Portfolio Expected Return Calculator

Portfolio Expected Return Calculator - E (r i) = r f + [ e (r m) − r f ] × β i where: Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf. Web portfolio return calculator instructions. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. So, the overall outcome of the expected return is 12.8%.

Web learn how to calculate the expected return of a portfolio using the formula for expected return and the standard deviation of a portfolio. Web portfolio return = (0.267 * 18%) + (0.333 * 12%) + (0.400 * 10%) portfolio return = 12.8%; The expected return analyzer identifies how your portfolio stacks up against your targeted return and highlights. Enter the probability, return on stock a, and return on. We arrive at this result by using the formula above: It can be used as a. Veterans resourcestax advice & toolspersonal finance & taxesexplore aarp® benefits

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Enter the probability, return on stock a, and return on. (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Web delivering on your clients’ goals is critical to your success. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web this.

Expected Return (ER) Of a Portfolio Calculation and Limitations

Web excel template portfolio expected return calculation example suppose we’re tasked with estimated the expected return on a portfolio of equity securities. The expected return analyzer identifies how your portfolio stacks up against your targeted return and highlights. If the benchmark goes up 10%, the portfolio will go exactly 10%. Expected return of portfolio =.

Expected Return Formula Calculator (Excel template)

Web learn how to calculate the expected return of a portfolio using the formula for expected return and the standard deviation of a portfolio. An expected return calculator is a tool that computes the expected return on an investment, considering the probabilities. You can use the portfolio return calculator below to calculate the return on.

Portfolio Expected Return Calculator Scaling Partners

Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web portfolio return = (0.267 * 18%) + (0.333 * 12%) + (0.400 * 10%) portfolio return = 12.8%; In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web.

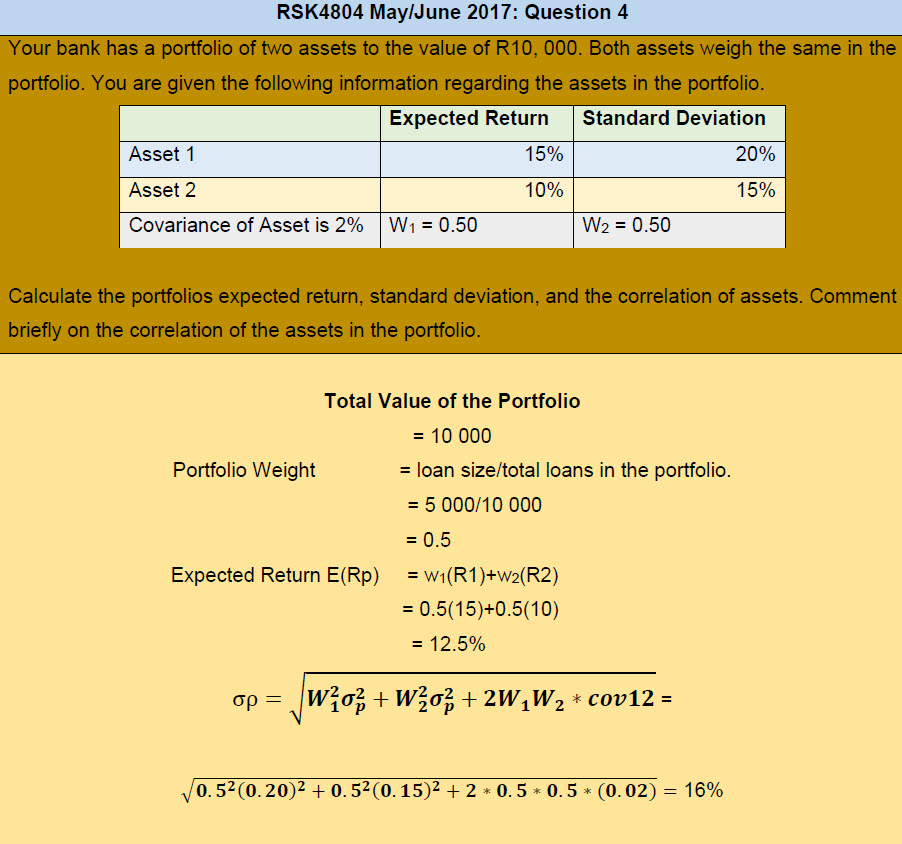

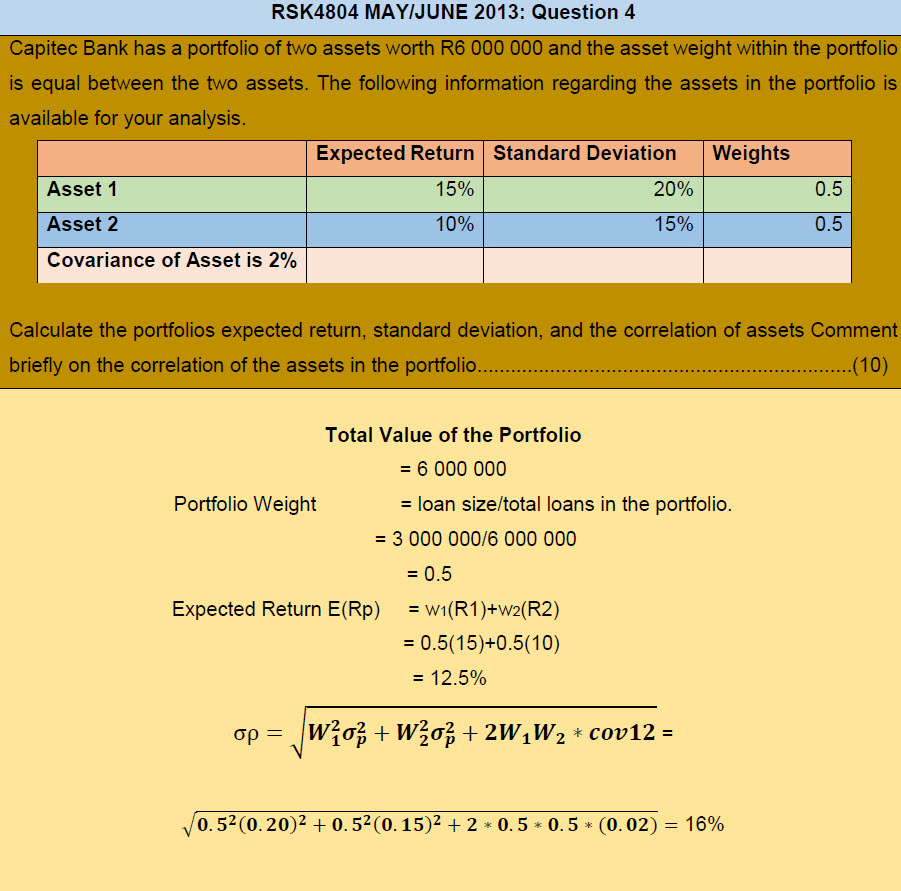

Calculate the portfolios expected return. Theron Group Blog

The expected return analyzer identifies how your portfolio stacks up against your targeted return and highlights. So, the overall outcome of the expected return is 12.8%. It can be used as a. You can use the portfolio return calculator below to calculate the return on a portfolio of up to 5 assets. Web portfolio return.

How to Calculate Portfolio Returns From Scratch (Example Included

Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of. (35% x 6%) + (25% x 7%) + (40% x 10%) = 7.85% Web delivering on your clients’ goals is critical to your success. It can be used.

How to Calculate Portfolio Returns From Scratch (Example Included

So, the overall outcome of the expected return is 12.8%. Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. If the benchmark goes up 10%, the portfolio will go exactly 10%. Enter the probability, return on stock a, and return on. In this formula, “r”.

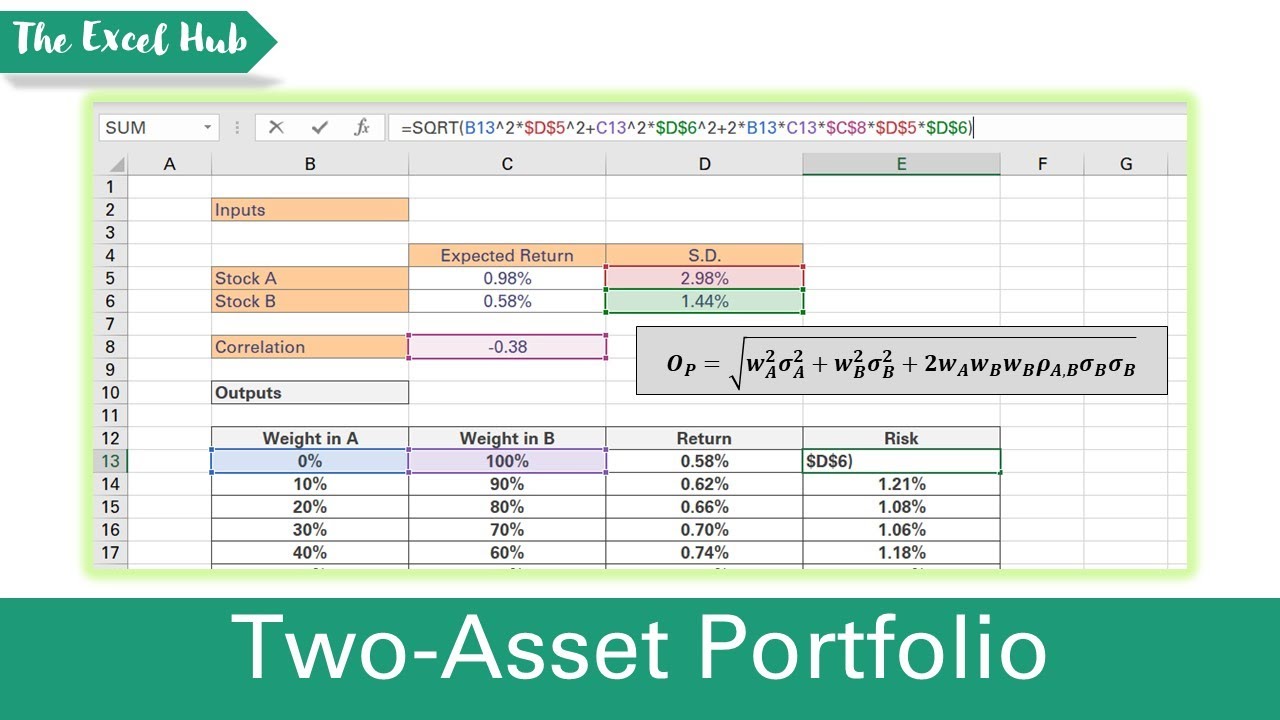

Calculate Risk And Return Of A TwoAsset Portfolio In Excel (Expected

Web portfolio return = (0.267 * 18%) + (0.333 * 12%) + (0.400 * 10%) portfolio return = 12.8%; Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. The expected return analyzer identifies how your portfolio stacks up against your targeted return and highlights. Web.

Portfolio Return Formula Calculator (Examples With Excel Template)

Veterans resourcestax advice & toolspersonal finance & taxesexplore aarp® benefits Web learn how to calculate the expected return of a portfolio using the formula for expected return and the standard deviation of a portfolio. Web the expected return of a portfolio formula is therefore: Web what is an expected return calculator? In this formula, “r”.

Calculate the portfolio expected return. Theron Group Blog

Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns. Expected return = (return a x probability a) + (return b x probability b) identify the. Veterans resourcestax advice & toolspersonal finance & taxesexplore aarp® benefits Web return on investment (roi) allows you to measure how.

Portfolio Expected Return Calculator Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf. Web return on portfolio calculator is an online personal finance assessment tool in the investment category to calculate the return on portfolio by choosing the proportion of. Web this free investment calculator will calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments. We arrive at this result by using the formula above: Web a tool to assess the potential performance of an investment based on the probability distribution of asset returns.

Web Excel Template Portfolio Expected Return Calculation Example Suppose We’re Tasked With Estimated The Expected Return On A Portfolio Of Equity Securities.

Web the formula of expected return for an investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below,. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Web the expected return of the overall portfolio would be 7.85%. Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf.

Web Portfolio Return = (0.267 * 18%) + (0.333 * 12%) + (0.400 * 10%) Portfolio Return = 12.8%;

Veterans resourcestax advice & toolspersonal finance & taxesexplore aarp® benefits It can be used as a. An expected return calculator is a tool that computes the expected return on an investment, considering the probabilities. We arrive at this result by using the formula above:

Web Capm Formula The Calculator Uses The Following Formula To Calculate The Expected Return Of A Security (Or A Portfolio):

Web portfolio return calculator instructions. So, the overall outcome of the expected return is 12.8%. Enter the probability, return on stock a, and return on. Expected return = (return a x probability a) + (return b x probability b) identify the.

Web Delivering On Your Clients’ Goals Is Critical To Your Success.

Web this free investment calculator will calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments. Web expected rate of return (err) = r1 x w1 + r2 x w2. Web what is an expected return calculator? Expected return of portfolio = 0.2(15%) +.