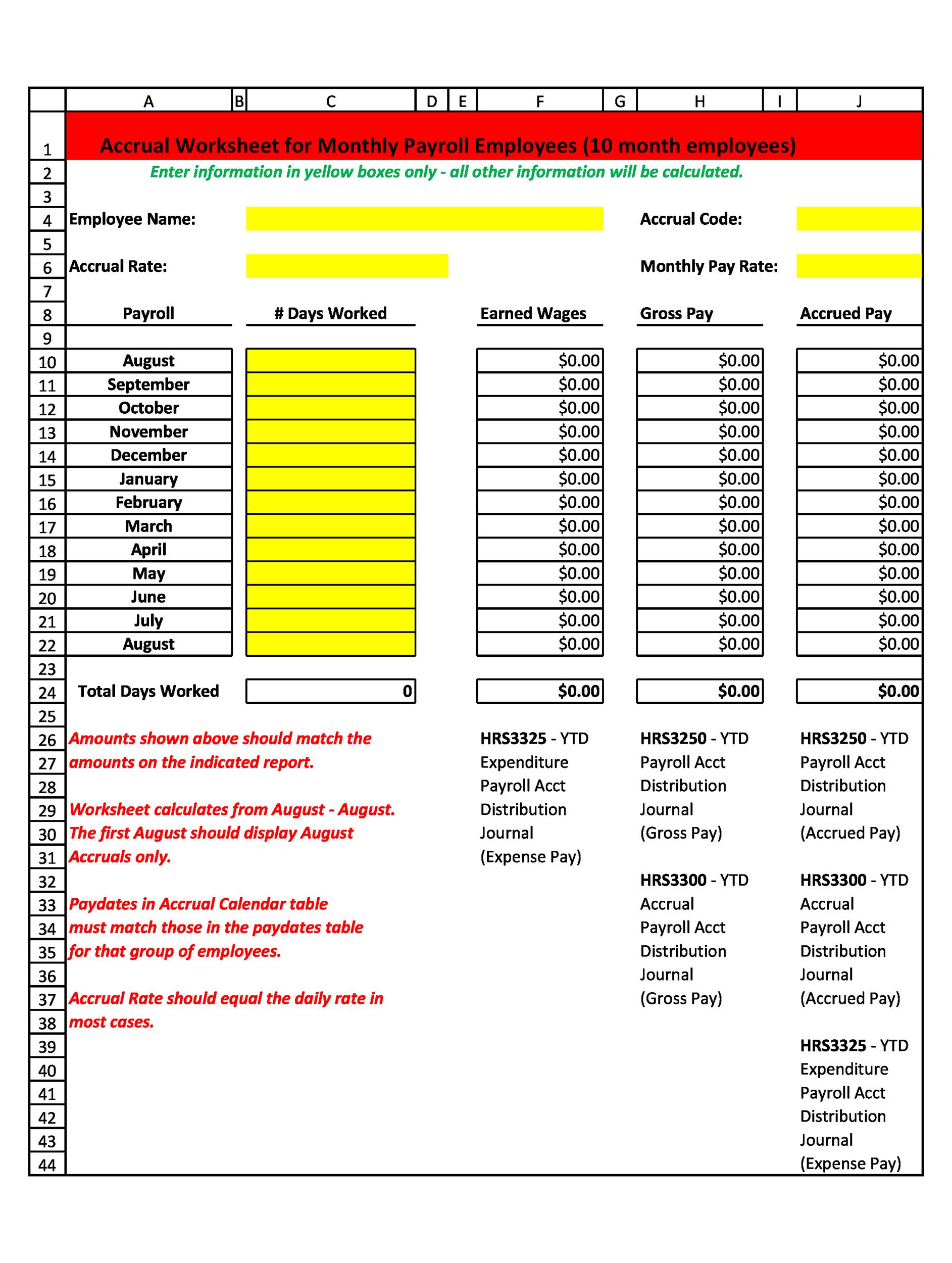

How to Make a Payroll Accrual Calculator in Excel

You can choose to enter the accrual rate per week, month, or year. Accordingly, accrued payroll is how much the organization still has to pay its. To calculate accrued payroll, count the amount of hours your employees worked since the last day they were paid. Web if you start with zero and put away $135.

