Payroll Burden Calculator

Payroll Burden Calculator - Find suta tax rate information. Web futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. Payroll burden rate = indirect costs/direct costs x 100. The right software reduces stress and a heavy administrative lift. Web to calculate the labor burden rate, you divide the indirect costs by the direct cost of payroll, and you include the benefits and payroll taxes on an employee's wages.

Web how much are your employees’ wages after taxes? Web calculate your labor burden for each employee by adding payroll taxes, workers compensation, health insurance and other overhead costs. Find suta tax rate information. Web accounting & bookkeeping | payroll by laura chapman updated march 01, 2019 payroll burdens for an employer are more than simply the wages. For more information, see our. Web futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. After collecting all relevant cost.

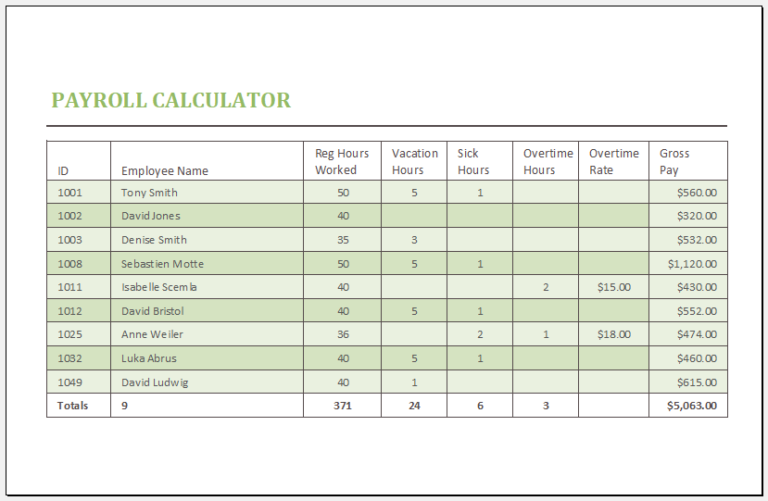

Payroll Calculator Template for MS Excel Excel Templates

When calculating the burden for salaried employees, divide the annual wage. Web accounting & bookkeeping | payroll by laura chapman updated march 01, 2019 payroll burdens for an employer are more than simply the wages. Web the burden rate calculator is a financial tool used by businesses to determine the total labor cost associated with.

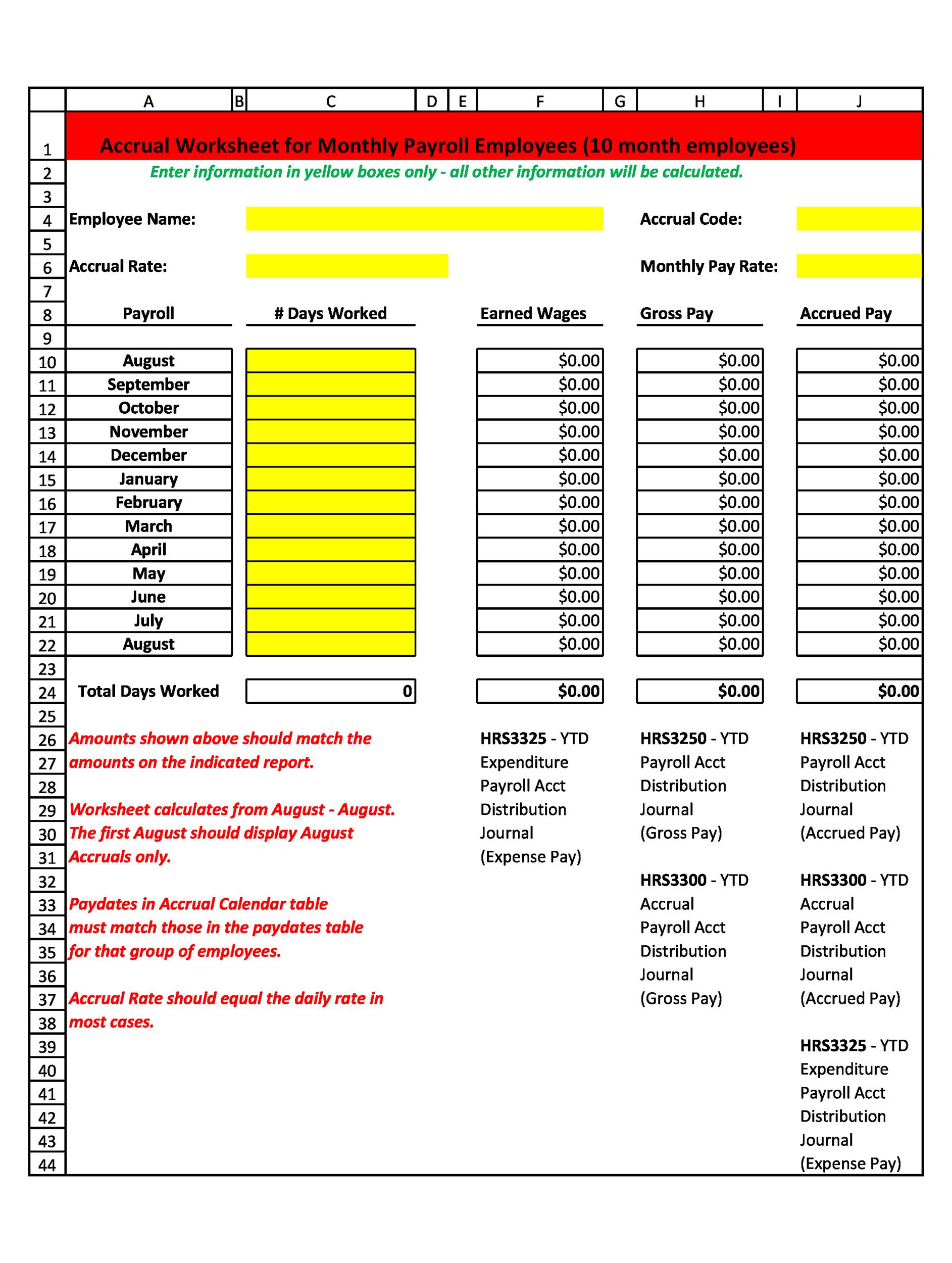

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web to get the payroll burden rate, indirect costs are divided by the direct costs as follows: Find suta tax rate information. Web accounting & bookkeeping | payroll by laura chapman updated march 01, 2019 payroll burdens for an employer are more than simply the wages. Labor burden rate = $8.02 / $20.00 x 100.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Find suta tax rate information. Web payroll tax management is crucial to a business’s compliance. Web calculate your labor burden for each employee by adding payroll taxes, workers compensation, health insurance and other overhead costs. It’s 2024—and if you’re part of your company’s human resources department, it’s time to refine your payroll. Web accounting &.

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

It’s 2024—and if you’re part of your company’s human resources department, it’s time to refine your payroll. Web $10,000 / $40,000 = $0.25 the burden rate is $0.25. Web updated december 5, 2023 payroll burden is an essential concept for employers to understand when evaluating the true cost of hiring and maintaining employees. You calculate.

Payroll Calculator Template for MS Excel Word & Excel Templates

You calculate payroll burden by first discovering two pieces of information: The right software reduces stress and a heavy administrative lift. Web how do you calculate payroll burden? Web $10,000 / $40,000 = $0.25 the burden rate is $0.25. After collecting all relevant cost. Web january 31, 2023 does the term “payroll burden” ring a.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

If this employee’s pay frequency is weekly the calculation is: The right software reduces stress and a heavy administrative lift. Web january 31, 2023 does the term “payroll burden” ring a bell to you? Web futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Web futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. Find suta tax rate information. The right software reduces stress and a heavy administrative.

Sample Payroll Tax Calculator 7+ Free Documents in PDF, Excel

The right software reduces stress and a heavy administrative lift. 7 steps to calculate your labor burden, calculate. How to calculate your labor burden rate. For more information, see our. When calculating the burden for salaried employees, divide the annual wage. Web to calculate the labor burden rate, you divide the indirect costs by the.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web calculate your labor burden for each employee by adding payroll taxes, workers compensation, health insurance and other overhead costs. Payroll burden rate = indirect costs/direct costs x 100. Web updated december 5, 2023 payroll burden is an essential concept for employers to understand when evaluating the true cost of hiring and maintaining employees. How.

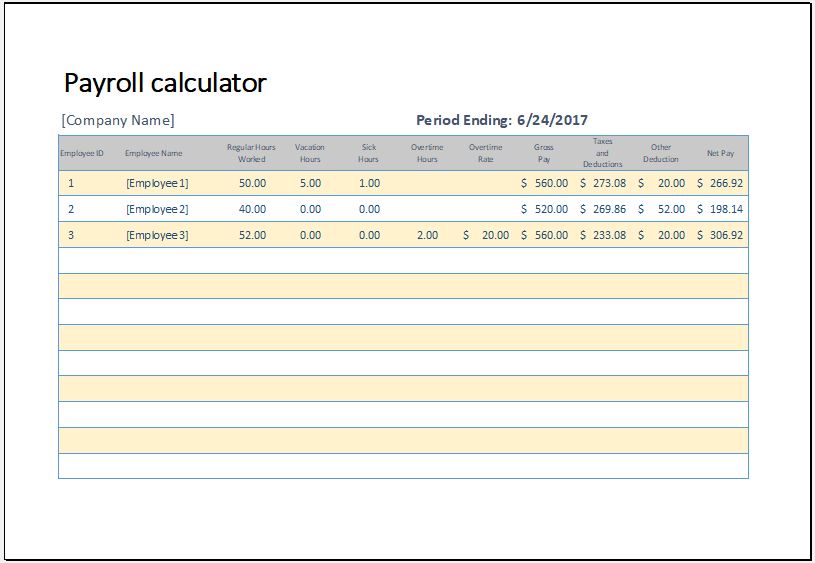

Employee Payroll Calculator »

It’s 2024—and if you’re part of your company’s human resources department, it’s time to refine your payroll. Web your labor burden rate is your indirect costs divided by your direct costs, expressed as a percentage: Web the burden rate calculator is a financial tool used by businesses to determine the total labor cost associated with.

Payroll Burden Calculator Web to calculate the labor burden rate, you divide the indirect costs by the direct cost of payroll, and you include the benefits and payroll taxes on an employee's wages. Web your labor burden rate is your indirect costs divided by your direct costs, expressed as a percentage: Web january 31, 2023 does the term “payroll burden” ring a bell to you? Web the calculation for payroll burden begins with the hourly wage of the employee. You calculate payroll burden by first discovering two pieces of information:

Web The Calculation For Payroll Burden Begins With The Hourly Wage Of The Employee.

Labor burden rate = $8.02 / $20.00 x 100 = 40.11%$8.02 /. Web if you would like to see what your own employee hourly cost is try our free online hourly cost calculator. Web to get the payroll burden rate, indirect costs are divided by the direct costs as follows: It’s 2024—and if you’re part of your company’s human resources department, it’s time to refine your payroll.

Web How Much Are Your Employees’ Wages After Taxes?

After collecting all relevant cost. Web futa’s maximum taxable earnings, what’s called a “wage base,” is $7,000 — anything an employee earns beyond that amount isn’t taxed. Payroll burden rate = indirect costs/direct costs x 100. Web accounting & bookkeeping | payroll by laura chapman updated march 01, 2019 payroll burdens for an employer are more than simply the wages.

When Calculating The Burden For Salaried Employees, Divide The Annual Wage.

How to calculate your labor burden rate. For more information, see our. Web $10,000 / $40,000 = $0.25 the burden rate is $0.25. Find suta tax rate information.

Web The Burden Rate Calculator Is A Financial Tool Used By Businesses To Determine The Total Labor Cost Associated With Each Employee, Including Both Direct Wages Or Salaries And.

The right software reduces stress and a heavy administrative lift. If this employee’s pay frequency is weekly the calculation is: How much you are paying an employee as a. 7 steps to calculate your labor burden, calculate.