Payroll Tax Calculator Michigan

Payroll Tax Calculator Michigan - Yes, michigan has local income taxes. Paycheck calculator pay breakdown your. Below are your michigan salary paycheck results. Web michigan hourly paycheck calculator results. Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50.

Use gusto’s salary paycheck calculator to determine withholdings and calculate. Michigan has a single income tax rate of 4.25% for all residents. Simply enter their federal and state w. For employer tax calculations, use paycheckcity payroll. Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Web check out paycheckcity.com for michigan paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in michigan.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

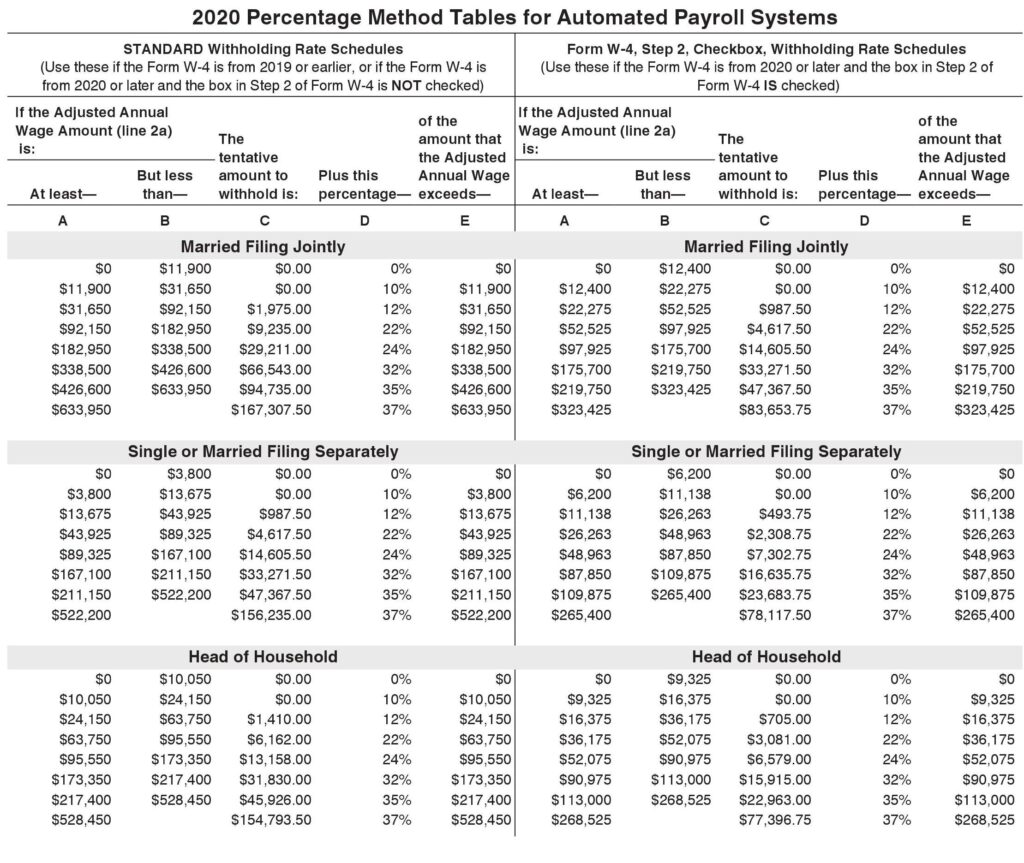

Web michigan (mi) payroll taxes for 2024. Michigan has a single income tax rate of 4.25% for all residents. Web use the michigan paycheck calculators to see the taxes on your paycheck. For employer tax calculations, use paycheckcity payroll. Web for example, if you made $45,000 in 2023, you would have fallen into the 22%.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Use adp’s michigan paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web for example, if you made $45,000 in 2023, you would have fallen into the 22% tax bracket for that tax year. But these cities charge an additional income. But if your income remains at $45,000 in.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50. Web for example, if you made $45,000 in 2023, you would have fallen into the 22% tax bracket for that tax year. The results are broken up into three sections: Use.

