Payroll Calculator Va

Payroll Calculator Va - The new w4 asks for a dollar amount. Web use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Here’s how to calculate it: This will help the tool calculate some of the employee’s local taxes.

Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web virginia employers can calculate gross pay, net pay, and deductions in just a few clicks with the calculator at the top of this page (and feel confident when cutting. Web calculate your net pay in virginia for 2023 with this online tool. After the calculator determines the rating, then you can. This will help the tool calculate some of the employee’s local taxes.

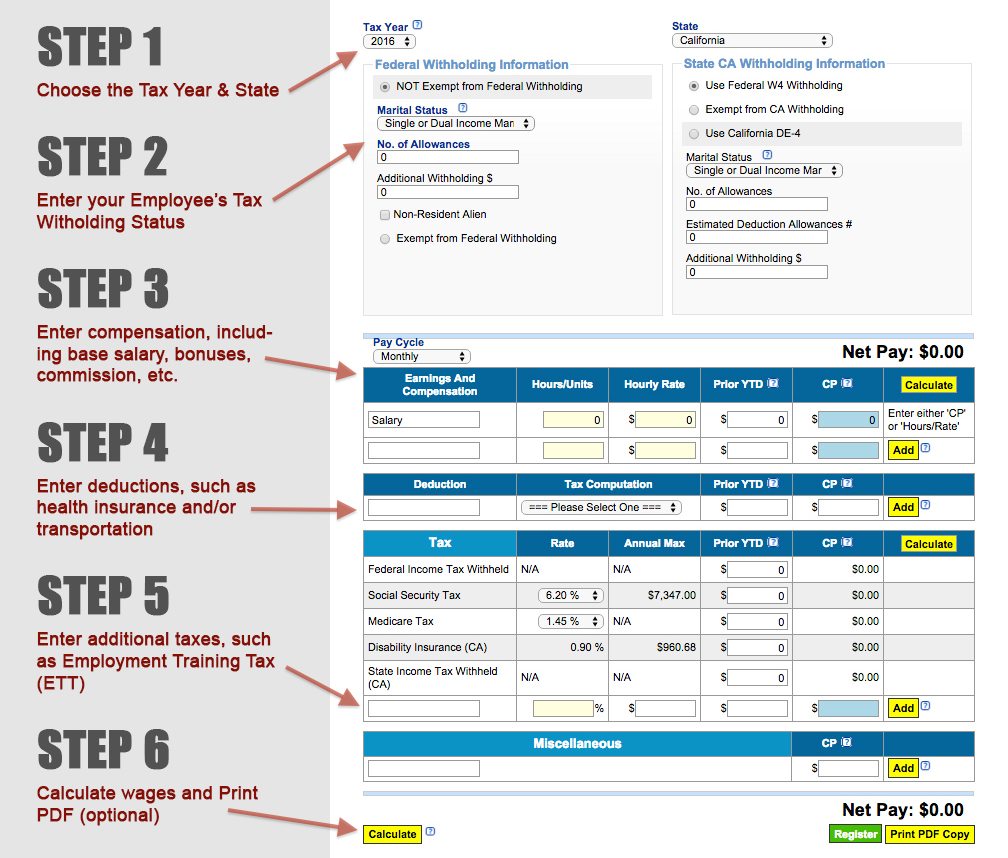

How to Use a Free Payroll Calculator

Web use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. You can add multiple rates. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Fill in the employee’s details this includes just two items: Here’s how to calculate.

14+ Virginia Payroll Calculator YiuIsabella

Accounting toolstime and attendancerun payrollfile taxes You can add multiple rates. Web use our virginia payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. If the veteran has a spouse but no children, the monthly pay increases to $3,946.25. After the calculator determines.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Here’s how to calculate it: Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). The new w4 asks for a dollar amount. ©istock.com/ryanjlane.

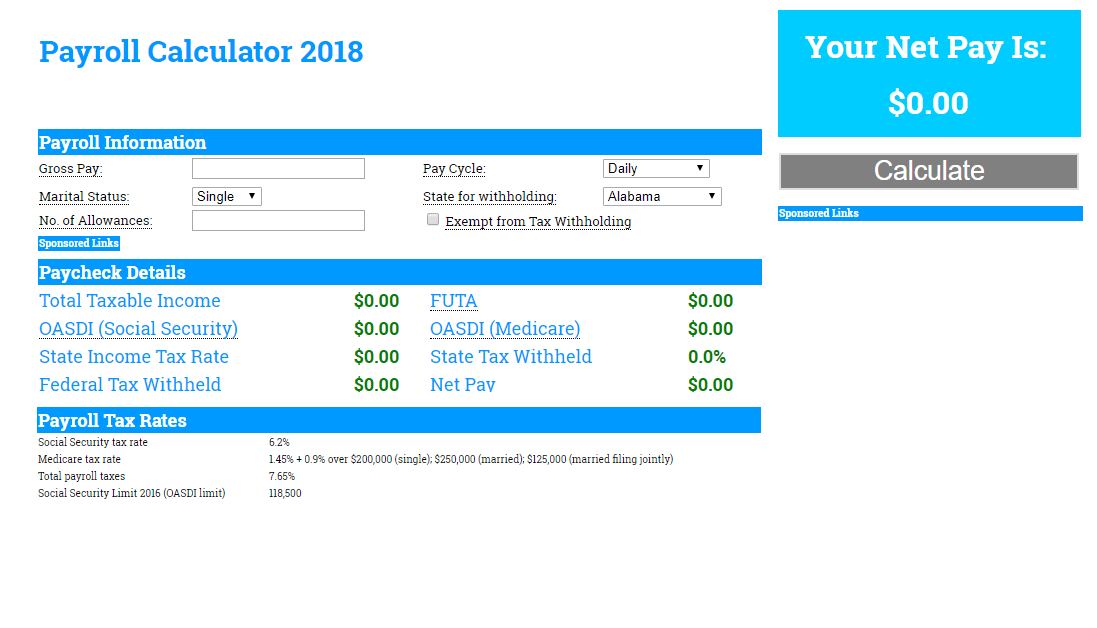

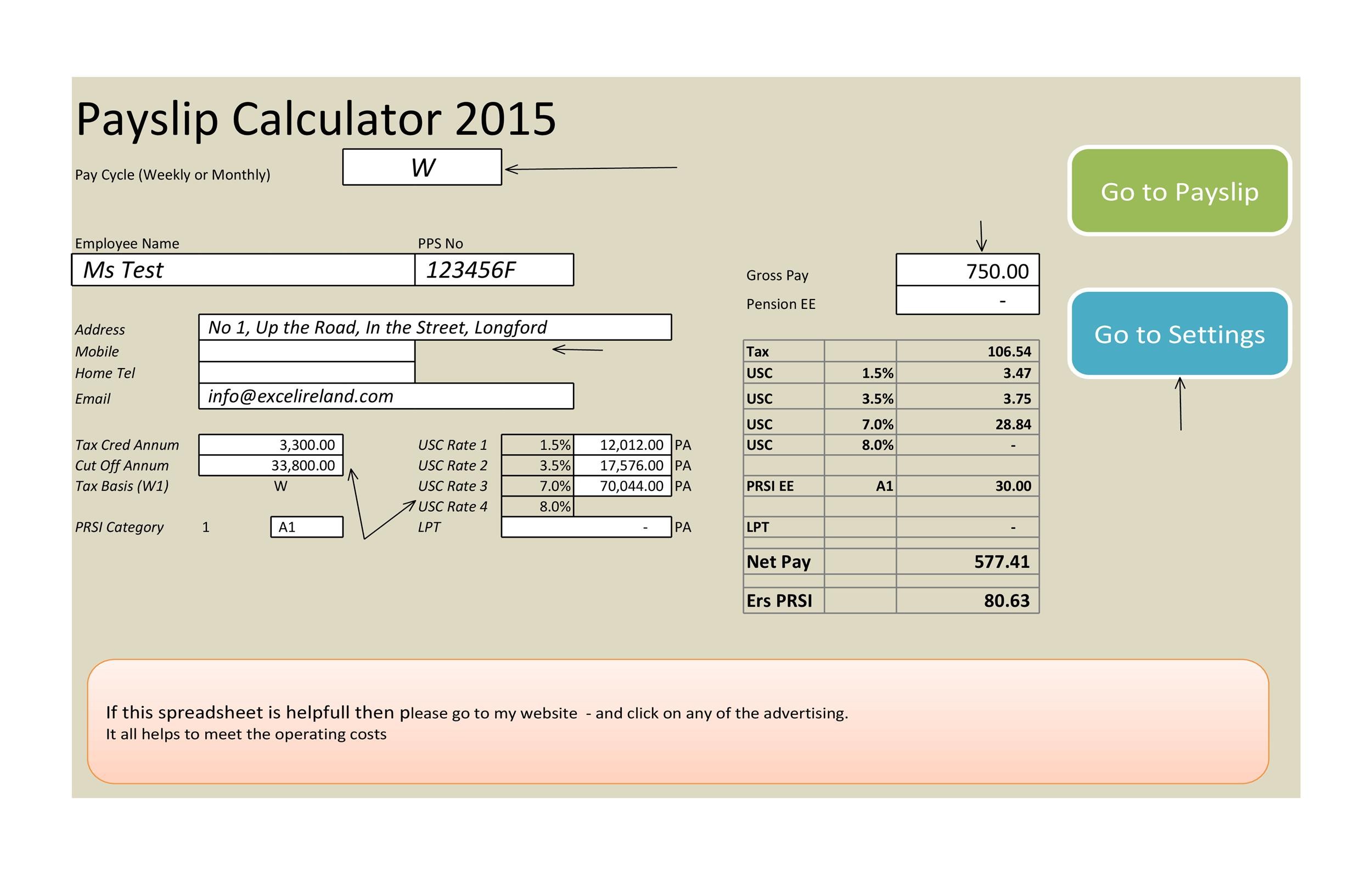

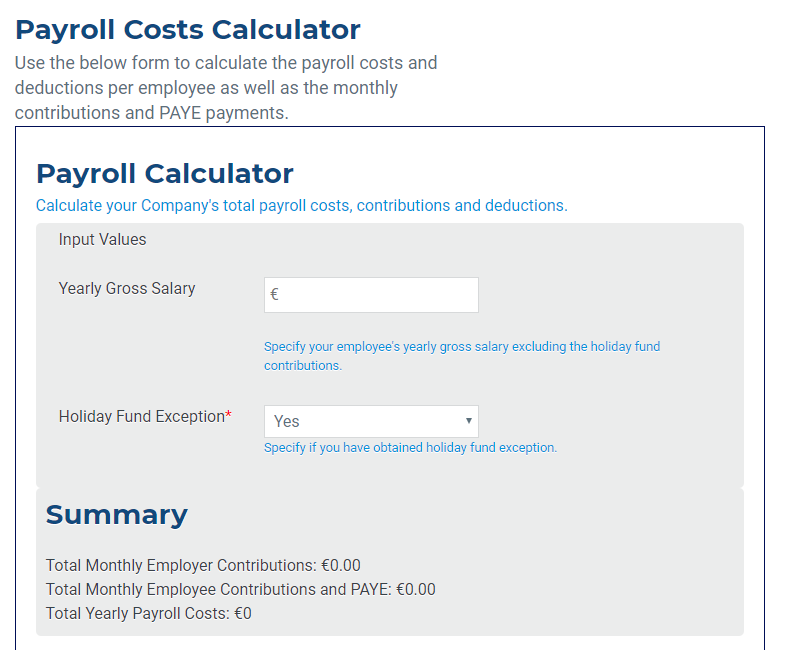

6 Free Payroll Tax Calculators for Employers

Web virginia employers can calculate gross pay, net pay, and deductions in just a few clicks with the calculator at the top of this page (and feel confident when cutting. Here’s how to calculate it: If the veteran has a spouse but no children, the monthly pay increases to $3,946.25. Web select a specific virginia.

What is Payroll Tax? Definition, Calculation, Who Pays It

The new w4 asks for a dollar amount. Free 24hr direct depositpeace of mindautomated tax calculationmore money, more time Here’s how to calculate it: Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web calculate paycheck in virginia, estimate state payroll taxes and federal withholdings, sui and sdi in.

Payroll calculators

Web calculate your net pay in virginia for 2023 with this online tool. Web use our virginia payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. Web use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or.

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Just enter the wages, tax withholdings and.

EXCEL of Employee Payroll Calculator.xlsx WPS Free Templates

Web select a specific virginia tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web calculate paycheck in virginia, estimate state payroll taxes and.

Payroll calculator Evidentrust Financial Services Ltd

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. After the calculator determines the rating, then you can. This calculator will take a gross pay and calculate the net. Fill in the employee’s details this includes just two items: Enter an amount for dependents.the.

Virginia Paycheck Calculator 2023 Paycheck Calculator VA

If the veteran has a spouse but no children, the monthly pay increases to $3,946.25. Accounting toolstime and attendancerun payrollfile taxes The new w4 asks for a dollar amount. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and.

Payroll Calculator Va Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Web select a specific virginia tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions for that tax year. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. If the veteran has a spouse but no children, the monthly pay increases to $3,946.25. This calculator will take a gross pay and calculate the net.

To Calculate An Annual Salary, Multiply The Gross Pay (Before Tax Deductions) By The Number Of Pay Periods Per Year.

Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web calculate paycheck in virginia, estimate state payroll taxes and federal withholdings, sui and sdi in virginia using our payroll calculator for va Free 24hr direct depositpeace of mindautomated tax calculationmore money, more time

Web Virginia Employers Can Calculate Gross Pay, Net Pay, And Deductions In Just A Few Clicks With The Calculator At The Top Of This Page (And Feel Confident When Cutting.

The new w4 asks for a dollar amount. Web calculate your net pay in virginia for 2023 with this online tool. Here’s how to calculate it: Web how to calculate annual income.

Web We Finally Developed A Disability Rating Calculator To Combine All The Veteran’s Ratings And Give The Final Combined Rating.

This number is the gross pay per pay period. Enter an amount for dependents.the old w4 used to ask for the number of dependents. Just enter the wages, tax withholdings and other. Learn about virginia income tax, local.

Web Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

Their name and the state where they live. If the veteran has a spouse but no children, the monthly pay increases to $3,946.25. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Fill in the employee’s details this includes just two items: