Payroll Calculator Rhode Island

Payroll Calculator Rhode Island - Web rhode island paycheck calculator generate paystubs with accurate rhode island state tax withholding calculations. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for. For example, if an employee receives. Use this rhode island gross pay calculator to gross up wages based on net pay. Enter your info to see your take home pay.

Web use rhode island paycheck calculator to estimate net or “take home” pay for salaried employees. How many income tax brackets are there in rhode island?. Paycheck results is your gross pay and specific deductions from your. Web new updates to the 2023 and 2024 401k contribution limits. Web smartasset's rhode island paycheck calculator shows your hourly and salary income after federal, state and local taxes. Enter your info to see your take home pay. Use this rhode island gross pay calculator to gross up wages based on net pay.

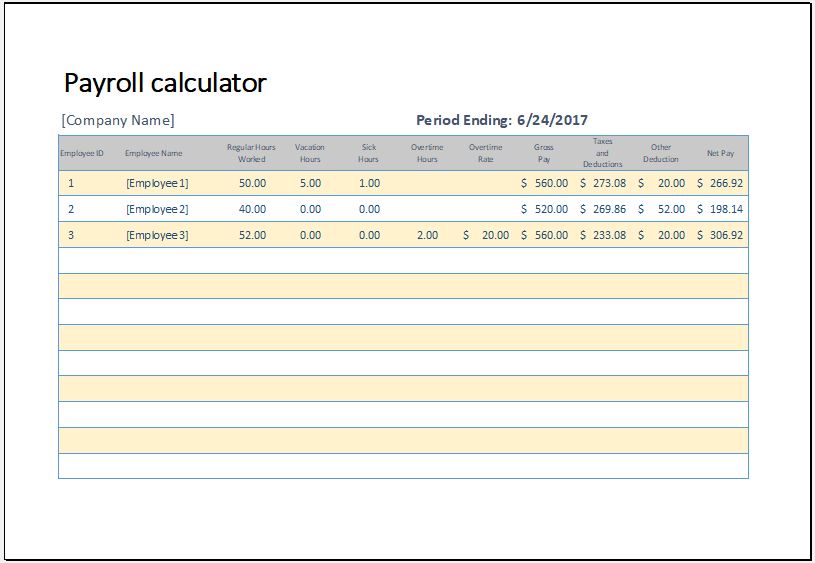

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Gusto.com has been visited by 100k+ users in the past month You can do it after taking into account. Use this rhode island gross pay calculator to gross up wages based on net pay. Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that.