Michigan Paycheck Calculator 2023

For employer tax calculations, use paycheckcity payroll. Web for example, if you made $45,000 in 2023, you would have fallen into the 22% tax bracket for that tax year. Web michigan hourly paycheck calculator results. Web michigan salary paycheck and payroll calculator calculating paychecks and need some help? Web use our simple paycheck calculator to.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

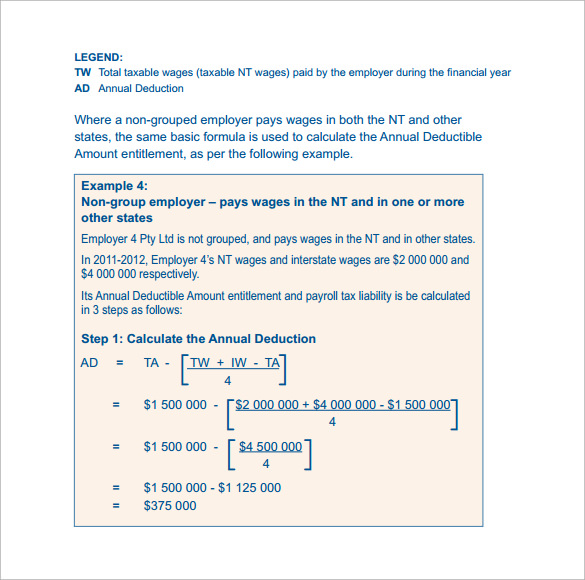

Does michigan have local taxes? Using a payroll tax service. Use adp’s michigan paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Simplify your financial planning with our michigan paycheck. Web michigan (mi) payroll taxes for 2024. Worksheet 2 (tier 3 michigan standard deduction) estimator. But if your income.

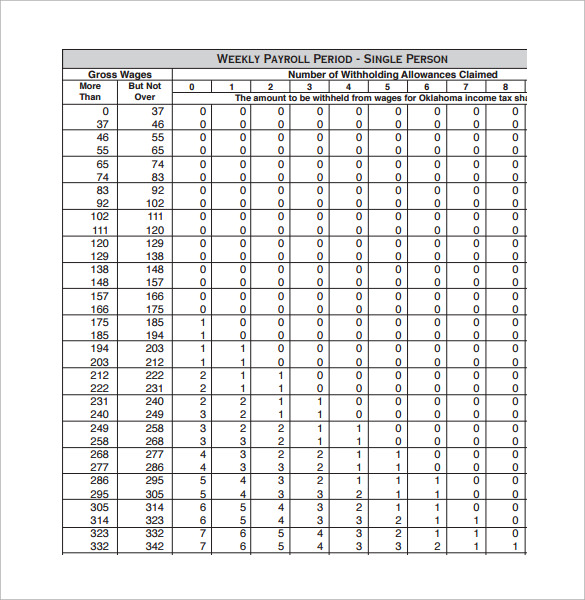

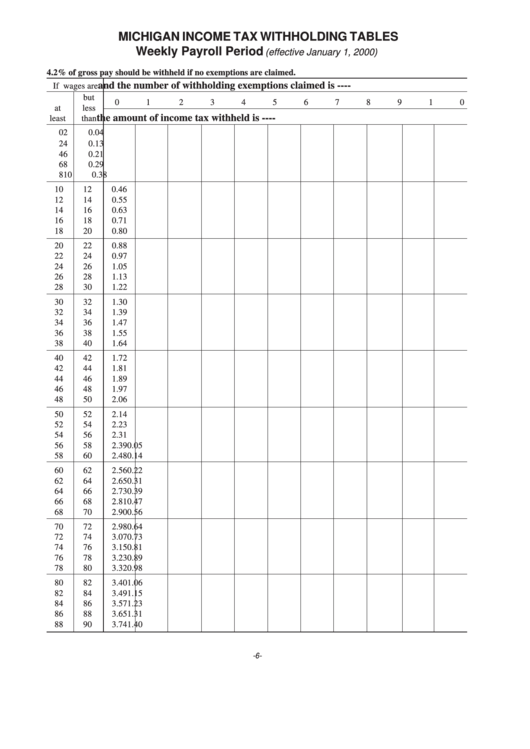

Michigan Tax Withholding Tables Weekly Payroll Period printable

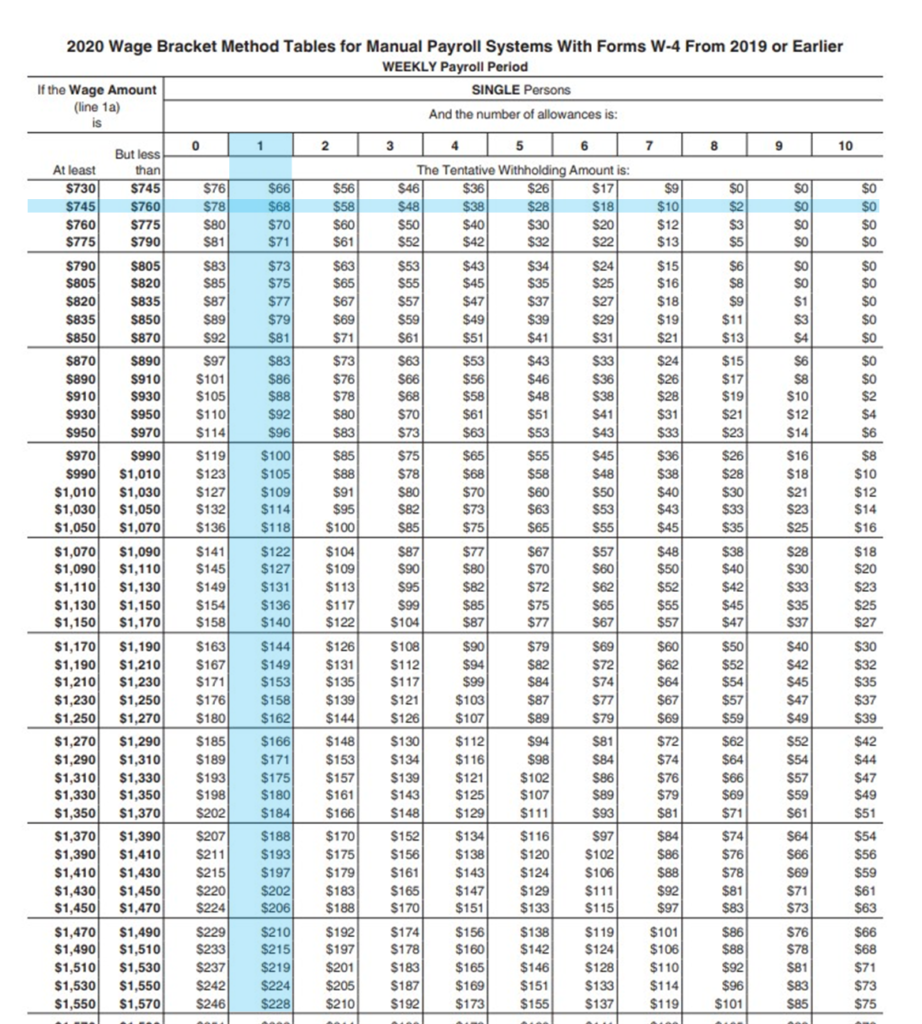

If this employee’s pay frequency is weekly the calculation is: Use adp’s michigan paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web michigan hourly paycheck calculator results. Web use icalculator™ us's paycheck calculator tailored for michigan to determine your net income per paycheck. Web use the paycheck calculator.

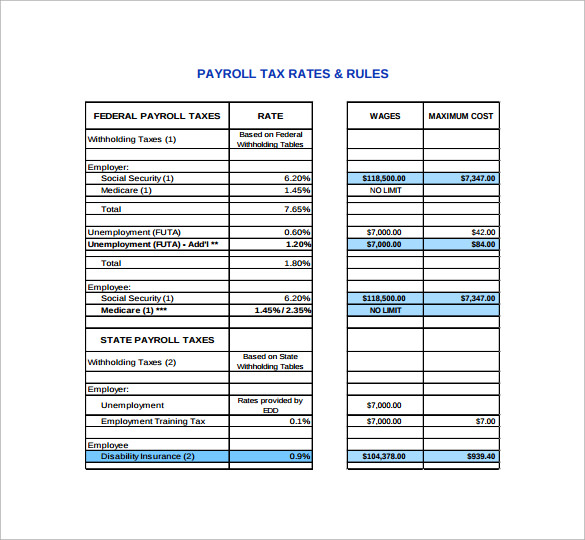

6 Free Payroll Tax Calculators for Employers

Does michigan have local taxes? Use michigan paycheck calculator to estimate net or “take home” pay for salaried. This applies to various salary frequencies including annual,. Simply enter their federal and state w. 2023 retirement and pension estimator. Use gusto’s salary paycheck calculator to determine withholdings and calculate. Web use this michigan gross pay calculator.

