Payroll Calculator Idaho

Payroll Calculator Idaho - Web id (us) tax 2024 idaho paycheck calculator use icalculator™ us's paycheck calculator tailored for idaho to determine your net income per paycheck. Simply input salary details, benefits and deductions, and any other. How your idaho paycheck works in idaho, employers are. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Calculating your idaho state income tax is similar to the steps we listed on our federal paycheck calculator:

Use a free paycheck calculator to gain insights to your 401k and financial future. Just enter the wages, tax. Web tip tax calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Calculating your idaho state income tax is similar to the steps we listed on our federal paycheck calculator: Surepayroll.com has been visited by 10k+ users in the past month Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Top 6 Free Payroll Calculators free paycheck calculator app TimeCamp

Web idaho hourly paycheck calculator. Web use idaho paycheck calculator to estimate net or “take home” pay for salaried employees. Just enter the wages, tax. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Idaho offers two income tax.

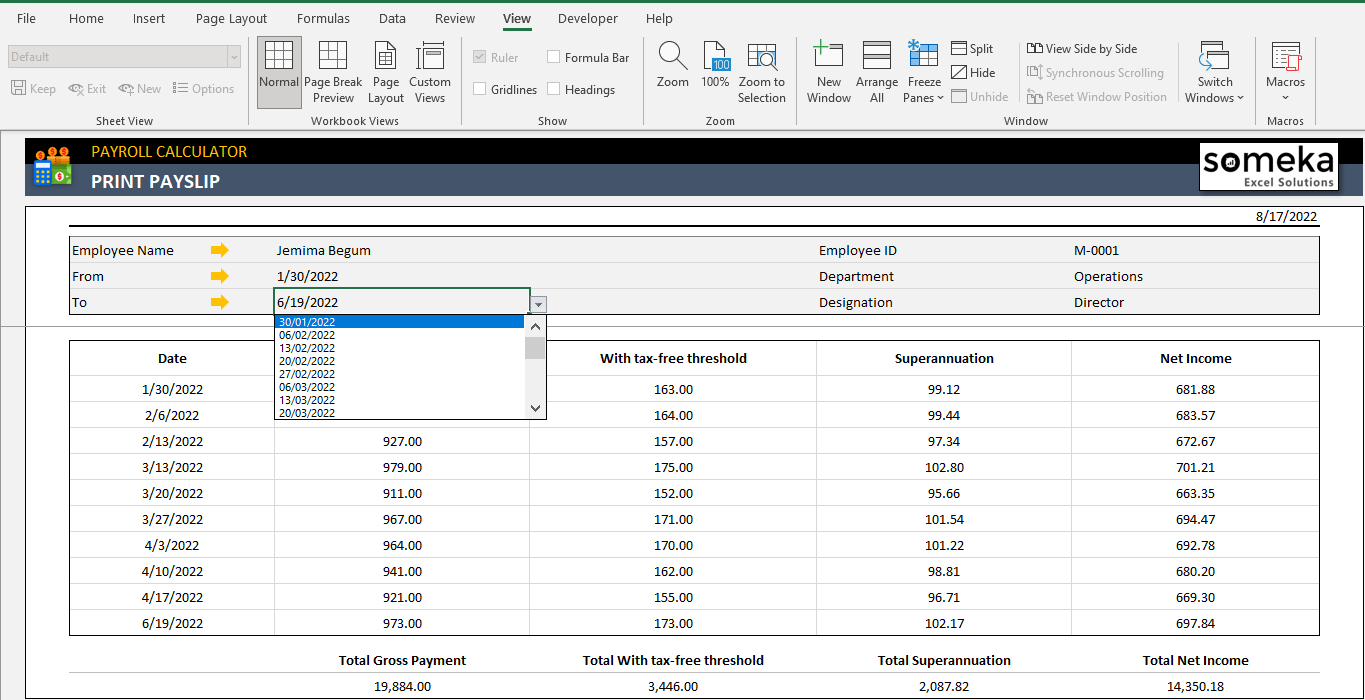

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Web idaho paycheck and payroll calculator. Use adp’s idaho paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Calculating your idaho state income tax is similar to the steps we listed on our federal paycheck calculator: You can also access historic tax. Take home pay is calculated based on.

Free Idaho Paycheck Calculator 2023

Simply input salary details, benefits and deductions, and any other. Web use idaho paycheck calculator to estimate net or “take home” pay for salaried employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Free 24hr direct depositautomated tax.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

You can also access historic tax. Last updated on february 08, 2024) enter your period or annual income together with the necessary federal, state,. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Idaho offers two income tax brackets, spanning from 0.00% to 5.80%. Fortunately, residents of idaho can.