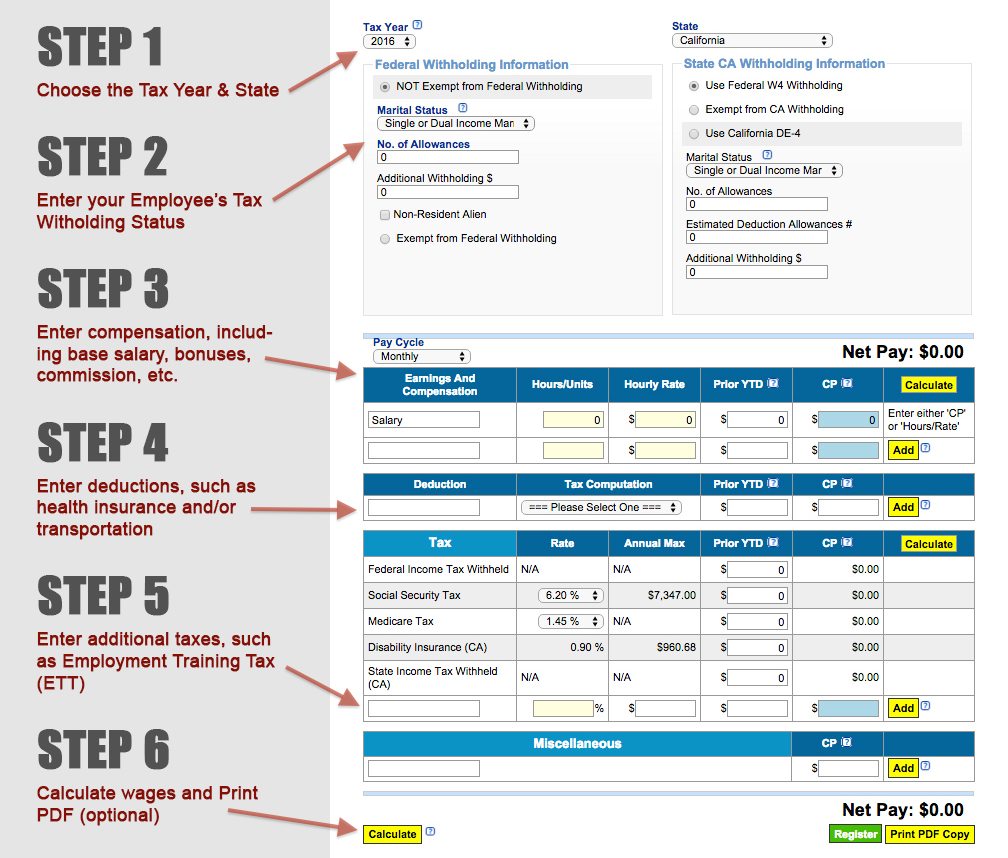

How to Use a Free Payroll Calculator

Web rhode island paycheck and payroll calculator. Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Quickfacts provides statistics for all states and counties. Paycheck results is your gross pay and specific deductions.

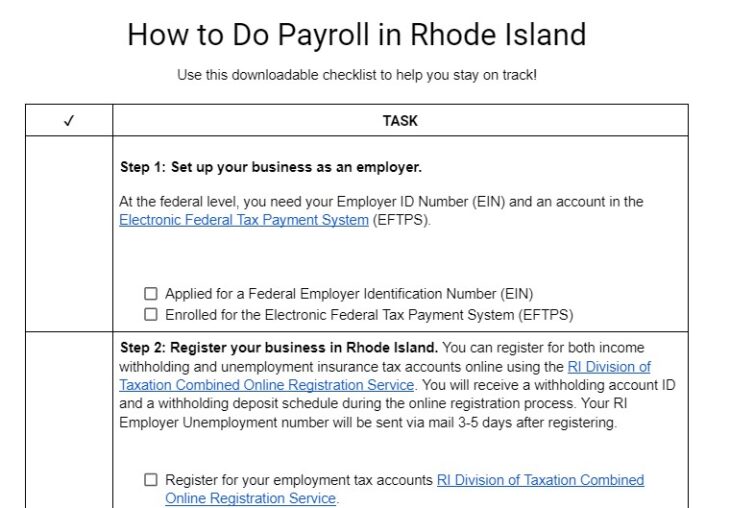

How to Do Payroll in Rhode Island A StepbyStep Guide Human Resource

Simply input salary details, benefits and deductions, and any. Total annual payroll, 2021 ($1,000). Web rhode island paycheck calculator advertiser disclosure rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and. Just enter the wages, tax withholdings and other. Web use our simple paycheck calculator to estimate your.

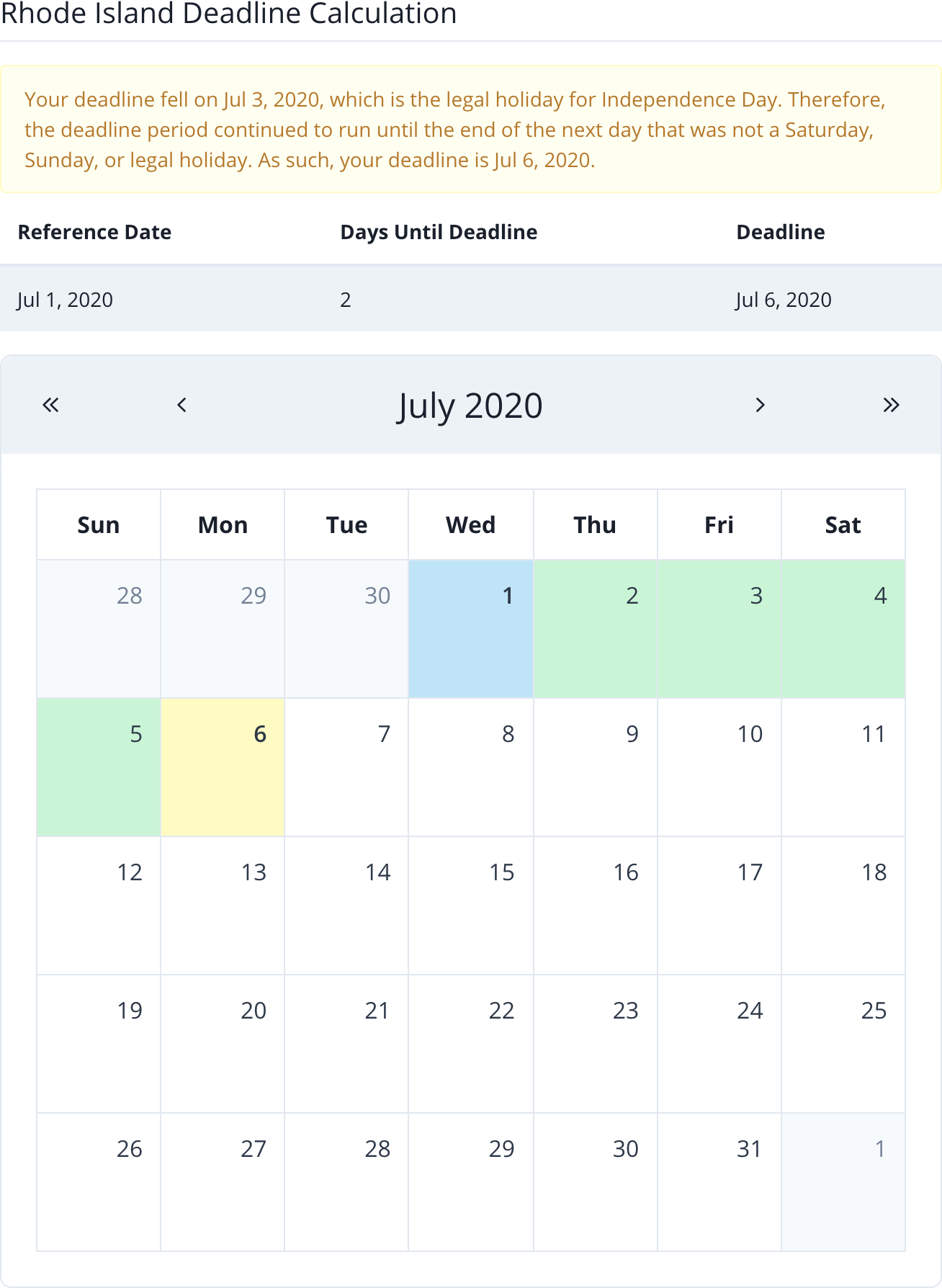

Calculating Rhode Island Deadlines Legal Calculators

Web by using netchex’s rhode island paycheck calculator, discover in just a few steps what your anticipated paycheck will look like. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in rhode island. Web use rhode island paycheck calculator to estimate net.

Top 5 Free Payroll Calculators TimeCamp

4/5 (1,006 reviews) Paycheck results is your gross pay and specific deductions from your. The results are broken up into three sections: Web by using netchex’s rhode island paycheck calculator, discover in just a few steps what your anticipated paycheck will look like. Web rhode island paycheck and payroll calculator. Web use adp’s rhode island.

Payroll in Rhode Island What Every Employer Needs to Know

You can do it after taking into account. Web new updates to the 2023 and 2024 401k contribution limits. Web this paycheck calculator can help estimate your take home pay and your average income tax rate. Web below are your rhode island salary paycheck results. Web below are your rhode island salary paycheck results. For.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in rhode island. Web this paycheck calculator can help estimate your take home pay and your average income tax rate. Web rhode island paycheck calculator generate paystubs with accurate rhode island state tax.

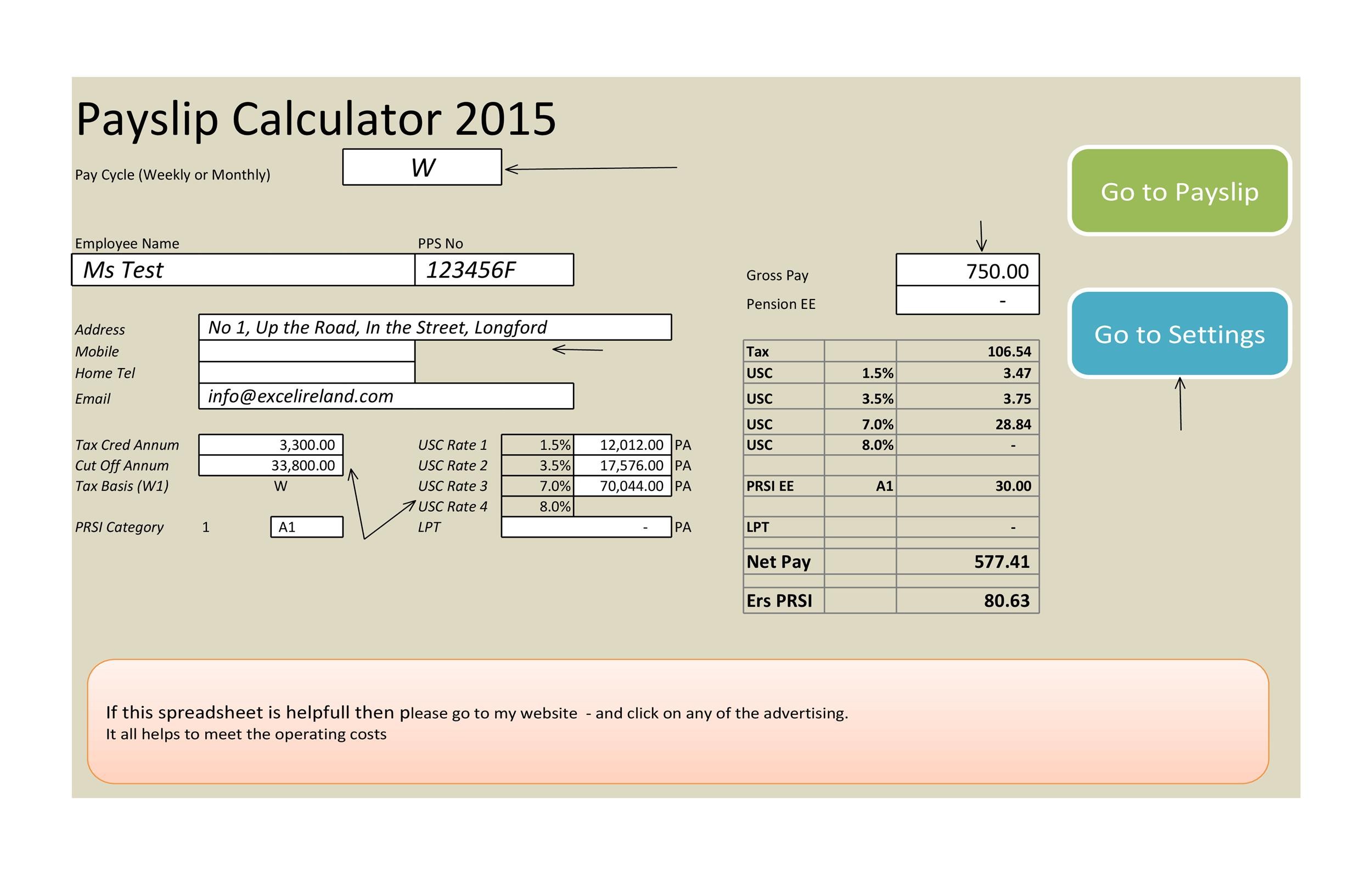

Payroll Calculator Template for MS Excel Word & Excel Templates

For example, if an employee receives. No api key found rhode island paycheck. The results are broken up into three sections: Use a free paycheck calculator to gain insights to your 401k and financial future. Web rhode island paycheck calculator generate paystubs with accurate rhode island state tax withholding calculations. How many income tax brackets.

Top 6 Free Payroll Calculators free paycheck calculator app TimeCamp

Web smartasset's rhode island paycheck calculator shows your hourly and salary income after federal, state and local taxes. Simply input salary details, benefits and deductions, and any. Web rhode island paycheck calculator advertiser disclosure rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and. Enter your info to.

Gs Pay Scale 2021 Rhode Island GS Pay Scale 2022/2023

Web below are your rhode island salary paycheck results. No api key found rhode island paycheck. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for. Web it will calculate net paycheck amount that an employee will receive based.

Payroll Calculator Rhode Island Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Simply input salary details, benefits and deductions, and any. Web rhode island paycheck calculator advertiser disclosure rhode island paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and. Also for cities and towns with a population of 5,000 or more. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount.

Web Use Adp’s Rhode Island Paycheck Calculator To Estimate Net Or “Take Home” Pay For Either Hourly Or Salaried Employees.

Gusto.com has been visited by 100k+ users in the past month Quickfacts provides statistics for all states and counties. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in rhode island. Just enter the wages, tax withholdings and other.

Web It Will Calculate Net Paycheck Amount That An Employee Will Receive Based On The Total Pay (Gross) Payroll Amount And Employee's W4 Filing Conditions, Such Us Marital Status,.

Web below are your rhode island salary paycheck results. Web use rhode island paycheck calculator to estimate net or “take home” pay for salaried employees. Paycheck results is your gross pay and specific deductions from your. Free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount.

Use This Rhode Island Gross Pay Calculator To Gross Up Wages Based On Net Pay.

Web rhode island hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Alabama alaska arizona arkansas california colorado. How many income tax brackets are there in rhode island?. Web you can use our rhode island payroll calculator to figure out your employees’ federal withholding as well as any additional taxes you are responsible for.

You Can Do It After Taking Into Account.

The results are broken up into three sections: Web new updates to the 2023 and 2024 401k contribution limits. Web this paycheck calculator can help estimate your take home pay and your average income tax rate. Web rhode island paycheck and payroll calculator.