Portfolio Risk Calculator

Portfolio Risk Calculator - Web chart the efficient frontier to explore risk vs. Web the asset allocation calculator is designed to help create a balanced portfolio of investments. Web use this comparison tool to see how your money could have been impacted by a proactive diversification strategy during the 2008 stock market crash. Web learn how to calculate portfolio risk using the standard deviation, covariance, and correlation of the assets in a portfolio. Web this free investment calculator will calculate how much your money may grow and return over time when invested in stocks, mutual funds or other investments.

Web we have designed this jensen's alpha calculator to help you calculate your investments performance. The next step is to take the net gain and divide it by the initial investment amount: You invested $60,000 in asset 1 that produced 20% returns and $40,000 in asset 2 that produced 12% returns. Web the modern portfolio theory describes how investors can combine different assets to create a portfolio that reduces risk but not the expected returns. Web arc’s portfolio risk calculator is the first analytical tool launched on arc hub, with further tools to be added over the coming 12 months. The returns of the given portfolio are first. Web use this comparison tool to see how your money could have been impacted by a proactive diversification strategy during the 2008 stock market crash.

Understanding your Portfolio Risk Review

The new research intends to test it against even larger datasets. Web the asset allocation calculator is designed to help create a balanced portfolio of investments. Jensen's alpha is one of the most widely used metrics in the. The next step is to take the net gain and divide it by the initial investment amount:.

How to Calculate Portfolio Risk From Scratch (Examples Included

Web use this comparison tool to see how your money could have been impacted by a proactive diversification strategy during the 2008 stock market crash. The new research intends to test it against even larger datasets. You can compare your portfolio returns, risk characteristics, style exposures,. Value at risk is a standard estimation of daily.

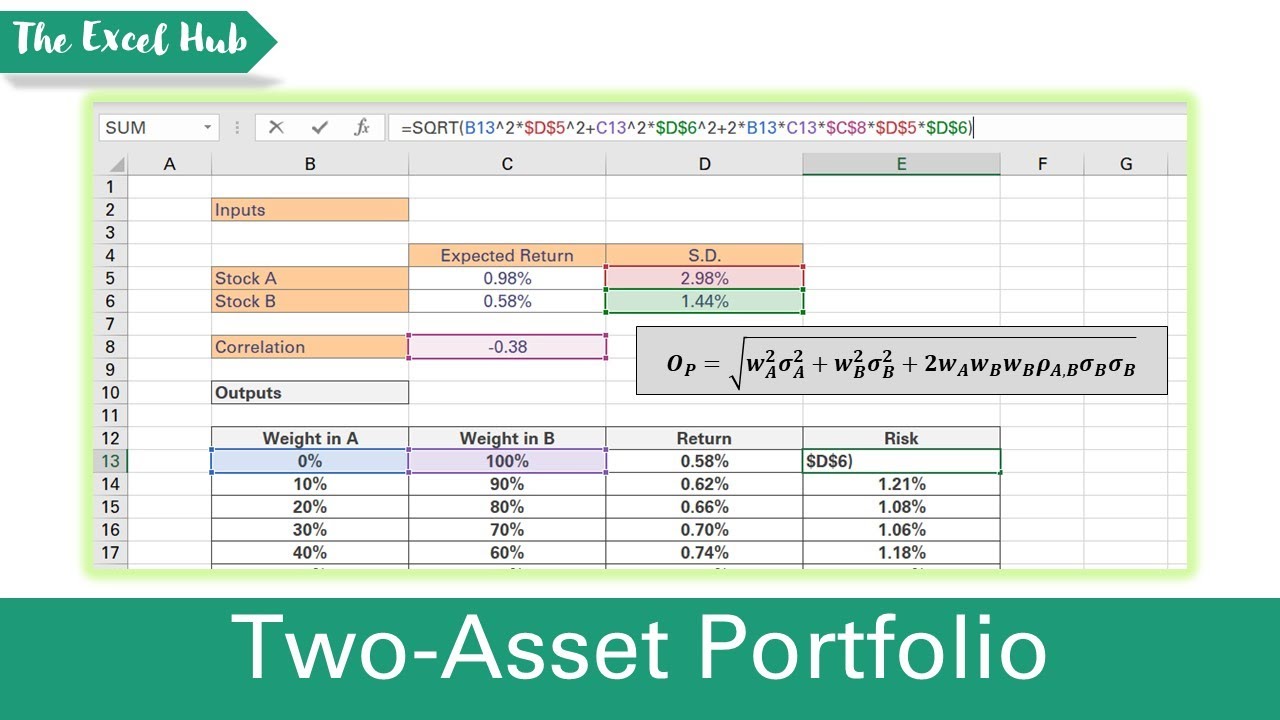

Calculate The Minimum Risk Two Stock Portfolio Using SOLVER In Excel

Web roi net gain = $13,350 — $10,000 + $500 — $150 = $3,700. Web this calculator is a guide to help you design investment portfolios for five different levels of risk. They are designed to optimise the risk/return relationship, including currency. The returns of the given portfolio are first. Web we have designed this.

