Payroll Tax Calculator Ohio

Payroll Tax Calculator Ohio - Gusto.com has been visited by 100k+ users in the past month Paycheck calculator is a great payroll. Paycheck calculator your estimated take home. Web a single ohioan will have a income tax liability of $9,498.37 and take home $44,501.63. The buckeye state has a progressive income tax system where the income taxes are relatively low compared to the rest of the country.

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Web use adp’s ohio paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web to use our ohio salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Paycheck results is your gross pay and specific deductions from your paycheck, net. Just enter the wages, tax withholdings and other information. Web ohio paycheck and payroll calculator free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status,.

How to calculate payroll taxes 2021 QuickBooks

After a few seconds, you will be provided with a full. The results are broken up into three sections: All you have to do is enter each employee’s wage and w. Paycheck calculator your estimated take home. Web our ohio wage calculator estimates workers’ net income based on their tax rates and withholdings. Web ohio.

State Of Ohio Payroll Tax Tables 2017 Review Home Decor

After a few seconds, you will be provided with a full. You can also access historic tax. Web below are your ohio salary paycheck results. Web a single ohioan will have a income tax liability of $9,498.37 and take home $44,501.63. Web our ohio wage calculator estimates workers’ net income based on their tax rates.

6 Free Payroll Tax Calculators for Employers

Web ohio paycheck and payroll calculator free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. You can also access historic tax. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. You can also access historic tax. Web use our income tax calculator to estimate how much tax you might pay on your taxable income. Web it will calculate net paycheck amount that an.

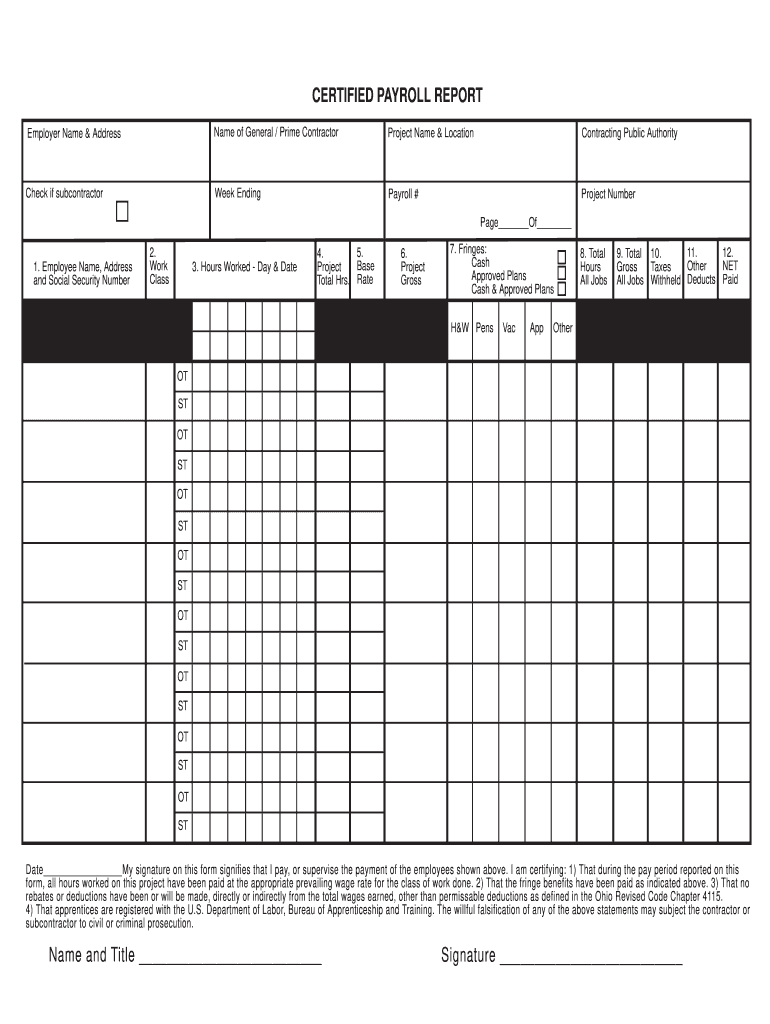

Ohio Certified Payroll Fill Online, Printable, Fillable, Blank

Web use adp’s ohio paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. We’ll do the math for you—all you need. Web paying payroll taxes using a payroll tax service use ohio paycheck calculator to estimate net or “take home” pay for salaried employees. Gusto.com has been visited by.

Tax Withholding Tables For Employers Elcho Table

The results are broken up into three sections: You can also access historic tax. Web to use our ohio salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Web ohio paycheck and payroll calculator free paycheck calculator to calculate net amount and payroll taxes from.

6 Free Payroll Tax Calculators for Employers in 2020 purshoLOGY

Paycheck calculator is a great payroll. The results are broken up into three sections: Web ohio paycheck calculator | ohio payroll tax calculator ohio paycheck calculator generate paystubs with accurate ohio state tax withholding calculations. Paycheck calculator your estimated take home. Paycheck results is your gross pay and specific deductions from your paycheck, net. Web.

Sample Payroll Tax Calculator 7+ Free Documents in PDF, Excel

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. We’ll do the math for you—all you need. Web our ohio wage calculator estimates workers’ net income based on their tax rates and withholdings. Web it will.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web ohio paycheck calculator | ohio payroll tax calculator ohio paycheck calculator generate paystubs with accurate ohio state tax withholding calculations. We’ll do the math for you—all you need. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and.

Ohio State Tax Tables 2023 US iCalculator™

Web luckily, our payroll calculator is here to help you avoid any payroll tax fiascos. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in ohio. Web our ohio wage calculator estimates workers’ net income based on their tax rates and withholdings..

Payroll Tax Calculator Ohio We’ll do the math for you—all you need. Web to use our ohio salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. This number is the gross pay per pay period. Web our ohio wage calculator estimates workers’ net income based on their tax rates and withholdings. Web use adp’s ohio paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

Web Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State, And Local Taxes.

Web use our income tax calculator to estimate how much tax you might pay on your taxable income. The buckeye state has a progressive income tax system where the income taxes are relatively low compared to the rest of the country. Web ohio paycheck and payroll calculator free paycheck calculator to calculate net amount and payroll taxes from a gross paycheck amount. We’ll do the math for you—all you need.

Web To Calculate A Paycheck Start With The Annual Salary Amount And Divide By The Number Of Pay Periods In The Year.

Web to use our ohio salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Calculate your 2023 ohio state income taxes. Web luckily, our payroll calculator is here to help you avoid any payroll tax fiascos. Web paying payroll taxes using a payroll tax service use ohio paycheck calculator to estimate net or “take home” pay for salaried employees.

Updated On Dec 8 2023.

Web use adp’s ohio paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status,. This number is the gross pay per pay period. Web below are your ohio salary paycheck results.

Web Our Ohio Wage Calculator Estimates Workers’ Net Income Based On Their Tax Rates And Withholdings.

Web a single ohioan will have a income tax liability of $9,498.37 and take home $44,501.63. Gusto.com has been visited by 100k+ users in the past month Paycheck calculator is a great payroll. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in ohio.