Payroll Tax Calculator Washington

Payroll Tax Calculator Washington - Web use our easy payroll tax calculator to quickly run payroll in washington, or look up 2024 state tax rates. We’ll do the math for you—all. Use this washington gross pay calculator to gross up wages based on net pay. Web suta tax rates in washington range from 0.2% to 6.0% for established businesses. Appsfreeeasy to use1 price all apps included

File taxesaccounting toolsdirect deposittax deductions Web the good news is that icalculator™ provides a free payroll calculator for washington and provides personal income tax tables and corporation income tax tables for 2024, our aim. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status,. Simply enter their federal and state. Enter your info to see your take home pay. Web visit paycheckcity.com for washington hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web use adp’s washington paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

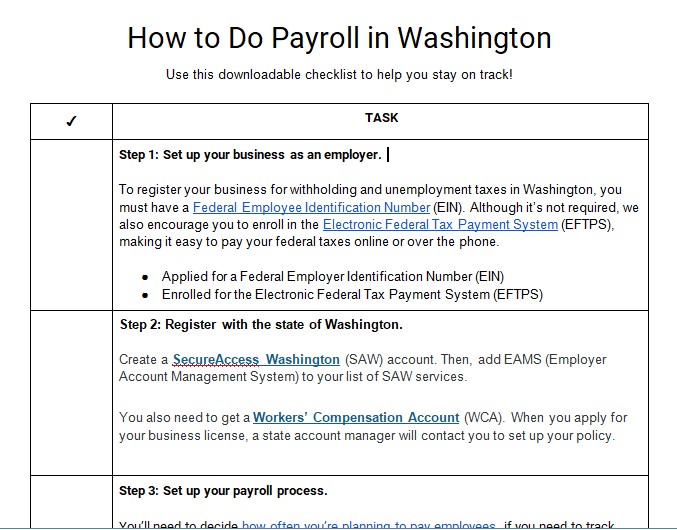

How to Do Payroll in Washington State

Updated on dec 05 2023. Web use adp’s washington paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web calculate your washington net pay or take home pay by entering your pay information, w4, and washington state w4 information. Web the good news is that icalculator™ provides a free.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web washington salary tax calculator for the tax year 2023/24. Web washington paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web calculate.

8+ Washington Paycheck Calculator

Use this washington gross pay calculator to gross up wages based on net pay. Web 22% on taxable income over $41,775 ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web start payroll your business what is payroll? Web visit paycheckcity.com for washington hourly.

How to Calculate Payroll Taxes Workful

Use this washington gross pay calculator to gross up wages based on net pay. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status,. Web visit paycheckcity.com for washington hourly paycheck calculators, withholding calculators, tax calculators,.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Enter your info to see your take home pay. Web use adp’s washington paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Appsfreeeasy to use1 price all apps included Web smartasset's washington paycheck calculator shows your hourly and salary income after federal, state and local taxes. Reporting and tax.

How to calculate payroll taxes 2021 QuickBooks

Web start payroll your business what is payroll? Web calculate your washington net pay or take home pay by entering your pay information, w4, and washington state w4 information. Simply enter their federal and state. Web washington paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will.

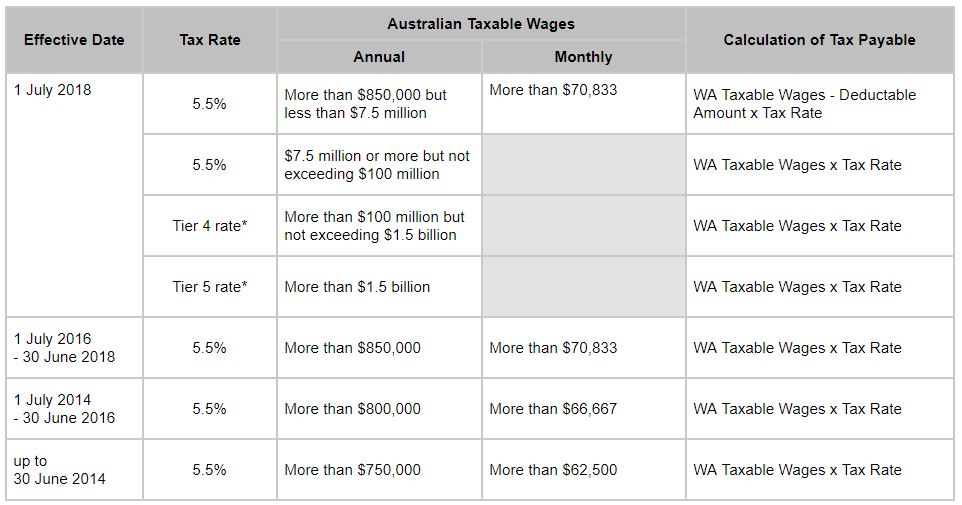

Payroll Tax WA atotaxrates.info

You are able to use our washington state tax calculator to calculate your total tax costs in the tax year. Do i need a payroll? Web suta tax rates in washington range from 0.2% to 6.0% for established businesses. Appsfreeeasy to use1 price all apps included Web start payroll your business what is payroll? Web.

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

Web visit paycheckcity.com for washington hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Appsfreeeasy to use1 price all apps included Use this washington gross pay calculator to gross up wages based on net pay. Web suta tax rates in washington range from 0.2% to 6.0% for established businesses. Web the good news.

8 Payroll Tax Calculator Templates to Download Sample Templates

Reporting and tax responsibilities record keeping paycheck information. Web it will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status,. Appsfreeeasy to use1 price all apps included Simply enter their federal and state. Web suta tax rates in.

Payroll Services Washington State University

Web federal paycheck calculator photo credit: Web washington paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web visit paycheckcity.com for washington hourly paycheck calculators, withholding calculators, tax calculators, payroll information, and more. Web use our easy payroll tax calculator to quickly run.

Payroll Tax Calculator Washington Simply enter their federal and state. Web the good news is that icalculator™ provides a free payroll calculator for washington and provides personal income tax tables and corporation income tax tables for 2024, our aim. Web use our easy payroll tax calculator to quickly run payroll in washington, or look up 2024 state tax rates. Do i need a payroll? Just enter the wages, tax withholdings and other.

Web Use Adp’s Washington Paycheck Calculator To Estimate Net Or “Take Home” Pay For Either Hourly Or Salaried Employees.

You are able to use our washington state tax calculator to calculate your total tax costs in the tax year. For example, if an employee receives. Enter your info to see your take home pay. Web the good news is that icalculator™ provides a free payroll calculator for washington and provides personal income tax tables and corporation income tax tables for 2024, our aim.

Web Federal Paycheck Calculator Photo Credit:

Updated on dec 05 2023. Web washington salary tax calculator for the tax year 2023/24. Web use our easy payroll tax calculator to quickly run payroll in washington, or look up 2024 state tax rates. File taxesaccounting toolsdirect deposittax deductions

Web Start Payroll Your Business What Is Payroll?

Web washington payroll provides free paycheck calculator, washington payroll tax info, washington payroll service, mobile payroll apps, and wa salary estimator Web smartasset's washington paycheck calculator shows your hourly and salary income after federal, state and local taxes. Just enter the wages, tax withholdings and other. Web washington paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

©Istock.com/Ryanjlane Federal Paycheck Quick Facts Federal Income Tax Rates Range From 10% Up To A Top Marginal Rate Of 37%.

We’ll do the math for you—all. Use this washington gross pay calculator to gross up wages based on net pay. Free tool to calculate your hourly and salary income. Appsfreeeasy to use1 price all apps included