Payroll Tax Calculator Kentucky

Payroll Tax Calculator Kentucky - Web kentucky hourly paycheck and payroll calculator need help calculating paychecks? Web use the kentucky paycheck calculator to estimate net or “take home” pay for salaried employees. Here’s how to calculate it: For instance, if you have a job that pays. Just enter the wages, tax withholdings and other.

Web smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web kentucky hourly paycheck and payroll calculator need help calculating paychecks? Web how to use the kentucky paycheck calculator. Your gross income is your annual salary. Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web below are your kentucky salary paycheck results. Paycheck calculator calculate tax pay.

Payroll Calculator Free Employee Payroll Template for Excel

Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky. Your gross income is your annual salary. Use the kentucky paycheck calculators. Web use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees..

6 Free Payroll Tax Calculators for Employers

Web kentucky paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Your gross income is your annual salary. Simply input salary details, benefits and deductions, and any. The results are broken up into three sections: Web smartasset's hourly and salary paycheck calculator shows.

Kentucky Paycheck Tax Calculator CALCKP

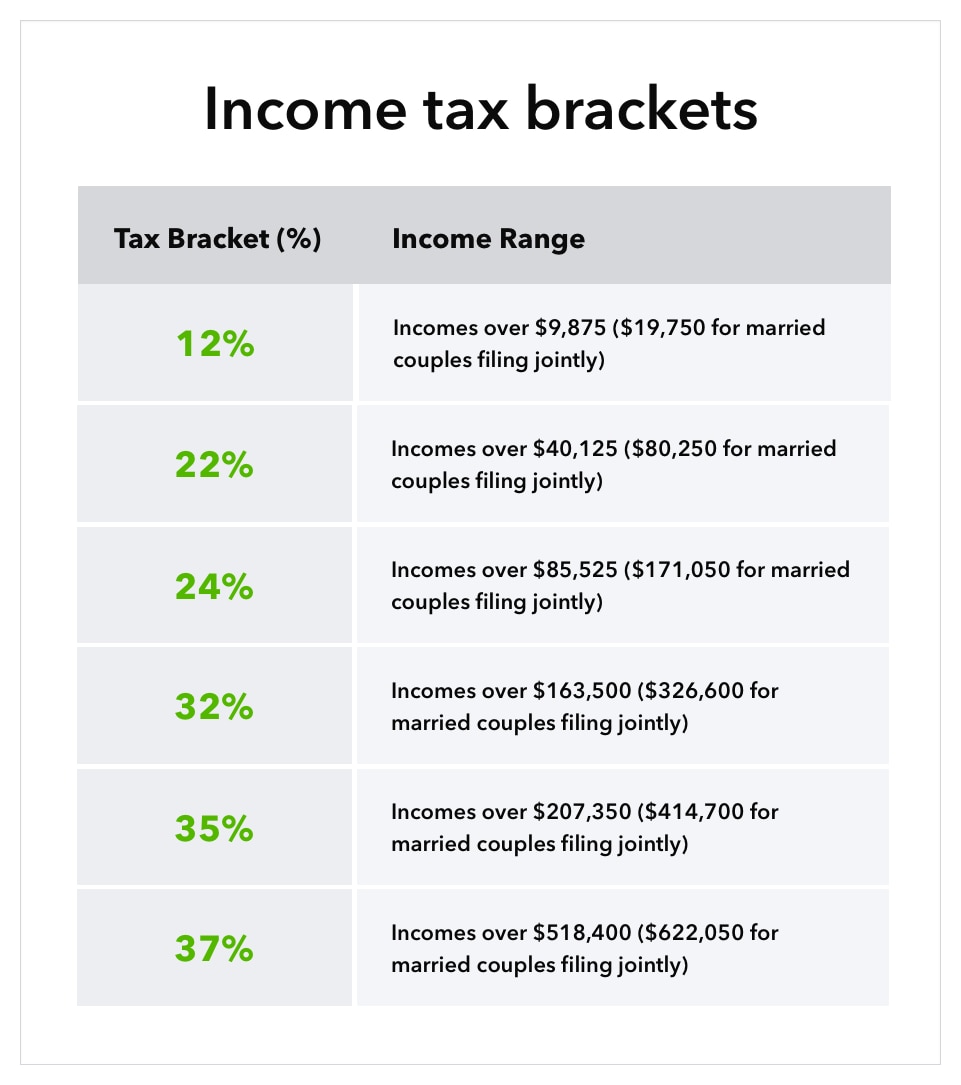

Web kentucky has a flat income tax rate of 4.5%, a statewide sales tax of 6% and median property taxes of $1,320 annually. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Gusto.com has been visited by 100k+ users in the past month All you have to do.