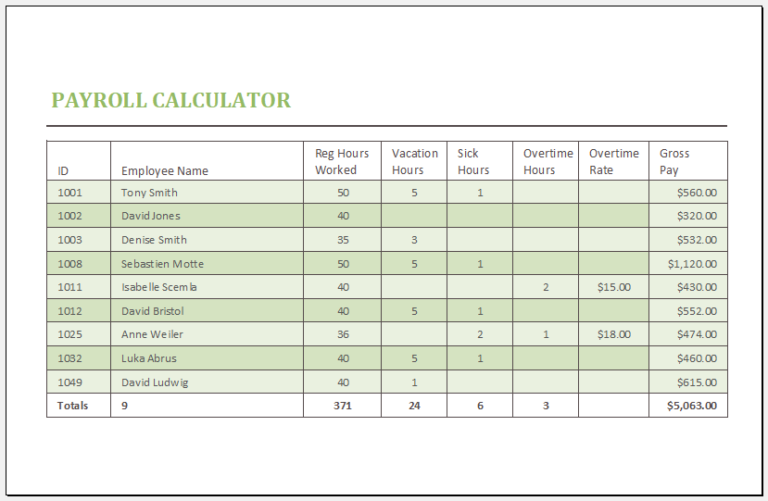

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Note the date on which you have calculated your payroll accrual. Ideal for businessestax complianceunlimited payroll runsonline access anywhere The first step of this procedure verily emphasizes setting up the employee dataset carefully. Web how do you calculate the payroll accrual? Get an accurate picture of the employee’s gross. Run payroll in minutessimple hr managementunlimited.

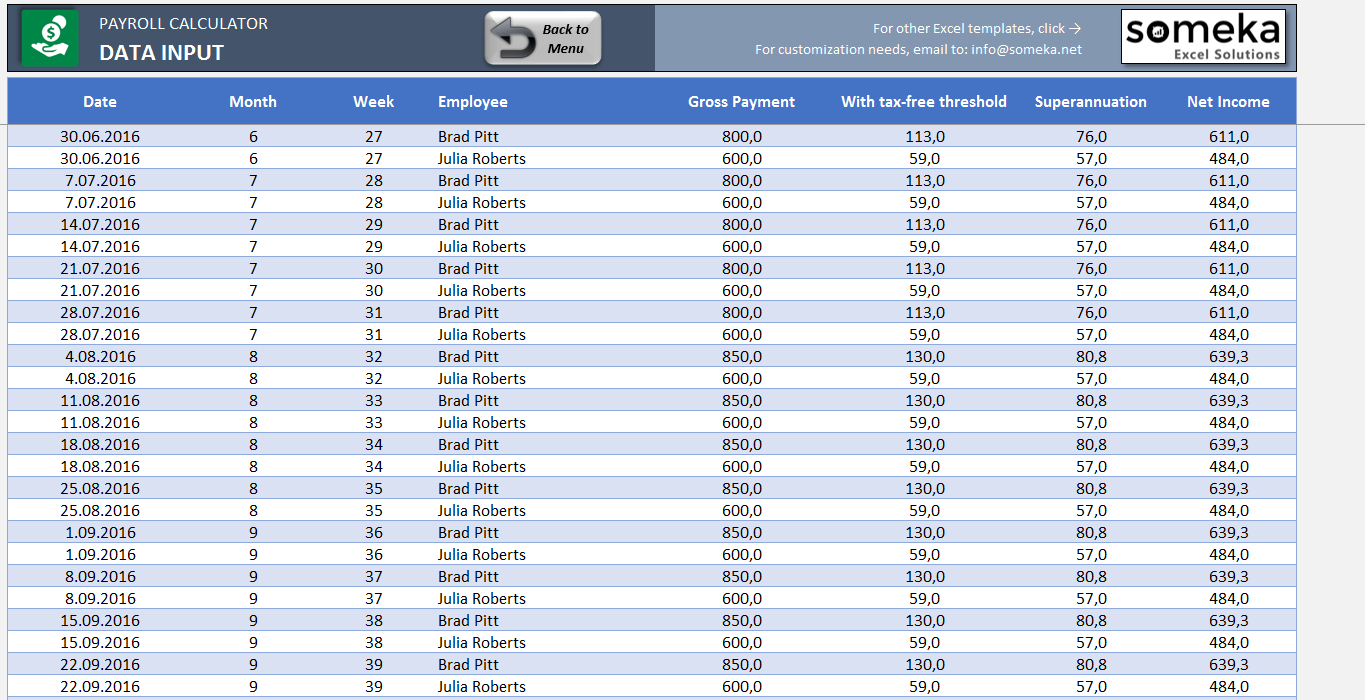

Payroll Calculator Template for MS Excel Excel Templates

Web add the amounts of unpaid wages or salaries for all of your employees to calculate your total payroll accrual. Web 80 pto hours / 2000 total hours = 0.04. Web this calculator can help you find the amount to accrue for each accrual period and then calculate the total accrual over a date range..

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Web add the amounts of unpaid wages or salaries for all of your employees to calculate your total payroll accrual. Futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. Web multiply the hourly rate by unpaid work hours to get the employee’s gross.

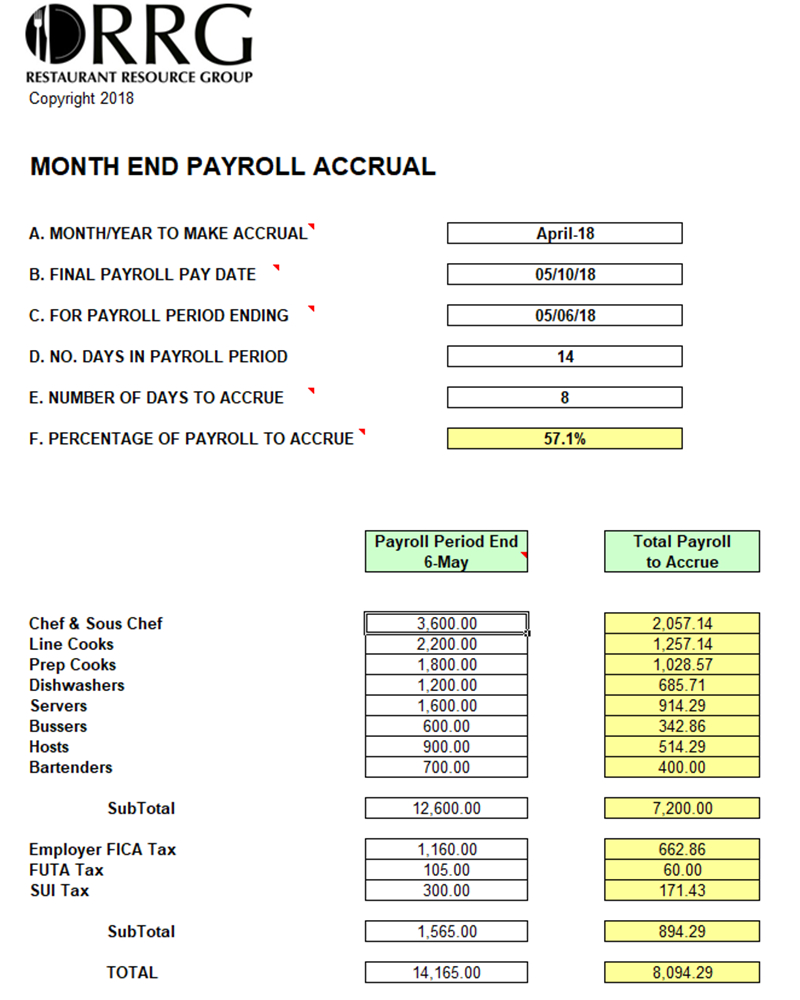

Payroll Accrual Spreadsheet 1 Printable Spreadshee payroll accrual

Web multiply the hourly rate by unpaid work hours to get the employee’s gross pay: Web it could be “one day off per two weeks worked” or “one hour earned for every 25 hours worked” — the exact accrual rate is up to your organization. Decide how much pto to provide employees. Calculate your fica.

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

How to calculate accrued payroll. 7.65% of $200 = $15.30. Web it could be “one day off per two weeks worked” or “one hour earned for every 25 hours worked” — the exact accrual rate is up to your organization. The first step of this procedure verily emphasizes setting up the employee dataset carefully. Web.

How to Create Payroll Calculator in Excel (with Easy Steps)

Salary and hourly wages gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions. Web monthly calculating pto accrual rates to correctly calculate pto, your policy will determine how many hours your employees can potentially accrue each year. Web paying more than the minimum helps reduce debt faster while.

Payroll Accrual Calculator Salary and hourly wages gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions. Futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. Decide how much pto to provide employees. Ideal for businessestax complianceunlimited payroll runsonline access anywhere $15 x 20 = $200.

Accordingly, Accrued Payroll Is How Much The Organization Still Has To Pay Its.

In this article, i will show you how to make a payroll accrual calculator in. Salary and hourly wages gross wages are an employee’s total compensation before payroll deductions, such as taxes and retirement contributions. 7.65% of $200 = $15.30. Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you.

Web How Do You Calculate The Payroll Accrual?

To calculate accrued payroll, count the amount of hours your employees worked since the last day they were paid. Calculate your fica tax expense: Web to calculate the payroll accrual all we need is to sum up the gross pay, allowances, and off time pay. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings.

Ideal For Businessestax Complianceunlimited Payroll Runsonline Access Anywhere

Financial managementoptimal erp solutionfree demodcaa compliance Web the pto accrual rate is how much pto an employee earns over a given period. Web add the amounts of unpaid wages or salaries for all of your employees to calculate your total payroll accrual. Web payroll accrual refers to money that is due to your employees but has not yet been paid.

The Standard Futa Tax Rate.

The first step of this procedure verily emphasizes setting up the employee dataset carefully. Note the date on which you have calculated your payroll accrual. Web how do i calculate payroll accrual? Web how to calculate accrued payroll.