2019 Payroll in Excel Idaho Weekly Edition YouTube

Web idaho payroll calculator 2024. Web new updates to the 2023 and 2024 401k contribution limits. Web tip tax calculator. Web idaho paycheck and payroll calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Just enter the wages,.

22+ Idaho Paycheck Calculator RoyceXavior

It will calculate net paycheck amount that an employee will receive based. Web tip tax calculator. Web building fees calculator; Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Simply input salary details, benefits and deductions, and any other..

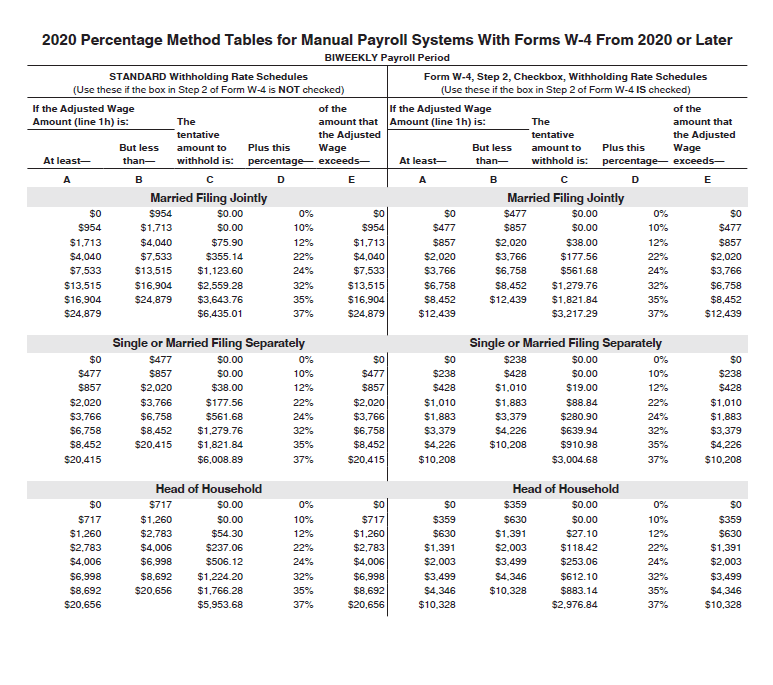

Idaho State Withholding Tables 2021 2022 W4 Form

Web the results are broken up into three sections: It will calculate net paycheck amount that an employee will receive based. Web idaho paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Calculate payroll costs for up to 20 employees in idaho in.

Idaho Small Business Payroll Software YouTube

Free 24hr direct depositautomated tax calculationpay your teamhappy employees Web idaho paycheck and payroll calculator. Your free and reliable idaho. Web fill out our contact form or call. Web id (us) tax 2024 idaho paycheck calculator use icalculator™ us's paycheck calculator tailored for idaho to determine your net income per paycheck. Web tip tax calculator..

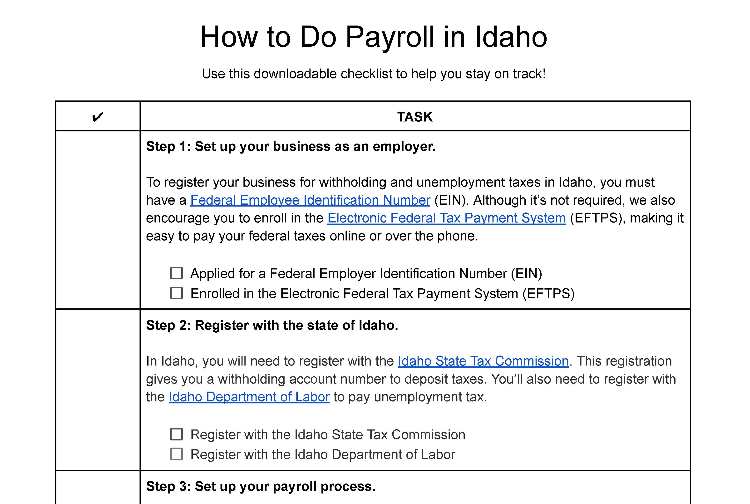

How to Do Payroll in Idaho What Business Owners Need to Know

Use a free paycheck calculator to gain insights to your 401k and financial future. Calculating your idaho state income tax is similar to the steps we listed on our federal paycheck calculator: Web building fees calculator; Web idaho hourly paycheck calculator. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck.

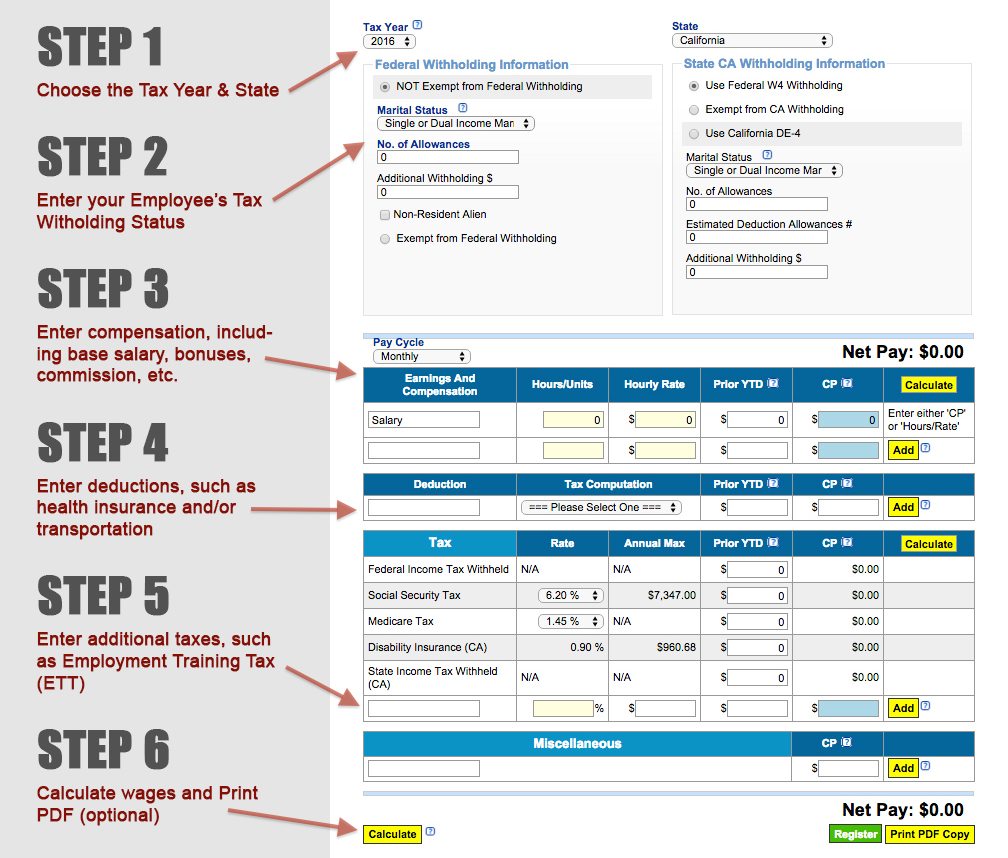

How to Use a Free Payroll Calculator

Web new updates to the 2023 and 2024 401k contribution limits. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web idaho payroll calculator 2024. Web use idaho paycheck calculator to estimate net or “take home” pay for salaried employees. Take home pay is calculated based on up to.

Payroll Calculator Idaho Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Web fill out our contact form or call. Web idaho paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web new updates to the 2023 and 2024 401k contribution limits. Web idaho payroll calculator 2024.

How Your Idaho Paycheck Works In Idaho, Employers Are.

You can find detailed information on. Idaho offers two income tax brackets, spanning from 0.00% to 5.80%. Use our easy payroll tax calculator to quickly run payroll in idaho, or look. Payroll check calculator is updated for payroll year 2024 and new w4.

Calculate Payroll Costs For Up To 20 Employees In Idaho In 2024 For Free (View Alternate Tax Years Available).

Use adp’s idaho paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Calculating your idaho state income tax is similar to the steps we listed on our federal paycheck calculator: Just enter the wages, tax. Web the results are broken up into three sections:

Web Idaho Paycheck And Payroll Calculator.

Web idaho payroll calculator 2024. Web new updates to the 2023 and 2024 401k contribution limits. Fortunately, residents of idaho can rest assured knowing that they are exempt. Web use idaho paycheck calculator to estimate net or “take home” pay for salaried employees.

Web Idaho Paycheck Calculator For Salary & Hourly Payment 2023 Curious To Know How Much Taxes And Other Deductions Will Reduce Your Paycheck?

Web tip tax calculator. Web fill out our contact form or call. Web idaho hourly paycheck calculator. Surepayroll.com has been visited by 10k+ users in the past month