How to Calculate Payroll Taxes StepbyStep Instructions OnPay

For employer tax calculations, use paycheckcity payroll. Simplify your financial planning with our michigan paycheck. Web state income tax. Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50. The results are broken up into three sections: Worksheet 2 (tier 3.

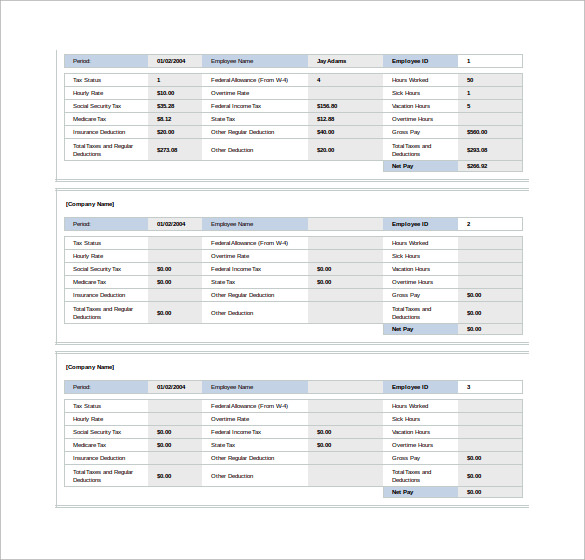

Sample Payroll Tax Calculator 7+ Free Documents in PDF, Excel

Updated on dec 8 2023. Does michigan have local taxes? Web michigan paycheck calculator easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget last. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as.

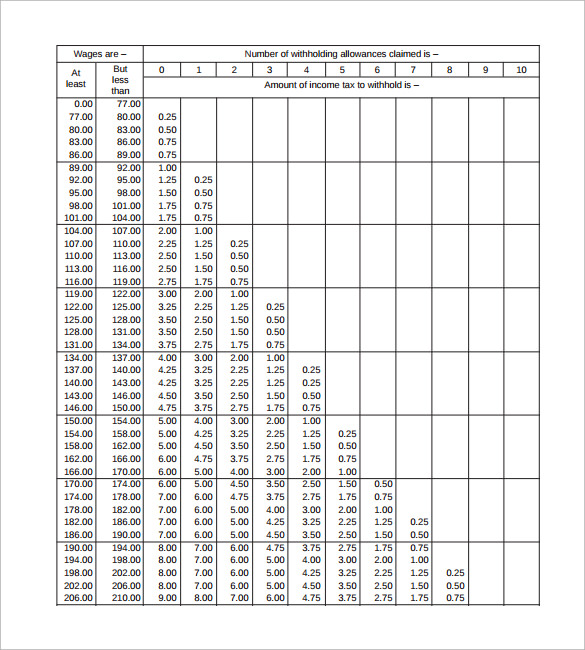

How to Calculate Payroll Taxes Workful

Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in michigan. Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50. Web use this michigan gross pay calculator.

Payroll Tax Calculator Michigan Yes, michigan has local income taxes. Web use the michigan paycheck calculators to see the taxes on your paycheck. Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50. But these cities charge an additional income. Web use icalculator™ us's paycheck calculator tailored for michigan to determine your net income per paycheck.

2023 Retirement And Pension Estimator.

Simplify your financial planning with our michigan paycheck. Web for example, if you made $45,000 in 2023, you would have fallen into the 22% tax bracket for that tax year. This applies to various salary frequencies including annual,. For employer tax calculations, use paycheckcity payroll.

Web Michigan Salary Paycheck And Payroll Calculator Calculating Paychecks And Need Some Help?

Updated on dec 8 2023. Use michigan paycheck calculator to estimate net or “take home” pay for salaried. Paycheck calculator pay breakdown your. Web with an annual salary of $55,000, a single filer will have an income tax of $11,033.50 and be able to bring home $43,966.50.

Web Michigan Paycheck Calculator For Salary & Hourly Payment 2023 Curious To Know How Much Taxes And Other Deductions Will Reduce Your Paycheck?

Web for salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount. Use gusto’s salary paycheck calculator to determine withholdings and calculate. The results are broken up into three sections: Web use icalculator™ us's paycheck calculator tailored for michigan to determine your net income per paycheck.

Using A Payroll Tax Service.

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Use adp’s michigan paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web michigan (mi) payroll taxes for 2024. Web check out paycheckcity.com for michigan paycheck calculators, withholding calculators, tax calculators, payroll information, and more.