Payroll Calculator Kansas

Payroll Calculator Kansas - File taxesrun payrollaccounting toolstax deductions Payroll check calculator is updated for payroll year 2024 and new w4. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). The results are broken up into three sections: Enter your info to see your take home pay.

Last updated on february 05, 2024) by entering your period or yearly income together with the relevant federal, state, and local w4 information, you. Enter your info to see your take home pay. The results are broken up into three sections: The sunflower state has a progressive income tax system where the income taxes are relatively low compared to. Free 24hr direct depositsend estimatesautomated tax calculationtrack inventory Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. Web kansas hourly paycheck calculator results.

Kansas Paycheck Calculator 2023

Web fill out our contact form or call. Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and local taxes. This applies to various salary. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas.

Payroll Withholding Calculator Kansas City CPA Firm

Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web use adp’s kansas paycheck calculator to assess net or “take home” salary for either hourly or salaried employees. Paycheck results is your gross. Web use kansas paycheck calculator to estimate net or “take home” pay for salaried.

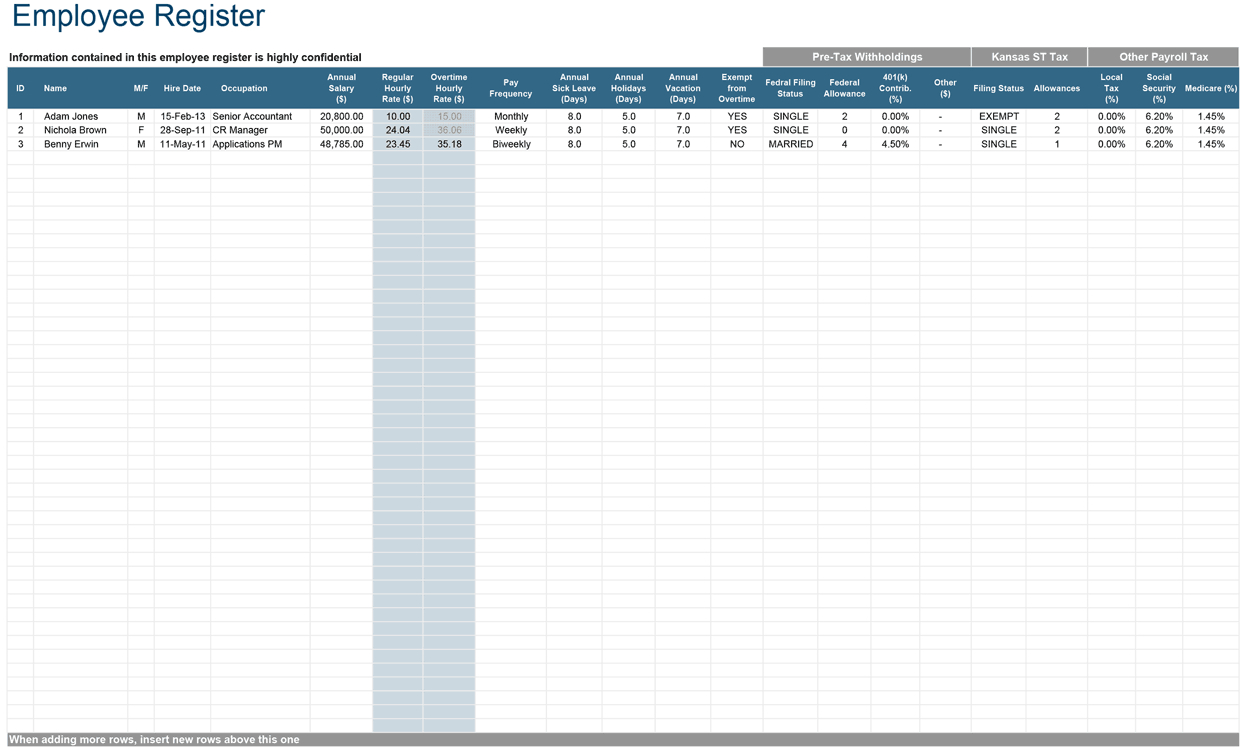

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

These kansas state government jobs pay around or more than the median household income in sedgwick county. Kansas has two personal income tax brackets. Just enter the salaries and a few basic data. A bipartisan proposal to raise kansas lawmakers’ pay by 93% took effect wednesday without holding a vote, making their compensation higher than..

AymiRavjot

We’ll do the math for you—all you. A bipartisan proposal to raise kansas lawmakers’ pay by 93% took effect wednesday without holding a vote, making their compensation higher than. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web when it comes to pay for the super bowl, it.

Payroll calculator Evidentrust Financial Services Ltd

Web calculate does kansas have state income tax? Paycheck results is your gross. A bipartisan proposal to raise kansas lawmakers’ pay by 93% took effect wednesday without holding a vote, making their compensation higher than. Updated on dec 05 2023. Web smartasset's kansas paycheck calculator shows your hourly and salary income after federal, state and.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Yes, kansas residents pay state income tax. Web use kansas paycheck calculator to estimate net or “take home” pay for salaried employees. Web kansas employers can use the calculator at the top of this page to quickly calculate their employees’ gross pay, net pay, and deductions in a few clicks. We’ll do the math for.