Calculate Risk And Return Of A TwoAsset Portfolio In Excel (Expected

Web this calculator is a guide to help you design investment portfolios for five different levels of risk. Web we have designed this jensen's alpha calculator to help you calculate your investments performance. Specify stock/etf/cryptos & quantities to instantly view value at risk (var) for portfolio using recent financial data. Web july 6, 2022 written.

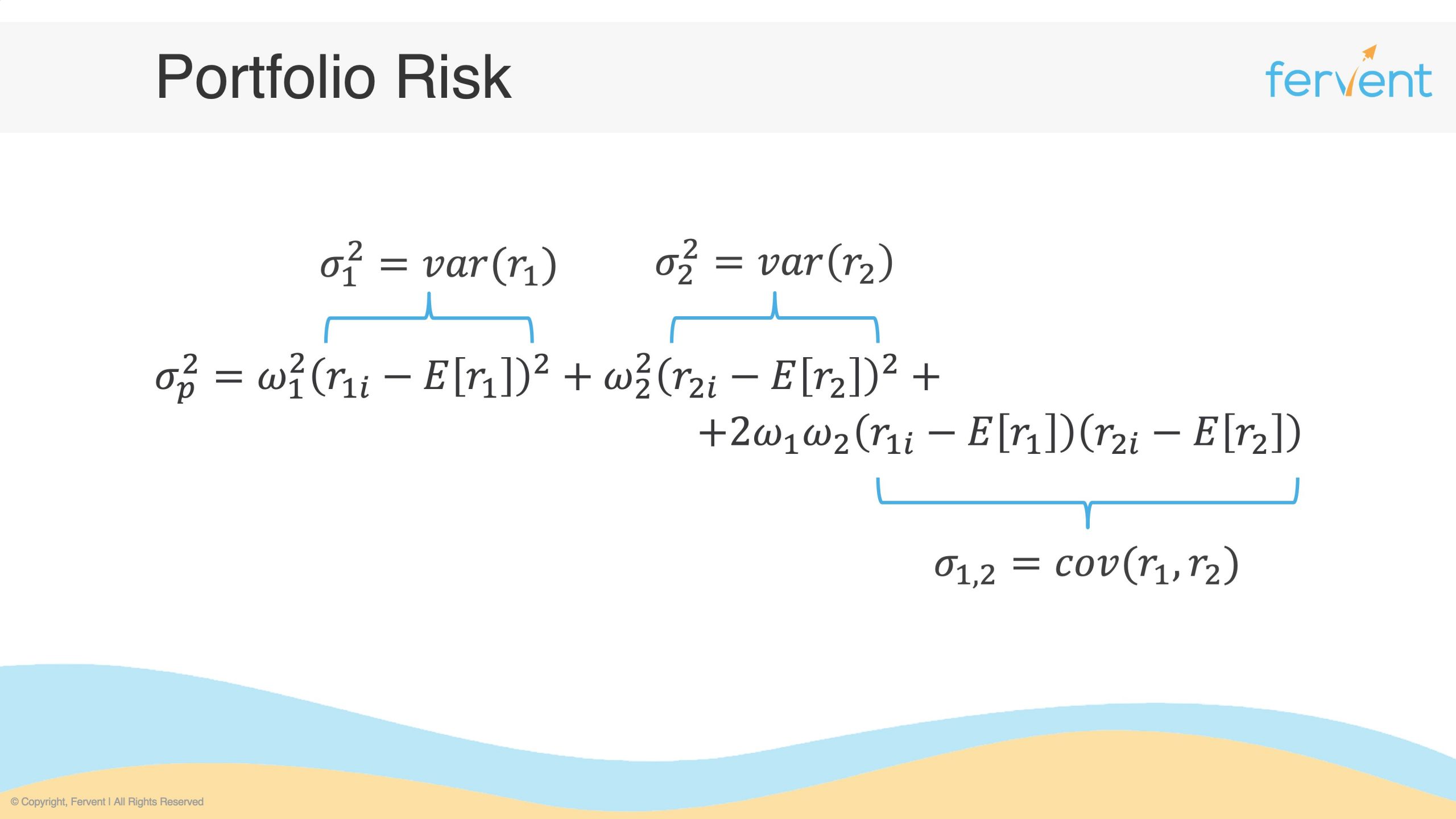

A faster way to calculate portfolio risk, and remember it too

Approximately $424 billion follows model portfolios as of june 2023, a 48% increase. The new research intends to test it against even larger datasets. See the formula, an example, and the importance. Web the asset allocation calculator is designed to help create a balanced portfolio of investments. Web learn how to calculate portfolio risk using.

How to Calculate Portfolio Risk From Scratch (Examples Included

Web rp = w1r1 + w2r2 let’s take a simple example. Web the process of trading with a portfolio of stocks requires a number of steps like stock selection, the formation of strategies while creating a portfolio and so on. The next step is to take the net gain and divide it by the initial.

How to Calculate Portfolio Risk From Scratch (Examples Included

Web this tool allows you to construct and analyze portfolios based on mutual funds, etfs, and stocks. Web the asset allocation calculator is designed to help create a balanced portfolio of investments. Web july 6, 2022 written & reviewed by michael ryan | last updated: Value at risk is a standard estimation of daily risk..

How to Calculate Portfolio Risk From Scratch (Examples Included

The new research intends to test it against even larger datasets. Web use this comparison tool to see how your money could have been impacted by a proactive diversification strategy during the 2008 stock market crash. See the formula, an example, and the importance. Age, ability to tolerate risk, and several other factors are used.

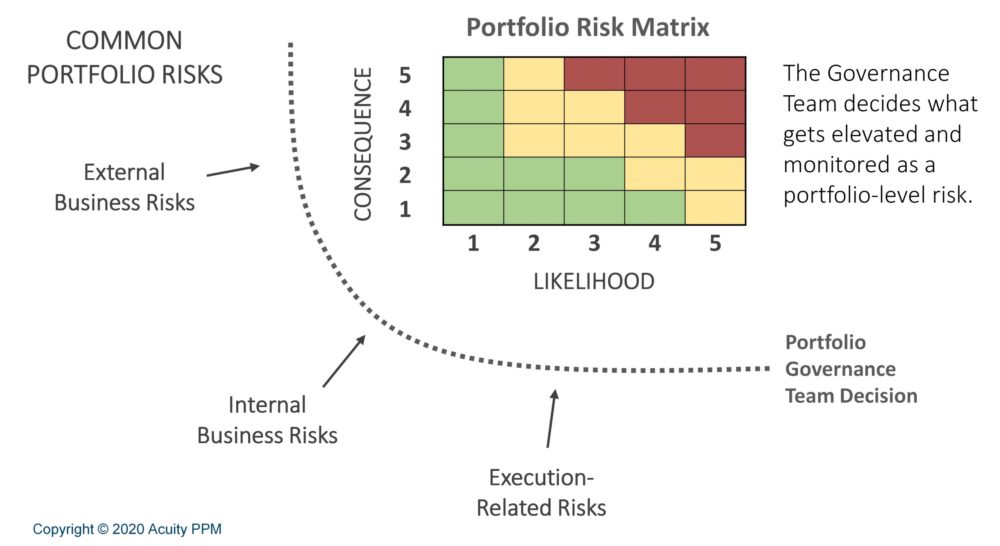

PPM 101 Portfolio Risk Management Acuity PPM

You can compare your portfolio returns, risk characteristics, style exposures,. Web risk factor allocation overview. Value at risk is a standard estimation of daily risk. Finance calculatorspersonal finance & taxesinvestment tools & tipsveterans resources See the formula, an example, and the importance. Analyze your portfolio's risk exposure. Web chart the efficient frontier to explore risk.

How to Calculate Portfolio Risk From Scratch (Examples Included

Age, ability to tolerate risk, and several other factors are used to calculate. December 20, 2023 navigating asset allocation and portfolio optimization can be complex for investors. Web risk factor allocation overview. Web learn how to calculate portfolio risk using the standard deviation, covariance, and correlation of the assets in a portfolio. Web rp =.

Portfolio Risk Calculator Web this tool allows you to construct and analyze portfolios based on mutual funds, etfs, and stocks. December 20, 2023 navigating asset allocation and portfolio optimization can be complex for investors. The new research intends to test it against even larger datasets. Analyze your portfolio's risk exposure. Web the modern portfolio theory describes how investors can combine different assets to create a portfolio that reduces risk but not the expected returns.

Web Learn How To Calculate Portfolio Risk Using The Standard Deviation, Covariance, And Correlation Of The Assets In A Portfolio.

Web the modern portfolio theory describes how investors can combine different assets to create a portfolio that reduces risk but not the expected returns. Web use this comparison tool to see how your money could have been impacted by a proactive diversification strategy during the 2008 stock market crash. Model portfolios continue to gain traction with financial advisors. Web this calculator can be used to estimate the percentage of an investment portfolio held in common stock, bonds, and cash based on a risk tolerance score.

Web Chart The Efficient Frontier To Explore Risk Vs.

The new research intends to test it against even larger datasets. Web we have designed this jensen's alpha calculator to help you calculate your investments performance. The returns of the given portfolio are first. Web july 6, 2022 written & reviewed by michael ryan | last updated:

Age, Ability To Tolerate Risk, And Several Other Factors Are Used To Calculate.

Web rp = w1r1 + w2r2 let’s take a simple example. You invested $60,000 in asset 1 that produced 20% returns and $40,000 in asset 2 that produced 12% returns. Web the calculator was initially validated using health data from more than 3 million people. Analyze your portfolio's risk exposure.

Web This Tool Allows You To Construct And Analyze Portfolios Based On Mutual Funds, Etfs, And Stocks.

The next step is to take the net gain and divide it by the initial investment amount: Web roi net gain = $13,350 — $10,000 + $500 — $150 = $3,700. Web arc’s portfolio risk calculator is the first analytical tool launched on arc hub, with further tools to be added over the coming 12 months. This tool supports optimizing the portfolio asset allocation based on the targeted risk factor exposures.