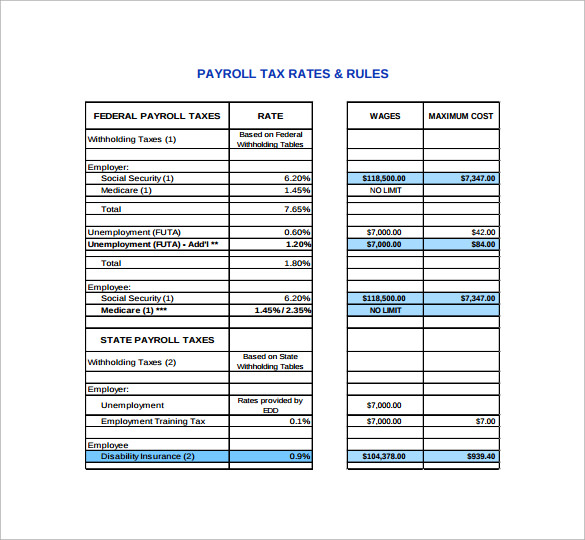

How to calculate payroll taxes 2021 QuickBooks

Paycheck results is your gross pay and specific deductions from your. Web how to use the kentucky paycheck calculator. The results are broken up into three sections: Web smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web kentucky has a flat income tax rate of 4.5%, a.

6 Free Payroll Tax Calculators for Employers in 2020 purshoLOGY

Paycheck results is your gross pay and specific deductions from your. Your gross income is your annual salary. Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. Web the kentucky payroll calculator includes current and historical tax years, this is particularly useful for looking at payroll trends (is.

Kentucky Paycheck Calculator 2022 2023

Enter your info to see your take home pay. Your gross income is your annual salary. We’ll do the math for you—all you. Here’s how to calculate it: Web kentucky paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? The results are broken.

Kentucky Paycheck Calculator 2023 2024

Just enter the wages, tax withholdings and other. Web kentucky hourly paycheck and payroll calculator need help calculating paychecks? Web in the specific context of calculating your paycheck: Web kentucky has a flat income tax rate of 4.5%, a statewide sales tax of 6% and median property taxes of $1,320 annually. We’ll do the math.

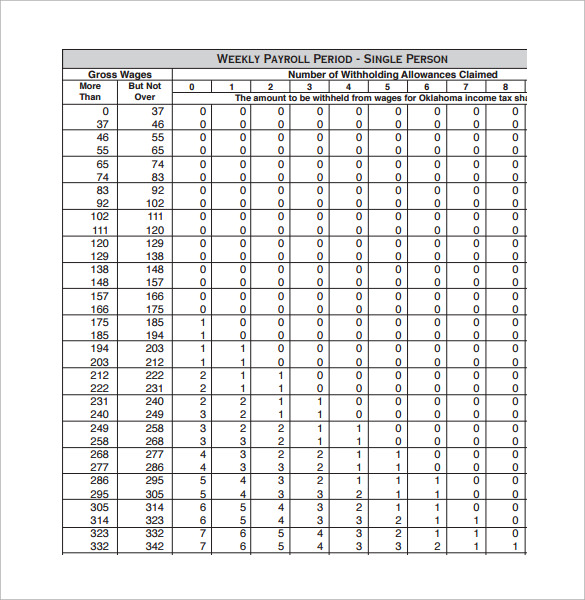

Sample Payroll Tax Calculator 7+ Free Documents in PDF, Excel

Enter your info to see your take home pay. Both the sales and property taxes are below. All you have to do is enter each employee’s wage and w. The new w4 asks for a dollar amount. The calculator was developed in a. Use the kentucky paycheck calculators. Web we designed a nifty payroll calculator.

Federal Payroll Tax Tables Bi Weekly Review Home Decor

Use the kentucky paycheck calculators. Web dor has created a withholding tax calculator to assist employers in computing the correct amount of kentucky withholding tax for employees. Your gross income is your annual salary. Both the sales and property taxes are below. Here’s how to calculate it: Web smartasset's hourly and salary paycheck calculator shows.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Paycheck results is your gross pay and specific deductions from your. The calculator was developed in a. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. Last updated on february 05, 2024) use our free kentucky paycheck calculator to determine your net. Here’s.

Payroll Tax Calculator Kentucky The results are broken up into three sections: Enter an amount for dependents.the old w4 used to ask for the number of dependents. Web in the specific context of calculating your paycheck: Web kentucky paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Web Smartasset's Hourly And Salary Paycheck Calculator Shows Your Income After Federal, State And Local Taxes.

Here’s how to calculate it: Web calculate kentucky payroll the bluegrass state has a flat income tax system where the income taxes are similar to national averages. Web dor has created a withholding tax calculator to assist employers in computing the correct amount of kentucky withholding tax for employees. Just enter the wages, tax withholdings and other.

The New W4 Asks For A Dollar Amount.

Surepayroll.com has been visited by 10k+ users in the past month Web below are your kentucky salary paycheck results. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes. Enter your info to see your take home pay.

Web Kentucky Paycheck Calculator For Salary & Hourly Payment 2023 Curious To Know How Much Taxes And Other Deductions Will Reduce Your Paycheck?

All you have to do is enter each employee’s wage and w. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky. Both the sales and property taxes are below. The calculator was developed in a.

Web Enter Your Employment Income Into The Paycheck Calculator Above To Estimate How Taxes In Kentucky, Usa May Affect Your Finances.

Web in the specific context of calculating your paycheck: Web we designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Simply input salary details, benefits and deductions, and any. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your.