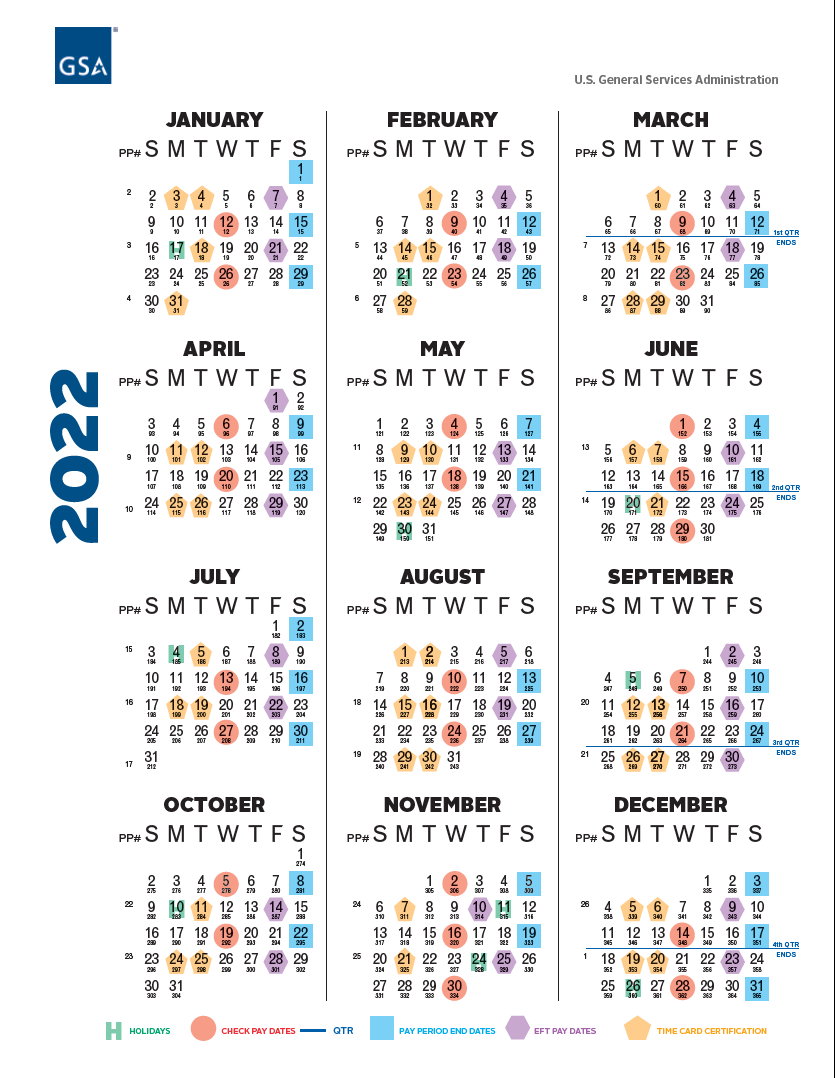

2023 Payroll Calculator Kansas Payroll Schedule

Web calculate does kansas have state income tax? Web when it comes to pay for the super bowl, it doesn't matter whether the kansas city chiefs or san francisco 49ers are the winners, their players will still get paid tens of. Yes, kansas residents pay state income tax. A bipartisan proposal to raise kansas lawmakers’.

Payroll Budget Spreadsheet for Example Of Payroll Budget Spreadsheet

The kansas payroll calculator will then produce your payroll cost calculation. Web kansas hourly paycheck calculator results. Web use adp’s kansas paycheck calculator to assess net or “take home” salary for either hourly or salaried employees. Yes, kansas residents pay state income tax. Web (tax year 2024: Kansas has two personal income tax brackets. Web.

Kansas Paycheck Calculator 2023 2024

Web looking for a new gig? Enter your info to see your take home pay. Web kansas paycheck and payroll calculator. Simply input salary details, benefits and deductions, and any other. Kansas has two personal income tax brackets. Web calculate does kansas have state income tax? Web when it comes to pay for the super.

Payroll Calculator Free Employee Payroll Template for Excel

Web looking for a new gig? Web kansas paycheck calculator use icalculator™ us's paycheck calculator tailored for kansas to determine your net income per paycheck. Web kansas hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local..

Payroll Calculator Kansas Web when it comes to pay for the super bowl, it doesn't matter whether the kansas city chiefs or san francisco 49ers are the winners, their players will still get paid tens of. Web use adp’s kansas paycheck calculator to assess net or “take home” salary for either hourly or salaried employees. Yes, kansas residents pay state income tax. Web kansas paycheck calculator use icalculator™ us's paycheck calculator tailored for kansas to determine your net income per paycheck. Web fill out our contact form or call.

Web Kansas Employers Can Use The Calculator At The Top Of This Page To Quickly Calculate Their Employees’ Gross Pay, Net Pay, And Deductions In A Few Clicks.

Web (tax year 2024: Just enter the salaries and a few basic data. Web february 8, 2024 1:36 pm. Web kansas paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

Web Check Our The Us Tax Hub For Kansas And Discover How Each Kansas Tax Calculator Provides The Same High Level Of Detailed Calculations Of Pay But Is Taiolred To Allow You To.

This applies to various salary. Web fill out our contact form or call. A bipartisan proposal to raise kansas lawmakers’ pay by 93% took effect wednesday without holding a vote, making their compensation higher than. Use adp’s kansas paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

We’ll Do The Math For You—All You.

Simply input salary details, benefits and deductions, and any other. Web use adp’s kansas paycheck calculator to assess net or “take home” salary for either hourly or salaried employees. Web kansas paycheck calculator use icalculator™ us's paycheck calculator tailored for kansas to determine your net income per paycheck. The results are broken up into three sections:

Understanding And Getting Familiar With Payroll Deductions And Payroll Costs.

Web looking for a new gig? Updated on dec 05 2023. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount.